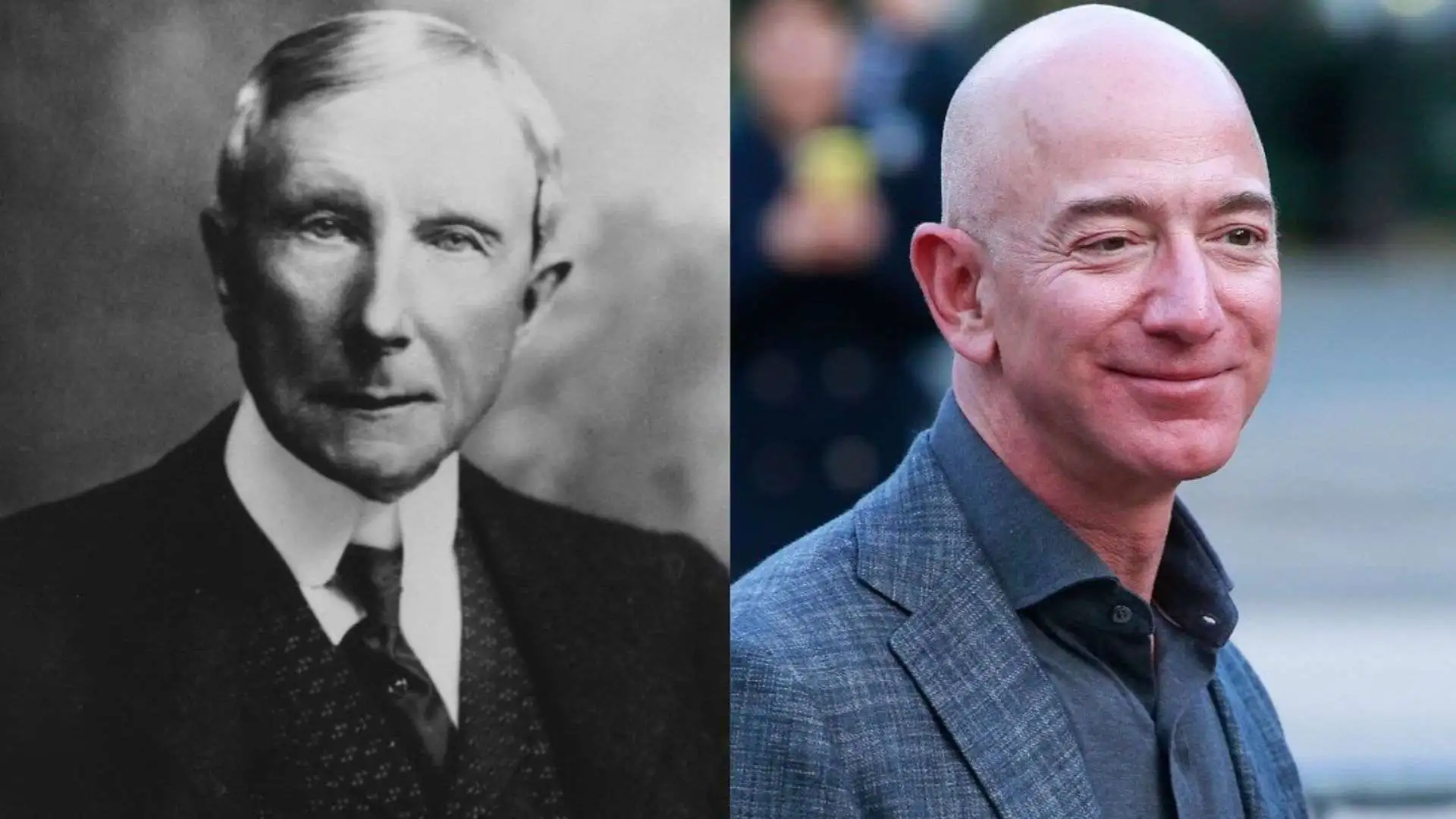

When you hear the name Rockefeller, you probably think of old-school oil monopolies, Gilded Age mansions, and the kind of wealth that doesn't just talk—it yells from the top of a skyscraper. But here’s the thing. There isn't just one Mark Rockefeller.

Usually, when people start digging into Mark Rockefeller net worth, they are looking for one of two very different men. One is a fourth-generation heir to the legendary dynasty, and the other is a modern-day fintech entrepreneur who built a business from his basement.

💡 You might also like: Cancel Kohls Charge Card: The Real Way to Do It Without Wrecking Your Credit

It’s kinda confusing, right?

If you’re looking for the heir, you’re talking about Mark Fitler Rockefeller. He’s the son of former Vice President Nelson Rockefeller. If you’re looking for the entrepreneur, you’re talking about Mark L. Rockefeller, the guy who co-founded StreetShares. Honestly, their bank accounts look nothing alike, even if they share a famous set of initials.

The Family Fortune: Mark Fitler Rockefeller

Let’s get the "dynasty" question out of the way first. Mark Fitler Rockefeller grew up at Kykuit, the massive family estate in Westchester County. That’s about as "old money" as it gets in America.

Estimating his exact personal net worth is basically impossible because the Rockefeller family is notoriously private about their trusts. Most experts suggest the total family wealth is spread across hundreds of heirs and dozens of trusts. While the original John D. Rockefeller was worth the equivalent of roughly $400 billion in today’s money, that fortune has been diluted over five or six generations.

Where His Money Comes From

Unlike his great-grandfather, Mark Fitler didn’t build a monopoly. He’s played the role of the sophisticated investor and steward.

- Venture Capital: He has served on the board of Venrock, the family’s venture capital arm that famously got into Apple and Intel early.

- Real Estate & Hospitality: He owns the South Fork Lodge in Idaho, a high-end destination for fly-fishing enthusiasts.

- Financial Services: He has held senior roles at Rockefeller Financial Services, helping manage the family’s ongoing interests.

So, what’s the number? While some "celebrity net worth" sites throw around figures like $100 million to $500 million, these are mostly educated guesses. He’s wealthy enough to receive six-figure farm subsidies just for letting his land stay natural, which gives you a hint of the scale we're talking about.

The Fintech Pivot: Mark L. Rockefeller

Then there’s the other Mark. Mark L. Rockefeller is a veteran and a lawyer who took a completely different path. He didn't start with a trust fund; he started with a mission to help fellow veterans get business loans.

He co-founded StreetShares in 2013. This wasn't just a small project. By 2018, the company had secured over $23 million in Series B funding. By the time it was acquired or pivoted into "StreetShares by Meridian" and later integrated into broader fintech ecosystems, it had powered billions in loan volume.

The Entrepreneurial Payday

When people search for his net worth, they’re usually trying to figure out how much he made from the StreetShares exit. While the exact buyout price of fintech startups is often kept under wraps unless the company is public, Mark L. Rockefeller’s wealth is tied to his equity in the companies he builds and his career as a high-level executive and Forbes contributor.

He’s a prime example of "new money"—wealth built on software, debt financing, and scalable platforms rather than oil wells and real estate.

Why the "Rockefeller" Name is Deceptive

People often assume every Rockefeller is a billionaire. That’s just not how it works anymore.

💡 You might also like: Howard Lutnick Explained: From Wall Street Tragedy to the Commerce Department

By 2026, the family has grown so large that the "Rockefeller net worth" is more of a collective influence than a single pile of gold. Mark Fitler Rockefeller, for example, has spent a huge chunk of his life on conservation and non-profit work, like his time with the National Fish and Wildlife Foundation.

When you have that kind of safety net, your "net worth" isn't just about what's in your checking account. It's about access. It's about the ability to sit on the board of a company like Venrock or Historic Hudson Valley.

Breaking Down the Assets

If we look at Mark Fitler's known assets, it's a mix of traditional and lifestyle investments:

- Idaho Property: The South Fork Lodge isn't just a hobby; it’s a premium asset in a booming outdoor recreation market.

- Trust Distributions: As a son of Nelson Rockefeller, he likely receives regular distributions from the 1934 and 1952 trusts.

- Venture Equity: His involvement in the early days of tech-focused family offices means he likely has personal stakes in various private equity ventures.

What This Means for You

If you’re trying to track the wealth of a Rockefeller, stop looking for a single number. Instead, look at the infrastructure of the wealth.

For Mark Fitler Rockefeller, the value is in the legacy—the real estate, the trusts, and the institutional power. For Mark L. Rockefeller, the value is in the "fintech flywheel"—building a brand, raising venture capital, and exiting.

One man inherited a name that opens every door in the world. The other used the name (or just happened to have it) while grinding in a basement to build a lending platform. Both are successful, but they represent the two different ways wealth is perceived in America today.

Actionable Takeaways

- Don't trust the "Net Worth" trackers: Most of those sites use AI to scrape old data. For private individuals like the Rockefellers, the numbers are almost always wrong.

- Watch the "Family Office" model: If you want to build long-term wealth like the Rockefellers, study how they use trusts to protect assets from taxes over generations.

- Follow the Fintech trend: Mark L. Rockefeller’s success shows that the real "new" money is in solving specific problems—like veteran lending—rather than trying to be a generalist.

Whether you're looking at the heir or the entrepreneur, the story is the same: wealth today is about moving capital, not just sitting on it.

To get a clearer picture of how these types of fortunes are managed, you should look into the specific structure of Generation-Skipping Trusts and how family offices like Rockefeller Capital Management operate in 2026. This provides a better roadmap for wealth preservation than any single net worth figure ever could.