You’ve seen the heavy metal cards. You know the "vanilla" Platinum is everywhere. But there’s a specific version of this card that feels like a secret handshake for the wealthy—or at least the financially savvy.

The Morgan Stanley American Express Platinum is a bit of a chameleon.

On the surface, it looks just like the standard American Express Platinum Card. Same lounge access. Same 5x points on flights. Same shiny finish that makes a satisfying clink on a marble counter. But under the hood? It’s a totally different beast.

Honestly, most people think you need to be a multi-millionaire with a private banker to get one.

You don't.

But you do need to understand the math, because as of 2026, the stakes have changed. With the annual fee for the Platinum card family climbing to $895 for many, getting the Morgan Stanley version isn't just about prestige—it's about making the bank pay for your luxury travel.

The $895 Question: Is It Really Free?

Let's address the elephant in the room. The annual fee is steep. $895.

That’s a lot of money for a piece of metal. However, the Morgan Stanley American Express Platinum has a unique feature called the Annual Engagement Bonus. If you play your cards right (pun intended), Morgan Stanley essentially cuts you a check for $895 every year to cover that fee.

Basically, you’re getting the most powerful travel card in the world for a net cost of zero dollars.

But there’s a catch. There's always a catch.

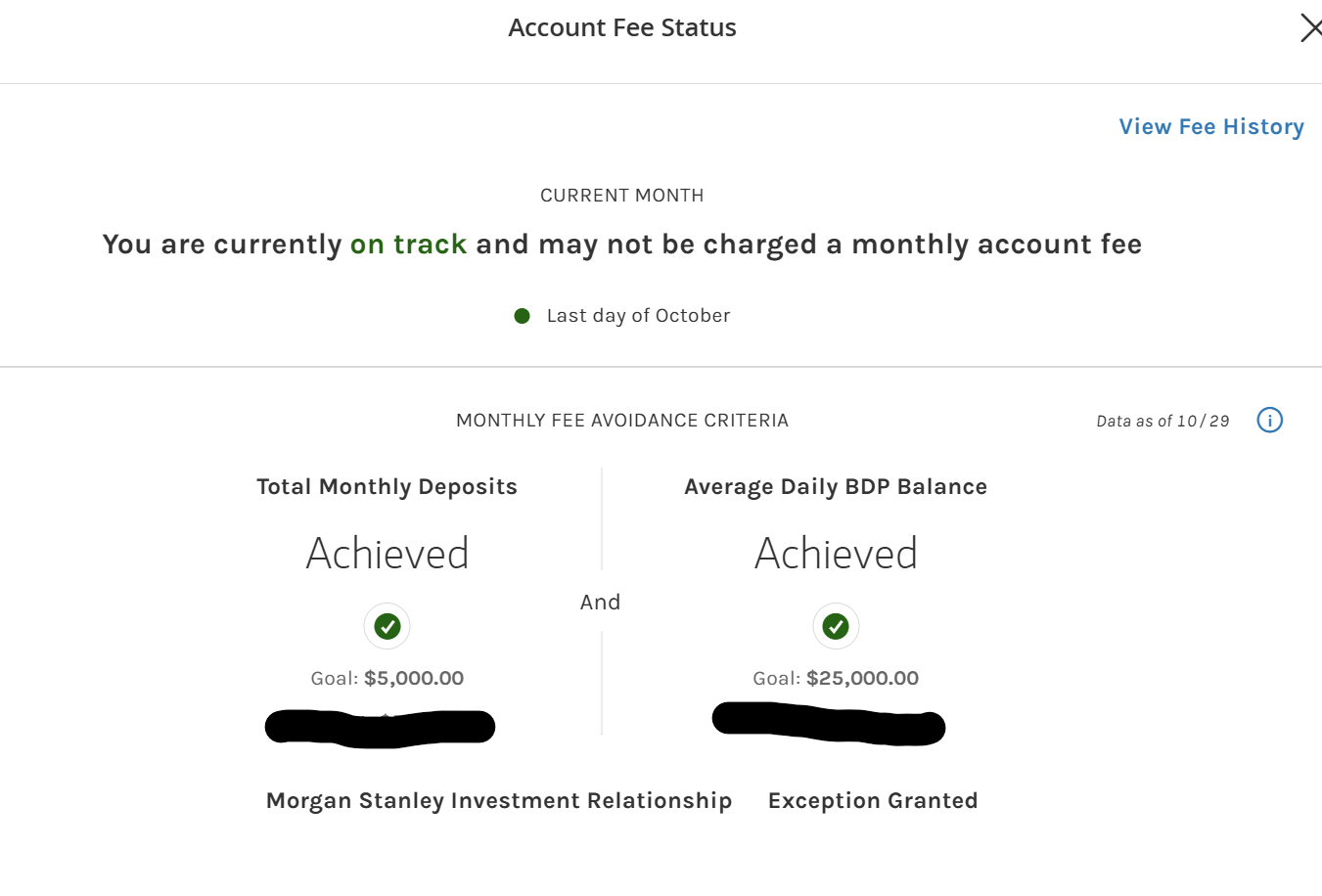

To get that "free" card, you have to park $25,000 in a Morgan Stanley Platinum CashPlus account. You also need to have $5,000 in monthly deposits hitting that account. And you need a qualifying investment relationship.

Is it worth it?

Well, if you have $25,000 sitting in a savings account anyway, moving it to Morgan Stanley to save nearly $900 a year is a 3.5% tax-free return on that cash. In 2026, with interest rates shifting, that’s actually a pretty solid deal. If you're a retiree and have Social Security deposited, the $5,000 monthly requirement is often waived.

One more thing people miss: Morgan Stanley is now more "open" than it used to be. You don't necessarily need a fancy wealth advisor anymore. Since the merger, E*TRADE accounts now qualify as an "eligible account."

That’s a huge shift. It means the "exclusive" card just became accessible to anyone with a brokerage account.

Why This Version Beats the "Vanilla" Card

If you're just looking at the Amex website, you might wonder why anyone bothers with the Morgan Stanley hoops.

The biggest reason? The first authorized user is free.

On the standard Platinum card, adding your spouse or a family member costs $195. With the Morgan Stanley American Express Platinum, that first extra card is $0.

Think about that. You and your partner both get:

- Centurion Lounge access.

- Delta SkyClub access (when flying Delta).

- Individual $120 Global Entry/TSA PreCheck credits.

- Hilton and Marriott Gold status.

That’s $1,090 in value ($895 fee + $195 AU fee) that you’re essentially wiping out with the engagement bonus.

The 2026 Perk Refresh

Amex recently overhauled the benefits. It's not just about Uber and Saks anymore. The "lifestyle" credits are getting weirdly specific, but valuable if you use them.

- The Hotel Credit: Now up to $600 annually ($300 every six months) for Fine Hotels + Resorts.

- Resy Credits: $100 per quarter. If you eat out at all, this is $400 in free food a year.

- Lululemon: $75 per quarter. Even if you don't do yoga, you can buy a pair of socks or a headband and call it a win.

- Oura Ring: A $200 credit toward the hardware.

If you're the kind of person who uses these, the card pays you to own it. If you're not... well, it’s a lot of coupons to track.

The Logistics: How to Actually Get It

You can’t just go to the Amex site and click "Apply" like a normal person. Well, you can, but you'll get denied if your accounts aren't linked.

First, you need the brokerage relationship. As mentioned, an E*TRADE from Morgan Stanley account works.

Second, you want that Platinum CashPlus account. This is the "hub." This is where the $895 bonus lands.

Third, you apply for the card through the Morgan Stanley portal.

One mistake I see all the time: people apply for the standard Platinum card first, thinking they can "convert" it later. You can't. They are separate products. If you want the Morgan Stanley version, you have to apply for it specifically.

The Downside Nobody Mentions

It’s not all champagne and airport lounges.

The $25,000 you leave in the CashPlus account earns almost zero interest. In a world where high-yield savings accounts might be paying 4% or more, you’re "losing" about $1,000 a year in interest to get an $895 credit.

The math is tight.

💡 You might also like: How to Look Up Tax Exempt ID Number Details Without Getting Scammed by the IRS

Also, that $895 engagement bonus? It’s usually reported on a 1099-MISC. That means it’s taxable income. So, depending on your tax bracket, that "free" card might actually cost you $200-$300 in taxes at the end of the year.

It’s still a discount, but it’s not "free-free."

Actionable Steps to Take Now

If you’re serious about the Morgan Stanley American Express Platinum, don't just jump in. Do this:

- Check your E*TRADE status. If you have an account there, see if you can link it to the Morgan Stanley wealth portal. This is the easiest entry point.

- Audit your "Lifestyle" spending. Do you actually eat at Resy restaurants? Do you shop at Lululemon? If you don't use at least $500 of the credits naturally, the "hoop-jumping" isn't worth the effort.

- Calculate your "Opportunity Cost." Take $25,000 and multiply it by the current best savings rate (e.g., $25,000 x 0.04). If that number is significantly higher than $895, you’re better off keeping your money in a HYSA and just paying the Amex fee out of pocket.

- Open the CashPlus account first. Give it a month to settle before applying for the card. It makes the automated approval process much smoother.

The Morgan Stanley American Express Platinum remains the "king" of the Platinum cards because of the free authorized user and the potential for a $0 net fee. But it requires a level of organization that most people find annoying. If you can handle the spreadsheets, it's the best deal in the premium card market.