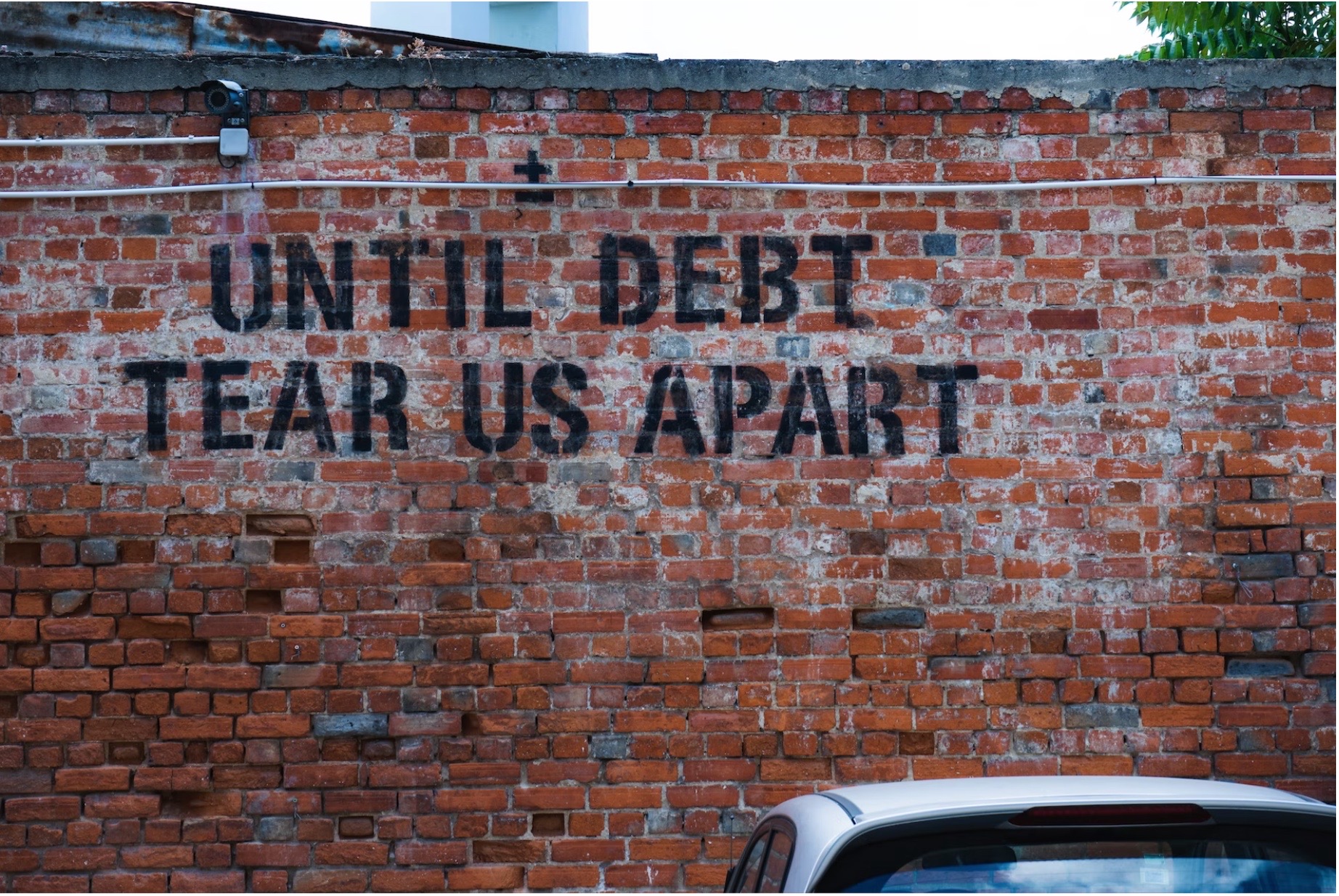

You’ve likely seen the ads. A friendly face promises to wipe out your credit card debt for pennies on the dollar. It sounds like a dream, especially when you’re staring at a balance that feels more like a mountain than a number. But lately, the chatter hasn't been about savings. It's been about the national debt relief lawsuit rumors and the very real legal battles swirling around the debt settlement industry.

Honestly, the truth is messy.

Most people think there is one giant, single lawsuit that just shut everything down. That isn’t how it works. Instead, we are looking at a patchwork of class actions, federal investigations, and individual horror stories that have reached the courts in 2025 and early 2026.

🔗 Read more: The Richest Country in the World: Why the Top Spot Isn't What You Think

The Reality Behind the National Debt Relief Lawsuit Rumors

If you’re looking for a "gotcha" moment where the company was wiped off the map, you won’t find it. National Debt Relief is still operating. However, "legitimate" and "risk-free" are two very different things.

What’s actually happening?

The most recent heat comes from investigations into violations of the Credit Repair Organizations Act (CROA). High-profile legal investigations, including those highlighted by groups like Top Class Actions in late 2025, have targeted the way these companies talk to you. Basically, if a company promises to "fix" your credit or charges you before they’ve actually done anything, they might be breaking federal law.

In April 2025, the Consumer Financial Protection Bureau (CFPB) even made waves by dismissing a long-standing case against the National Collegiate Student Loan Trusts. You might think that's a win for the big guys, but it actually signaled a shift in how debt lawsuits are handled under the current administration.

Why People are Suing

It usually boils down to three things:

- Deceptive Marketing: Being told your credit won't be ruined (it will).

- Upfront Fees: Charging you before a single debt is settled.

- The "Lawsuit" Surprise: Finding out your creditors can still sue you even while you're in the program.

I heard about a guy in Ohio—let’s call him Jim—who enrolled $30,000 in debt. He stopped paying his cards because the program told him to. Six months later, he wasn't "debt-free." He was being sued by Discover. His wages were garnished. National Debt Relief didn't "defend" him in court because they aren't a law firm. That’s where the lawsuits against them usually start.

What Most People Miss About the "Settlement"

Debt settlement is a gamble.

You are essentially beting that your creditors will get so tired of not being paid that they’ll take a fraction of the money. But here’s the kicker: many big banks like Chase or Amex sometimes refuse to work with settlement companies altogether.

So, you’re sitting there, putting money into a "dedicated account," while your original debt is growing. Why? Because interest and late fees don't stop just because you signed a contract with a third party. If the settlement company fails to reach a deal, you end up with more debt than you started with, plus a trashed credit score.

The Hidden Costs of National Debt Relief

It isn't free. They usually charge 15% to 25% of the total debt you enroll.

Think about that.

If you enroll $40,000, you might pay $10,000 in fees alone. That’s on top of whatever you pay to settle the debt. Sometimes, after the fees and the taxes (yes, forgiven debt is often taxed as income by the IRS), you’ve only saved a tiny sliver of money.

Is There a Class Action You Can Join?

Right now, in early 2026, there are several active investigations into "credit repair" and "debt settlement" practices. Firms like Atlas Consumer Law have been looking for people who were charged illegal upfront fees.

If you feel like you were misled, you don't just wait for a check in the mail. You have to be proactive.

- Check your contracts: Did they charge you before settling a debt? Under the Telemarketing Sales Rule, that’s a massive no-no.

- Look for "Guarantees": Did they promise your credit score wouldn't drop? That’s a red flag that could be used in a legal claim.

- Document the "Served" papers: If you were sued by a creditor while in the program, and the debt relief company told you they'd "handle it," keep those records.

Better Ways to Handle the Debt

Look, I get it. Bankruptcy sounds scary. It’s a "dirty" word in our culture. But honestly? Bankruptcy offers federal legal protections that debt settlement simply cannot.

When you file for Chapter 7, an "automatic stay" kicks in. That means creditors must stop calling. They must stop suing. In debt settlement, the creditors can do whatever they want until a deal is signed.

If you aren't ready for the "B-word," consider a Non-Profit Credit Counselor. These are different. They work with your creditors to lower interest rates through a Debt Management Plan (DMP). Your credit stays mostly intact, and you aren't gambling on whether or not a settlement will happen.

Actionable Steps for You Right Now

If you're already in a program and feeling uneasy, don't panic. But don't stay on autopilot either.

Audit your dedicated account. See exactly how much has gone to "fees" versus "settlements." If the fee column is higher than the settlement column after a year, you’re in trouble.

Call your creditors directly. Ask them if they even work with the company you hired. You might be surprised to find they’ve flagged that company and won’t even pick up the phone for them.

Consult a consumer rights attorney. Many offer free consultations to see if you have a path for a national debt relief lawsuit of your own. If you’ve been charged upfront fees, you might be able to get that money back.

Stop the bleeding. If you’re being sued by a creditor, a debt settlement company cannot represent you in court. You need a lawyer, or you need to file an answer with the court yourself to avoid a default judgment.

The most important thing to remember is that you have more power than these companies want you to think. You don't have to be a victim of a system that promises a "fresh start" but delivers a legal nightmare. Check your statements, know your rights, and don't be afraid to walk away from a deal that isn't working.