If you’re living in California, you already know that "expensive" is just the baseline for everything from a sourdough loaf to a gallon of gas. But here’s the kicker: the floor just moved again. As of January 1, 2026, the official California minimum wage has climbed to $16.90 per hour.

That sounds straightforward, right? Not even close.

In this state, the "minimum" is rarely the actual minimum. Between city-specific laws, industry-specific hikes for fast food and healthcare, and new rules for white-collar workers, figuring out your paycheck—or your payroll—is kinda like trying to solve a Rubik's cube while riding the San Diego Trolley.

The New Baseline for 2026

Honestly, the 40-cent jump from last year’s $16.50 isn’t exactly making anyone rich. It’s an inflation adjustment, plain and simple. The Department of Finance looked at the numbers in August, saw the Consumer Price Index (CPI-W) creeping up, and triggered the increase.

One big thing to remember: the headcount doesn't matter anymore. Back in the day, small businesses with fewer than 26 people got a break and paid a lower rate. That’s gone. Whether you’re a massive tech firm in Palo Alto or a tiny boutique in Ojai, $16.90 is the state floor.

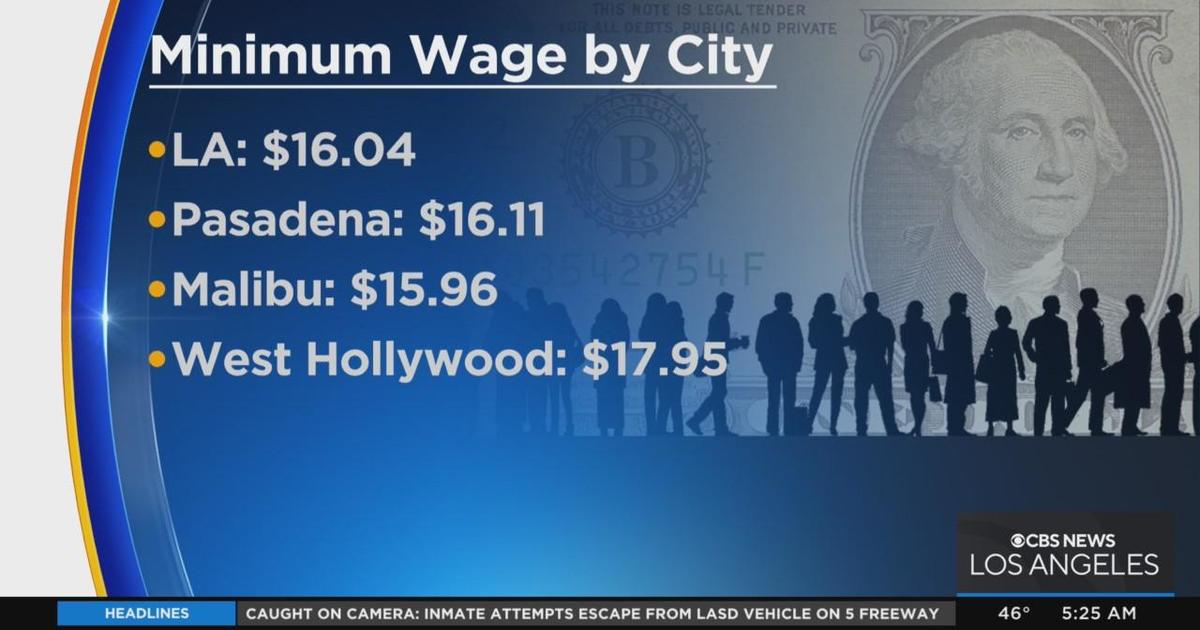

Why Your City Might Owe You More

This is where it gets messy. California allows cities and counties to set their own "living wage" ordinances. If the local law says you get paid more than the state rate, the state loses. You get the higher number.

Take West Hollywood. They aren't playing around. Starting January 2026, the rate there hit $20.25 per hour. That makes it the highest "general" minimum wage in the state. If you’re working a few miles away in a different jurisdiction, you might be making $3 an hour less for the exact same job.

💡 You might also like: Lloyd W Howell Jr: The Rise and Fall of the NFL's Corporate Outsider

Here is a quick look at some of the heavy hitters for 2026:

- Mountain View: $19.70

- Sunnyvale: $19.50

- San Francisco & Berkeley: $19.18

- Emeryville: $19.90 (effective since mid-2025)

- Palo Alto & Santa Clara: $18.70

Basically, if you work in the Bay Area or parts of LA, you’ve gotta check your specific zip code.

The "Fast Food" and "Healthcare" Exceptions

You’ve probably seen the headlines. Fast food workers in California got a massive bump to $20.00 per hour back in 2024. For 2026, that rate hasn't automatically jumped with the state’s $16.90, but the Fast Food Council still has the power to tweak it. If you’re flipping burgers at a chain with 60+ locations nationwide, you’re almost certainly in the $20 club.

Healthcare is even more complex. It's a tiered system. Large health systems (10,000+ employees) and dialysis clinics are already paying $24.00 per hour. By July 1, 2026, many of these workers will see that hit $25.00.

It's not just nurses. We're talking about janitors, groundskeepers, and clerical staff at these facilities. If you’re at a smaller "safety net" hospital, your path to $25 is slower, but the trajectory is the same.

The Salary Threshold: The $70,304 Rule

This is the one that catches employers off guard every single time. In California, if you want to classify an employee as "exempt" (meaning no overtime pay), you can't just give them a fancy title like "Manager." You have to pay them at least twice the state minimum wage in a full-time salary.

With the 2026 hike to $16.90, that math looks like this:

$16.90 \times 2 \times 2080 \text{ hours} = $70,304 \text{ per year}$

If a "salaried" professional is making $69,000, they are technically no longer exempt under California law as of January 1. They become entitled to overtime. It’s a massive trap for small businesses that don't update their offer letters.

What Most People Miss: The "Learner" Loophole

Is there anyone who doesn't get the full $16.90? Sorta.

California has a "Learner" rate. An employer can pay 85% of the minimum wage to an employee with zero experience in that specific occupation, but only for the first 160 hours of work. After that, the training wheels come off and the full rate kicks in.

Also, it’s worth noting that "tipped" employees don't get a lower rate here. Unlike in states like Texas or Virginia, California does not allow a "tip credit." If you’re a server at a high-end spot in San Diego, you get your $16.90 (or more) plus every cent of your tips.

✨ Don't miss: Another Word for Higher Up: Why Your Vocabulary Choice is Tanking Your Career

Actionable Steps for 2026

If you're a worker, don't just assume your payroll department got the memo.

- Check your pay stub immediately. If your hourly rate hasn't moved to at least $16.90 (or your local city's higher rate), talk to HR.

- Verify your "Exempt" status. If you’re on salary and making less than $70,304, you might actually be entitled to overtime pay for all those late nights.

- Watch the July 1st window. Many cities (like LA and San Francisco) and the healthcare industry often do their "mid-year" bumps in July rather than January.

For the business owners out there, audit your payroll now. The California Labor Commissioner’s office is famously aggressive. A simple mistake in calculating the "regular rate of pay" for overtime—which must now factor in that $16.90 base—can lead to "waiting time penalties" that cost thousands. Update your "Official Minimum Wage" posters in the breakroom. It’s a tiny detail, but it’s the first thing an inspector looks for.

The reality is that $16.90 still feels tight in a state where the median rent is north of $2,800. While the 2024 ballot measure to hit $18 earlier was narrowly rejected, the momentum for a $20 or even $25 "universal" floor is growing in cities like Los Angeles. For now, stay sharp on your specific city and industry rules.

Next Steps for You:

Check the UC Berkeley Labor Center's Inventory to see if your specific city has a higher rate than the $16.90 state floor. If you're in healthcare, confirm your facility's "tier" to see if your next raise hits in July.