You just filed your Articles of Organization with the Kentucky Secretary of State. You paid the $40 fee. You're officially a business owner. But here’s the thing: you aren't actually protected yet. Not really. Most people think the state filing is the "shield," but in the Bluegrass State, the Kentucky LLC operating agreement is actually the engine under the hood that keeps the whole thing from stalling out or crashing into a legal ditch.

Honestly, a lot of folks skip this. Why? Because Kentucky law doesn't technically require you to file one with the state. KRS 14.9-010 and the surrounding statutes (Chapter 275) describe what an LLC is, but they don't force you to write down your internal rules. That’s a trap. If you don't have your own agreement, you are essentially telling the Kentucky courts, "Hey, I don't care how my business is run, just use the generic state default rules for me." Trust me, you don't want the state’s default rules. They’re rigid, they’re impersonal, and they usually don't fit how you actually plan to make money.

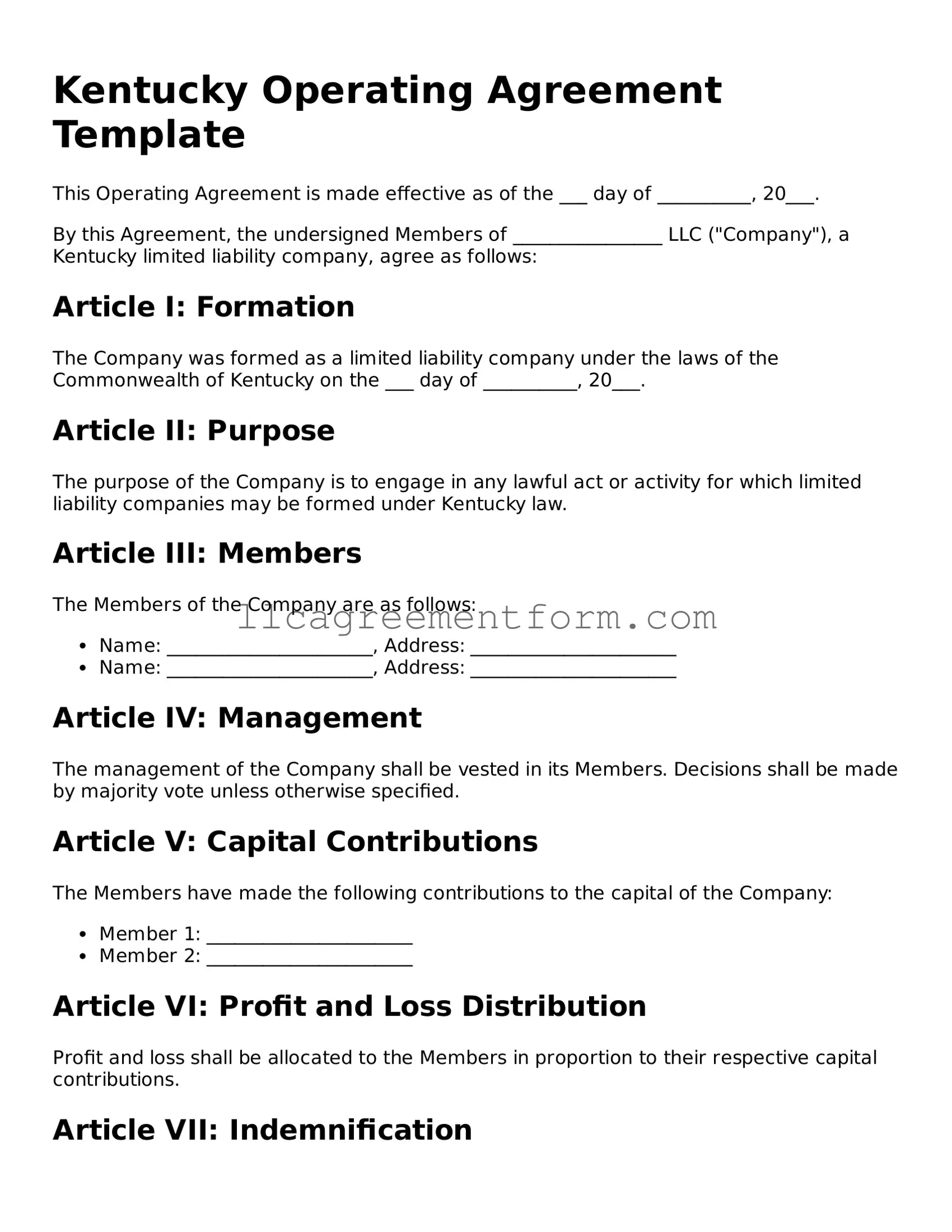

The Invisible Shield You Didn't Know You Needed

An operating agreement is basically a contract between members. If you’re a single-member LLC, it’s a contract with yourself—which sounds schizophrenic but is legally vital. It separates you from the business. Without a formal Kentucky LLC operating agreement, a creditor or a hungry lawyer could argue that your LLC is just an "alter ego" of yourself. This is what's known as "piercing the corporate veil." If that happens, your personal house, your truck, and your kid’s college fund are all on the table to pay off a business debt.

💡 You might also like: Sarah Al Amiri Bank Connections: What Most People Get Wrong

Kentucky courts, like in the case of Inter-Tel Conf. Ctr., Inc. v. Linn Station Props., LLC, look at whether the company followed corporate formalities. Even though LLCs have fewer "hoops" than corporations, having a signed, dated operating agreement is Exhibit A in proving your business is a legitimate, separate entity. It’s the difference between being a professional and being a hobbyist with a tax ID number.

Who’s the Boss? (Managing the Chaos)

You have to decide if you’re Member-Managed or Manager-Managed. In Kentucky, if you don't specify this, the default is usually that all members have a say. That’s fine if it's just you. But what if you bring in a partner? If you haven't outlined who can sign checks or enter into contracts, you’re asking for a nightmare.

Imagine you own a bourbon tour company in Bardstown. You have a 10% partner who decides, without telling you, to buy a $200,000 luxury bus. If your Kentucky LLC operating agreement doesn't explicitly limit their authority to spend over $5,000, you might be legally on the hook for that bus. Kentucky’s version of the Uniform Limited Liability Company Act gives members broad "agency" power unless you put a leash on it in writing.

Voting Rights and the 51% Myth

People think 51% always wins. Not in Kentucky. Not unless your agreement says so.

📖 Related: NJ Auto Insurance Codes: What Most People Get Wrong

The law provides certain default voting requirements for "extraordinary" events—like merging the company or dissolving it. Sometimes these require a unanimous vote under state default rules. Imagine being stuck in a deadlocked business because your 5% minority partner refuses to sell the company, and you never wrote an agreement that said a simple majority rules. You’re trapped. You’re basically married to someone you can't stand, legally speaking.

Your agreement should clearly define:

- What requires a unanimous vote (like bringing in new members).

- What requires a "supermajority" (maybe 75% for selling major assets).

- What the "Daily Driver" decisions are (51%).

- How you handle a tie. Do you go to mediation? Does one person have a tie-breaking "Golden Share"?

The Money: Distributions and Capital Calls

Kentucky is pretty flexible about how you split the loot. You don't have to split profits based on ownership percentage. You could own 90% of the company but give your 10% partner half the profits because they do all the "sweat equity" work. But if it isn't in your Kentucky LLC operating agreement, the IRS and the state are going to assume profits follow ownership percentages.

Then there’s the "Capital Call." What happens if the business is $50,000 short on rent and insurance? Does every member have to cough up cash? What if one member can't? Does their ownership get diluted? If you don't answer these questions now, while everyone is happy and getting along, you'll be answering them in a deposition later. It gets ugly fast.

The "Death and Divorce" Problem

This is the part nobody likes to talk about. Life happens. In Kentucky, if a member gets a divorce, their membership interest in the LLC could be considered marital property. Suddenly, your ex-business partner’s ex-spouse owns a chunk of your company. They’re at the meetings. They’re looking at the books.

A well-drafted Kentucky LLC operating agreement includes "Buy-Sell" provisions. These act like a prenuptial agreement for your business. It can mandate that if a member leaves, dies, or gets divorced, the company has the first right to buy back those shares at a predetermined price or via a specific valuation formula. You want to keep the "bloodline" of the business clean. You don't want to be forced into business with a stranger because of a probate court ruling.

Why "Online Templates" Usually Fall Short

You can find a free template in five seconds. But most of those are generic. Kentucky has specific statutes, like KRS 275.165, which deals with the "standard of care" for members and managers. A generic template from a California-based website might use language that doesn't mesh with Kentucky's specific legal "flavor."

For example, Kentucky allows for "Series LLCs" (though they are more common in states like Delaware or Nevada, Kentucky's laws are distinct). If you're trying to run multiple rental properties under one master LLC, a generic operating agreement will fail you completely. You need language that creates the "internal firewalls" between those properties.

🔗 Read more: Citi Card Bill Payment: How to Actually Avoid Fees and Why the App Sometimes Glitches

Fiduciary Duties: The "Don't Screw Me" Clause

In a Kentucky LLC, members generally owe each other a duty of loyalty and a duty of care. But did you know you can actually limit some of these duties in your operating agreement? You can't authorize intentional misconduct or a knowing violation of the law, but you can define what "competition" looks like.

If you and a buddy start a landscaping company, can he start a side-hustle pressure washing houses? Is that a conflict of interest? Your Kentucky LLC operating agreement is where you draw those boundaries. Without it, you’re leaning on "common law," which is just a fancy way of saying you're paying a lawyer $300 an hour to argue about it in front of a judge who might be having a bad day.

Keeping the Tax Man Happy

The IRS sees an LLC as a "pass-through" entity by default. This means the business doesn't pay taxes; you do, on your personal return. However, you can elect to be taxed as an S-Corp or even a C-Corp. Your operating agreement needs to reflect this tax election. If you tell the IRS you're an S-Corp but your operating agreement is written for a standard partnership, you're waving a red flag for an audit. The "Check-the-Box" regulations are strict, and your internal documents need to match your tax filings.

Actionable Steps for Your Kentucky LLC

Don't just let this sit on your to-do list. The longer you operate without a formal agreement, the more "precedent" you set through your informal actions—and that precedent can be used against you later.

- Audit your current setup: Even if you have a one-page "agreement," read it. Does it actually say what happens if you die? Does it say who can take out a loan in the company's name?

- Define the "Exit": Decide today how a member can leave. Can they sell their interest to anyone, or do you have to approve the buyer?

- Formalize your meetings: You don't need the crazy formalities of a corporation (no need for velvet robes or gavels), but you should keep "Minutes" of major decisions. Reference your operating agreement in those minutes.

- Sign and Date: It sounds stupid, but many people draft an agreement and never sign it. An unsigned contract is just a piece of scrap paper. Keep a digital copy in the cloud and a hard copy in a safe place.

- Review annually: Kentucky laws change. Your business grows. If you started as a solo freelancer but now have three employees and a storefront in Lexington, your 2021 agreement is probably obsolete.

The Kentucky LLC operating agreement is your business's constitution. It's the only thing that stands between a simple disagreement and a full-blown "business divorce" that bankrupts everyone involved. Spend the time to get it right, or you'll spend the money later to fix it.