Honestly, talking about taxes and retirement feels like a chore. Most people hear "IRS" or "inflation adjustment" and immediately tune out. But if you’re trying to figure out the Max Roth contribution 2024 rules, you're actually looking at one of the most significant jumps in savings capacity we've seen in a while.

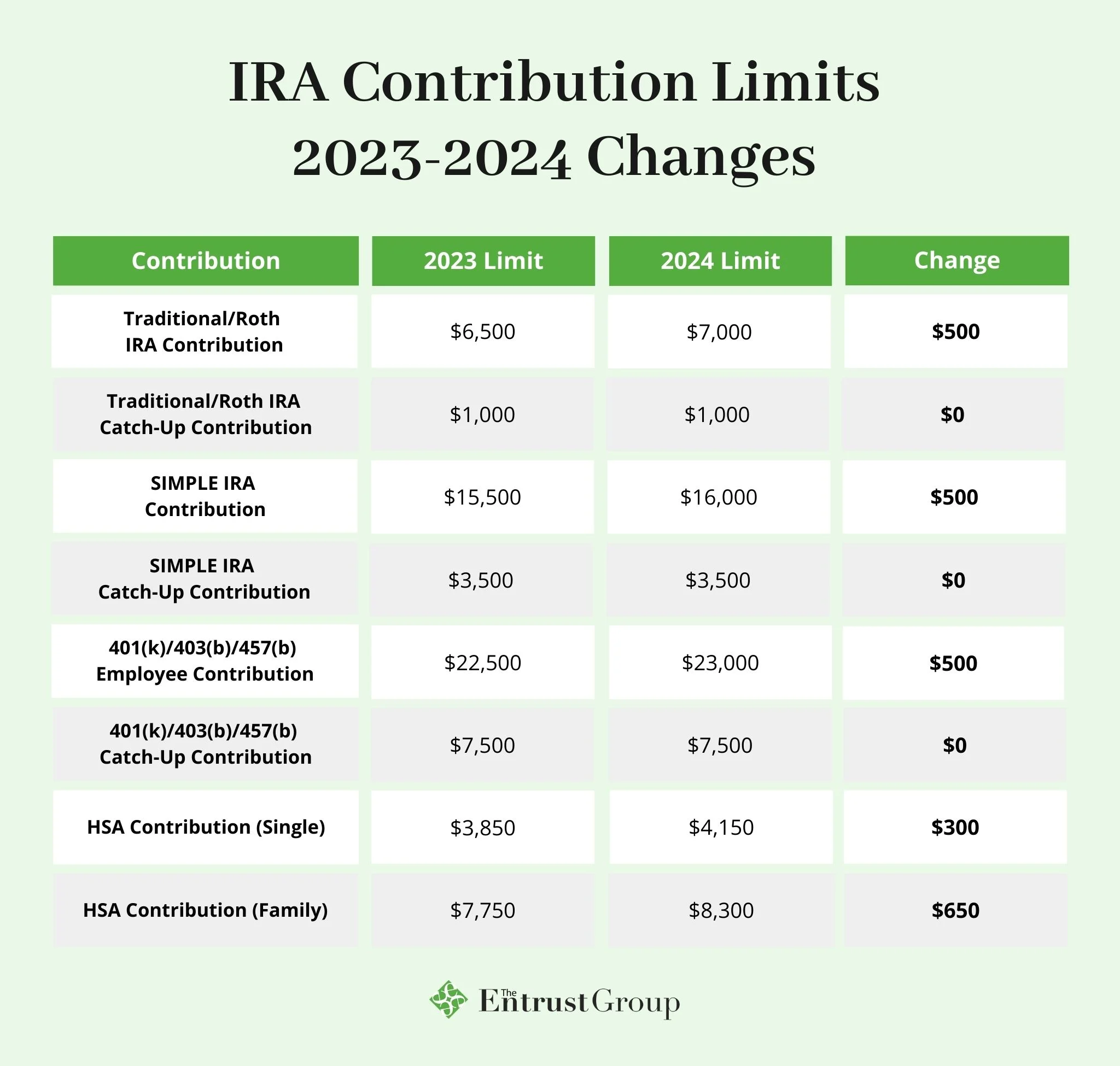

For 2024, the IRS bumped the numbers up. It's not just a tiny tweak. If you’re under 50, you can put away $7,000 into a Roth IRA. That is a $500 increase from the previous year. If you’re 50 or older? You get a "catch-up" bonus, bringing your total to $8,000.

But here is where people trip up.

Just because the "limit" exists doesn't mean you're allowed to use it. Roth IRAs are picky. They have these "phase-out" ranges based on your Modified Adjusted Gross Income (MAGI). Basically, if you make too much money, the IRS tells you that you can't play in the Roth sandbox anymore.

The Real Numbers for Your Max Roth Contribution 2024

Let’s look at the math without the corporate fluff. For 2024, the income limits shifted upward to account for the cost of living. This is actually good news because it means more people qualify for a full contribution than they did in 2023.

If you’re filing as Single or Head of Household, the phase-out starts at $146,000. Once your MAGI hits $161,000, your eligibility for a direct Roth IRA contribution drops to zero.

Married filing jointly? The range is $230,000 to $240,000.

If you earn $235,000 as a couple, you can't put in the full $7,000 (or $8,000). You have to do this weird calculation to find your "reduced" limit. It's annoying. Most people just use a calculator or ask their CPA because the formula is a headache.

💡 You might also like: Netflix's New Jersey Studio is Actually Happening: What the Fort Monmouth Megaproject Means for the East Coast

Why the 2024 jump matters

In the grand scheme of things, $500 extra a year might not feel like a lot. It’s like, what, two fancy dinners? But in a Roth account, that money grows tax-free. Forever.

When you pull that money out at age 65, you aren't paying a dime to Uncle Sam on the gains. That’s the magic. If you maximize your Max Roth contribution 2024 and keep doing it for thirty years, that extra $500-a-year difference could easily turn into an extra $50,000 or more depending on how the market behaves.

The "Other" Max Roth: Workplace 401(k) Limits

Wait. There’s another "Roth" you might be thinking of.

A lot of people confuse the Roth IRA with a Roth 401(k). They are very different animals. The 401(k) version allows you to shove way more cash into the account. For 2024, the employee contribution limit is a staggering $23,000.

If you’re 50 or over, you can add another $7,500.

🔗 Read more: General Motors Stock Graph: What Most People Get Wrong

Totaling $30,500.

Unlike the IRA, the Roth 401(k) doesn't care how much money you make. You could be making a million dollars a year and still contribute the full $23,000 to your workplace Roth 401(k). This is a massive loophole for high earners who are locked out of the traditional Roth IRA.

Common mistakes with 2024 contributions

- The Combined Limit: You can have a Traditional IRA and a Roth IRA. But you cannot put $7,000 in both. The $7,000 limit is the total across all your IRAs.

- Missing the Deadline: You actually have until the tax filing deadline (April 2025) to make your 2024 contribution. Don't rush it on December 31st if you need more time to find the cash.

- The Earned Income Rule: You can't contribute more than you earned. If you only made $3,000 at a part-time job in 2024, your max contribution is $3,000, not $7,000.

What to do if you make too much money

If you’re staring at that $161,000 (single) or $240,000 (married) limit and realizing you're "too rich" for a Roth, don't panic. There’s something called the Backdoor Roth IRA.

It’s totally legal. Sorta feels like a cheat code. You put money into a Traditional IRA (which has no income limits for contributions) and then immediately convert it to a Roth.

✨ Don't miss: Will Interest Rates Go Up? Here’s What the Data Actually Says

You’ll have to deal with the "Pro-Rata Rule" if you have other Traditional IRA funds, but for many people, this is the only way to hit that Max Roth contribution 2024 target when their salary is high.

Actionable Steps to Take Now

First, check your 2024 MAGI. Look at your last few paystubs or your 2023 return to estimate where you'll land.

If you're under the limit, set up an automatic transfer. Even $583 a month gets you to that $7,000 goal by the end of the year.

If you're over the limit, talk to your HR department about a Roth 401(k) option. If they don't offer it, look into the Backdoor Roth strategy.

Double-check your age. If you turn 50 at any point in 2024—even on December 31st—you are eligible for that extra $1,000 catch-up.

The biggest mistake is doing nothing. The 2024 limits are generous. Use them.