You remember that feeling? Walking into a McDonald’s with a crumpled five-dollar bill and knowing you were about to eat like a king. It wasn't that long ago. But today, if you walk in with that same five-er, you might struggle to get a Happy Meal, let alone a combo. People are genuinely upset. McDonald’s prices over time have become the unofficial yardstick for how much our purchasing power has eroded, and honestly, the math is a bit staggering.

Prices are up. Way up.

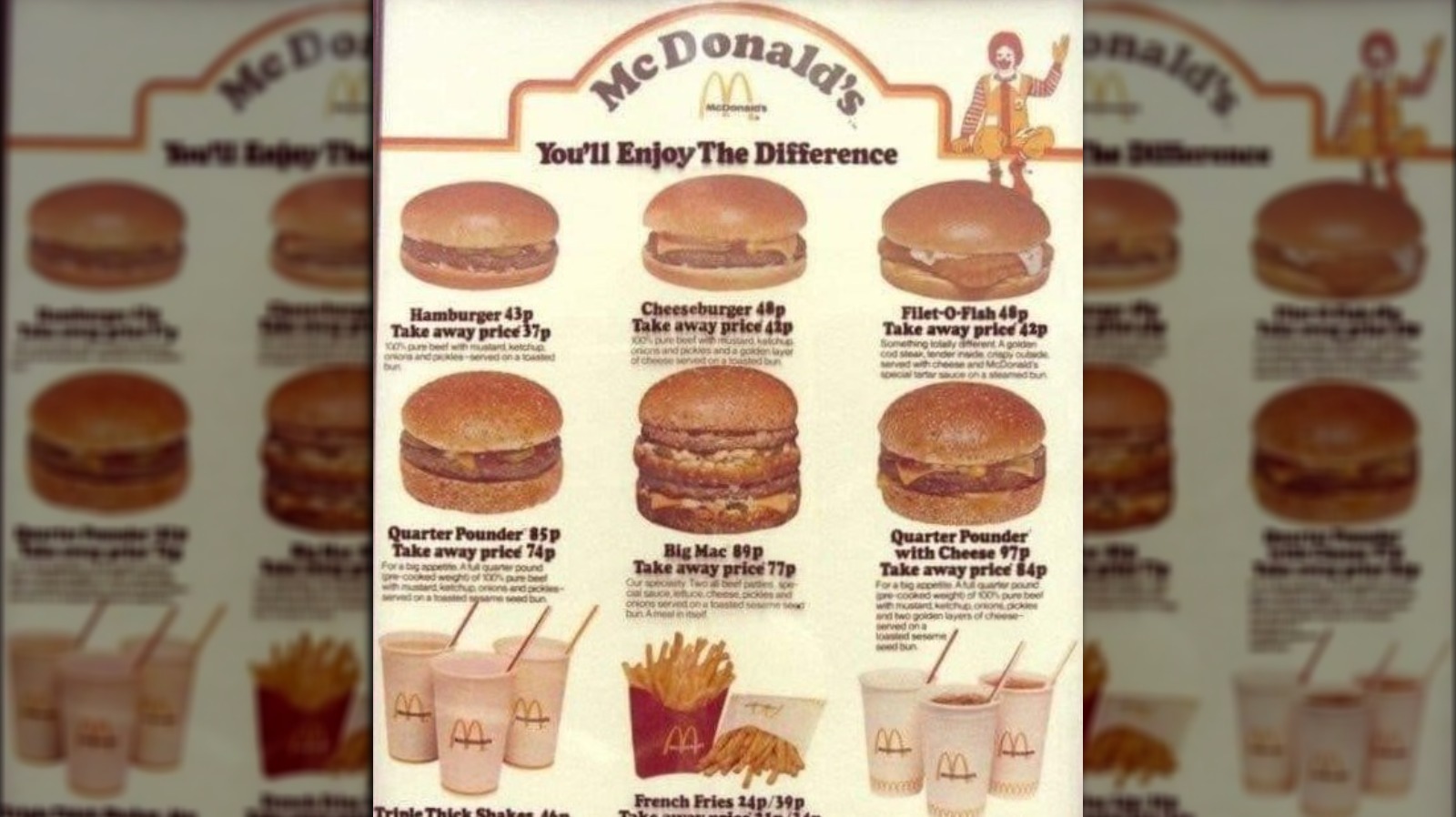

If you look back at the 1950s, a burger was fifteen cents. By the 1970s, you were looking at roughly sixty-five cents for a Big Mac. Even in the early 2000s, the Dollar Menu was a legitimate cultural phenomenon that actually offered items for a single dollar. Now? That menu is a ghost. It’s been replaced by "McValue" menus that rarely feature anything for four quarters unless it’s a small soda or a cookie.

The death of the dollar menu and the rise of the $18 Big Mac meal

Earlier this year, a photo of a Big Mac meal in Darien, Connecticut, went viral because it cost nearly $18. People lost their minds. And rightfully so. While that specific location was a rest stop—which always carries a premium—it highlighted a massive shift in how the Golden Arches positions itself. McDonald’s isn't the "cheap" option anymore; it’s just the "convenient" one.

Finance experts often point to the "Big Mac Index," a tool created by The Economist in 1986 to measure Purchasing Power Parity (PPP) between nations. But lately, Americans are using it to measure their own frustration. According to data from various consumer price trackers, the average price of a Big Mac in the U.S. has jumped roughly 21% since 2019. That outpaces the general rate of inflation for the same period.

Why is this happening? It’s not just corporate greed, though many people on TikTok would argue otherwise. It's a "perfect storm" of labor costs, supply chain disruptions, and the skyrocketing price of beef and potatoes. When the minimum wage rises in states like California to $20 an hour for fast-food workers, that money has to come from somewhere. Usually, it comes from your McDouble.

Breaking down McDonald's prices over time by the decades

Let's get into the weeds.

In 1955, the menu was simple. Hamburger: 15 cents. Cheeseburger: 19 cents. Fries: 10 cents.

By the mid-80s, the Big Mac had climbed to about $1.60. If you adjusted that for inflation using 2024 dollars, it should be around $4.50 today. But in many major cities, you’re paying $6 or $7 for the sandwich alone. That’s a "real-term" increase that hurts the wallet.

The 1990s were the golden era of value. You had the 59-cent cheeseburger days. You had massive promotional tie-ins with movies like Jurassic Park. The brand was focused on volume. They wanted as many feet through the door as possible.

The shift started in the 2010s. McDonald’s realized they couldn’t keep selling food for a dollar and maintain the profit margins their shareholders demanded. They started "premiumizing" the menu. Think Signature Crafted Recipes or the Artisan Grilled Chicken. These failed, mostly, but they paved the way for the higher baseline prices we see now.

📖 Related: Adani Enterprises Share Value: Why the Market is Acting So Weird Right Now

Why the franchise model complicates things

Most people think of McDonald's as one giant company. It’s not. It’s a real estate company that leases to franchisees. About 95% of McDonald’s locations in the U.S. are owned by independent businessmen and women.

These owners set their own prices.

This is why a McChicken might be $1.79 in rural Ohio but $3.49 in downtown Chicago. The corporate office provides "suggested" pricing, but at the end of the day, the person paying the electricity bill for the fryers makes the call. They are squeezed by local taxes, local rent, and local labor markets.

The "Greedflation" debate

There is a lot of talk about "Greedflation." This is the idea that companies used the cover of general inflation to hike prices even further than necessary. Ian Borden, McDonald’s CFO, has noted in earnings calls that the company has had to raise prices to "offset" costs, but he also admitted that they’ve seen a pullback from lower-income consumers.

Basically, they pushed the price ceiling until it started to crack.

When you look at McDonald’s prices over time, the steepest curve occurred between 2021 and 2023. During this window, the price of eggs (for McMuffins) tripled at one point due to avian flu. Beef prices hit record highs. Transportation costs surged because of fuel prices.

💡 You might also like: Job Interview Questions to Ask: Why Your Silence Is Killing Your Job Offer

But even as those costs stabilized, the menu prices didn't go back down. They never do. Deflation is a myth in the fast-food world. Once a customer accepts paying $3 for a large fry, the company has no incentive to lower it back to $2.

What about the digital divide?

If you aren't using the app, you’re getting ripped off. Period.

McDonald’s has shifted its pricing strategy toward "digital engagement." They want your data. To get it, they offer deals like "Buy one get one for $1" or "20% off any order over $15" exclusively through their smartphone app.

This creates a two-tiered pricing system.

- The "Analog" Price: What you see on the lit-up board in the drive-thru. (Expensive)

- The "Digital" Price: What you pay after applying three different coupons and rewards points. (Reasonable)

If you’re a senior citizen who doesn't like smartphones, or someone without a data plan, you are effectively paying a "tech tax." This is a massive shift in how they’ve handled McDonald’s prices over time. It used to be the same price for everyone. Now, it’s a game of who can navigate the interface the best.

Real-world comparison: 2019 vs. 2024

Let’s look at a standard Quarter Pounder with Cheese meal.

👉 See also: Health Care Select Sector SPDR: Why This Defensive Play Isn't as Boring as You Think

- 2019 Average Price: ~$6.39

- 2024 Average Price: ~$9.19–$11.99 (depending on location)

That is a jump of nearly 50% in some markets. In that same timeframe, the U.S. Consumer Price Index (CPI) rose about 19-20%. The disparity is why people feel like they’re being "nickel and dimed." Actually, it’s more like being "dollared and fived."

The company recently launched a $5 Value Meal in response to the backlash. It includes a McDouble or McChicken, 4-piece nuggets, small fries, and a small drink. It was supposed to be a limited-time offer, but they’ve extended it because it’s the only thing bringing people back. It’s a temporary band-aid on a much larger problem: the middle class is being priced out of "cheap" food.

Is there any way back to the "Old" prices?

Honestly? No.

Labor isn't getting cheaper. The cost of land for new restaurants is at an all-time high. And despite the complaints, people are still buying. McDonald’s global sales have remained relatively resilient, though they’ve finally started to see some "consumer resistance" in late 2024 and early 2025.

They’re testing larger burgers, like the "Big Arch," to justify higher price points. The strategy is moving away from "cheap snacks" and toward "filling meals." They want you to spend $12, but they want you to feel like you got a lot of food for it. Whether that works is yet to be seen.

How to manage the cost of eating at McDonald's today

If you’re still a fan of the Golden Arches but hate the price hikes, you have to be tactical.

- The App is Mandatory: You are throwing money away if you don't use it. The rewards points alone can usually net you a free sandwich every three visits.

- Avoid the "Meal" Trap: Often, buying two items off the value menu and a separate drink is cheaper than the bundled "Extra Value Meal."

- Survey Codes: Look at the back of your receipt. There is almost always a "Buy One Get One Free" code for a Quarter Pounder or Big Mac if you spend two minutes filling out a survey.

- Time Your Visits: Many apps have specific deals for "Free Fries Friday" or breakfast specials that vanish after 10:30 AM.

McDonald's prices over time tell a story of a changing America. We’ve moved from a production-based economy with cheap commodities to a service-based economy where labor and convenience are the most expensive things on the menu.

The next time you’re at the drive-thru, don't just look at the total. Look at the value. If a Big Mac meal costs the same as a local diner burger, maybe it's time to support the local guy. Or, keep the app open and hunt for those deals. The days of the 15-cent burger are gone, and they aren't coming back.

Next Steps for Navigating Fast Food Costs

To minimize the impact of rising fast-food prices on your budget, start by auditing your spending habits through your banking app. Specifically, look for "convenience spending" where you paid full price at a drive-thru without using a loyalty program or digital coupon. Moving forward, commit to a "digital-only" rule for fast-food purchases—if the deal isn't in the app, choose a different meal option. Additionally, compare the price-per-calorie of "value" bundles versus individual items; often, the bundled "meals" carry a 15-25% markup just for the convenience of saying a single number at the speaker box. Finally, keep an eye on the "McValue" section of the menu, which often houses smaller, more calorie-dense options like the McDouble, which remains one of the most efficient price-to-protein ratios in the industry.