Money is weird. One day you feel like you’re absolutely crushing it because your checking account has a comma in it, and the next, you realize your car is worth less than a used mountain bike and your student loans are basically a sentient being living in your basement. Honestly, tracking your financial progress is the only way to stop that low-grade anxiety that kicks in every time you swipe your card. Most people go looking for a net worth excel template because they want a magic pill. They want a spreadsheet that solves the "where is my money going" mystery instantly.

But here is the thing.

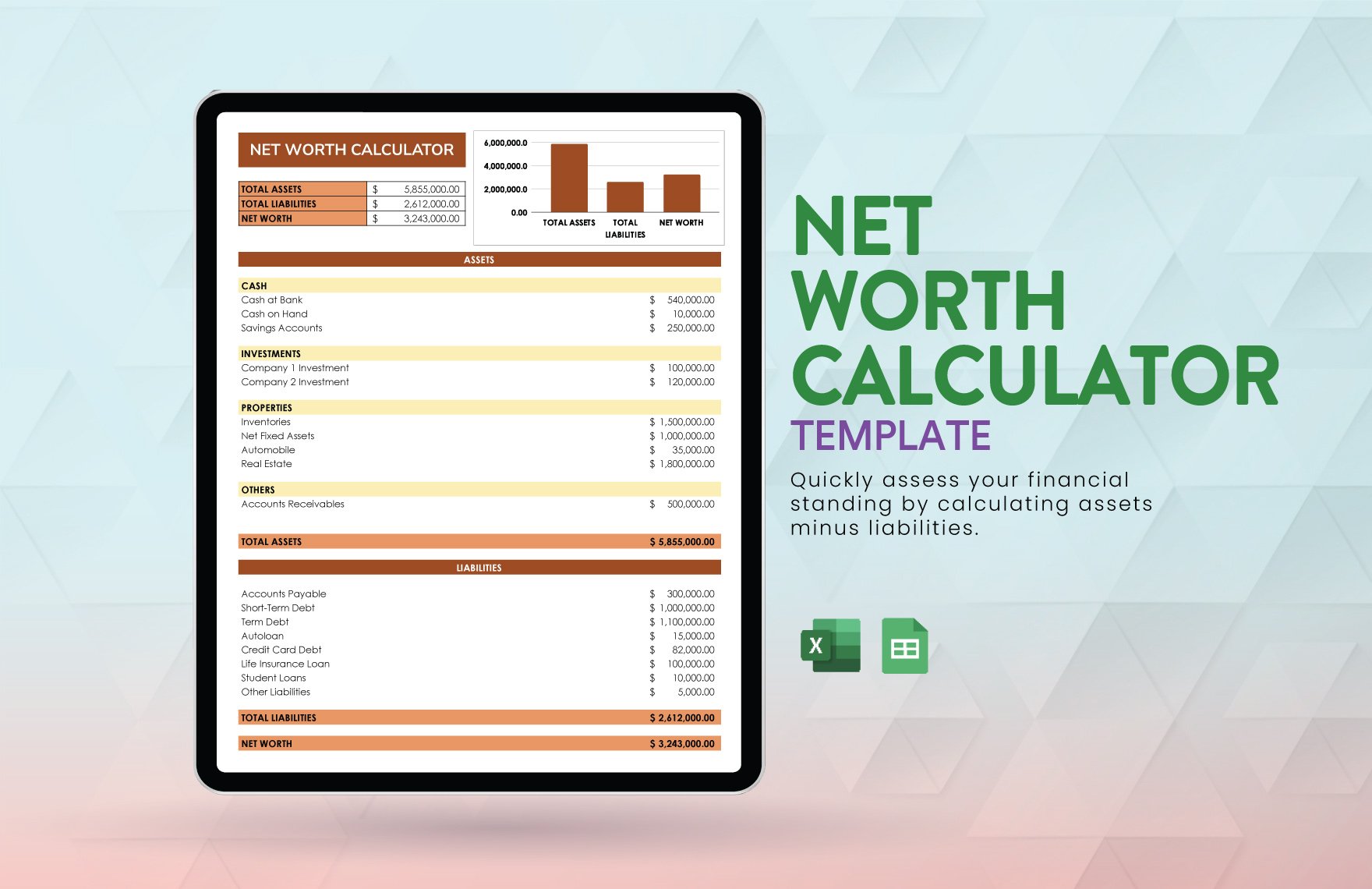

Most templates you find online are either too simple to be useful or so bloated with macros that they crash Excel the moment you try to add a line for your Robinhood account. You don't need a 50-tab masterpiece. You need a clear, cold look at what you own versus what you owe. That is it. That is the whole game.

The Math is Simple, the Psychology is Hard

Net worth is just assets minus liabilities. If you own a house worth $400,000 and you owe $300,000 on the mortgage, your net worth isn't $400,000. It’s $100,000. Simple, right? Yet, when people sit down to fill out a net worth excel template, they start bargaining with themselves. They’ll list their 2018 MacBook Pro as an asset worth $1,000.

Newsflash: It’s not.

If you can’t sell it for that price on Facebook Marketplace within 48 hours, it’s not an asset for net worth purposes; it’s just stuff. True net worth tracking is about liquidity and long-term solvency. We’re talking about cash, brokerage accounts, retirement funds (like your 401k or IRA), and real estate equity. On the flip side, we’re looking at credit card debt, student loans, car notes, and that personal loan you took from your uncle and haven't mentioned in three years.

Why Excel Beats Apps Every Single Time

I know, I know. Mint is dead, and everyone moved to Empower (formerly Personal Capital) or Monarch Money. Those apps are great for convenience because they sync your data automatically. But there’s a massive downside to automation: you stop paying attention. When the data just flows in, you glance at the graph, see it’s "upish," and go back to scrolling TikTok.

When you manually type numbers into a net worth excel template, you feel the weight of them. Typing out a $12,450 credit card balance hits differently than seeing a little red bar on a screen. It forces a level of radical honesty that an algorithm can’t provide. You see the trend lines. You notice that your "miscellaneous" spending is actually a $600-a-month habit. Plus, Excel doesn't care if a bank's API breaks. Your data is yours. It’s private. No one is selling your spending habits to advertisers when you’re using a local .xlsx file.

Building the Framework of Your Spreadsheet

You don't need to be a VBA wizard to make this work. In fact, the more "manual" the better. Start with the date in Column A. Then, create a section for Cash and Cash Equivalents. This is your "sleep well at night" money. High-yield savings accounts, checking, and maybe the physical cash you keep in a shoebox for emergencies.

Next up: Investments. This is where most of your growth happens. You’ll want separate rows for your 401(k), Roth IRA, and any taxable brokerage accounts. If you’re into crypto, give it a row, but maybe don’t count on it for your retirement baseline. High volatility assets can mess with your head if you check your net worth too often.

Then come the big ones—the Fixed Assets. Your home value (use a conservative estimate from Zillow or Redfin, then knock 5% off for realism) and any other real estate.

The Liabilities Section (The Part Everyone Hates)

Now we flip the script. List everything you owe. Start with high-interest debt because that’s the fire you need to put out first. Credit cards are the priority. Then the auto loan. Then the student loans. Finally, the mortgage.

When you subtract the total of the second group from the first, you get that one number. The number. It might be negative. If it is, don't panic. A negative net worth in your 20s or even 30s is incredibly common, especially with the current state of education costs. The goal of using a net worth excel template isn't to feel good today; it's to make sure that number is moving in the right direction over time.

Common Mistakes in Net Worth Tracking

People love to "pad" their numbers. They’ll include the "estimated" value of their jewelry or their collection of vintage sneakers. Unless you are a professional dealer, leave the lifestyle assets out. Your net worth should represent your financial freedom, and you can’t pay for groceries with a pair of Jordans very easily.

Another trap? Not accounting for taxes. If you have $100,000 in a traditional 401(k), that isn't $100,000 of spending power. When you eventually withdraw it, Uncle Sam is going to take his cut. Some hardcore spreadsheet nerds like to apply a "tax haircut" to their pre-tax retirement accounts—basically multiplying the balance by 0.75 or 0.80—to get a more "real" number. It’s depressing, but it’s accurate.

Frequency Matters

Don't do this every day. You'll go insane. The stock market wiggles. Your net worth will drop on a Tuesday because the S&P 500 had a bad morning, and you’ll feel like a failure. Once a month is the sweet spot. It's frequent enough to catch trends but infrequent enough to ignore the daily noise of the economy.

Set a "Money Date." Grab a coffee, sit down on the first Sunday of the month, and update the cells. This 15-minute habit is worth more than any "hot tip" on a meme stock. It turns your finances from a scary monster in the closet into a project you’re managing.

How to Actually Use This Data to Change Your Life

A net worth excel template is just a mirror. It shows you what you look like financially. If you don't like what you see, the template won't fix it—your behavior will.

If your net worth is stagnant, you have two levers:

💡 You might also like: White People Braids Men: What You Actually Need to Know About the Style and the Controversy

- Increase the Gap: Earn more or spend less to put more into assets.

- Kill the Dragons: Aggressively pay down the liabilities that carry high interest rates.

Seeing the "Total Liabilities" number go down is just as satisfying as seeing the "Total Assets" number go up. In fact, for many, it's the psychological win they need to stay motivated.

Customizing for Your Specific Goals

Maybe you’re aiming for FIRE (Financial Independence, Retire Early). In that case, your spreadsheet should probably include a "Safe Withdrawal Rate" calculation. Take your total invested assets and multiply by 0.04. That’s roughly what you could live on per year. If that number is $12,000 and you need $60,000 to live, you know exactly how far you have to go. No guessing. No "vibes." Just math.

Actionable Steps for Your Financial Tracking:

- Create your skeleton: Open a blank Excel sheet and create four headers: Date, Total Assets, Total Liabilities, and Net Worth.

- Gather the "Cold Hard Truth": Log into every account you own. Yes, even the one with the password you forgot three years ago. Use a password manager like Bitwarden or 1Password to keep track of these for next month.

- Input your first data point: Don't worry about the formatting yet. Just get the numbers in.

- Set a conservative house value: If you own a home, find the lowest reputable estimate and use that. It’s better to be surprised by extra money later than to count on money that isn't there.

- Schedule a recurring calendar event: "Net Worth Update" for the 1st of every month.

- Ignore the "Stuff": Remove your car, your furniture, and your electronics from the asset list. If it depreciates, it’s not part of your net worth foundation.

- Analyze the trend: After three months, look at the "Net Worth" column. If it’s not going up, look at your "Total Liabilities" and "Total Assets" separately to see where the leak is.