You're staring at your phone, scrolling through the App Store or Google Play, typing "Nelnet" for the fifth time. You see something called "Nelnet Bank," but the reviews are a total train wreck. People are screaming in the comments about how they can't log in or how it doesn't show their federal loans. Honestly, it’s a mess.

If you’re looking for the nelnet student loan app to manage your federal debt, here is the cold, hard truth for 2026: it basically doesn't exist anymore.

Nelnet actually pulled their official federal student loan management app from the stores a while back. While they used to have a functional tool called "Loan Assist" years ago, the company shifted gears. Now, if you have federal loans serviced by Nelnet (those account numbers starting with the letter E), you’re stuck using a mobile browser. It's frustrating, I know.

The Great App Disappearance

Why would a massive company like Nelnet kill its app? Most people think it's a glitch or that they just have the wrong search term. Nope. It was a deliberate move. Nelnet transitioned their federal servicing to a specific web portal: nelnet.studentaid.gov.

They want you on the website.

The "Nelnet Bank" app you do see in the app store is a completely different beast. That app is specifically for private personal loans or home improvement loans issued by Nelnet Bank. If you try to jam your federal student loan credentials into that app, it’ll spit out an error message faster than you can say "tuition hike."

👉 See also: Reform and Opening Up: What Most People Get Wrong About China's Economic Shift

How to Manage Your Loans on Your Phone Without an App

Since there is no dedicated nelnet student loan app for federal borrowers, you have to get a little creative to make your life easier. You don't want to type that long URL every time you need to check if your interest is ballooning.

- Open your mobile browser (Safari or Chrome).

- Go to nelnet.studentaid.gov.

- Tap the "Share" icon on iPhone or the three dots on Android.

- Select "Add to Home Screen."

Boom. You now have a "fake" app icon on your phone that takes you directly to the login page. It’s not a native app, but it saves you the headache of searching for it every month.

Why the Web Portal is Actually Better (Kinda)

Look, I hate mobile websites as much as the next person. They feel clunky. But in Nelnet’s case, the website is the only place where the data is actually 100% accurate.

Apps often struggle to sync with the Department of Education’s massive, ancient database in real-time. By forcing everyone onto the web portal, Nelnet ensures you’re seeing the exact same numbers the government sees. This is crucial for things like:

- Income-Driven Repayment (IDR) Recertification: Doing this in an app is a nightmare. The web portal handles the document uploads much more reliably.

- PSLF Tracking: If you're aiming for Public Service Loan Forgiveness, you need to see your payment counts. The website is where that data lives.

- Applying for Forbearance: If life hits you hard and you need to pause payments, the "Temporary Hardship" forms are built for the web, not a tiny app interface.

What About Sloan Servicing?

Here is a curveball for you. Some people who think they are with Nelnet are actually with Sloan Servicing. If your account starts with a D or a J, you’ve been moved.

Sloan is basically Nelnet’s sibling for commercially held FFELP loans. They also don’t have a great app. If you’re in this camp, you’ll be heading to SloanServicing.com instead. It’s confusing, sort of like having two different keys for the same house, but it’s how the government split the debt.

Common Myths About the Nelnet App

You’ll see a lot of misinformation online. Some "tech" blogs still list the Nelnet app as a top download. They are wrong. They’re likely using outdated info from 2020 or earlier.

📖 Related: United States Dollar to Zambian Kwacha: Why the Rate is Moving So Fast Right Now

Myth 1: You can pay by text.

Technically, you can get text alerts, but you still have to jump to the web to authorize the cash movement unless you have Auto Debit set up.

Myth 2: The app was hacked.

No, it wasn't pulled because of a security breach. It was pulled because maintaining a native app that meets Department of Education security standards is incredibly expensive and difficult. They took the "easy" way out by sticking to a responsive website.

Making Payments Without the Headache

Since you can't just tap a button in an app, the smartest move is to set up Auto Debit.

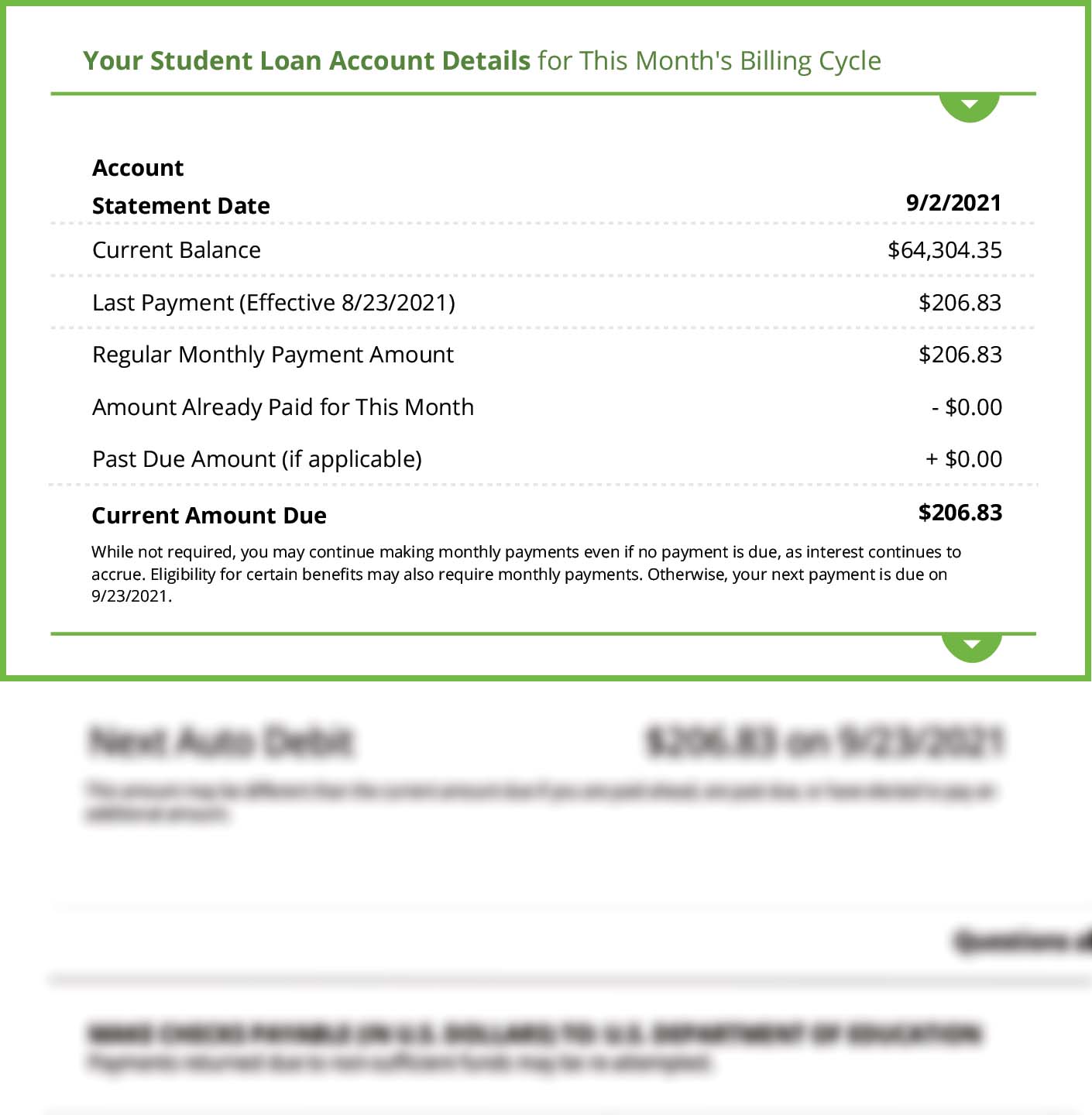

Nelnet (and most federal servicers) gives you a 0.25% interest rate deduction just for letting them take the money automatically. On a $30,000 loan, that's not exactly "retire on a beach" money, but it's better in your pocket than theirs.

You set this up on the website. Once it’s running, you can basically ignore the fact that there isn't an app. Just keep an eye on your emails to make sure the payment actually cleared.

Actionable Next Steps

Stop hunting for a download link that isn't coming back. Here is exactly what you should do right now to manage your Nelnet account effectively:

- Audit your login: Go to nelnet.studentaid.gov and make sure your 2-factor authentication (2FA) is linked to a phone number you actually still use.

- Create the shortcut: Use the "Add to Home Screen" trick mentioned above so you have one-tap access.

- Check your "Group" letters: Nelnet breaks loans into groups (Group A, Group B, etc.). If you want to pay off a high-interest loan early, you have to use the "Pay by Group" feature on the website. You can't do this through simple bill-pay from your bank.

- Download your statements: Since there's no app to store your history locally, download your last three months of statements as PDFs and save them to a Google Drive or iCloud folder. If Nelnet ever loses your records (it happens), you’ll want that proof.

Managing student debt is already a full-time job. Don't waste more time searching for an app that doesn't want to be found. Stick to the web portal, grab that 0.25% discount, and keep your records organized.