If you checked your bank account on November 1, 2025, and felt a massive wave of relief, you weren't alone. Honestly, it was a weird morning for about 1.3 million people in uniform. The government had been shut down for an entire month—31 days, to be exact—and the rumors were flying that the money had finally dried up.

People were bracing for the first "zero" LES (Leave and Earnings Statement) in modern history. But then, the military pay november 1 deposits actually hit.

👉 See also: DJIA Today: Why the Dow Still Moves the World

It wasn't a miracle, though it felt like one. It was a high-stakes financial shell game played by the Pentagon to keep the lights on for military families while Congress was deadlocked. Most people just saw the numbers show up and went about their day, but the "how" behind that specific payday is actually pretty wild.

The Shell Game Behind Military Pay November 1

Usually, military pay is straightforward. You get paid on the 1st and the 15th. If those days land on a weekend, you get paid the Friday before. Simple.

But November 1, 2025, was anything but simple. The government had been shut down since October 1 because appropriations—the fancy word for "the money Congress okays"—had expired. Normally, when there's no budget, there's no authority to cut checks.

The Trump administration basically went digging through the couch cushions of the Pentagon. They found roughly $5.3 billion by pulling from three specific pots:

- The "One Big Beautiful Bill" Act funds (about $2.5 billion)

- Procurement accounts (money meant for buying gear and hardware)

- R&D funds (research and development)

By "reprogramming" this money, they bypassed the need for a new Congressional vote just to cover the military pay november 1 cycle. It was a move that some legal experts, like those at the Bipartisan Policy Center, called a "gray area," but for a Sergeant with a mortgage and two kids, the legality didn't matter as much as the direct deposit.

Why Your Bank Made a Difference

If you bank with a military-focused credit union, your experience on November 1 was probably even smoother. Banks like Navy Federal and USAA have a long history of "fronting" the money during shutdowns, but 2025 was a bit different because the shutdown lasted so long.

- Navy Federal Credit Union: They posted on October 31 that they’d received the funds from DFAS. Because they offer early direct deposit for many members, plenty of folks saw their "November 1" money as early as October 30 or 31.

- USAA: They generally aim to get funds into accounts two business days early. In this specific case, they were leaning hard on the Pentagon's reassurance that the reallocated funds were coming.

- Traditional Banks: If you used a "regular" big-box bank, you likely didn't see that money until the actual morning of November 1.

Wait. It’s worth noting that while the active duty side got paid, some National Guard and Reserve members had a much harder time. Because their "drilling" schedules aren't as uniform as active duty, their pay cycles were a mess of delays and administrative confusion during that 43-day shutdown.

The Pay Scale Confusion (Wait, Did I Get a Raise?)

Around the time the military pay november 1 checks were being processed, everyone was also talking about the 2026 pay raise. It gets confusing. You see the news about a 3.8% raise and you start looking for it on your November LES.

That’s not how it works.

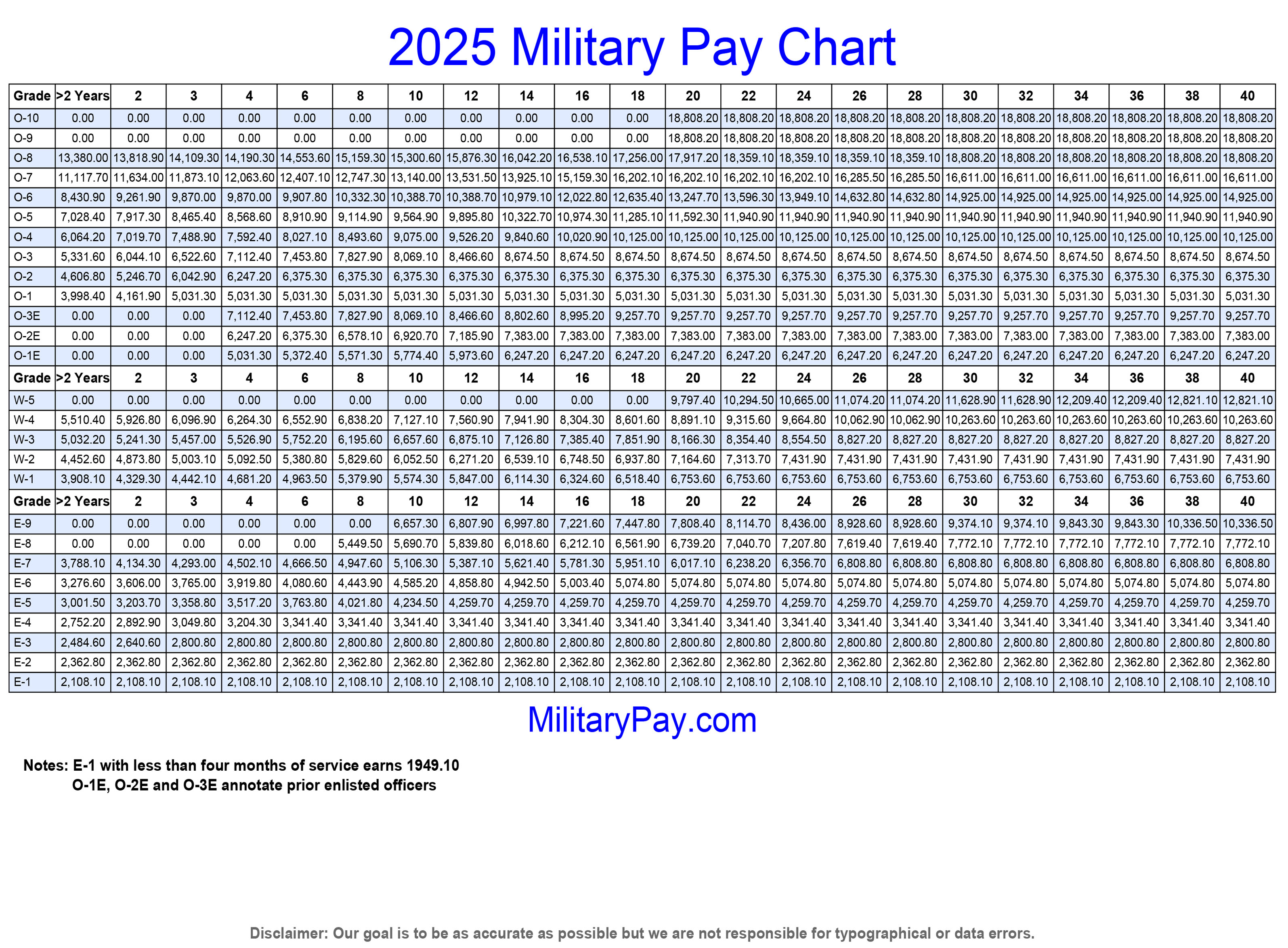

The pay you received on November 1, 2025, was still based on the 2025 pay charts (which included that massive 4.5% jump for most, and even more for junior enlisted). The new 3.8% raise that everyone is currently seeing in their 2026 checks didn't actually kick in until January 1, 2026.

Essentially, that November paycheck was the "survival" check. It was the same rate you'd been getting all year, just delivered via a very unorthodox legal loophole.

What Most People Got Wrong About That Payday

The biggest misconception was that "essential" status meant you were guaranteed to get paid on time. That's a myth.

👉 See also: Max Financial Services Stock Price: What Most People Get Wrong

Being "essential" (or "excepted") means you have to show up to work. It does not mean the money is legally allowed to leave the Treasury. In the 2013 and 2019 shutdowns, Congress passed specific laws—like the Pay Our Military Act—to make sure the checks went out.

In 2025, they didn't do that.

The military pay november 1 cycle happened purely because the Department of Defense moved money from "buying stuff" to "paying people." If the shutdown had lasted another two weeks into mid-November, those procurement accounts would have been tapped out. We were about 14 days away from a total pay freeze for the entire Department of Defense.

Quick Look at the 2025 vs. 2026 Shift

- November 1, 2025: Paid via reallocated R&D and procurement funds. No new raise yet.

- January 1, 2026: The official 3.8% basic pay raise finally went live.

- Current Status: We are back on the standard DFAS schedule with a full budget.

How to Handle Future "Shutdown" Paycycles

Look, 2025 was the longest shutdown in history (43 days). It was a wake-up call. If you’re looking at your pay and wondering how to prep for the next time Congress hits a wall, there are a few real-world steps that actually work.

First off, check your bank's "Direct Deposit" policy. Not all "early pay" is created equal. Some banks just give you the money when they see the notification, while others (like Navy Fed) have historically offered 0% interest loans during shutdowns if the pay actually stops.

Secondly, keep a "shutdown fund." I know, "just save money" is annoying advice when prices are high. But even having $500 specifically set aside can cover the gap between an early-pay bank and a late-pay bank.

Thirdly, monitor your LES like a hawk. When the government is moving money between accounts to pay you, administrative errors happen. Check your November 2025 LES against your October one. If your BAH or BAS looked "off," it’s probably because the system was struggling to pull data from frozen accounts.

📖 Related: Josh Connor: What Most People Get Wrong About the Transport Financier

Moving Forward With Your 2026 Pay

Now that we’re in 2026, the military pay november 1 drama is mostly behind us, but the 3.8% raise is the new reality.

For an E-1, that’s roughly $2,407 a month now. For an O-4 with over a decade of service, you’re looking at about $9,419. It’s a decent bump, even if it feels smaller than the 2025 jump.

The smartest thing you can do right now is take half of that 3.8% increase and automate it into a high-yield savings account or a TSP. If 2025 taught us anything, it’s that the "guaranteed" military paycheck is only as solid as the funding behind it.

Actionable Steps for Your Pay:

- Download your November 2025 and January 2026 LES. Compare them to ensure your 3.8% raise and any BAH locality adjustments were applied correctly.

- Verify your bank's "Shutdown Policy." Call your bank and ask: "If there is a government shutdown and DFAS doesn't send a file, do you offer a 0% pay advance?"

- Adjust your TSP contributions. With the new 2026 base pay, your percentage-based contributions will naturally increase. Make sure you aren't hitting the annual limit too early if you're a high-earner.

The November 1 payday was a historical anomaly—a moment where the Pentagon acted as its own bank. While it worked out then, the goal is to make sure your personal finances are never that dependent on a last-minute budget shuffle again.