So, you’re looking into what is currency in Kenya? Honestly, it’s one of those things that sounds straightforward until you’re actually standing at a market stall in Mombasa or trying to pay for a taxi in Nairobi. Most people will tell you it's just the Shilling. Technically, they’re right. But if you think that means you’ll be carrying around a fat wallet of paper bills for every transaction, you’re in for a bit of a surprise.

Kenya is basically living in the future of finance while keeping its feet firmly planted in tradition. It's a weird, fascinating mix.

The Official Currency in Kenya: Meet the Shilling

The official currency in Kenya is the Kenyan Shilling, and you’ll see it abbreviated as KSh or by its international code, KES.

📖 Related: Is TD Bank Open Tomorrow? What You Actually Need to Know

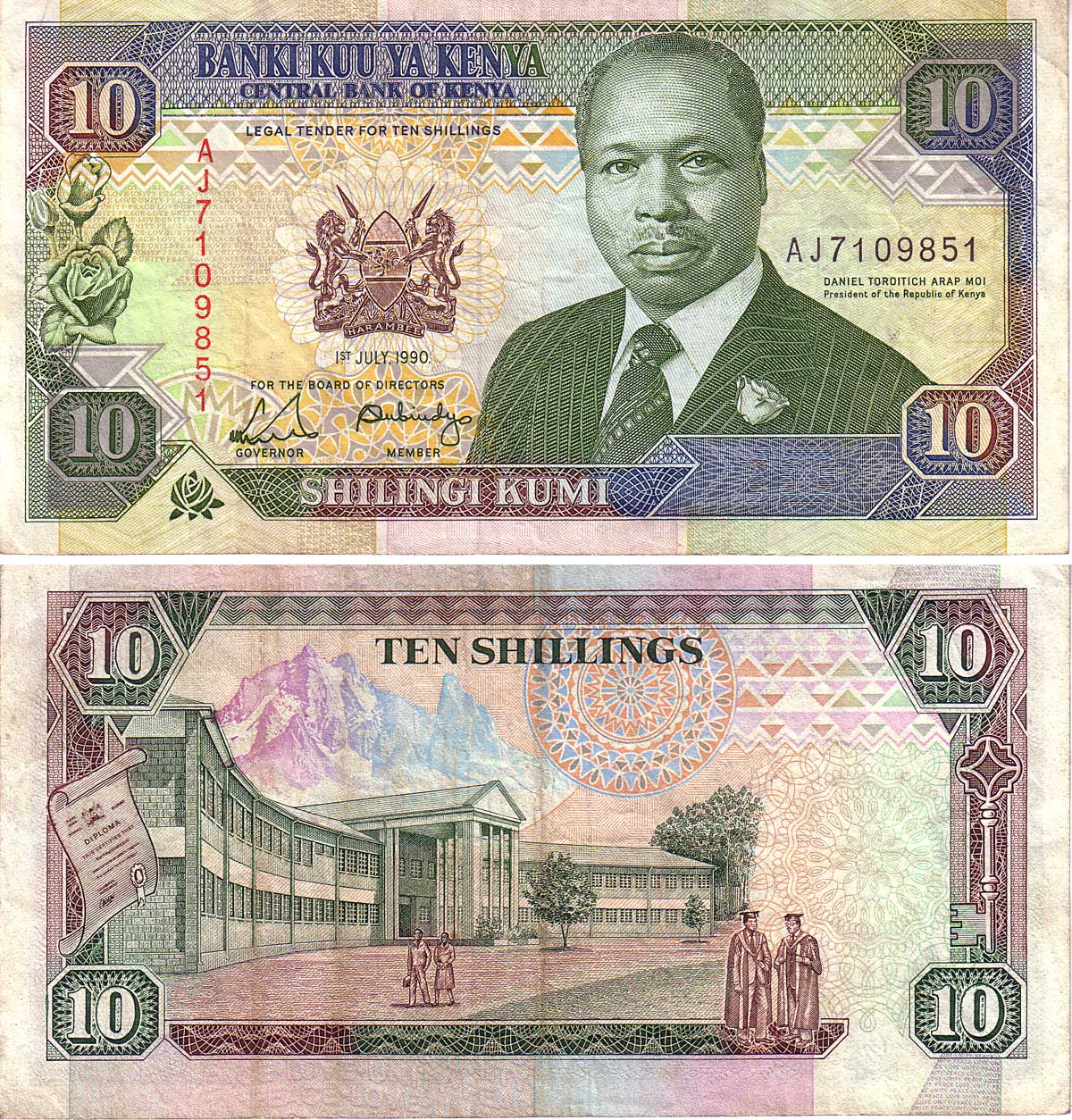

Now, if we’re talking physical money—the stuff you can actually touch—the Central Bank of Kenya (CBK) runs the show. Since about 2019, the country has been using a "New Generation" of banknotes. This wasn't just a cosmetic makeover. The government actually pulled a pretty bold move and demonetized the old 1,000-shilling notes to crack down on "dirty money" and counterfeiting. If you find an old 1,000-shilling note from ten years ago in a drawer somewhere, sorry to say, it’s basically a souvenir now.

What’s currently in your pocket?

If you withdraw cash today, you’re going to see a specific set of denominations. They’re colorful, they’re durable, and they tell a story about the country.

- 1,000 KSh (Maroon): This is the "big" note. It features the Kenyatta International Convention Centre (KICC) and focuses on "Governance."

- 500 KSh (Pink/Purple): Dedicated to tourism, which makes sense given how much the safari industry pumps into the economy.

- 200 KSh (Blue): This one highlights social services and features images of medical professionals and athletes.

- 100 KSh (Violet): Agriculture is the theme here. You’ll see corn and livestock.

- 50 KSh (Green): This note celebrates green energy, specifically wind and geothermal power.

You’ve also got coins. The current ones—issued around 2018—are pretty cool because they ditched the portraits of politicians for wildlife. You’ll find 1 Shilling (Giraffe), 5 Shillings (Rhino), 10 Shillings (Lion), and 20 Shillings (Elephant). There is a 40 Shilling coin out there too, but it’s a bit of a rare beast in daily change.

The Digital Elephant in the Room: M-PESA

You cannot talk about what is currency in Kenya without talking about M-PESA. Honestly, it’s more "currency" to many Kenyans than the physical shilling itself.

Think of it like Venmo or PayPal, but on steroids and woven into the very fabric of society. M-PESA is a mobile money service run by Safaricom. You don’t even need a smartphone for it; it works on basic "brick" phones via USID codes.

💡 You might also like: One Ounce of Gold Price USD: What Most People Get Wrong About the $4,600 Surge

In Kenya, you use M-PESA to pay for literally everything. A bunch of bananas at a roadside stand? M-PESA. A high-end dinner in Westlands? M-PESA. Your electricity bill? M-PESA. In fact, many businesses have a "Lipa na M-PESA" (Pay with M-PESA) "Till Number" displayed prominently.

It’s so dominant that by early 2026, data suggests over 50% of Kenya's GDP flows through this digital ecosystem. If you’re traveling there, or doing business, you’ll quickly realize that "cash" isn't always king—mobile credit is.

Current Exchange Rates and Why They Move

The Shilling hasn’t exactly had a boring ride lately. As of mid-January 2026, the exchange rate is hovering around 129 to 130 KES for 1 US Dollar.

It’s been a bit of a rollercoaster. A few years ago, we saw the Shilling weaken significantly against the dollar, driven by global inflation, high debt servicing costs, and a thirsty demand for imports. However, recent interventions by the Central Bank and a boost in tea and coffee exports have helped stabilize things a bit.

If you’re checking the rate, don’t just look at the "mid-market" rate on Google. If you’re at a bank or a forex bureau in Nairobi, expect a spread. You’ll likely get a slightly worse deal at the airport—shocker, I know—compared to the bureaus in the city center like those at the Village Market or Sarit Centre.

The "Invisible" Money: Small Change Struggles

Here’s a nuance most guides skip: the "shilling rejection" phenomenon.

Technically, the Shilling is divided into 100 cents. But in reality? Cents are dead. You will almost never see a cent coin. Even the 50-cent coin is basically a relic. In fact, in many rural areas and even some city kiosks, people are starting to get picky about the 1-shilling and 5-shilling coins. Because of inflation, their purchasing power is so low that some traders find them more of a hassle to carry than they’re worth.

📖 Related: Banks That Are Open Today: Why Your Local Branch Might Be Ghosting You

If your bill is 102 shillings and you give 110, don't be surprised if the vendor "rounds off" or gives you a small piece of candy instead of two 1-shilling coins. It’s just how the street economy works.

Expert Tips for Handling Money in Kenya

If you’re heading to Kenya or managing a business there, here are some actionable insights to keep your finances smooth:

- Don't rely solely on plastic. While Visa and Mastercard are accepted in big malls and hotels, your card will be useless at most local markets or for public transport (Matatus).

- Get M-PESA as soon as possible. If you're a visitor, you can register for a Safaricom SIM card at the airport with your passport. Loading some cash into your M-PESA account will make your life 100% easier.

- Carry "clean" US Dollars. If you’re bringing USD to exchange, make sure the bills are crisp, new (post-2013), and have no tears. Many bureaus will flat-out refuse old or "small" head bills.

- ATM strategy. Stick to ATMs attached to major banks like KCB, Equity Bank, or Stanbic. They are generally safer and less likely to have "skimmers" or technical glitches.

- Watch the "Small Notes" trap. Sometimes, if you're out in the bush or a small village, people won't have change for a 1,000 KSh note. Try to break your large bills at supermarkets or petrol stations to keep a supply of 50s, 100s, and 200s.

Understanding the currency in Kenya is really about understanding the balance between the physical shilling and the digital revolution. Whether you're counting out colorful notes or "zapping" a payment via your phone, the system is efficient once you know the unwritten rules.

Next Step: Check the live Central Bank of Kenya (CBK) indicative rates if you're planning a transaction today, as the market can shift by 1-2% in a single week.