You’ve probably seen the movies. The guys in the tailored suits screaming at each other, waving slips of paper like their lives depend on it, and that iconic bell ringing while everyone cheers. It’s high drama. But if you think the largest stock exchange in the world is just a loud room in Lower Manhattan, you're only seeing about 1% of the picture.

The New York Stock Exchange (NYSE) is a titan. Honestly, the scale of it is kind of hard to wrap your head around. As of early 2026, the NYSE sits on a total market capitalization of roughly $31.58 trillion. To put that in perspective, if the NYSE were its own country, its "economy" would be significantly larger than the GDP of China. It’s the undisputed heavyweight champion of the financial world, but the way it holds that title is changing faster than most retail investors realize.

Why the largest stock exchange in the world still dominates

Numbers don't lie. While the Nasdaq—its tech-heavy younger sibling—is nipping at its heels with about $30.6 trillion in market cap, the NYSE stays on top because it’s where the "Old Guard" lives. We're talking about the blue chips. The companies that basically run the physical world. JPMorgan Chase, ExxonMobil, Coca-Cola—these aren't just tickers; they are the bedrock of the global economy.

One thing people get wrong? They think the NYSE is just for American companies.

Not even close.

It's a massive international hub. You have giants from all over the globe listing here because being on the "Big Board" is the ultimate status symbol. It says you’ve arrived. It says you can handle the most rigorous regulatory scrutiny on the planet. For a company in Brazil or South Korea, an NYSE listing is like winning a gold medal in the financial Olympics.

The hybrid engine under the hood

The NYSE is weirdly traditional. While almost every other exchange has gone 100% digital, the NYSE still keeps that famous trading floor at 11 Wall Street. But don't be fooled. It’s not just for the cameras. They use what’s called a "hybrid" model.

🔗 Read more: The Largest Dow Drop in History: Why Points and Percentages Tell Different Stories

Most trades happen in the blink of an eye via servers in Mahwah, New Jersey.

Fast.

Deadly fast.

But for the big stuff—like an Initial Public Offering (IPO) or during a massive market crash—human beings called Designated Market Makers (DMMs) step in. These folks are essentially the "adults in the room." Their job is to keep things from spiraling into total chaos when the algorithms start acting up. It's this mix of high-frequency tech and human judgment that keeps the largest stock exchange in the world more stable than its purely electronic competitors.

The 2026 landscape: NYSE vs. The World

The gap is closing. For a long time, the NYSE was miles ahead of everyone. Now? It’s a dogfight. The Nasdaq has benefited immensely from the AI boom. When companies like Nvidia and Apple see their valuations skyrocket, the Nasdaq’s total market cap balloons right along with them. In fact, there are days when the Nasdaq's trading volume makes the NYSE look almost sleepy.

Then you have the East.

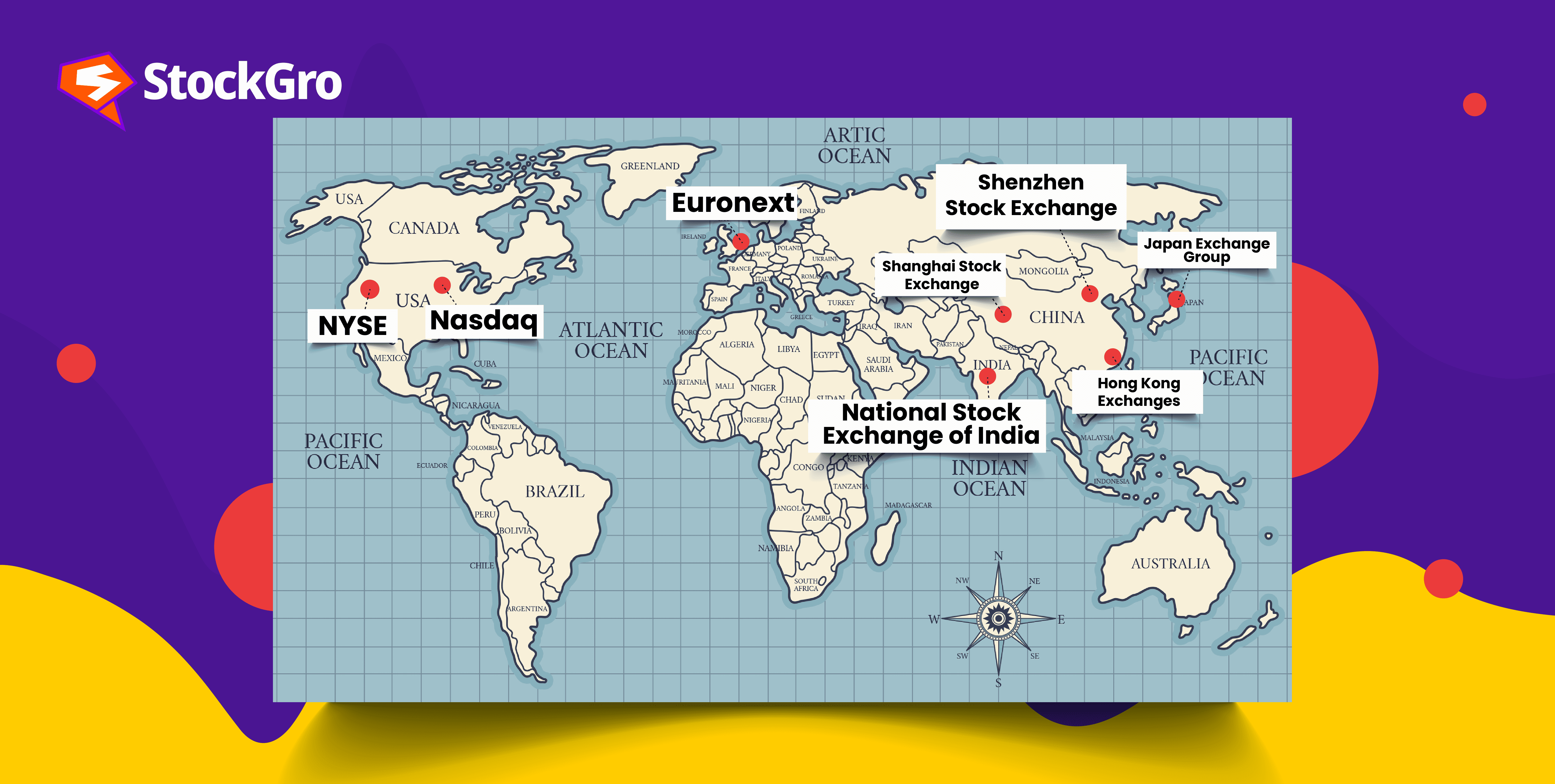

The Shanghai Stock Exchange and the Japan Exchange Group (Tokyo) are massive players, hovering around the $6 trillion to $7 trillion mark. They are huge, sure, but they haven't yet managed to capture the global trust that Wall Street commands.

Here is a quick look at how the top tier stacks up right now:

- New York Stock Exchange (NYSE): ~$31.58 Trillion

- Nasdaq: ~$30.6 Trillion

- Shanghai Stock Exchange: ~$7.2 Trillion

- Japan Exchange Group: ~$6.6 Trillion

- Euronext: ~$5.4 Trillion

You notice the drop-off? It’s a cliff. The combined might of the two US exchanges—totaling over $60 trillion—represents about 60% of the entire world's equity market value. That is a staggering amount of influence concentrated in one corner of Manhattan.

What actually happens when the bell rings?

The "Opening Bell" is the most famous sound in business. But what is it actually doing? It's basically a "go" signal for a massive, synchronized auction.

The NYSE uses a continuous auction format. Unlike a "dealer market" (like the Nasdaq) where you’re often buying from a middleman's inventory, the NYSE tries to match buyers and sellers directly. If you want to buy 100 shares of Disney at $110, the system looks for someone who wants to sell 100 shares at $110. Simple, right? Except it’s happening millions of times a second across thousands of different stocks.

The "Circuit Breakers" you need to know about

The largest stock exchange in the world has a built-in "panic button." After the 1987 "Black Monday" crash—where the market dropped over 22% in a single day—they realized they needed a way to slow things down. They implemented circuit breakers.

👉 See also: How Much Is 6 Figures? Why Most People Get the Math Totally Wrong

- Level 1: If the S&P 500 drops 7%, trading halts for 15 minutes.

- Level 2: If it drops 13%, another 15-minute timeout.

- Level 3: If it hits a 20% drop, the exchange just packs up and goes home for the day.

We saw this in action during the early days of the pandemic in 2020. It’s a safety valve. It forces everyone to take a breath, check their data, and stop the "algorithm feedback loops" that can destroy billions in value in minutes.

The "Buttonwood" myth and real history

Everyone loves the story of the 24 brokers meeting under a buttonwood tree on Wall Street in 1792 to sign an agreement. It’s a nice image. But the NYSE didn't just become the largest stock exchange in the world because of a tree. It became the leader because it survived.

In the 1800s, there were dozens of exchanges. The NYSE won because it had the strictest rules. It forced companies to actually show their books. Before the NYSE, "investing" was often just gambling on companies that might not even exist. By creating a "listed" system, the NYSE built the one thing more valuable than money: trust.

Actionable insights for the modern investor

Knowing about the largest stock exchange in the world isn't just trivia; it should change how you look at your portfolio.

First, understand the "listing effect." When a company moves from a smaller exchange to the NYSE, it often sees a bump in liquidity. More big institutional investors (like pension funds) are allowed to buy NYSE stocks than "Over-the-Counter" (OTC) stocks. If a company you like is graduating to the Big Board, that's usually a massive bullish signal.

Second, watch the NYSE Composite Index ($NYA). Most people just watch the Dow or the S&P 500. But the NYSE Composite includes every common stock listed on the exchange. It’s a much broader, and honestly more honest, look at the health of the economy than the tech-heavy indexes.

Finally, keep an eye on "Dual Listings." Many massive foreign companies are listed on their home exchange and the NYSE. Because the NYSE has so much volume, the price action here often dictates what happens to that stock globally.

Next Steps for You:

If you want to capitalize on the dominance of the NYSE, start by researching "Dividend Aristocrats." These are NYSE-listed companies that have increased their dividends for at least 25 consecutive years. They represent the stability that makes this exchange the global leader. You should also look into NYSE-specific ETFs that track the broader exchange rather than just the top 500 companies, providing a more diversified exposure to the literal center of global capital.