Let’s be real for a second. Looking at college costs today feels a lot like staring at a receipt from a high-end grocery store where you only bought three things, yet somehow the total is three digits.

If you’re eye-balling loyola marymount tuition and fees, you probably already know it’s a gorgeous campus. It’s got that "best of both worlds" vibe—stuck right between the beach and the tech hub of Silicon Beach in Los Angeles. But that view comes with a price tag that can make your eyes water.

For the 2025-2026 academic year, the sticker price for a full-time undergraduate student is sitting at $64,470 for tuition alone. If you add in the mandatory fees, you’re looking at about $65,367.

That’s a big number. Honestly, it’s a 5.7% jump from the previous year. You might wonder why it keeps climbing, but that seems to be the trend across most private universities in California right now.

Breaking Down the "Sticker Price" vs. Reality

Most people see that $65k figure and panic. Don't.

That's just the base. If you're living on campus—which most freshmen do—you have to factor in housing and food. LMU estimates the average on-campus housing and meal plan will run you about $23,520 for the year.

When you combine tuition, fees, room, and board, the "direct costs" (the stuff you actually pay the school) hit roughly $88,887.

But wait, there's more. The "Cost of Attendance" (COA) is the number the financial aid office uses. It includes things LMU doesn't bill you for directly, like books, toothpaste, and that occasional Uber to Santa Monica. For an on-campus student in 2026, the total estimated COA is $94,598.

Is anyone actually paying that? Some are. But most aren't. About 90% of LMU students get some form of financial aid. The "net price"—what you actually pay after grants and scholarships—is usually much lower.

Those Sneaky Mandatory Fees

Tuition is the main course, but the fees are like the side dishes that add up. You can't really opt out of most of these.

For starters, every full-time undergrad pays a Student Activity Fee of about $144 per semester. Then there's the Student Recreation Facility Fee ($107.50 per semester) which pays for that fancy gym you should probably use more often.

If you’re a new student, you’ll get hit with a one-time New Student Fee of $490. It’s basically a "welcome to the club" tax.

The Health Insurance Hurdle

This is the big one people forget. LMU requires every student taking 7 or more units to have health insurance. If you don't provide proof that you're covered by your parents' plan, they will automatically bill you for the university's plan.

For the 2025-2026 year, the Fall insurance is $1,164 and the Spring/Summer coverage is $1,612. Totaling $2,776 for the year.

📖 Related: The Real Recipe for McDonald's Holiday Pie: How to Recreate the Cult Favorite at Home

Pro tip: If you already have insurance, you MUST fill out the waiver by late September. If you miss that deadline, you’re stuck paying for it. No exceptions. They are very strict about this.

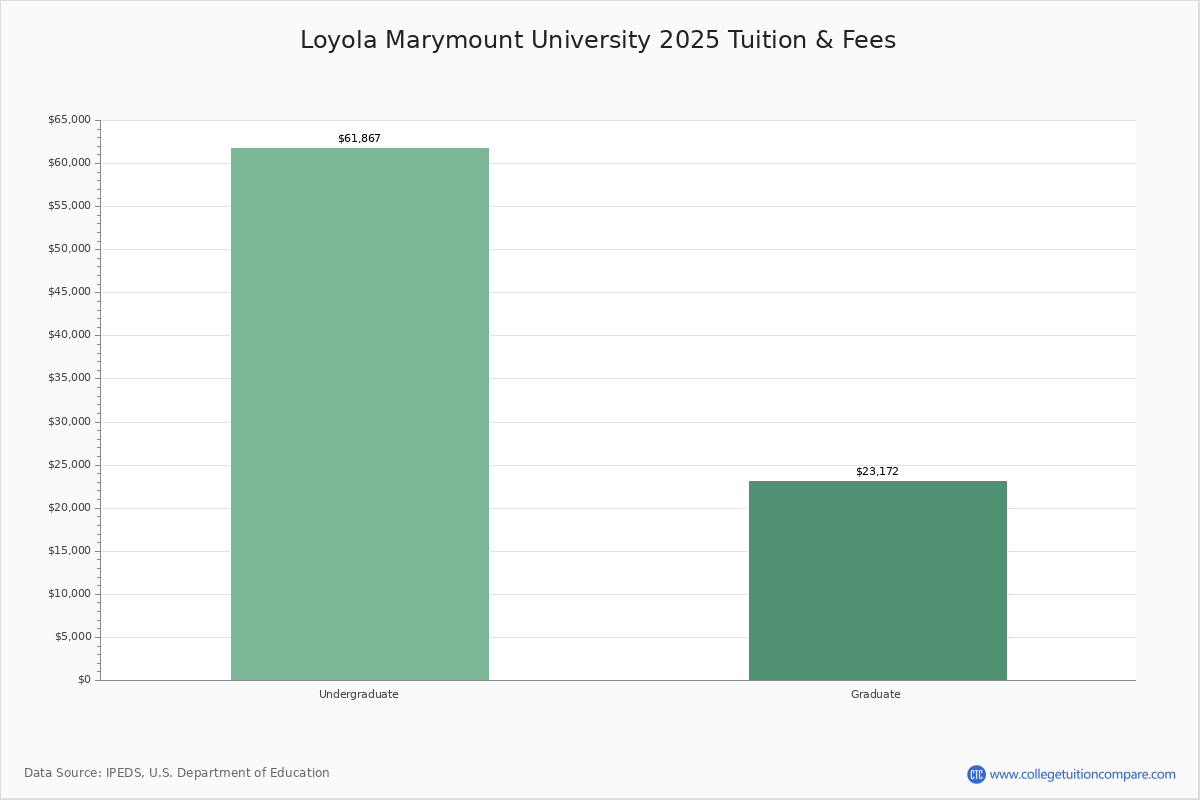

Graduate Students: A Different Ballgame

Graduate costs at LMU are a bit more "pay-as-you-go." Instead of a flat rate, you're usually billed per unit.

If you're going for an MBA or most programs in the College of Business Administration, you're looking at $1,802 per unit. Doing a Master’s in Film and Television or Science and Engineering? That’s $1,719 per unit.

The Bellarmine College of Liberal Arts is slightly "cheaper" at $1,632 per unit.

It adds up fast. A typical 3-unit class in the MBA program costs over $5,400. Graduate students also pay a $65 registration fee and a $35 student activity fee every single semester.

The Cost of Living (and Parking) in LA

If you think the tuition is steep, wait until you see the parking situation. Bringing a car to campus isn't free.

The parking fee is $487 per semester. That’s nearly $1,000 a year just for the privilege of finding a spot in a concrete garage.

Housing is its own beast. LMU offers everything from traditional dorms to on-campus apartments.

- Traditional Dorms (like Rosecrans or Desmond): Roughly $13,724 per year.

- Suites (McCarthy or Rains): About $14,994 per year.

- On-Campus Apartments (Palm South): Can go as high as $21,528 per year for a single.

Most students move off-campus by junior year. While LMU estimates off-campus housing and food at $25,684, the reality depends on how many roommates you're willing to squeeze into a Playa del Rey apartment.

Is the Price Tag Worth It?

This is where the nuance kicks in. LMU isn't just a degree; it's a network.

The "Seaver College of Science and Engineering" and the "School of Film and Television" are top-tier. Being in LA means internships at Disney, Google, or aerospace firms are literally down the street.

The university also has a massive endowment for merit scholarships. When you apply, you're automatically considered for these. You don't even need a separate application. Some merit awards can knock $15,000 to $30,000 off that annual price tag immediately.

💡 You might also like: Twin Bed Mattress Covers: What Most People Get Wrong About Protecting a Small Bed

Real Steps to Manage the Cost

If you're serious about attending, don't just look at the $94k total and walk away.

- File the FAFSA early. Even if you think you won't qualify for "need-based" aid, some institutional grants require it. The 2026-2027 FAFSA should be your first priority.

- Appeal your aid package. If your family’s financial situation changed since you filed your taxes (job loss, medical bills), LMU has a formal appeal process. They won't give you more money if you don't ask.

- Check the Cal Grant. If you’re a California resident, the Cal Grant can cover a significant chunk of tuition. The deadline is usually early March—don’t miss it.

- Work on campus. LMU has plenty of student worker jobs that pay decent hourly wages and look great on a resume.

- Audit your meal plan. Freshman are often forced into the bigger plans (like the "L" or "I" plans), but by sophomore year, you can drop down to a smaller plan if you realize you aren't eating $6,000 worth of cafeteria food.

Navigating loyola marymount tuition and fees is basically a part-time job in itself. It’s expensive, yes. But with the right mix of merit aid, careful budgeting on housing, and a hawk-like eye on those insurance waivers, that "sticker price" starts to look a lot more manageable.

Start by using the LMU Net Price Calculator on their financial aid site. It uses your actual financial data to give you a much more realistic estimate than any general article ever could.