If you've been following the news lately, you probably heard that the massive tax changes from a few years ago were supposed to "sunset" or disappear. Well, things just got a whole lot more interesting. On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) was signed into law, and it basically rewrote the script for what we were all expecting.

Honestly, the "tax cliff" everyone was panicking about? It didn't happen.

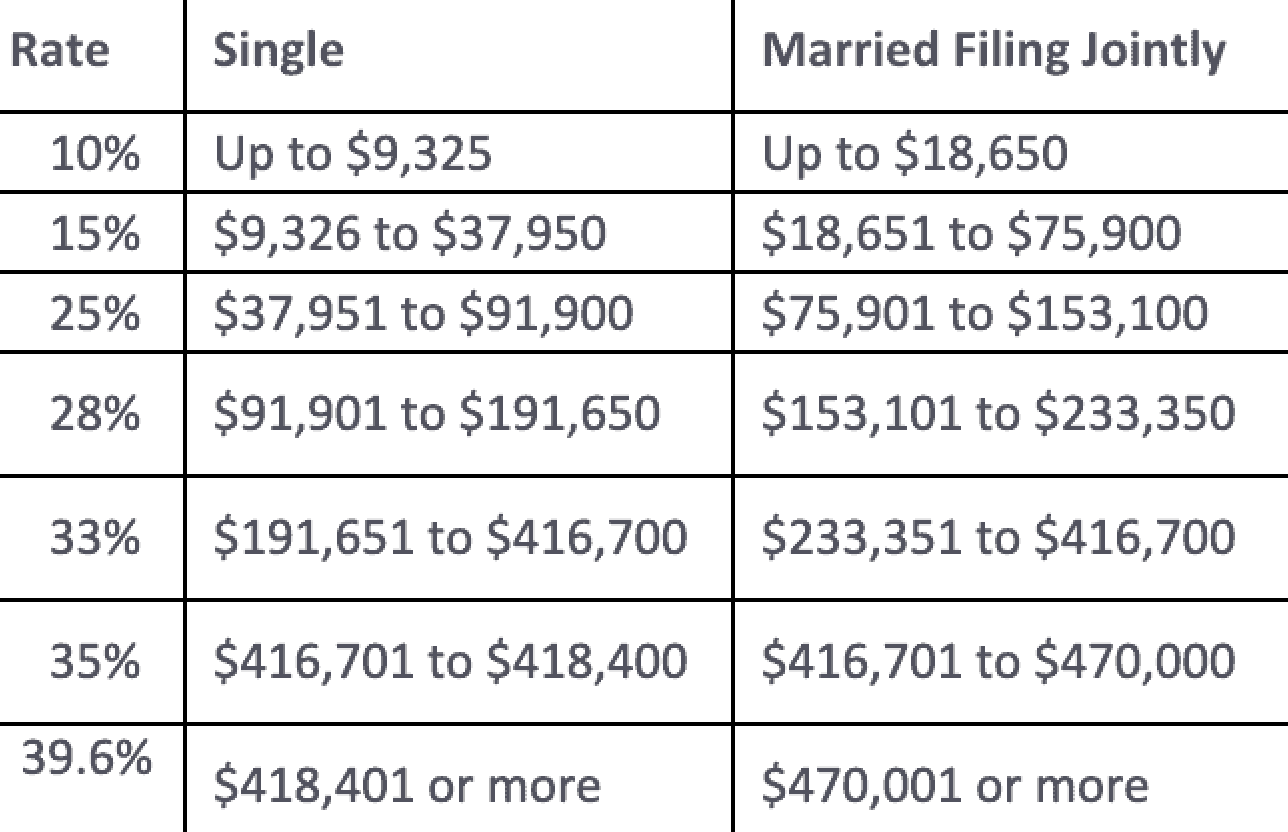

Instead of jumping back to the old, higher rates from a decade ago, the new tax brackets 2026 have mostly kept the current structure. But "mostly" is a heavy word in the tax world. There are some sneaky adjustments for inflation and some big wins for the standard deduction that you’re going to want to see before you plan your 2026 spending.

What’s Actually Happening with New Tax Brackets 2026?

Basically, the OBBBA made the tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) permanent. That’s the big news. If you were worried the top rate would spike back up to 39.6%, breathe. It’s staying at 37%.

🔗 Read more: 55 Euros in Pounds: Why the Number You See Online Isn’t What You’ll Actually Get

The IRS recently dropped the official numbers for the new tax brackets 2026, and they’ve adjusted everything for inflation by about 2.7% on average. But there’s a twist. To help out lower-income earners, the bottom two brackets actually got a 4% inflation boost, while the higher ones only went up by 2.3%.

If you’re filing as a Single Filer in 2026, here is how the math shakes out:

The 10% rate applies to your first $12,400. Once you pass that, you’re in the 12% bracket up to $50,400. From there, it jumps to 22% for income up to $105,700, and then 24% until you hit $201,775. The 32% bracket covers you up to $256,225, followed by 35% up to $640,600. Anything over $640,601 is taxed at the top 37% rate.

For Married Couples Filing Jointly, the numbers are double for the lower rungs:

You’ll pay 10% on the first $24,800 and 12% on income up to $100,800. The 22% bracket goes to $211,400, and the 24% bracket hits its limit at $403,550. Above that, you're looking at 32% up to $512,450, 35% up to $768,700, and that 37% cap kicks in at $768,701.

The Standard Deduction Got a Massive Boost

This is where the OBBBA actually made things better than they were before. Most people take the standard deduction instead of itemizing. For 2026, a single person gets a $16,100 standard deduction. If you’re married filing jointly, that number is a whopping $32,200.

If you’re 65 or older, there’s an extra "Senior Deduction" of $6,000 available through 2028, though it starts phasing out if your income is over $75,000 (single) or $150,000 (joint). It’s a nice little cushion for retirees.

The Child Tax Credit and Families

Parents, listen up. The Child Tax Credit (CTC) was one of the biggest points of drama in the new law.

The maximum credit for 2026 is now $2,200 per qualifying child.

The best part? It’s finally indexed for inflation, so it won’t just sit at a flat number while the price of eggs goes up. However, the refundable portion—the part you get back even if you don't owe taxes—is still capped at $1,700 for most families.

There's also a new "Other Dependent Tax Credit" of $500 for kids who are 17 or 18, or college students up to age 24. It’s not a life-changing amount, but it helps when you’re staring at a tuition bill.

SALT Caps: The $10,000 Limit is Dead (For Now)

If you live in a high-tax state like New York or California, you’ve probably spent the last few years grumbling about the $10,000 limit on State and Local Tax (SALT) deductions.

The new law actually raised this cap significantly. For the tax years 2025 through 2029, the SALT deduction limit is now $40,000.

🔗 Read more: Andrew Berlin Net Worth: Why the Packaging Giant and Cubs Owner Is Worth More Than You Think

But—and there is always a "but" with the IRS—this starts phasing out once your adjusted gross income (AGI) hits $250,000 for singles or $500,000 for couples. If you make $600,000 as a couple, you’re back to getting zero SALT deduction. It’s a classic "middle-class-ish" benefit that disappears as you climb the ladder.

Capital Gains and Your Investments

Investors didn't get left out of the 2026 shuffle. The thresholds for long-term capital gains (assets you’ve held for more than a year) moved up with inflation too.

- 0% Rate: You pay nothing on gains if your taxable income is below $49,450 (single) or $98,900 (married).

- 15% Rate: This is the sweet spot for most. It covers income up to $545,500 for singles and $613,700 for couples.

- 20% Rate: If you’re doing better than those numbers, the 20% rate applies.

Don't forget the Net Investment Income Tax (NIIT). If your income is over $200k (single) or $250k (joint), you still have to tack on an extra 3.8% tax on your investment income. That hasn't changed.

Practical Steps to Take Now

Don't just wait for tax season 2027 to deal with this.

✨ Don't miss: Wait, How Long Is 3-5 Business Days From Today Really?

- Adjust your withholdings. With the standard deduction and brackets shifting, you might be overpaying (or underpaying) throughout the year. Use the IRS withholding estimator in early January.

- Review your SALT strategy. If you previously stopped itemizing because of the $10k cap, $40k might change the math for you. Start keeping better records of your property taxes and state income tax.

- Max out your HSA. The OBBBA added new rules for Direct Primary Care arrangements. Starting in 2026, you can use HSA funds for those monthly fees tax-free.

- Check your "Senior Deduction" eligibility. If you or your spouse are turning 65, that $6,000 extra deduction is a huge win—make sure your tax software or CPA knows about it.

- Charitable "Bunching" is still a thing. Since the standard deduction is so high ($32,200 for couples!), it’s still hard to "beat" it with itemized deductions. You might want to give two or three years' worth of donations in a single year to a Donor-Advised Fund (DAF) to get over that threshold.

The new tax brackets 2026 aren't the scary monster people thought they would be. In fact, for a lot of people, the permanent 37% top rate and the boosted standard deduction mean a slightly lighter tax bill. Just keep an eye on those phase-out limits, because that's where the IRS usually hides the sting.