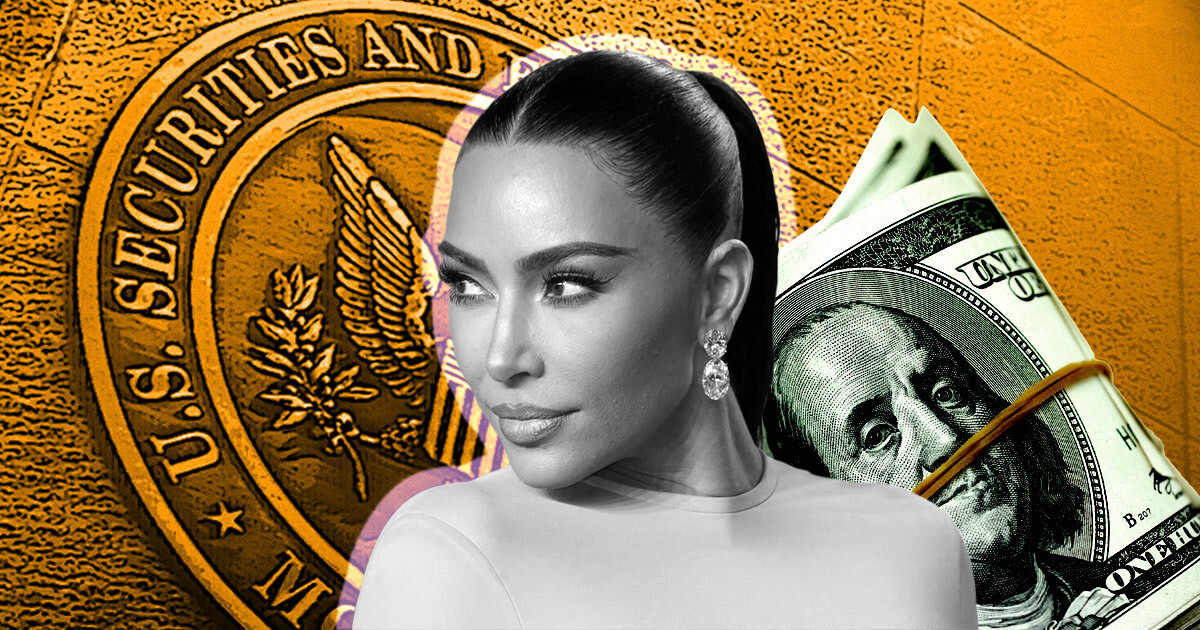

It was just one Instagram story. Back in June 2021, Kim Kardashian posted a quick "Are you guys into crypto????" to her hundreds of millions of followers. She mentioned the EthereumMax (EMAX) token, tossed in a #AD at the bottom, and moved on. Honestly, most people probably swiped past it without a second thought. But the federal government didn't.

Fast forward to October 2022, and the headline hit like a ton of bricks: Kim Kardashian agreed to pay $1.26 million to settle charges with the Securities and Exchange Commission (SEC). This wasn't about her being a bad person or trying to scam her fans in a traditional sense. It was about a very specific, very old rule that many influencers—even the world-class ones—didn't realize applied to them.

The $250,000 Mistake

Basically, Kim was paid $250,000 to post that single story. While she did include the hashtag for an advertisement, she didn't disclose how much she was paid or the fact that she was paid specifically to "tout" a security. That’s the kicker. Under Section 17(b) of the Securities Act of 1933, if you’re promoting a security, you have to tell people exactly what you’re getting out of it.

You can’t just say "thanks to my friends at [Company Name]" or use a generic hashtag. The SEC wants the cold, hard numbers.

✨ Don't miss: LA Fires Celebrity Homes: Why the 2025 Disaster Changed Hollywood Real Estate Forever

The penalty broke down like this:

- She had to give back the $250,000 (disgorgement).

- She had to pay about $10,000 in interest.

- She got slapped with a $1,000,000 fine.

That million-dollar fine was a "message case." SEC Chair Gary Gensler wasn't just looking to penalize Kim; he wanted to make an example of her to every other celebrity thinking about dipping their toes into the crypto-promotion waters.

Why the SEC Cared So Much

Think about the reach. At the time, Kim had over 330 million followers. One in five American adults reportedly saw that post. When someone with that much influence tells people to "swipe up" for a speculative investment, the potential for mass financial loss is huge. EMAX tokens eventually lost more than 95% of their value.

People lost real money.

💡 You might also like: Who Has Been Cancelled by Cancel Culture: The Messy Reality of Public Exile

The SEC’s argument is that crypto tokens like EMAX aren't just "digital currency"—they are investment contracts. Using the Howey Test (a legal standard from the 1940s), the SEC determines if an asset is a security by looking at whether there's an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

If it's a security, the rules change instantly. You aren't just selling a waist trainer or a skincare line anymore. You’re selling a financial product.

Not the First (Or Last)

Kim was actually in "good" company. Boxer Floyd Mayweather and music producer DJ Khaled had already been caught in the SEC’s net years earlier for similar promotions. Even Steven Seagal got hit with a fine for promoting an ICO (Initial Coin Offering) without disclosing his $250,000 cash and $750,000 in token compensation.

👉 See also: Brenda Song and Macaulay Culkin: What Really Happened Behind the Scenes

Paul Pierce, the NBA legend, also got caught up in the EMAX drama. He ended up paying $1.4 million in early 2023 for his own tweets about the token. It seems like the SEC has a specific folder in their filing cabinets just for EMAX promoters.

The Three-Year Ban

Part of the settlement wasn't just about the money. Kim Kardashian had to agree not to promote any crypto asset securities for three years. That ban stays in effect until late 2025.

For a businesswoman who thrives on new ventures, this was a significant hurdle. It forced her to pivot. Shortly after the settlement, she launched her private equity firm, SKKY Partners. This move toward institutional finance probably made it even more important to settle the SEC charges quickly. You can't really run a serious private equity firm while you're in a protracted legal battle with the primary regulator of the financial industry.

What This Means for You

If you’re an investor, the takeaway is simple: don’t buy things just because a celebrity tells you to. They are often being paid hundreds of thousands of dollars to say they like it. They might not even hold the asset themselves.

If you’re a creator or an influencer, the rules are even more vital:

- Disclose everything. If you’re talking about a financial product, "#ad" is not enough. You must disclose the amount and nature of your compensation.

- Vet the product. If the SEC decides the token is a security, you are legally responsible for how you promote it.

- Get a lawyer. Not just any lawyer—a securities lawyer. The FTC rules for Instagram are child's play compared to the SEC's "anti-touting" provisions.

The Kim Kardashian SEC settlement changed the landscape of social media marketing forever. It proved that the "wild west" of crypto wasn't actually outside the law; it was just waiting for the sheriff to show up.

Moving forward, expect even more scrutiny on "finfluencers" and celebrities. The era of the casual crypto shout-out is officially over. If you want to stay on the right side of the law, transparency isn't just a good idea—it's the only way to avoid a seven-figure bill from the government.

Next Steps for Staying Compliant:

- Review the SEC's 2017 Statement Urging Caution Around Celebrity-Backed ICOs for the foundational rules.

- If you are an influencer, ensure all financial-related posts include a clear and conspicuous disclosure of the exact dollar amount received for the promotion.

- Investors should use tools like the SEC’s EDGAR database to research if a company is registered before following social media advice.