Honestly, trying to keep up with the IRS is like trying to track a moving target while wearing a blindfold. Every year, the numbers shift just enough to be annoying, and if you aren't paying attention, you end up leaving money on the table—or worse, getting hit with a penalty you didn't see coming. If you're looking for the quick answer, the maximum IRA contribution for 2024 is $7,000.

But wait.

If you’re 50 or older, that number jumps to $8,000. That extra thousand is what the tax pros call a "catch-up contribution," and it’s basically the government's way of saying, "Hey, we know you're getting closer to retirement, so here's a little extra room."

Why the 2024 limits feel different

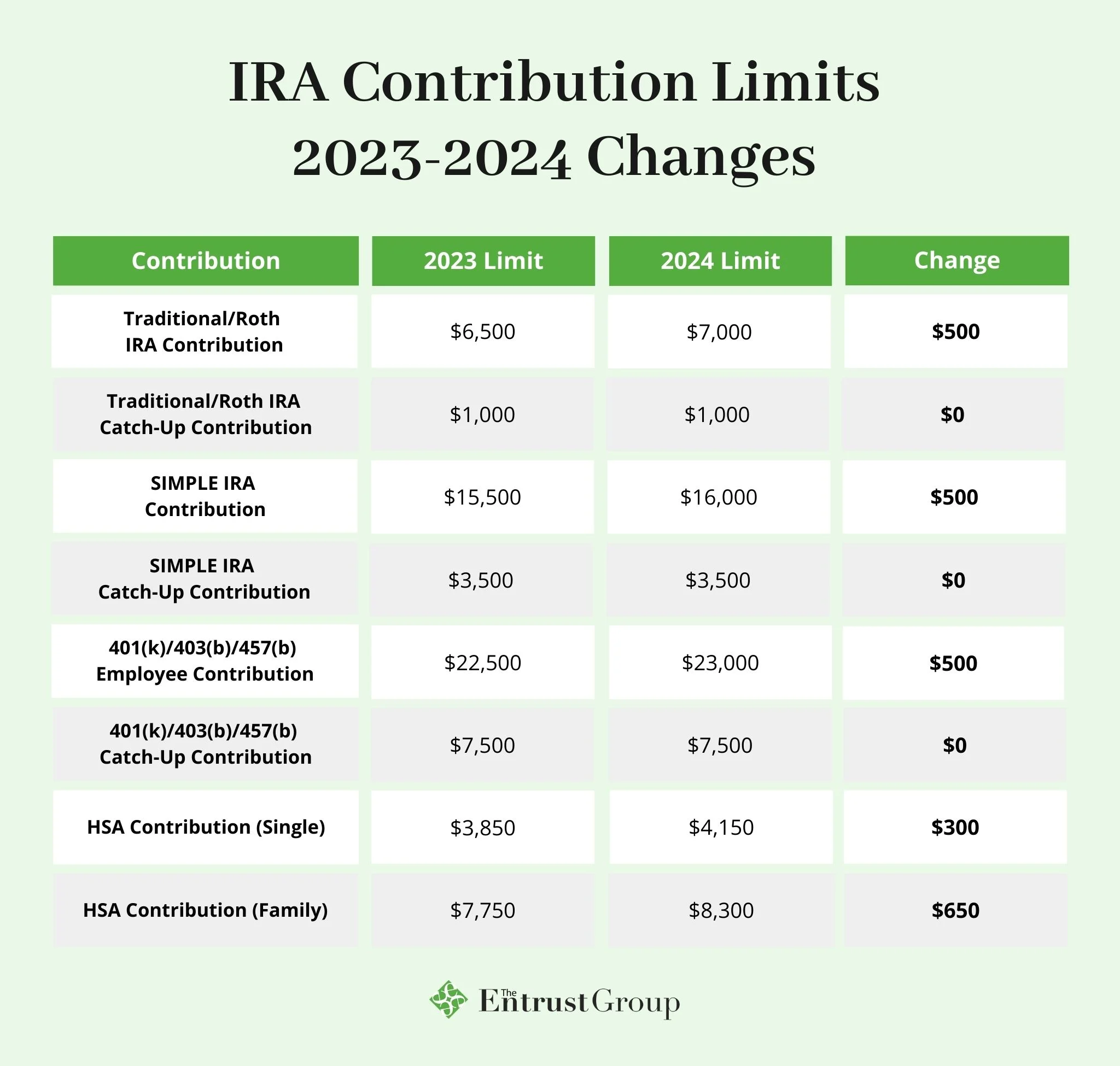

For a long time, the IRA limits felt stagnant. They’d sit at $6,000 for years, then maybe crawl up to $6,500. But for the 2024 tax year, we saw a pretty significant bump thanks to the high inflation we've all been feeling at the grocery store and the gas pump. The IRS indexes these limits to inflation, so when the cost of living spikes, our ability to stash away tax-advantaged cash usually follows suit.

It’s not just about that top-line number, though.

Understanding the maximum IRA contribution for 2024 requires a bit of nuance because "maximum" doesn't always mean "you can actually do it." Your income, your job, and even your spouse’s job can suddenly turn that $7,000 limit into a big fat zero if you aren't careful.

The "Earned Income" trap

You can't just take $7,000 from a literal inheritance or a lucky night at the casino and dump it into an IRA. You need what the IRS calls "taxable compensation." Basically, you have to work for it. If you only earned $3,000 from a part-time gig in 2024, your personal maximum IRA contribution for 2024 is $3,000. You can't contribute more than you made.

✨ Don't miss: Black Market Rate of Dollar to Naira Explained: What Most People Get Wrong

There is one cool loophole here: the Spousal IRA. If you’re a stay-at-home parent or currently unemployed but your spouse is working, they can contribute to an account in your name using their income. It’s a lifesaver for one-income households trying to build two retirement nests.

Roth vs. Traditional: The "Soft" Limits

Here is where things get kinda messy. While the $7,000 (or $8,000) limit applies to the total you put into all your IRAs combined, your ability to get the tax perks depends heavily on your Modified Adjusted Gross Income (MAGI).

For Roth IRAs:

If you make too much money, the IRS effectively bans you from contributing directly. For 2024:

✨ Don't miss: Converting 4 million yen to us dollars: What you actually need to know about the exchange rate right now

- Single filers: If your MAGI is over $161,000, you're out. The phase-out starts at $146,000.

- Married filing jointly: The "no-go" zone starts if you make more than $240,000 together.

For Traditional IRAs:

Anyone can contribute, regardless of income. However, whether you can deduct that contribution on your taxes is a different story. If you or your spouse have a 401(k) at work, those deduction limits kick in fast. For a single person with a workplace plan, the ability to take a full deduction disappears once you cross $87,000 in MAGI.

What most people miss about SECURE 2.0

You might have heard about the SECURE 2.0 Act. It’s a massive piece of legislation that changed a ton of retirement rules. One of the biggest wins for IRA owners is that the $1,000 catch-up limit is now indexed to inflation. It used to be a flat number that stayed the same for decades, but now it will actually grow as the world gets more expensive.

Another weird quirk? There’s no age limit for contributing anymore. You could be 95 years old, and as long as you’re still pulling a paycheck from a side hustle or a part-time job, you can still hit that maximum IRA contribution for 2024.

The cost of over-contributing

Don't get over-ambitious. If you accidentally put in $7,500 when you were only allowed $7,000, the IRS is going to find out. And they aren't nice about it. They charge a 6% excise tax on the excess amount for every year it stays in the account.

If you realize you messed up, you usually have until the tax filing deadline (plus extensions) to pull the extra money out along with any earnings it made. If you leave it in, that 6% penalty just keeps eating your gains year after year.

Actionable steps for your 2024 strategy

- Check your 2024 earnings. Make sure you actually earned at least $7,000 (or $8,000 if 50+).

- Calculate your MAGI. Use your last few paystubs or your 2023 return as a guide to see if you’re nearing the Roth phase-out ranges.

- Automate it. If you haven't maxed out yet, you actually have until April 15, 2025, to make contributions for the 2024 tax year. You don't have to do it all at once; $583.33 a month gets you to that $7,000 goal.

- Look at the "Backdoor." If your income is too high for a Roth but you still want that tax-free growth, look into a Backdoor Roth IRA conversion. It's a perfectly legal way to bypass the income caps.

Managing your maximum IRA contribution for 2024 is mostly about timing. Since you have until the spring of 2025 to finish your 2024 contributions, you have plenty of time to adjust your strategy based on how your final year-end income shakes out. Just don't wait until April 14th to start thinking about it.