You're staring at a 300-page manual. It's dry. Honestly, it's brutal. If you’re looking for a life insurance study guide, you probably realized pretty quickly that the terminology feels like a foreign language designed by lawyers who hate fun. But here’s the thing about the licensing exam: it isn’t actually testing if you’re a genius. It’s testing if you can spot the difference between a "rider" and a "provision" without second-guessing yourself into a panic.

Most people fail because they try to memorize every single word. Big mistake. You need to understand the mechanics. Why does this policy exist? Who gets the money? What happens if the guy stops paying? Once you get the logic, the definitions just sort of fall into place.

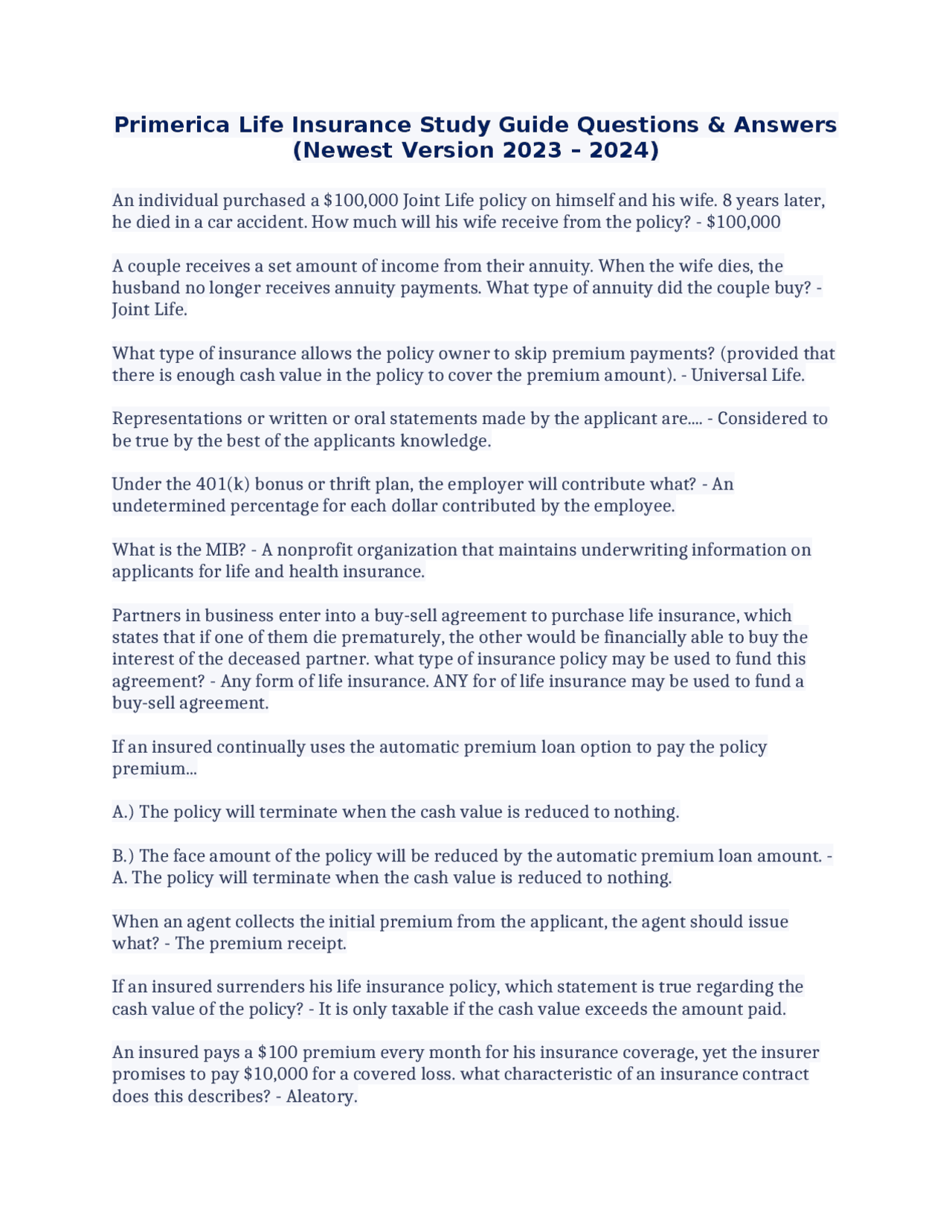

The Absolute Basics You Can’t Skip

Let’s talk about the parties involved. It sounds simple, but the exam loves to trip you up here. You’ve got the applicant, the insured, and the owner. Usually, they are the same person. But sometimes they aren’t. If a wife buys a policy on her husband, she’s the applicant and the owner, but he’s the insured. If you mix those up in a test question, you’re toast.

Then there’s the "insurable interest" rule. This is a massive pillar of any real life insurance study guide. You can't just take out a policy on a random stranger you saw at the grocery store. That’s gambling. You have to have a financial stake in them staying alive. And here is the kicker that always shows up on the exam: insurable interest only has to exist at the time of application. If you get divorced later, the policy is still valid.

Term vs. Whole Life: The Great Debate

Everyone argues about this. In the real world, people have strong opinions. On the exam, you just need to know the math.

Term life is the "pure" protection. It’s cheap because it expires. It’s like renting an apartment. You pay the rent, you get a place to stay. When the lease is up, you have nothing. It’s straightforward. Most students find this part easy because there are no "cash value" components to worry about. You've got level term, decreasing term (usually for mortgages), and increasing term.

Whole life is where it gets weird. This is "permanent" insurance. It’s more like buying a house with a massive mortgage that eventually builds equity. That equity is the cash value.

- Ordinary Whole Life: You pay the same premium until you're 100.

- Limited Pay: You pay more upfront so you can stop paying at age 65 or after 20 years.

- Single Premium: You drop one massive bag of cash and you’re done forever.

The test loves to ask about Universal Life. Think of this as the "unbundled" policy. It’s flexible. You can skip payments or change the death benefit. But because it’s flexible, it’s also dangerous if the owner doesn't keep an eye on the costs. It’s basically a combination of a term policy and a side savings account.

👉 See also: What Really Happened With Trump Guitars: The Gibson Legal Drama Explained

Provisions, Options, and Riders (The "Gotcha" Section)

This is the meat of the exam. If you don’t know these, you won't pass. Period.

Provisions are the rules written into the contract. The Incontestability Clause is a famous one. Basically, if the insurance company finds out you lied on your application, they have two years to bust you. After two years? They generally have to pay out anyway, even if you "forgot" to mention you enjoy cliff jumping every weekend.

Then you have the Grace Period. It’s usually 30 or 31 days. It exists so that if you’re a few days late on a bill, your family doesn't lose everything. It’s a safety net.

Riders: The Add-Ons

Riders are like toppings on a pizza. They cost extra, but they change the experience.

- Waiver of Premium: This is the most common one. If you become totally disabled, the company pays your premiums for you. There is usually a six-month waiting period. Don't forget that number.

- Accidental Death (Double Indemnity): If you die in a wreck, the payout doubles. But if you die of a heart attack? Standard payout.

- Guaranteed Insurability: This lets you buy more insurance later without proving you’re still healthy. It’s huge for young people who might get sick later in life.

Why People Actually Fail the Exam

It’s rarely because they didn't study. It’s because they didn't read the question. The test is full of "except" questions. "All of the following are true EXCEPT..." Your brain is wired to find the right answer, so you see option A, recognize it as true, and click it. Boom. Wrong.

You also have to understand the Taxation of Life Insurance. This is a huge part of any serious life insurance study guide.

Generally:

- Premiums are not tax-deductible (you pay with after-tax money).

- Death benefits are tax-free to the beneficiary (this is a massive selling point).

- Cash value growth is tax-deferred. You only pay taxes if you take out more than you put in.

Complex Policies: Variable and Equity-Indexed

If the word "Variable" is in the name, you need a securities license (like a Series 6 or 7) to sell it. Why? Because the money is in the stock market. You could lose it all. The insurance company doesn't guarantee the growth.

Equity-Indexed is the middle ground. It’s tied to an index like the S&P 500. You get some of the upside when the market is booming, but you’re protected from the downside. It’s for the person who wants to gamble a little, but not with their whole retirement.

💡 You might also like: Why your fax cover sheet printable still matters in a digital world

Underwriting: The Gatekeepers

Underwriters are the people who decide if you’re too risky to insure. They look at your "MIB" report (Medical Information Bureau). No, it’s not Men in Black. It’s a massive database where insurance companies share your medical history. If you lied to one company about your blood pressure, the next company will know.

They categorize you into four groups:

- Preferred: You’re a marathon runner who eats kale. Low rates.

- Standard: You’re average. Normal rates.

- Substandard: You have health issues or a dangerous hobby (like racing cars). High rates.

- Declined: They won't touch you.

How to Actually Use This Life Insurance Study Guide

Don't just read this and think you're ready. You need to do practice questions until your eyes bleed. Specifically, focus on the Annuities section. Annuities are the opposite of life insurance. Life insurance protects you if you die too soon; annuities protect you if you live too long. They provide a steady stream of income.

There are "Fixed Annuities" (guaranteed interest) and "Variable Annuities" (market-based). The test loves to compare these two. If you see "inflation" in a question, the answer is almost always "Variable" because stocks tend to keep pace with inflation better than fixed interest rates.

The Replacement Rule

When an agent tries to convince someone to drop their old policy for a new one, that’s "replacement." It’s highly regulated. Why? Because the agent gets a big commission, but the client might lose their "incontestability" protection or pay new start-up costs. You have to provide a "Notice Regarding Replacement" to the applicant. State regulators are obsessed with this because it’s where a lot of unethical behavior happens.

Actionable Steps for Exam Day

Stop studying 24 hours before the test. Seriously. If you don't know it by then, cramming will just mix up the definitions in your head.

On the morning of the exam, eat a real breakfast. Your brain runs on glucose. When you sit down, use the "scratch paper" they give you to write down the things you're afraid you'll forget—like the different "Nonforfeiture Options" (Cash Surrender, Reduced Paid-Up, and Extended Term). Doing a "brain dump" immediately clears up mental RAM so you can focus on the wordy questions.

Focus on the State Laws section at the very end. Every state has different rules about how many days an agent has to report a change of address or how often the Commissioner of Insurance visits. These are easy points if you just memorize the numbers.

📖 Related: San Diego Business News Explained (Simply): What’s Really Moving the Needle in 2026

Read every question twice. Even the easy ones. If the question asks about a "Qualified" plan, it’s talking about IRS-approved retirement plans like 401(k)s. If it’s "Non-qualified," it’s a different tax ballgame.

Get through the easy questions first. Flag the hard ones and come back. Often, a later question will actually give you the answer to an earlier one you were stuck on. It’s a weird quirk of how these exams are built. Stay calm. The math is simple; the vocabulary is the real hurdle. Master the words, and you’ll get the license.

Immediate Next Steps:

- Identify your weakest area: Are you confused by Annuities or Policy Riders? Spend the next two hours focusing only on that specific topic.

- Take a full-length practice exam: Mimic the actual testing environment. No phone, no snacks, no interruptions.

- Review every wrong answer: Don't just look at the score. Figure out why the correct answer was right. Was it a "except" question you misread?

- Memorize the "Life and Health Insurance Guaranty Association" limits: Your state will have specific dollar amounts they cover if an insurance company goes bankrupt. This is a guaranteed test question.

- Check your state's specific "free look" period: It’s usually 10 days, but for seniors or replacements, it can be 20 or 30. Know your state's number.

By narrowing your focus to the "Big Three"—Provisions, Riders, and Taxation—you've already cleared the biggest hurdle in your life insurance study guide journey. The rest is just staying calm and reading carefully.