You’re looking at a beautiful brick colonial in Naperville. The schools are top-tier, the downtown is charming, and then you see the "estimated taxes" on the listing. Your stomach drops.

It's the classic Naperville trade-off.

Honestly, the Naperville IL property tax rate is one of the most misunderstood numbers in the Midwest. People see a percentage and panic, or they look at a neighbor’s bill and wonder why they’re paying three grand more for the same square footage.

The reality? There isn't just "one" rate.

The Tale of Two Counties

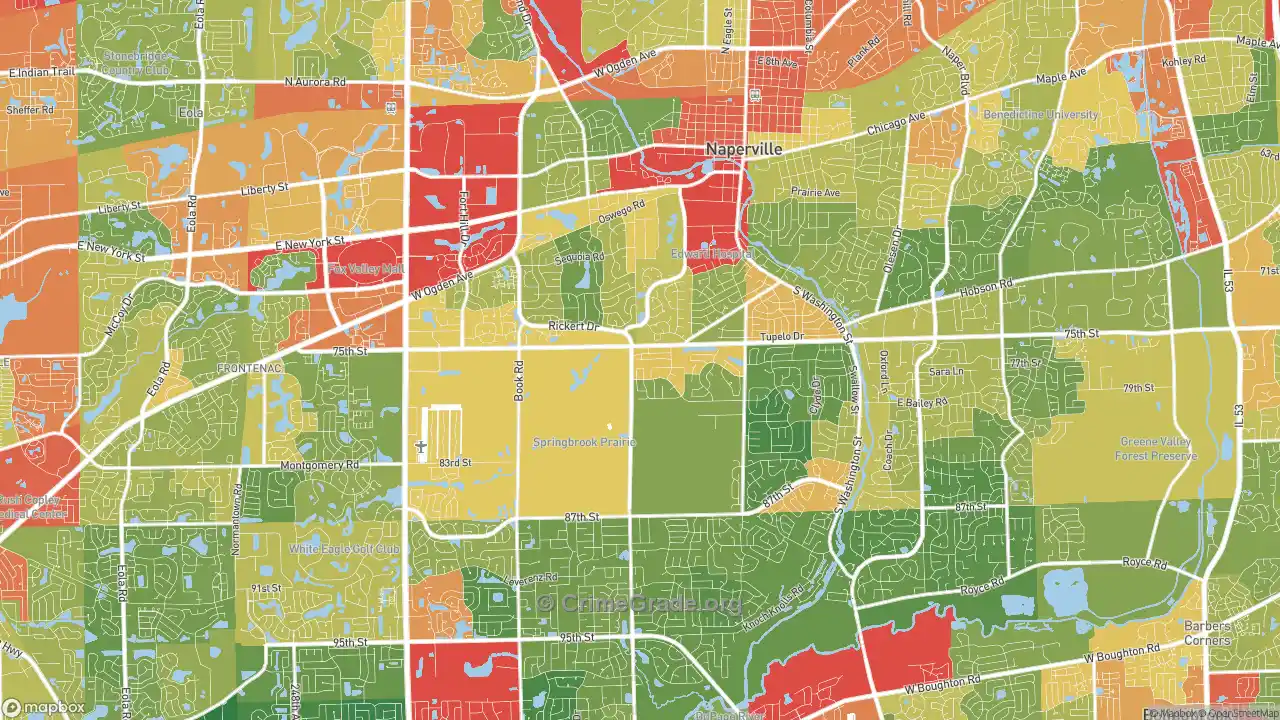

Naperville is a bit of a geographic rebel. It sits in both DuPage and Will Counties, and where that county line falls on your property map changes everything.

If you’re on the DuPage side, you’re looking at an average effective tax rate hovering around 2.1% to 2.2%. Over in Will County? It often creeps higher, sometimes hitting 2.3% or 2.4%.

That might sound like a tiny difference. It isn't. On a $600,000 home, a 0.2% difference is an extra $1,200 out of your pocket every single year. Forever.

Why the Bill is Actually So High

It’s easy to blame the city, but the City of Naperville itself usually only takes about 7% to 10% of your total tax bill. The real "culprit" (if you want to call it that) is the education system.

Approximately 70% to 75% of your property taxes go directly to school districts like Naperville 203 or Indian Prairie 204.

You've basically bought a subscription to some of the best public schools in the country. If you have three kids in school, you're getting a bargain compared to private tuition. If you're a retiree with no kids in the system, it's a much tougher pill to swallow.

👉 See also: Dow Jones Today Now: Why the Market is Acting So Weird Lately

The Math That Makes Your Head Spin

Illinois doesn't make this easy. Your tax bill isn't just (Market Value x Rate).

- Assessed Value: The county takes your market value and divides it by three. In Illinois, you are taxed on 33.3% of what your home is worth.

- Equalization Factor: The state applies a "multiplier" to make sure every county is assessing fairly.

- Exemptions: This is where you actually save money.

The General Homestead Exemption is the big one. Most Naperville residents get an $8,000 reduction in their Equalized Assessed Value (EAV). It's usually automatic, but you'd be surprised how many people forget to check if it’s actually applied.

Can You Actually Fight the Assessment?

Yes. And you probably should.

Assessment notices usually go out in the late summer or fall. You have a tiny window—usually just 30 days—to file an appeal.

Most people think they can appeal because "the taxes are too high." The Board of Review doesn't care about that. They only care if your valuation is wrong. If your house is worth $500,000 but the assessor says it's worth $600,000, you have a case.

You'll need "comps"—similar houses in your neighborhood that sold for less or are assessed for less. Don't just bring a printout from Zillow. Bring the actual property record cards from the township assessor’s office.

Common Misconceptions About the 2025-2026 Cycle

I hear this a lot: "My house didn't change, so my taxes shouldn't go up."

🔗 Read more: Kaspar Basse: What Most People Get Wrong About the Joe & The Juice Founder

Kinda wish it worked that way.

Even if your home value stays flat, if the school district or the park district increases their "levy" (the total amount of money they're asking for), your bill goes up. For 2025, the Naperville Park District proposed a levy increase of about 5%, and District 203 looked at a roughly 3.8% increase.

Inflation hits the city’s gas bill and the school’s teacher salaries just like it hits your grocery bill.

Surprising Details About "Unincorporated" Pockets

There are little "islands" in Naperville that aren't actually part of the city. They’re unincorporated DuPage or Will.

If you live in one of these, you might not pay a city library tax or a city fire tax. You might have a well and a septic tank instead of city water. Your tax rate might look lower on paper, but you’re often paying separate fees for trash or fire protection that city dwellers get "included" in their bill.

It’s a "grass is greener" situation that isn't always greener when you see the private contractor bills.

Senior Citizens and the "Freeze"

If you’re 65 or older, there's a huge benefit called the Senior Assessment Freeze.

💡 You might also like: Converting 3 million naira in usd: Why the math keeps changing

If your total household income is under $75,000 (as of the 2026 tax year), you can "freeze" the assessed value of your home. Your tax rate can still go up, but the value they multiply it by stays locked in. Over a decade, this can save a Naperville senior thousands of dollars.

How to Actually Lower Your Bill

Don't just pay the bill and grumble. Take these steps:

- Audit your exemptions: Look at your second installment bill (usually due in September). Look for the words "General Homestead." If it’s not there and you live in the house, call the township assessor immediately.

- Check the Senior Exemption: If you turned 65 this year, you qualify for the Senior Homestead Exemption, which is a straight-up discount, regardless of income.

- The 4-Year Improvement Rule: Did you just finish your basement? In Naperville, you can often get a Home Improvement Exemption that delays the tax increase on that new value for up to four years.

- Watch the Township Deadlines: Naperville Township, Lisle Township, and Wheatland Township all have different appeal deadlines. Mark your calendar for August.

The Naperville IL property tax rate is high because the demand for the area is high. You're paying for the safety, the schools, and the fact that your home will likely hold its value better than almost anywhere else in the Midwest.

Actionable Next Steps

- Find your PIN: Your Property Index Number is on your last bill.

- Visit the Assessor Website: Go to the DuPage County or Will County treasurer’s site.

- Verify Exemptions: Ensure you have the General Homestead and, if applicable, the Senior or Veteran exemptions applied.

- Compare Comps: Use the county's GIS map to see what the house next door is assessed at. If they have the same floor plan but a $20,000 lower assessment, start gathering your evidence for an appeal this fall.