Money is a weirdly private topic until it isn't. We all want to know if we're "behind" or "ahead," but looking at the national average salary is honestly like trying to judge the weather in the entire United States by looking at a single thermometer in Kansas. It tells you something, but it probably won't tell you if you need a jacket in Seattle or a swimsuit in Miami.

The numbers are moving fast. If you haven't checked the data lately, you're likely looking at 2023 or 2024 stats that feel like ancient history. By the start of 2026, the landscape has shifted. Inflation has cooled, but it left a permanent mark on what a "good" paycheck looks like.

The actual national average salary right now

Let's get the big number out of the way. According to the latest Bureau of Labor Statistics (BLS) data and private sector trackers like Jobted, the national average salary in the U.S. for 2026 is roughly $65,470 to $69,846 per year.

That sounds specific. It isn't.

The Social Security Administration’s National Average Wage Index recently hit $69,846.57 for the latest full indexing year. But here is where it gets tricky. If you walk into a room of ten people, and one of them is a hedge fund manager making $5 million and the other nine are baristas making $35,000, the "average" salary for that room is over $500,000.

Does anyone in that room actually feel like they make half a million dollars? Nope.

That is why experts usually point to the median salary. The median is the true middle. As of late 2025 and moving into 2026, the median weekly earnings for full-time workers sit around $1,214. If you do the math for a full year, that's approximately $63,128.

Why the "average" is usually a lie

Average (the mean) is almost always higher than the median because the ultra-wealthy pull the number up. Most people—roughly 60% of the workforce—actually earn less than the reported national average.

It’s a classic statistical trap. When you hear "the average American makes $70k," and you're making $55k, you feel like you're failing. In reality, you might be right in the middle of the pack for your age and location.

The massive gap between industries

Where you work matters more than how hard you work. That's a bitter pill, but the data backs it up. You could be the world's most efficient barista, but you will never out-earn a mediocre software architect.

National average salary by occupation (2026 estimates)

- Management & Finance: This is the heavy-hitter category. Median weekly earnings here are roughly $1,912 for men and $1,466 for women.

- Professional & Related: This covers lawyers, engineers, and scientists. They are averaging about $1,503 per week.

- Service Occupations: This is the low end of the spectrum. We're talking about $747 to $897 per week.

- Construction & Extraction: A solid middle-ground at about $1,020 per week.

If you're in the tech sector, things have actually "softened" a bit. Payscale's 2026 Salary Budget Survey noted a 0.5% decrease in planned pay increases for tech compared to 2025. The "gold rush" of the post-pandemic years has turned into a "gold crawl." On the flip side, if you're in Pharma, Biotech, or Healthcare, your industry is still seeing raises above the 3.5% national baseline.

📖 Related: Morgan Poche and Brown & Root: What Most People Get Wrong About This Industrial Powerhouse

The Education Premium

Is college still worth it? Statistically, yes.

Workers with a Bachelor’s degree or higher see median weekly earnings of $1,747.

Compare that to high school graduates with no college, who are bringing home $980.

The gap is nearly $40,000 a year. That’s a whole second salary for some people.

Geography is the ultimate salary filter

A $70,000 salary in Jackson, Mississippi, makes you a king. That same $70,000 in San Francisco makes you roommates with three other people and a very stressed-out cat.

Massachusetts currently leads the pack with an average annual salary over $80,000. New York and Washington follow closely behind. At the other end, states like Mississippi ($47,570) and Arkansas ($51,250) have lower averages, but your dollar actually buys a house there instead of a parking spot.

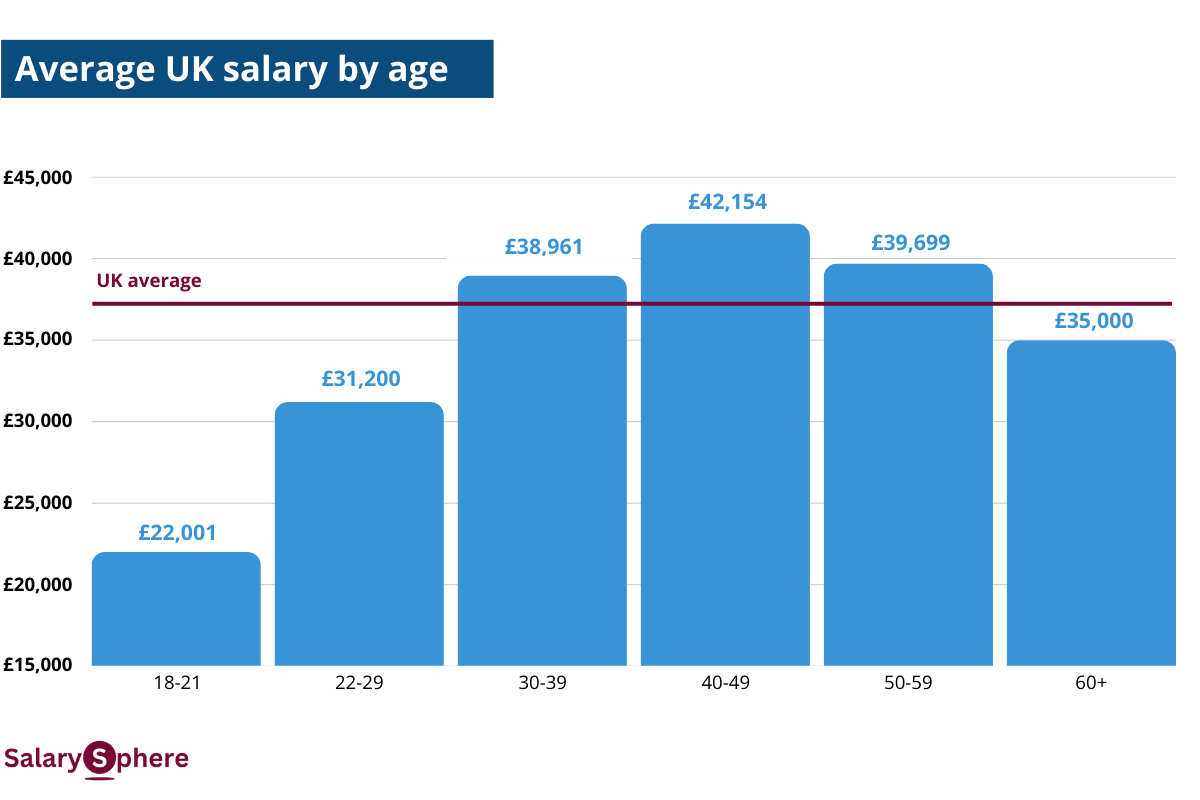

What is the national average salary for your age?

You don't start at the average. You grow into it.

Usually, your earning power peaks between ages 35 and 54.

- Ages 16–24: The "paying your dues" phase. Median weekly earnings are about $715 to $802.

- Ages 25–34: The climb. You’re likely hitting around $1,139 per week.

- Ages 35–54: The peak. This is when most people hit the $1,350 to $1,520 range.

- Ages 65+: Earnings start to dip slightly, often because people move to part-time work or "consultant" roles, averaging $1,198.

The Gender and Race Reality

We can't talk about the national average salary without acknowledging the friction in the data. Women’s median earnings are still about 80.7% of men’s. In the third quarter of 2025, men’s median weekly earnings were $1,333, while women’s were $1,076.

Race plays an even larger role. Asian workers have the highest median earnings at $1,620 per week. White workers sit at $1,238, while Black ($970) and Hispanic ($944) workers continue to face a significant gap. These aren't just numbers; they represent massive differences in generational wealth-building potential.

Beyond the base: The 2026 "Total Compensation" shift

In 2026, the smart money is looking past the "base salary."

Because wage growth has slowed to about 3.2% to 3.5%, employers are getting creative.

They can't always give you a $10,000 raise, but they might give you **$10,000 in "lifestyle" value**.

The Benefits Boom

According to recent BLS surveys, benefits now make up nearly 30% of total compensation.

Keep an eye out for these in your next negotiation:

👉 See also: Crash of the US dollar: Why everyone is talking about it and what actually happens next

- Childcare assistance: This is the "new" 401k. Companies are desperate to keep parents in the workforce.

- The "In-Person" Premium: Some firms are now paying a 5% to 10% higher salary specifically for people willing to be in the office five days a week.

- Variable Pay: More companies are moving toward performance bonuses rather than permanent base-pay increases. It keeps their overhead low and gives you a "carrot" to chase.

How to use this data for your next raise

Stop comparing yourself to the "National Average." It’s a ghost.

Instead, follow these steps to see where you actually stand:

1. Calculate your "Real" Average. Go to the BLS website or use a tool like Robert Half’s 2026 Salary Guide. Look for your specific job title within your specific city. That is your true benchmark.

2. Factor in the "Cost of Living" adjustment. If you’re offered $100k in NYC and $85k in Raleigh, take the Raleigh job. You'll be richer. There are "COLA" (Cost of Living Adjustment) calculators online that will show you exactly how much your paycheck shrinks when you move to a high-tax state.

3. Negotiate on "Total Comp." If your boss says the budget for raises is capped at 3% this year, ask for an extra week of PTO or a professional development stipend. In 2026, these are often "bucketed" differently in HR software, and you’re more likely to get a "yes."

4. Watch the "Wage Index." The Social Security Administration’s index matters because it dictates your future benefits. If you’re consistently earning below the $69,846 mark, you might want to look into upskilling in high-growth sectors like healthcare or green energy, which are outpacing the rest of the economy.

The national average salary is a benchmark, not a boundary. Use it to understand the tide, but don't let it tell you how to sail your own ship. Understanding the nuance between median, mean, and geographic weight is the difference between feeling underpaid and actually being empowered to ask for more.