Markets are weird. One day a company is a "relic of the 2000s," and the next, it’s the darling of institutional investors. If you’ve been tracking the Just Dial share value lately, you know exactly what I’m talking about. It’s been a wild ride. For years, people wrote off Just Dial as that "phone-in" directory service your parents used to find a plumber. But then Reliance Retail stepped in, and the narrative shifted overnight.

Honestly? Most people look at the ticker and see a number. They don't see the massive pivot happening under the hood.

We’re talking about a company that survived the transition from voice to web, then web to app, and is now trying to conquer B2B e-commerce. It's not just about searching for a local gym anymore. The current fluctuations in Just Dial share value reflect a deeper tension between its high-cash reserves and the brutal competition from giants like Google and IndiaMART.

The Reliance Factor and Why It Changed Everything

When Reliance Retail Ventures took a controlling stake in 2021, the market went nuts. Investors thought, "This is it." They expected Just Dial to become the digital front-end for the entire Jio ecosystem.

It hasn't been that simple.

Integration takes time. A lot of it. The Just Dial share value initially spiked on the news, then spent a long time cooling off as the reality of "corporate synergy" set in. Reliance didn't just buy a search engine; they bought a massive database of small and medium enterprises (SMEs). In India, data is the new oil, and Just Dial has decades of it.

Think about it. While new startups are burning millions to acquire customers, Just Dial already has millions of listings. They have 170+ million quarterly unique users. That’s a massive moat. However, the market is skeptical. Can they monetize these users as effectively as a nimble tech startup? That's the billion-dollar question keeping the stock price in a tug-of-war.

The B2B Pivot (JD Mart)

If you want to understand the recent movement in Just Dial share value, you have to look at JD Mart. This is their dedicated B2B portal. It’s a direct shot at IndiaMART.

It’s a tough fight.

IndiaMART has the first-mover advantage in the wholesale space. But Just Dial has the sales force. They have thousands of feet on the street. These are people who actually walk into shops in Tier 2 and Tier 3 cities and convince business owners to go digital. You can't replicate that with just a fancy UI and a Google Ads budget.

Breaking Down the Numbers: Is the Value Real?

Let's get technical for a second, but not too boring. Just Dial is practically debt-free. That is incredibly rare for an internet company in this era.

Look at their cash and cash equivalents. It's massive. In many ways, when you buy into the Just Dial share value, you’re buying a giant pile of cash and a profitable business attached to it. Their "Other Income" (which is basically the interest they earn on that cash) often makes up a significant chunk of their net profit.

Some analysts hate this.

They argue that a tech company should be re-investing every penny into growth, not sitting on a mountain of treasury gains. But in a high-interest-rate environment, or when the market gets shaky, that cash provides a safety net that most "growth at all costs" startups simply don't have. It’s a classic value play hidden inside a tech wrapper.

Revenue Streams and Paid Listings

Just Dial makes money through paid listings. Small businesses pay them to show up at the top of the results. Simple.

But here’s the kicker: the cost of acquiring these advertisers is rising. Google is eating everyone’s lunch by placing its own "Local Service Ads" at the very top of search results. This forces Just Dial to spend more on marketing to keep their traffic up.

- Paid campaigns are getting more expensive.

- Organic traffic is harder to steal from Google.

- The transition to mobile apps is non-negotiable.

Despite these headwinds, their "active paid campaigns" have shown resilience. This tells us that local vendors still find value in the platform. If a local wedding photographer gets five high-quality leads from Just Dial a month, they’ll keep paying. It’s a utility for them.

The "Discovery" Problem and Google’s Shadow

Google is the elephant in the room. Every time Google updates its algorithm, it impacts the Just Dial share value indirectly. Why? Because if Just Dial’s SEO rankings drop, they have to pay for more traffic.

However, Just Dial has a secret weapon: Voice.

Long before Siri or Alexa, Just Dial was a voice-first company. You called 88888 88888. As voice search becomes more popular in vernacular languages across India, Just Dial’s experience in handling spoken queries might give them a second life. They understand how Indians ask for things, which is often very different from how they type things.

Operating Margins and the Human Cost

Their margins are decent, usually hovering around the 20-25% mark, but they are sensitive to employee costs. Just Dial is a people-heavy business. They need sales reps. They need customer support. Unlike a pure AI play, their growth is tied to their ability to manage a large, decentralized workforce.

When the economy slows down, SMEs are the first to cut their advertising budgets. This cyclical nature is why the stock can be so volatile. You aren't just betting on a website; you're betting on the health of the Indian neighborhood shop.

What Most People Get Wrong About Just Dial

People think it's a "dying" brand.

It’s not. It’s a "pivoting" brand.

There is a huge difference. A dying brand loses users and bleeds cash. Just Dial is growing its user base and making more money than it knows what to do with. The disconnect between public perception and the balance sheet is where the opportunity (and the risk) lies.

If you look at the historical data, the Just Dial share value has been through several "hype cycles." There was the IPO hype, the e-commerce hype (when they tried to do JD Omni), and now the Reliance-led B2B hype. Each cycle leaves the company a little more robust, even if the stock price doesn't always stay at the peak.

Peer Comparison

Compare them to the "new age" tech companies that listed recently. Many of those companies are still struggling to find a path to profitability. Just Dial has been profitable for ages. It’s the "boring" uncle at the party who actually has a massive savings account while the youngsters are flaunting rented Ferraris.

- IndiaMART: Higher valuation multiples, better B2B focus.

- Zomato/Swiggy: Compete in specific niches like food and grocery, but don't offer the broad directory service.

- Google: The ultimate competitor that Just Dial has to coexist with.

The Impact of Local Services Expansion

The "hyperlocal" space is where the next war will be fought. As Urban Company dominates the high-end service market (plumbers, beauticians), Just Dial is trying to hold onto the "everything else" category.

From finding a wholesale dealer for PVC pipes to locating a nearby puja samagri shop, Just Dial covers the long-tail of search. This long-tail is hard for Google to categorize perfectly and too small for the big e-commerce players to care about. This is Just Dial's sweet spot.

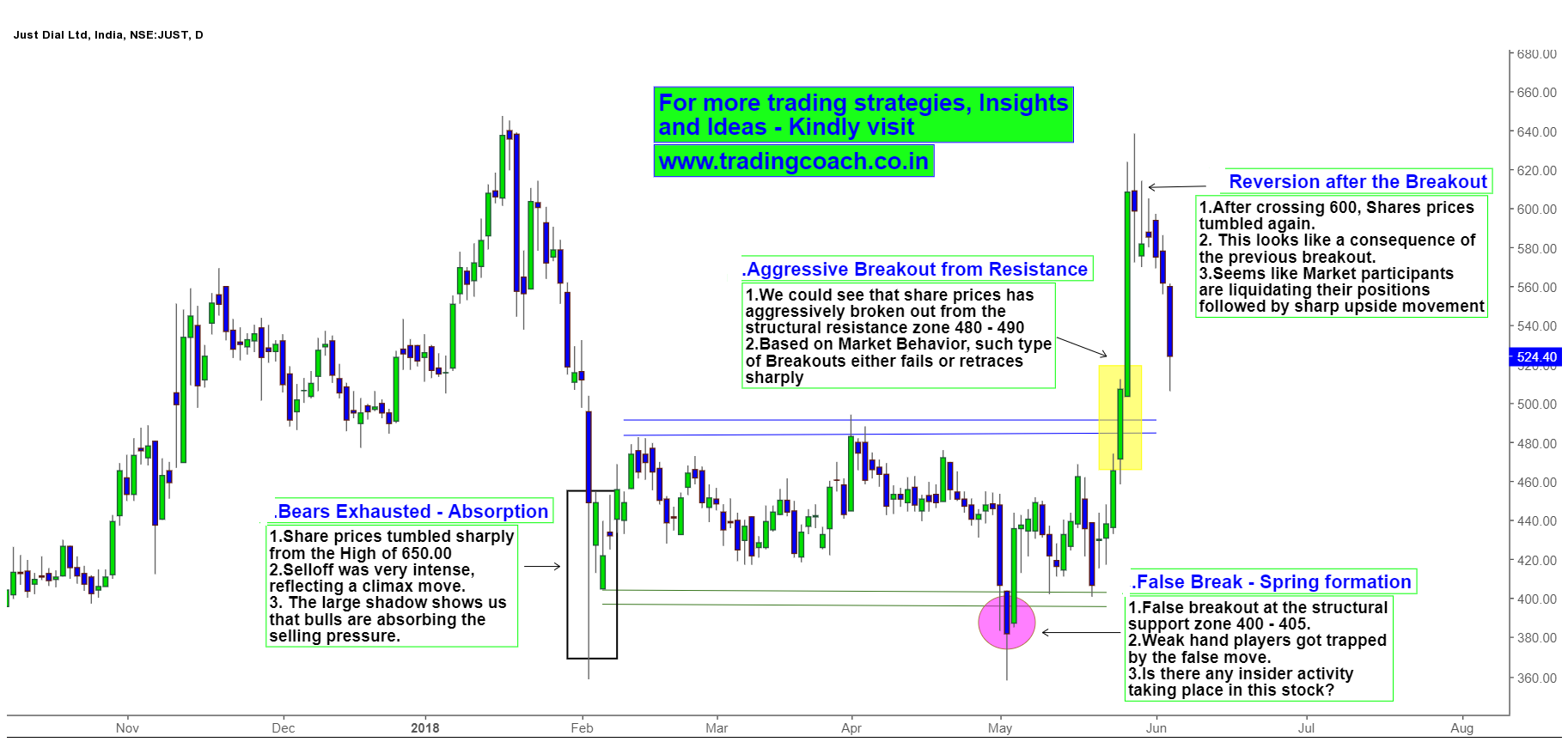

Analyzing the Technical Trends

If you're looking at the charts, the Just Dial share value often hits resistance at certain psychological levels. Institutional investors (FIIs and DIIs) have been fluctuating their stakes. When the "big boys" increase their holdings, it usually signals a belief that the Reliance integration is finally bearing fruit.

But don't ignore the dividend history. Because they have so much cash, they occasionally announce buybacks or dividends. This provides a floor for the share price. If the stock drops too low, the valuation becomes so attractive based on cash-per-share that it almost becomes a no-brainer for value investors.

Risks You Can't Ignore

It’s not all sunshine and roses. The biggest risk is "platform irrelevance." If the next generation of business owners decides they only need Instagram and WhatsApp to run their shops, Just Dial’s directory becomes a ghost town.

They are fighting a war on two fronts:

- Upstream against Google.

- Downstream against specialized vertical apps (like Practo for doctors or MyGate for services).

To win, they have to prove they are a "super app" for businesses.

Moving Forward with Just Dial

So, what’s the move? If you're watching the Just Dial share value, you need to stop looking at daily ticks and start looking at quarterly "Paid Listing" growth. That is the only metric that truly matters. If that number goes up, the business is healthy. If it stalls, the Reliance magic hasn't worked yet.

The valuation currently suggests the market is waiting for a "spark"—a major announcement regarding a deep integration with JioMart or a massive expansion of JD Mart. Until then, it remains a high-cash, steady-profit business in a high-growth, volatile sector.

Actionable Steps for Investors

First, stop treating it like a startup. It's a mature company. Treat it like a utility play in the digital space.

Second, watch the "Other Income" vs. "Operating Revenue." You want to see the operating revenue growing faster. If the company is just living off interest, the stock will stagnate.

🔗 Read more: CGC Stock Price: What Most People Get Wrong About Canopy Growth

Third, monitor the competition. If IndiaMART’s growth slows down while JD Mart’s picks up, that’s a huge signal for a re-rating of the Just Dial share value.

Check the quarterly filings for the "Deferred Revenue" section. This represents money collected from advertisers for services not yet rendered. It’s a leading indicator of future revenue. If deferred revenue is rising, the next two quarters will likely be strong.

Keep an eye on the management commentary regarding AI. Just Dial has a goldmine of data. If they can implement LLMs (Large Language Models) to make their search more intuitive or help small businesses create catalogs automatically, their cost of service will plummet.

The story of Just Dial isn't over; it's just in a very long, very profitable middle chapter. It’s a bet on the persistence of the Indian SME and Reliance’s ability to eventually digitize the entire country’s supply chain. Just don't expect it to happen by next Tuesday.

Understand the liquidity. The stock isn't as liquid as a Nifty 50 giant. Large orders can move the price significantly. Always use limit orders if you're looking to enter a position. This is a stock that rewards the patient, not the frantic. Stay focused on the earnings per share (EPS) growth rather than the social media chatter. That's how you actually navigate the Just Dial share value without losing your mind.