You’re sitting there with a stack of bills and a coffee that’s gone cold, trying to figure out where your money actually goes. It’s a Friday night. Maybe a Tuesday. Doesn't matter. You just want to make sure your Mutual of Omaha pay mortgage task is checked off so you can stop thinking about interest rates and escrow accounts for at least thirty days. But if you’ve been a customer for a while, you might have noticed things look a little different lately.

The truth is, Mutual of Omaha Mortgage isn't just one static thing. It’s a massive operation that handles billions in loan originations. Because they’ve grown so fast—especially in the reverse mortgage space where they are a dominant player—the way you actually send them money has evolved. It’s not just about licking a stamp anymore. Honestly, if you're still doing that, you're living in 1995.

The Shell Game of Mortgage Servicing

Here is something nobody tells you when you sign those hundred pages of closing documents: the company that gave you the loan isn't always the company that collects your check.

Mutual of Omaha Mortgage often uses third-party "servicers." This is why you might get a letter in the mail saying your payment address has moved to a random P.O. Box in Dallas or Charlotte. It’s confusing. It’s annoying. But it’s how the secondary mortgage market functions. If you are trying to handle a Mutual of Omaha pay mortgage situation, the first thing you have to do is check your most recent statement to see who is actually "servicing" the loan today.

Usually, you’ll be directed to their primary portal. This is where most people get stuck. They try to log into the main Mutual of Omaha insurance site, but that’s for life insurance or Medicare supplements. Mortgage is a different beast entirely. You need the specific mortgage login, which is often hosted on a platform managed by companies like Black Knight or LoanCare.

📖 Related: Other Words for Exploiting: Why Choosing the Right Term Changes Everything

Digital vs. Old School: Your Payment Options

You've basically got four ways to get this done.

First, there’s the Online Portal. This is the path of least resistance. You set up a username, link your checking account, and click "Pay Now." It’s instant. Well, "banking instant," which usually means 24 to 48 hours for the ACH to actually clear.

Then you have AutoPay. This is great if you have a steady salary and zero anxiety about your bank balance. But a word of caution: if your property taxes or insurance premiums go up, your escrow payment changes. If you don't keep an eye on those "Notice of Change" letters, AutoPay can sometimes pull more than you expected, leaving you short for groceries or the electric bill.

What about Phone Payments? Yeah, they still exist. You call the customer service line (usually found on the back of your statement). Sometimes they charge a "convenience fee" for this. It feels like a penalty for not being tech-savvy, and frankly, it kind of is. If you're in a rush because the 15th of the month is tomorrow and the grace period is closing, the phone is your best bet, but it'll cost you.

Finally, there’s Mail. Some people love the paper trail. If you send a check, make sure your loan number is written on the memo line in big, bold ink. If that check gets separated from the coupon in the envelope, it can wander around a mailroom for a week before anyone figures out whose house it belongs to.

The Reverse Mortgage Twist

Mutual of Omaha is huge in the reverse mortgage world. If you or a family member has a HECM (Home Equity Conversion Mortgage), the "pay mortgage" part of the equation is fundamentally different.

In a standard "forward" mortgage, you're paying down the balance. In a reverse mortgage, you usually aren't making monthly payments at all. The interest just gets added to the back end. However, many people choose to make voluntary payments to keep the balance from ballooning. If you're doing this, you need to be incredibly specific with the servicer that the money should be applied to the principal. Otherwise, they might just sit on it as "unapplied funds" or a "suspense account" because their system isn't programmed to expect a check from you.

Why Your Payment Might Be Rejected

It’s a nightmare scenario. You sent the money, but they sent it back. Why?

Usually, it's because of a "partial payment." Most mortgage servicers, including those working for Mutual of Omaha, have a strict policy: if you owe $1,500 and you send $1,450, they won't take it. They’ll put it in a suspense account until you send the other $50, or they’ll just mail the check back to you. Meanwhile, your late fees are ticking up.

✨ Don't miss: USD to UZS Exchange Rate Today: Why the Som is Surprising Everyone

If you're going through a financial hardship, don't just send what you can and hope for the best. Call them. Mutual of Omaha has loss mitigation departments specifically designed to handle "forbearance" or "loan modifications." It’s better to have a documented plan than a rejected check.

Escrow: The Hidden Variable

Your Mutual of Omaha pay mortgage amount isn't just principal and interest. It’s also taxes and insurance. This is the part that fluctuates. Every year, the servicer does an "Escrow Analysis."

If your local school district raised taxes, your monthly payment goes up. If you changed homeowners insurance companies and forgot to tell the mortgage company, they might "force-place" insurance on your property. Forced-place insurance is incredibly expensive—sometimes triple the price of a standard policy.

Always check your monthly statement for the breakdown. If you see a line item for "Hazard Insurance" that looks way too high, that’s a red flag. It means they think you aren't insured, and they’re charging you for it.

The "Grace Period" Myth

Most people think they have until the 15th to pay. Technically, the payment is due on the 1st. The 15th is just when the late fee kicks in.

While it feels like you're getting away with something by paying on the 14th, you’re actually flirting with disaster. If there’s a banking glitch or a weekend holiday, and that payment doesn't post until the 16th, you’re hit with a fee that’s usually 4% to 5% of your principal and interest payment. On a $2,000 payment, that’s an extra $100 just... gone. Into thin air.

Actionable Steps to Manage Your Account

Don't let the process manage you. Take control of the paperwork so you can go back to living your life.

- Verify your servicer today. Look at your most recent statement. If the logo isn't Mutual of Omaha but rather a company like Celink (for reverse mortgages) or a different third party, that is where your portal account needs to be created.

- Switch to bi-weekly payments if you want to save money. You can't usually do this through the standard online portal. You often have to set it up through your own bank's "Bill Pay" system. By paying half your mortgage every two weeks, you end up making 26 half-payments a year. That equals 13 full payments. You shave years off your loan without even feeling it.

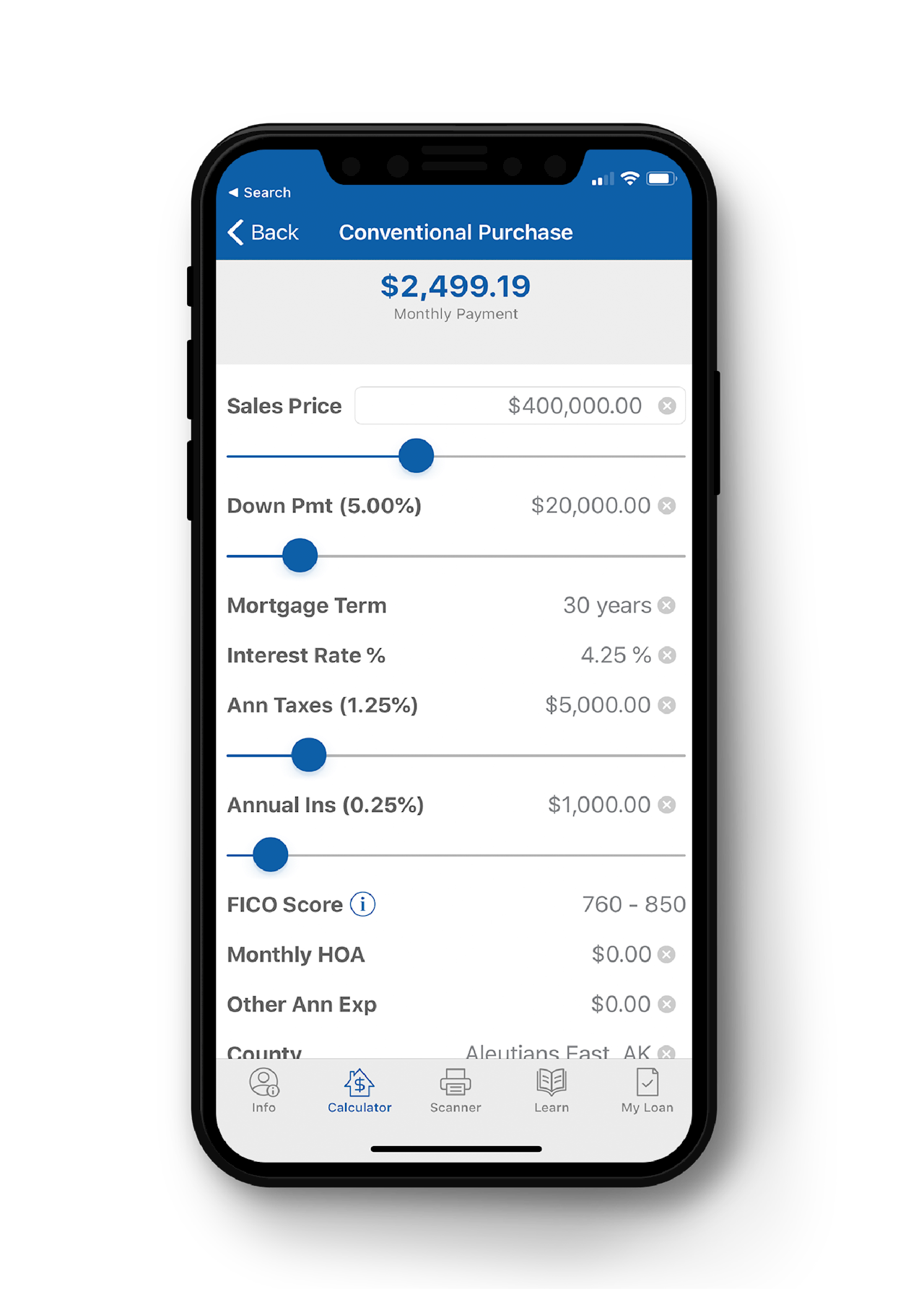

- Download the app. Mutual of Omaha Mortgage has mobile tools that let you snap a picture of documents and check your balance. It’s much faster than waiting on hold for twenty minutes to ask a simple question about your escrow balance.

- Audit your Escrow Analysis. When that annual statement arrives in the mail, don't toss it in the "later" pile. Compare it to your tax bill from the county. If the mortgage company is over-collecting (which happens), you can actually request a refund of the surplus.

- Set up "Push" notifications. Instead of relying on a paper bill that might get lost in the rain, set up text alerts. Get a text when the statement is ready and another one when the payment is processed. This creates a digital trail that protects you if the bank ever claims you missed a payment.

Managing a Mutual of Omaha pay mortgage requirement isn't exactly fun, but it doesn't have to be a headache. Just remember that the system is automated. It doesn't have feelings. It doesn't care if you had a bad week. By setting up a recurring, verified digital payment and keeping an eye on your escrow, you effectively turn a complex financial obligation into background noise.

If you ever find yourself in a spot where the payment is impossible, the worst thing you can do is stay silent. Reach out to the servicing department early. They would much rather help you modify a payment plan than go through the expensive, soul-crushing process of a foreclosure. Keep your loan number handy, keep your records organized, and always, always double-check your account 48 hours after you hit "submit."

Next Steps for Homeowners:

- Locate your most recent 10-digit loan number on the upper right-hand corner of your statement.

- Register for the specific "Mortgage Servicing" portal rather than the general Mutual of Omaha corporate site.

- Confirm your "Grace Period" end date to ensure you avoid unnecessary late fees during holiday months.