Draft day is pure chaos. You've got general managers sweating through expensive suits, phones ringing off the hook, and a ticking clock that makes everyone a little bit crazy. In the middle of that madness, there is usually a single sheet of paper—or a digital spreadsheet—that dictates the future of a multi-billion dollar franchise. People call it the Jimmy Johnson chart. Or a draft value board. Basically, it's an NFL draft trade chart calculator, and while it looks like a simple math problem, it’s actually a high-stakes psychological game.

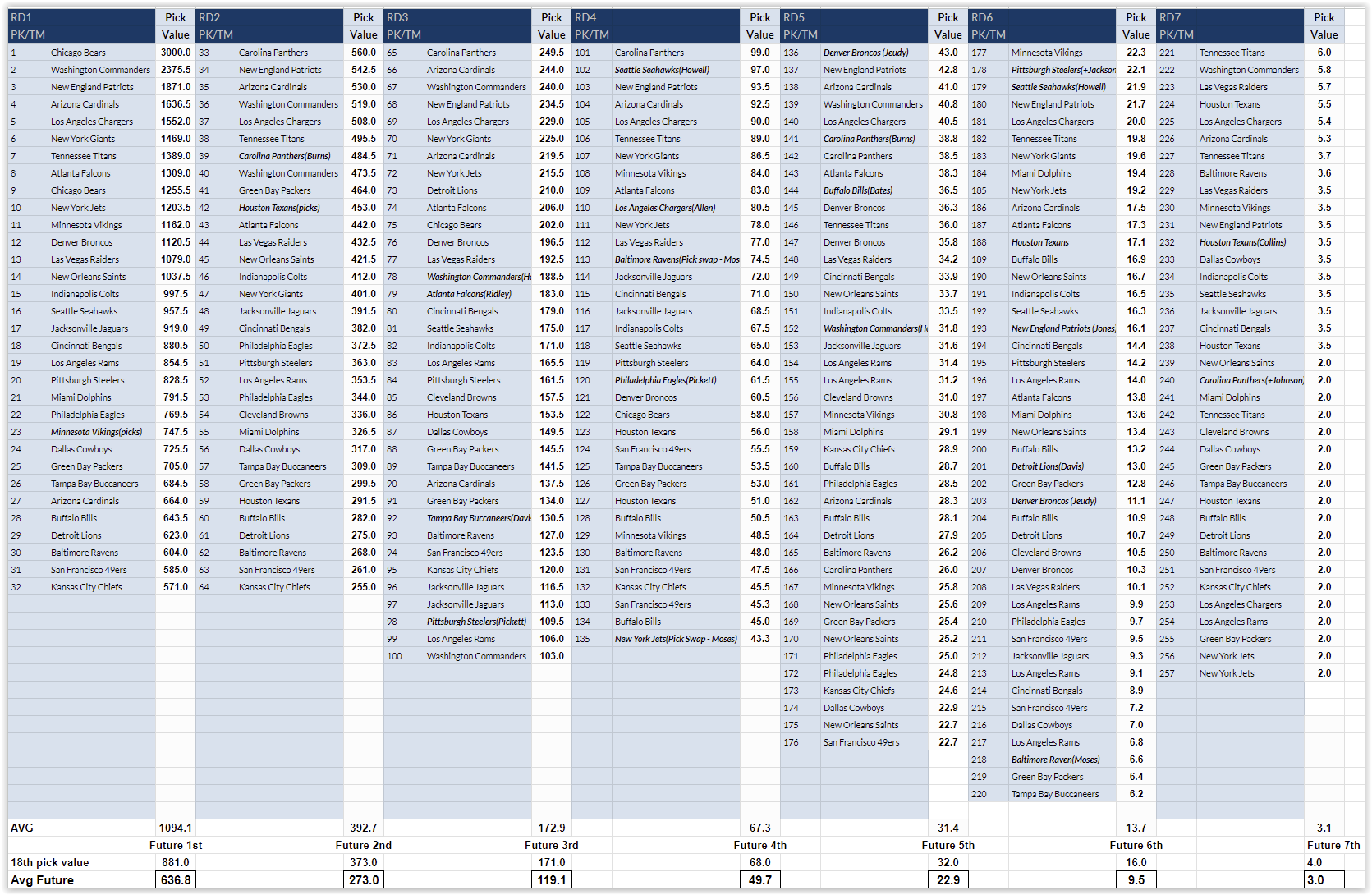

Jimmy Johnson, the legendary Cowboys coach, didn’t invent the idea of value, but he was the first to put a specific number on every single pick. He assigned 3,000 points to the first overall selection. The last pick in the seventh round? That was worth maybe one or two. The goal was simple: if you want to trade up, you better give me enough picks to equal the points I'm losing. It worked. Dallas built a dynasty on it.

But here is the thing. The league has changed.

If you try to use that original 1990s chart today, you’re gonna get fleeced. Modern analytics guys like Kevin Meers and the researchers at Over The Cap have realized that the old chart drastically overvalues top-five picks and undervalues the middle rounds. Why? Because the "bust rate" for a top-ten pick is way higher than we like to admit. You might spend 3,000 points on a quarterback who’s out of the league in three years, while the guy who traded down got three starters for the same "price."

How an NFL Draft Trade Chart Calculator Actually Works

Most fans think these calculators are set in stone. They aren't. Every team has their own proprietary version, but they all start with a baseline. You take the pick you want (let's say it's Pick 10) and you look at its assigned point value. Then you look at the picks you're willing to give up (maybe Pick 20 and a second-rounder). If the math adds up to a "profit" for the team moving down, a deal usually happens.

It's sorta like trading Pokémon cards, but with millions of dollars and your job on the line.

The Rich Hill model is the one a lot of "Draft Twitter" folks use now. It’s more realistic for the modern NFL. It acknowledges that the gap between the 1st pick and the 10th pick isn't as massive as Jimmy Johnson thought. In the Hill model, value is a curve, not a cliff.

Wait. There is a catch.

The "Quarterback Tax" breaks every calculator ever made. If a team is desperate for a signal-caller, they will happily "overpay" by 500 points just to get their guy. In 2021, the 49ers traded three first-round picks to move up for Trey Lance. On any standard NFL draft trade chart calculator, that was a massive overpay. They didn't care. When you're hunting for a franchise QB, the math goes out the window.

The Variance in Point Systems

- The Classic (Johnson) Chart: Very top-heavy. Assumes the #1 pick is a god-tier asset.

- The Fitzgerald-Spielberger Chart: Focuses on "Expected Value" and salary cap implications. It argues that more picks are almost always better than higher picks.

- The Harvard Model: Developed by researchers like Cade Massey and Richard Thaler. They found that NFL teams are consistently overconfident in their ability to scout. Their "calculator" suggests that trading down is the only winning move over a long enough timeline.

Honestly, it’s a bit of a mess. You’ve got old-school scouts who trust their gut and "Ivy League" GMs who won't move an inch unless the spreadsheet says yes. Most successful teams, like the Ravens or the Chiefs, tend to land somewhere in the middle. They use the calculator as a guardrail, not a god.

Why Your Favorite Team Just Got Robbed

You’ve seen it. Your team trades a second and a fourth to move up six spots in the third round. You pull up a draft calculator and realize they lost the trade by 40 points. You're furious. You're tweeting at the GM.

But you're missing the context of the "Draft Tier."

GMs don't just see a list of players from 1 to 250. They see tiers. Maybe there are 15 players they consider "Blue Chip" talents. If they are sitting at Pick 18 and only one of those 15 guys is left, they will pay a premium to jump up to Pick 14. To the calculator, it’s a loss. To the team, it’s the difference between a Pro Bowler and a guy who might not make the roster.

Also, the "Future Pick Discount" is real. If I trade you a first-round pick next year for a second-round pick this year, how do we calculate that? Most GMs treat a future pick as one round lower than its actual value. A 2027 first-rounder is basically a 2026 second-rounder in the eyes of a guy who needs to win games now to keep his job.

The Psychological Element of the Clock

Time is the one variable no NFL draft trade chart calculator can account for. When a team is "on the clock," the value of that pick is at its absolute peak.

🔗 Read more: ESPN Basketball Announcers Tonight: Who Is Calling the Cavs vs. Sixers and Nuggets vs. Mavs?

Panic sets in.

If a team's top-rated player is falling, they get aggressive. We saw this with the Eagles moving up for Jordan Davis or DeVonta Smith. They knew the "math" was slightly against them, but they also knew the teams behind them were making calls. Sometimes you pay the "convenience fee" just to ensure no one else steals your player.

It's also worth noting that compensatory picks have changed the game. Since 2017, these picks can be traded. This added a whole new layer of "loose change" to the calculator. Teams like the Rams use these late-round "lottery tickets" to grease the wheels on larger trades. It’s basically the equivalent of adding a candy bar to a grocery order to hit a free shipping minimum.

Modern Trends: The Death of the "Standard" Chart?

We are moving toward a more nuanced era. Teams now look at "Surplus Value." This means they calculate the difference between what a player will cost on a rookie contract versus what they would cost on the open market.

Take a Wide Receiver. A top-ten WR on a rookie deal is incredibly cheap compared to the $30 million per year vets are getting now. This makes a top-ten pick "worth" more in a calculator that accounts for the salary cap than one that only looks at on-field performance.

Conversely, a Running Back at Pick 10 has almost zero surplus value because you're already paying him near-top-of-market money. That’s why you see RBs slide. The math—specifically the financial math—says it’s a bad investment.

Actionable Insights for Draft Day

If you want to track the draft like a pro, stop using just one chart. Follow these steps to see who is actually winning the weekend.

Compare the models. Use a site that shows you both the Jimmy Johnson (traditional) and the Rich Hill (modern) values. If a trade is a "win" on both, that GM killed it. If it’s a win on Johnson but a loss on Hill, the team is likely overvaluing a single "star" prospect.

Watch the "Blue Chip" drop. Identify the top 10-12 consensus players. Once they are gone, the value of picks usually plummets. If a team trades into the top 10 after the big names are off the board, they’re likely reaching.

Factor in the QB tax. If a trade involves a quarterback, add a 20-30% "premium" to the cost. It’s not "fair" value, but it is the market rate. Don't call it a bad trade just because the points don't align; the position is simply too valuable for standard math.

Track future assets. Look at which teams are accumulating picks for the following year. Teams in a "rebuild" phase should always be "winning" the calculator by trading down and collecting future capital. If a bad team is trading up, they are likely making a desperate move to save a coaching staff.

The draft isn't a science. It's an auction held in a windstorm. The NFL draft trade chart calculator is just a map—but as any hiker will tell you, the map isn't the territory. Sometimes you have to go off-road to find the guy who's going to win you a Super Bowl.