Everyone talks about lithium like it’s the new gold. Or the new oil. Honestly, it’s basically the backbone of everything with a battery right now. If you’ve looked at your phone today or seen a Tesla hum past, you’re looking at the end result of a massive, global scramble for "white gold."

But here’s the thing. There’s a huge difference between having lithium in the ground and actually being able to use it.

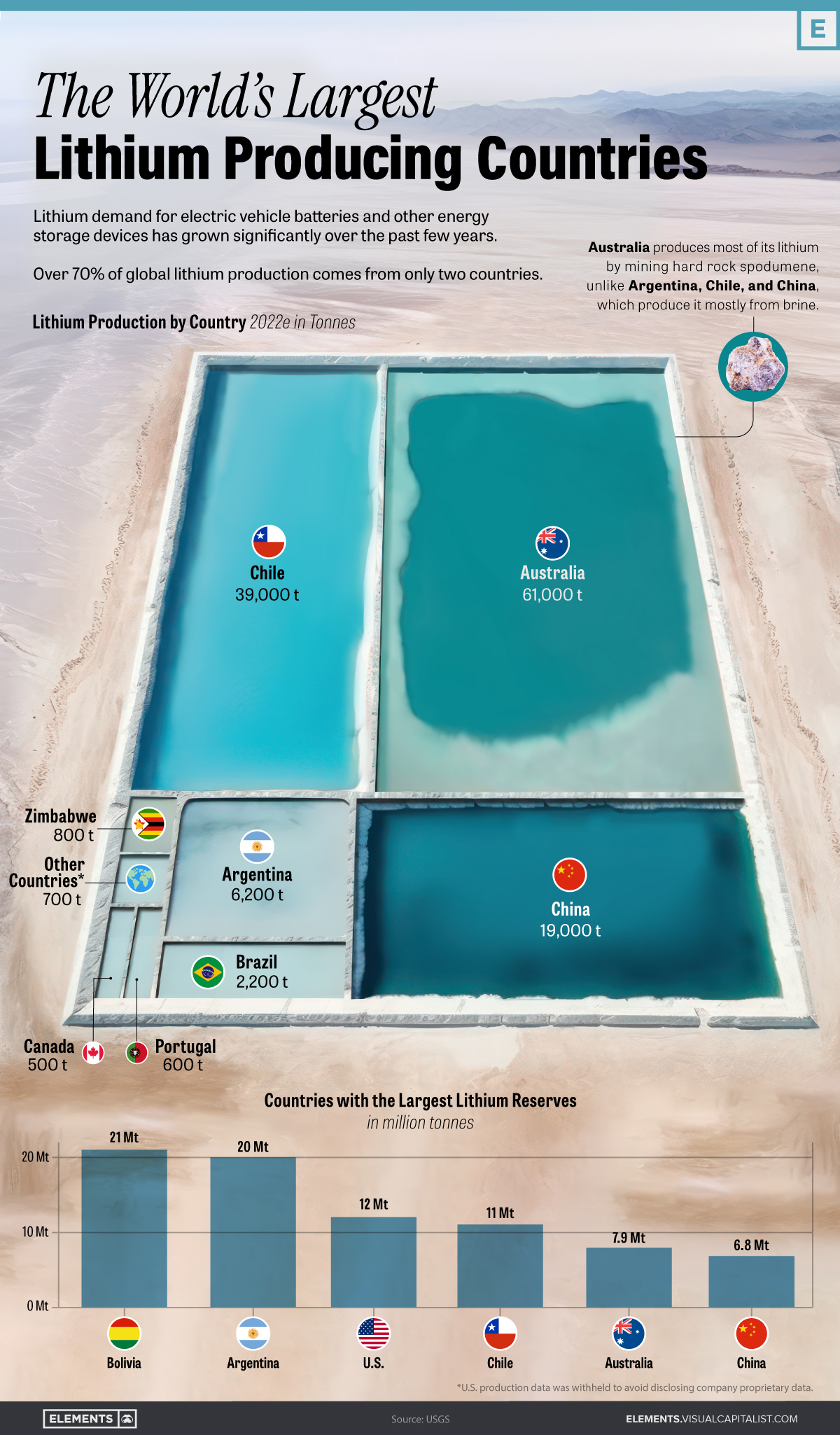

When we talk about the largest lithium reserves in the world, the map looks a lot different than the list of who is actually winning the production race. Some countries are sitting on a literal goldmine of brine but haven't figured out how to get it out of the dirt. Others have less on paper but are digging it up faster than anyone else.

The Lithium Triangle: A South American Powerhouse

If you zoom into South America, you’ll find the Lithium Triangle. This region—straddling Chile, Argentina, and Bolivia—is home to more than half of the planet’s known lithium resources. It’s a high-altitude, sun-scorched landscape of salt flats (salares) that looks like another planet.

✨ Don't miss: Class 3 milk futures: What most traders and dairy farmers get wrong about the market

Bolivia is the wild card here.

Technically, Bolivia holds the title for the single largest lithium resource on Earth. The Salar de Uyuni is estimated to contain over 21 million tons. That’s an insane amount of potential. However, if you look at the actual market, Bolivia is barely a blip. Why?

It’s complicated. The brine in Bolivia has a high magnesium content, which makes it a nightmare to process. Plus, there’s the political side. The government has kept a tight grip on these resources, favoring state-led development that has been, frankly, slow to move. By 2026, we’re seeing new deals with Chinese firms like CATL, but they’re still playing catch-up.

Chile and the Atacama Reality

Chile is a different story. It’s the second-largest producer globally and holds about 9.3 million metric tons of "economically extractable" reserves.

✨ Don't miss: Walmart Key Event Days: What Most People Get Wrong About Point Management

The Salar de Atacama is basically the crown jewel of the industry. It’s incredibly dry, which is perfect for solar evaporation. You pump the brine into giant ponds, let the sun do its thing, and eventually, you get lithium. But even here, things are shifting. President Gabriel Boric’s move toward a semi-nationalized model has made investors a bit jumpy. State-owned Codelco is now taking the lead in negotiations with giants like SQM and Albemarle.

The Rise of China’s New Deposits

For a long time, China was the processing king but not necessarily a reserve leader. That changed recently.

Early in 2025, reports surfaced of massive new discoveries in places like Xinjiang and Inner Mongolia. Some estimates now put China’s reserves at roughly 16.5% of the global total, which is a massive jump from earlier years. They’ve found everything from lepidolite (a harder-to-process rock) to more salt lake brines.

China is playing the long game. They don't just want the mines; they already control about 70% of the world’s lithium refining capacity. Even if you mine your lithium in Australia or Africa, there’s a good chance it’s heading to China to be turned into battery-grade chemicals.

Australia: The Production King

Australia doesn't have the biggest "reserve" on paper—ranking behind Chile with about 6 to 7 million tons—but they are the undisputed heavyweights of production.

They do things differently. Instead of waiting for water to evaporate in a salt flat, they dig up hard rock called spodumene. It’s faster, but it’s more expensive and energy-intensive. The Greenbushes mine in Western Australia is the biggest single source of lithium on the planet. By 2026, it’s projected to pump out over 40,000 tons annually.

Australia is stable. It’s predictable. That’s why automakers are flocking there to sign long-term deals, even if the lithium is "rock" rather than "brine."

The American "Smackover" Surprise

The U.S. has been a minor player for decades, mostly relying on one small mine in Nevada. But things are getting interesting.

Recent USGS surveys of the Smackover formation in Southern Arkansas suggest there could be between 5 and 19 million tons of lithium sitting in old oil brine. If those numbers hold up, it could flip the script on North American energy security. You've also got the Thacker Pass project in Nevada, which is fighting through legal and environmental hurdles to tap into one of the largest sedimentary deposits in the country.

Honestly, the "reserves" list is a moving target. As technology like Direct Lithium Extraction (DLE) gets better, deposits that were "too hard to mine" five years ago suddenly become part of the global reserve.

✨ Don't miss: The Richest Presidents of USA: Why the Numbers Keep Changing

Current Global Standings (Estimated 2026)

- Bolivia: 21+ Million Tons (Largest resource, but minimal production)

- Argentina: ~20 Million Tons (Rapidly expanding projects in Salta and Catamarca)

- United States: 14+ Million Tons (Massive spike due to Smackover and Nevada discoveries)

- Chile: 9.3 Million Tons (The current "brine king")

- Australia: 6.2 Million Tons (Leader in hard-rock production)

- China: ~3 Million Tons (Traditional reserves, though new discoveries are being verified)

What Actually Matters for the Future

Don't just look at the numbers. Look at the "grade" and the "cost."

Argentina is the one to watch right now. Unlike Bolivia, they’ve been very welcoming to private investment. They have a hybrid model that’s actually working. By the end of 2026, Argentina is expected to nearly double its production, making it a serious rival to Chile.

We’re also seeing a shift in how we define a "reserve." The IEA and other experts are worried about the concentration of refining. Even if the U.S. or Australia finds more lithium, if they can't process it without sending it across the ocean, the supply chain remains fragile.

Environmental costs are the other big hurdle. Brine mining uses a lot of water in places that don't have much of it. Hard rock mining leaves giant holes in the ground and uses more carbon. The next few years aren't just about who has the most lithium; it’s about who can get it out of the ground without destroying the local ecosystem.

Actionable Next Steps

If you’re looking at this from an investment or industry perspective, stop focusing solely on the "Largest Reserves" list. Instead:

- Monitor DLE Technology: Keep an eye on companies testing Direct Lithium Extraction in the U.S. and Argentina. If it works at scale, it makes "dirty" or "low-grade" reserves incredibly valuable.

- Watch the Refining Gap: Look for countries (like Australia or Canada) that are building their own processing plants to bypass the Chinese bottleneck.

- Track Policy Shifts: In South America, the "Lithium Triangle" is becoming more nationalist. Watch for new tax laws in Chile or Argentina that could change the "economically extractable" status of their reserves.

The "white gold" rush is far from over, but the winners won't necessarily be the ones with the biggest piles of salt. It'll be the ones who can actually turn that salt into a battery.