You open your mailbox in May and there it is. That long, trifold envelope from the Kane County Treasurer. For most of us in Geneva, Aurora, or Elgin, it’s the most stressful piece of mail we get all year. You look at the total, wince, and wonder how on earth a house that hasn't changed in a decade suddenly costs $800 more to "own" this year.

Honestly, the kane county il property tax system is a beast. It’s not just one bill; it’s a collection of dozens of smaller taxes from your school district, your library, the forest preserve, and even that mosquito abatement district you forgot existed. If you feel like you’re paying more than your neighbors, you might actually be right.

But here’s the thing: most people just grumble and pay it. They don't realize that the "assessed value" on that paper isn't some divine truth handed down from a mountain. It's a calculation made by humans, and humans make mistakes. Whether you're in a historic Victorian in St. Charles or a new build in Pingree Grove, understanding the cycle is the only way to keep your head above water.

Why Your Bill Keeps Climbing (Even If Your House Stays the Same)

It’s a common myth that if you don’t renovate, your taxes shouldn't go up. I wish. In reality, your kane county il property tax is tied to the market around you. If a house down the street with the same floor plan sells for a record high, your "fair market value" just took a jump in the eyes of the township assessor.

In Illinois, your property is assessed at 33.33% of its fair market value. So, if the county thinks your home is worth $300,000, your Equalized Assessed Value (EAV) starts at $100,000. Then come the tax rates. These rates aren't flat. They are "extended" based on the levies requested by local bodies like School District 303 or 129.

Basically, the school district says, "We need $100 million to run this year." The county clerk then looks at the total value of all property in that district and calculates the rate needed to hit that $100 million. If property values go down but the schools still need the same amount of money? Your rate goes up. It's a see-saw that rarely feels like it's in your favor.

The Two-Installment Trap

Kane County splits the pain into two parts. For the 2024 taxes (which you pay in 2025), the dates are set in stone.

- First Installment Due: June 2, 2025.

- Second Installment Due: September 2, 2025.

If you miss these, the interest starts at 1.5% per month. That adds up fast. I’ve seen people lose track of the September date because it’s right around Labor Day, and suddenly they're looking at a penalty that covers a whole week's worth of groceries.

The Secret to Lowering Your Kane County IL Property Tax

You shouldn't just accept the number on the bill. There are two main ways to fight back: exemptions and appeals.

Most people have the General Homestead Exemption, which knocks $6,000 off your EAV. But did you know about the Senior Citizen Assessment Freeze? For the 2025 tax year (payable in 2026), the income limit for this was $65,000, but a new law—Senate Bill 642—is actually bumping that limit to $75,000 for the following year. This is huge for retirees in places like Sun City who are living on fixed incomes while the cost of living in the Chicago suburbs skyrockets.

How to Appeal Without Hiring a Lawyer

If you think your assessment is just plain wrong, you have a window to complain. This is the "Board of Review" phase. Every township has a different deadline. For example, back in 2025:

- Batavia deadlines were usually early August.

- Elgin was mid-October.

- Aurora hit in late August.

You don't need a high-priced attorney to do this. You just need "comparables." Find three houses in your neighborhood that are similar in square footage and age but have lower assessments. If you can show the Board of Review that you're being over-assessed compared to your literal next-door neighbor, they’re often surprisingly reasonable about adjusting it.

Where the Money Actually Goes

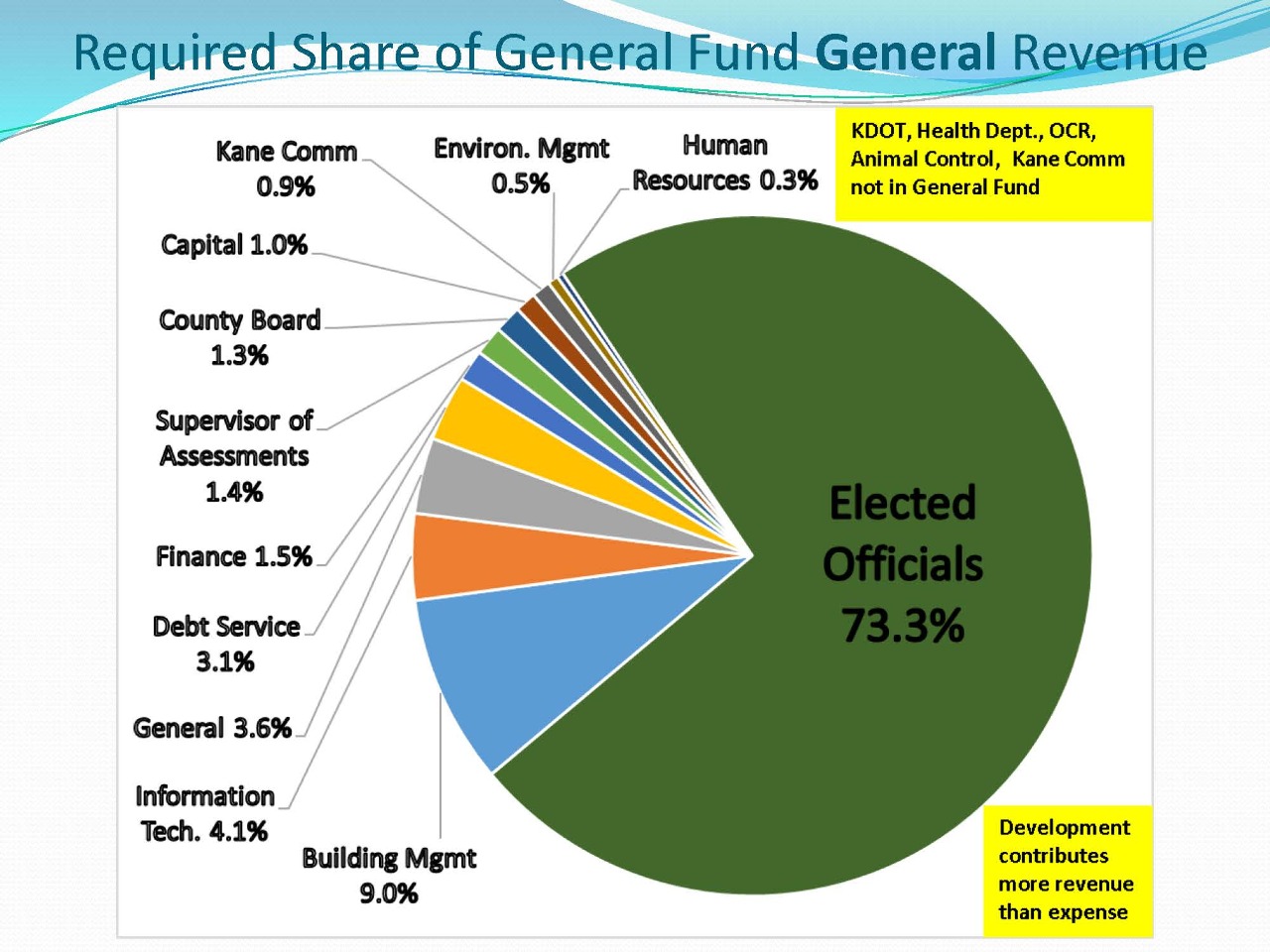

It’s easy to get mad at the Kane County Treasurer, Chris Lauzen, or the Supervisor of Assessments, Mark Armstrong. But they are just the bill collectors. The real "culprits" are the local taxing bodies.

In Kane County, about 60% to 70% of your bill goes straight to public schools. The rest is a patchwork. You’ve got the Kane County Forest Preserve (usually a small slice), your township road district (for plowing those streets), and your municipal government.

If you live in a "Special Service Area" (SSA), you’re paying even more. These are often found in newer subdivisions where the developer took out a bond to build the roads or sewers, and the homeowners are paying it back over 20 or 30 years. If you're house-hunting in Kane, always ask if there's an active SSA. It can add $1,000 or more to your annual bill.

Real World Example: The "New Construction" Shock

Let's talk about a guy named "Dave" in South Elgin. Dave buys a new construction home for $450,000. The first year, his kane county il property tax bill is tiny—maybe $1,200. He thinks he hit the jackpot.

📖 Related: Lucent Technologies Inc Stock: What Really Happened to the Most Owned Stock in History

He didn't.

That first bill was based on the land value only because the house wasn't finished when the assessor did their walkthrough. The next year, the "improvement" (the house) gets added. Suddenly, Dave’s bill jumps to $11,000. If Dave didn't have that money in escrow, he's in deep trouble.

This happens more than you’d think. If you buy a flip or a new build, always estimate your taxes based on the purchase price, not what the previous owner paid. Use a rough estimate of 2.5% to 3% of the purchase price for a realistic annual number.

Navigating the 2026 Tax Season

As we move through 2026, the data from 2025 is what’s going to haunt your mailbox. Market values in the Tri-Cities (Geneva, Batavia, St. Charles) have stayed stubbornly high, which means assessments aren't dropping anytime soon.

Check your exemptions every single year. Sometimes they "fall off" during a deed transfer or if the county's system has a glitch. If you’re a veteran with a disability, you might be eligible for a massive reduction—sometimes even a total exemption from kane county il property tax—depending on your service-connected rating.

💡 You might also like: DraftKings Stock Price: What Most People Get Wrong About DKNG

Actionable Steps to Handle Your Tax Bill

Stop treating your tax bill like a static expense you can't control. It’s more like a utility bill where you can find "leaks" and plug them.

- Verify Your Exemptions: Go to the Kane County Supervisor of Assessments website. Search for your parcel. If you don't see "General Homestead" and you live there, you are literally throwing money away.

- Mark Your Calendar for July: This is usually when the "blue cards" (assessment notices) start hitting mailboxes. You only have 30 days from the date of publication to file an appeal. If you wait until the bill arrives in May, you are a year too late to fight that specific value.

- Use the Drive-Up Drop Box: If you’re paying by check, don't risk the mail or the long lines inside the Geneva office. There’s a drive-up drop box behind Building A at the Government Center (719 S. Batavia Ave). It’s open 24/7 during tax season.

- Research the "Senior Freeze" Income: If your household income is hovering around that $75,000 mark, look at your 2025 tax returns. Small adjustments to your distributions might keep you under the threshold, saving you thousands in future assessment hikes.

- Analyze Your Tax Code: Your bill has a "Tax Code" (like AU015). This tells you exactly which districts are taking your money. If you're upset about the library tax, go to the library board meetings. That’s where the "levy" is decided.

The system is complicated by design, but it’s not impenetrable. By the time the second installment rolls around in September, you should already be looking forward to next year's assessment window to make sure you aren't paying a penny more than your fair share.