The IRS just fundamentally changed how your paycheck looks. Honestly, most people miss the annual inflation adjustments until they're staring at a tax form in April, wondering where their refund went. But this year is different.

The Internal Revenue Service (IRS) officially released the new IRS tax brackets for the 2025 and 2026 tax years. Because of the "One, Big, Beautiful Bill" (OBBBA) and standard cost-of-living shifts, the numbers have moved significantly.

Basically, the IRS shifts these "buckets" of income to prevent "bracket creep." That’s a fancy way of saying they don't want you paying higher tax rates just because your boss gave you a small raise to keep up with the price of eggs. If the brackets didn't move, inflation would effectively be a secret tax hike.

🔗 Read more: Talladega Daily Home Newspaper Obituaries: What Most People Get Wrong

The 2025 Breakdown: Taxes Due in 2026

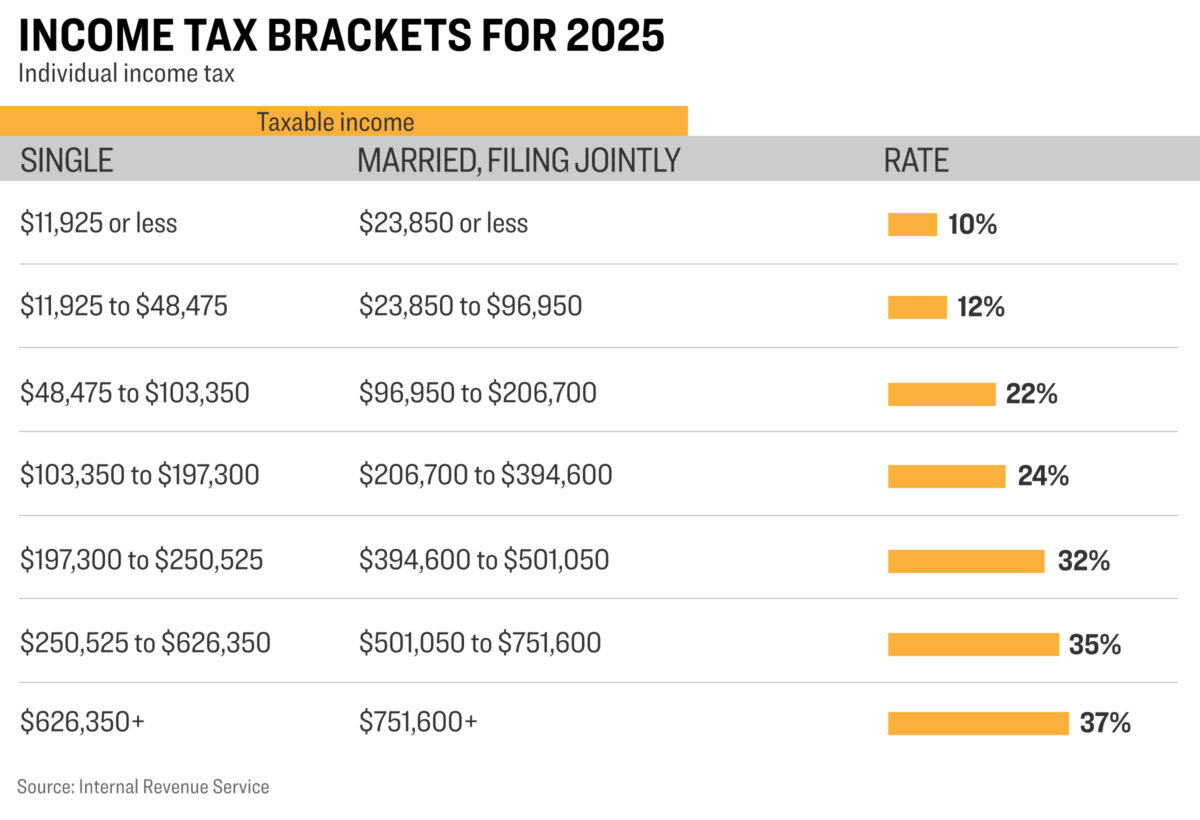

For the 2025 tax year—the one we are currently in—the brackets have widened by about 2.8 percent. This is good news. It means you can earn more money before hitting a higher tax percentage.

If you are a single filer, the 10% bracket now covers everything from $0 up to **$11,925**. Once you cross that line, you don't pay 12% on everything. You only pay 12% on the dollars above that amount.

Here is how those layers look for a single person in 2025:

📖 Related: Power Outage San Mateo: Why Your Lights Keep Going Out and How to Actually Handle It

- 10%: $0 to $11,925

- 12%: $11,926 to $48,475

- 22%: $48,476 to $103,350

- 24%: $103,351 to $197,300

- 32%: $197,301 to $250,525

- 35%: $250,526 to $626,350

- 37%: $626,351 or more

Married couples filing jointly get double the space in most of these buckets. For instance, that 10% rate for couples now goes all the way up to $23,850. The 22% bracket for married folks starts at $96,951 and tops out at $206,700.

Why the Standard Deduction Matters More Now

Most Americans don't itemize. They take the standard deduction. For 2025, that amount jumped to $15,750 for singles and $31,500 for married couples.

Think of this as "free" income. You don't pay a cent of federal tax on these first few thousand dollars. If you're a married couple earning $100,000, you effectively only pay tax on $68,500 after the standard deduction.

The 2026 Shift: A Glimpse Forward

Looking ahead to 2026, the IRS has already projected further increases. The top 37% tax rate will eventually hit single filers at $640,600 and married couples at $768,700.

The OBBBA legislation made several parts of the old Tax Cuts and Jobs Act (TCJA) permanent but added a few twists. For example, there's a new 4 percent inflation adjustment specifically for the bottom two brackets. Washington is trying to give a little extra breathing room to lower and middle-income earners.

Surprising Changes You Probably Missed

There is a brand-new Senior Deduction. If you're 65 or older, you can snag an extra $6,000 deduction on top of the standard one. However, it phases out. If you're single and make over $75,000, that benefit starts to shrink.

And for the workers? Overtime is finally getting a break. Under the new rules, you might be able to deduct up to $12,500 of qualified overtime pay. That’s huge. It means the "time-and-a-half" portion of your extra hours could be tax-free, provided you fall under the income limits (usually $150,000 for singles).

Capital Gains and the "Hidden" Taxes

It isn't just about your salary. If you sell stocks or a house, the new IRS tax brackets for capital gains apply.

In 2025, you pay 0% on long-term capital gains if your taxable income is below $48,350 (single) or $96,700 (married). Many retirees use this to pull money from brokerage accounts without paying any tax at all.

Once you go over those amounts, the rate jumps to 15%. If you're a high-flyer making over $533,400 as a single person, you’re looking at a 20% hit.

Actionable Steps for Your Money

- Adjust Your Withholding: If your 2025 tax bracket has shifted, you might be overpaying the government every month. Check the IRS Tax Withholding Estimator.

- Max Your 401(k): For 2025, the limit is $23,500. This reduces your taxable income directly. If you're in the 22% bracket, putting $10,000 in your 401(k) saves you $2,200 in taxes.

- Track Your Overtime: If you're an hourly worker, keep meticulous records of your overtime hours. The new deduction is powerful but requires proof.

- Look at the SALT Cap: The State and Local Tax (SALT) deduction cap was bumped to $40,000. If you live in a high-tax state like California or New York, itemizing might finally be worth it again.

Tax season is never fun, but knowing where the lines are drawn helps you keep more of what you earn. The 2025 and 2026 updates are some of the most complex we've seen in a decade, so double-check your income against these new thresholds before you make any big financial moves this year.