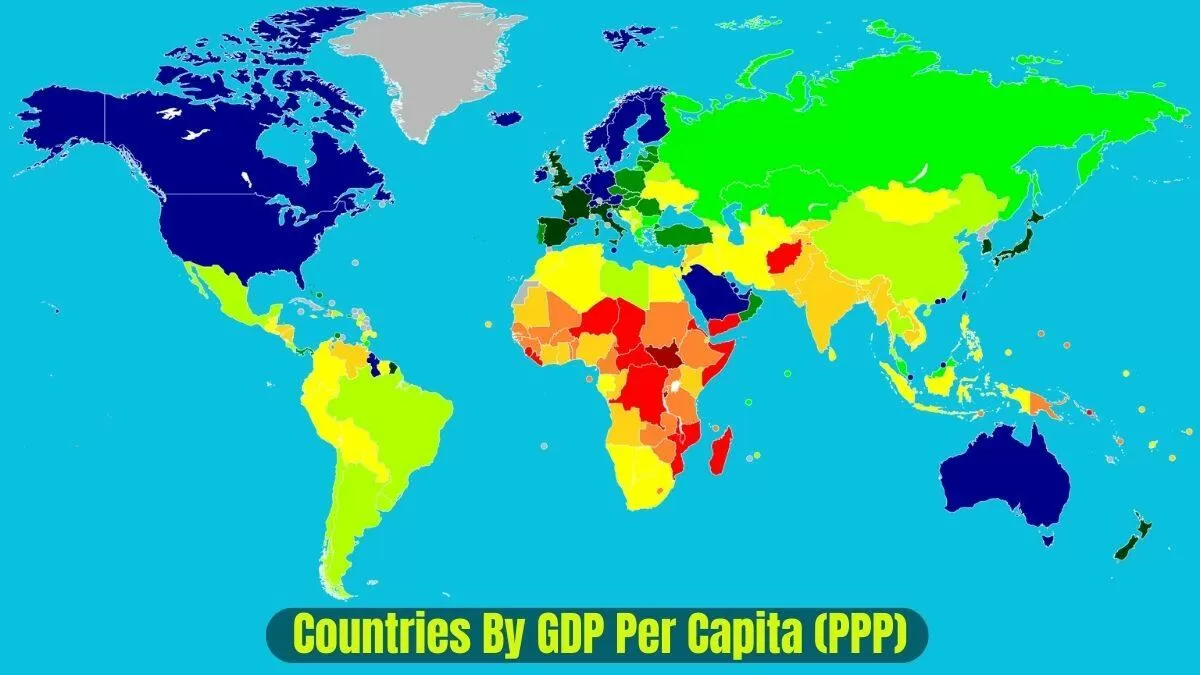

Money is weird. You can have a million dollars in Manhattan and feel "middle class," or you can have that same amount in Bali and live like a minor royal. That basically explains why looking at raw numbers—what economists call nominal GDP—is often a total waste of time if you actually want to know how well people are living.

To get the real story, you need to look at the list countries GDP PPP per capita.

📖 Related: Edward Collins West Palm Beach 33409: Why This Financial Specialist is a Big Deal

PPP stands for Purchasing Power Parity. It's a fancy way of saying we’ve adjusted the numbers for the cost of a burger, a haircut, and rent. It levels the playing field. Without it, you're just comparing currency exchange rates, which change every time a central banker sneezes. Honestly, if you want to know which nations are actually "rich" in terms of lifestyle and buying power in 2026, the PPP list is the only one that matters.

The Top Tier: Small States and Tax Havens

If you look at the 2026 International Monetary Fund (IMF) projections, the top of the list is dominated by places you could cross in a long afternoon drive.

Luxembourg usually sits at the throne. Why? It’s a tiny powerhouse with a massive financial sector. They have a GDP PPP per capita hovering around $141,080. But here's the catch: a huge chunk of that wealth is generated by people who don't even live there. Cross-border commuters from France, Germany, and Belgium inflate the production numbers, but they aren't counted in the population divisor. It makes the country look richer on paper than any individual resident might feel while paying for a coffee in Luxembourg City.

Then there's Ireland. Their numbers are literally through the roof, often cited over $135,000 in PPP terms. But ask a local in Dublin about the "wealth," and they’ll probably complain about the housing crisis. Ireland’s GDP is notoriously distorted by "leprechaun economics"—a term coined by Paul Krugman—because so many multinational tech giants like Google and Apple park their intellectual property there for tax reasons. The money is "there," but it’s not all in the pockets of the citizens.

Singapore and Qatar round out this elite club. Singapore is a miracle of logistics and trade, sitting at roughly $156,000 by some 2026 estimates, while Qatar relies on the massive gas reserves of the North Field. These are the outliers. They aren't representative of the "average" global experience.

Why Nominal GDP is Kinda Lying to You

Imagine you make $50,000 a year. In Ohio, you’re doing great. In San Francisco, you’re looking for roommates.

Nominal GDP measures the "San Francisco" version of the world. It uses current market exchange rates. But PPP uses an international dollar. It assumes that one dollar should buy the same amount of goods and services everywhere.

For instance, India looks relatively poor on a nominal basis, ranking lower in the global standings per person. But when you look at the list countries GDP PPP per capita, India's rank jumps significantly. Why? Because a dollar goes so much further in Mumbai than it does in Munich.

Labor-intensive services—like healthcare, construction, and local food—are much cheaper in developing nations. PPP accounts for this. It’s the "Big Mac Index" on steroids. It gives a much more nuanced view of the actual standard of living.

The 2026 Heavy Hitters: A Closer Look

When we dig into the mid-to-high range of the list, we see the real engines of the global economy. These aren't just tax havens; they are productive societies with massive internal markets.

- United States: Still a beast. The U.S. is one of the few large-population countries that maintains a massive GDP PPP per capita, projected to be around $92,880 in 2026. Most wealthy countries are small. The U.S. is the exception—a giant that is also incredibly rich.

- Guyana: This is the one nobody talks about enough. Thanks to massive offshore oil discoveries by ExxonMobil, Guyana’s growth has been vertical. Their PPP per capita has skyrocketed from "developing" to "elite" in less than a decade, now pushing toward the $100,000 mark.

- United Arab Emirates: Diversifying away from oil has worked. With a PPP per capita of about $89,560, the UAE is a hub for tourism, tech, and finance.

- Norway: The gold standard for "boring but rich." They managed their oil wealth through a sovereign wealth fund, and their PPP stays high—around $109,000—because they didn't spend it all at once.

The Problem with the "Average"

You've got to remember that GDP per capita is an average. It’s the total economic output divided by the number of people. It doesn't tell you how that money is shared.

👉 See also: How to Format Cover Letter: What Most Hiring Managers Actually Hate Seeing

A country could have a high PPP per capita because 10 billionaires live there while everyone else is struggling. The Gini coefficient is what you’d look at to see income inequality. For example, the U.S. has a higher PPP per capita than many European nations, but also much higher inequality. In Denmark or Sweden, the "average" person might actually feel wealthier because of the social safety net and lower out-of-pocket costs for things like education, even if their per-capita number is technically lower.

Beyond the Top 10: Where the World Really Lives

Most of the world doesn't live in Luxembourg. If you look further down the list, you see the real progress—or lack thereof.

China is the most fascinating case. On a nominal basis, it's the second-largest economy. But on the list countries GDP PPP per capita, it sits much further down, around $29,000 to $31,000 for 2026. It’s a middle-income country now. The "Chinese Dream" is real for the urban middle class, but there are still hundreds of millions in rural areas living on a fraction of that.

Eastern Europe is the "quiet winner" of the last twenty years. Countries like Poland and the Czech Republic (Czechia) have been climbing the PPP charts relentlessly. Poland is now reaching a point where its purchasing power is rivaling parts of the UK. It’s a massive shift in the European balance of power that people are finally starting to notice.

Then there's the bottom of the list. Burundi, South Sudan, and the Central African Republic often have PPP per capita figures under $1,500. These aren't just numbers; they represent a total lack of infrastructure, safety, and opportunity. The gap between the top and the bottom isn't just wide—it's a different reality.

📖 Related: NFL Stock Price: Why You Can't Actually Buy the League

Practical Takeaways for 2026

If you're looking at this list for business or travel, here is how you should actually use the information.

First, don't move to a country just because it has a high GDP PPP. You have to look at the Cost of Living Index. Switzerland has a massive PPP, but if a pizza costs you $40, you aren't going to feel rich. PPP tries to account for this, but it doesn't always capture the specific lifestyle you might want.

Second, look at the trend, not just the snapshot. A country like Vietnam or India might have a lower absolute number today, but their growth rate is what matters for investment. They are adding "international dollars" to their citizens' pockets faster than the established West.

Lastly, realize that "Standard of Living" includes things GDP can't measure. Clean air, commute times, and social connection don't show up in the PPP list. But as far as economic metrics go, the list of countries by GDP PPP per capita remains the most honest tool we have to compare the material reality of people across the globe.

To apply this to your own life or business strategy, start by identifying "rising stars"—countries where PPP is growing faster than nominal GDP. These are often the markets where local consumption is about to explode. Focus on regions like Southeast Asia or Eastern Europe, where the gap between local costs and global output is creating a new, wealthy middle class that the world hasn't fully accounted for yet.