If you’ve been watching the nhpc ltd share price lately, you’ve probably noticed it’s doing that annoying thing where it teases a breakout but then just... sits there. Honestly, it’s enough to make any retail investor want to pull their hair out. As of January 16, 2026, the stock is hovering around the ₹80.13 mark.

It’s down a bit from its recent intraday highs. But here’s the thing: most people are looking at the daily squiggles on the chart instead of the massive hydropower engines humming in the background.

The 2026 Reality Check: What's Actually Moving the Needle?

NHPC isn't your typical high-speed tech stock. It’s a beast. It’s the Government of India’s flagship for hydropower, and right now, it’s at a massive crossroads.

📖 Related: How Much Is a Euro Worth in Dollars Explained (Simply)

Earlier this month, the heavyweight brokerage CLSA dropped a report that basically set the cat among the pigeons. They gave NHPC a "High Conviction Outperform" rating with a target of ₹117. That’s a massive 43% upside from where we are sitting today.

Why so bullish?

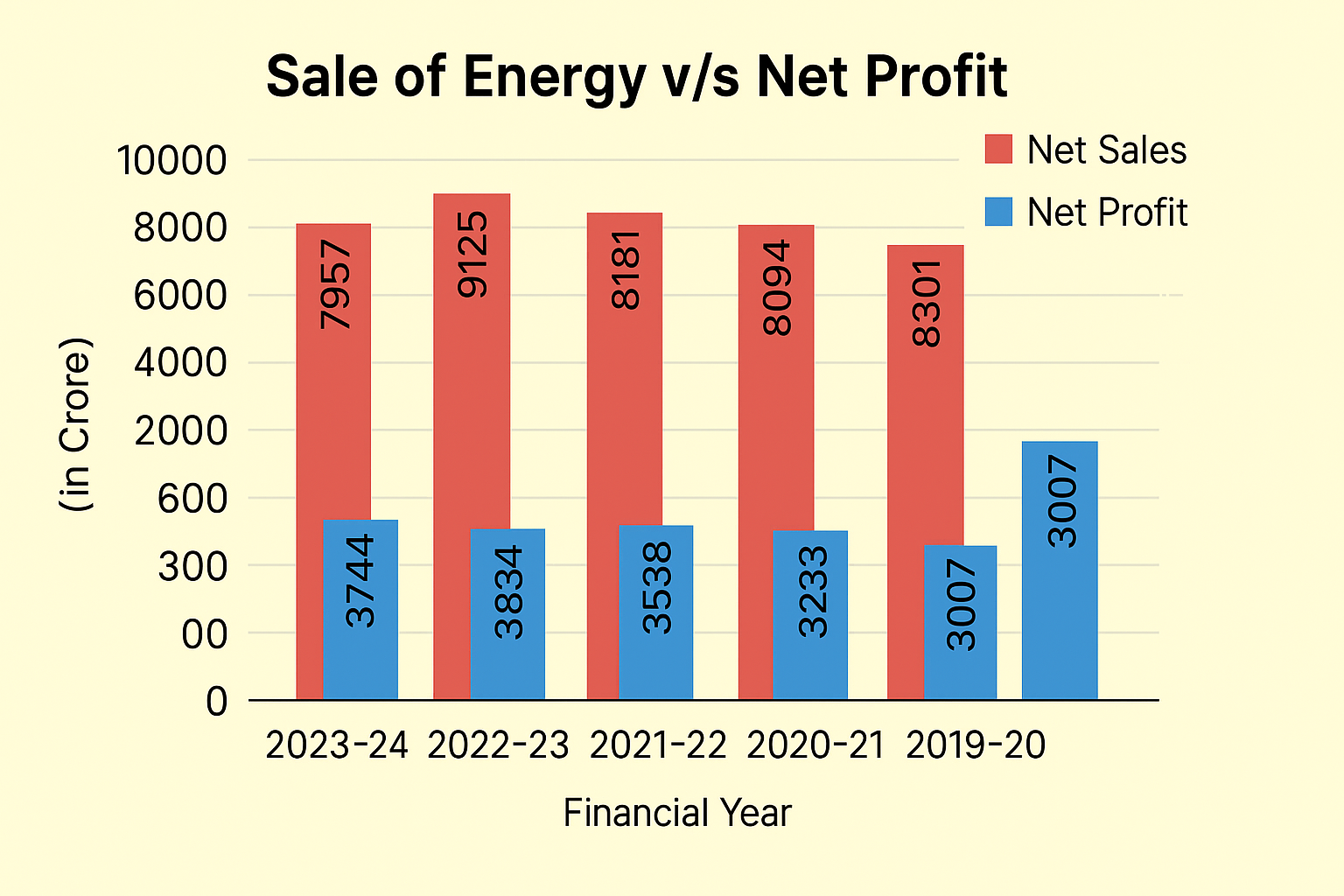

Well, the big secret—which isn't really a secret if you read the fine print—is the Subansiri Lower Hydro Electric Project. This monster of a project is expected to be fully commissioned by the fourth quarter of 2026. When that happens, we are talking about an incremental annual revenue of roughly ₹4,000 to ₹4,500 crore.

That is not small change.

The Projects You Need to Know About

- Parbati II: This one has been a long time coming. Tariff finalization for this project is a huge catalyst because it represents about 25% of NHPC’s regulated equity base. Clearer tariffs mean clearer profits.

- Pumped Storage: Everyone is talking about Green Energy, and NHPC is finally leaning into pumped storage and solar. They recently commissioned a chunk of the Bikaner solar project, too.

- Capacity Expansion: Analysts are forecasting a 64% expansion in installed capacity by the end of this year.

Is the NHPC Ltd Share Price Overvalued or Just "Pre-Growth"?

You've probably heard the "valuation is too high" argument. It’s a common one. On paper, the Price-to-Earnings (P/E) ratio sits around 25.3x. Some fundamentalists look at that and think, "Hey, for a utility company, that's pricey."

✨ Don't miss: The South African Rand Explained: More Than Just the Big Five

But you've got to look at the Earnings Per Share (EPS) growth.

If the capacity expansion hits as predicted, EPS could surge by 90% between now and FY27. When you factor in that kind of growth, a 25x P/E starts to look like a bargain. It’s the classic "value trap" vs. "growth play" debate.

Honestly, the stock has been trading about 11% below its 52-week high of ₹92.34. For someone looking for an entry point, this "pullback" phase is usually where the smart money starts nibbling.

The Dividend Factor

NHPC is basically a dividend machine. For a lot of folks, the nhpc ltd share price matters less than the credit notification they get in their bank account every few months.

- Current Yield: Roughly 2.38%.

- Recent Payouts: They paid out about ₹5.10 per share in August 2025.

- Expectations: There’s talk of an interim dividend coming up around February 2026.

If you’re the type who likes "boring" income while waiting for capital appreciation, this is usually the main draw.

The Risks Nobody Likes to Talk About

It’s not all sunshine and flowing water. Hydropower is risky. Nature doesn't always play ball.

Take the Teesta-V station, for instance. Operational hurdles there led to a dip in generation last year, which took a bite out of the profit after tax.

Then there’s the debt. NHPC has a lot of it. Building dams isn't cheap. The board recently approved raising up to ₹2,000 crore through bonds for the 2025-26 borrowing plan. While this is necessary for expansion, rising finance costs can weigh on the bottom line if projects get delayed.

And let’s be real: project delays are almost a tradition in large-scale infra. If Subansiri gets pushed back again, expect a sharp correction in the nhpc ltd share price.

Expert Take: Hold, Buy, or Run?

The analyst community is split, which is always a good sign for a lively market.

Out of the eight or so main analysts tracking this, it’s a bit of a mixed bag. You’ve got the bulls like CLSA aiming for ₹117, while the bears at ICICI Securities have been cautious with targets closer to ₹72.

Why the gap?

It comes down to timing. The bears think the current price already bakes in the Subansiri success. The bulls think the market is massively underestimating the cash flow once these turbines actually start spinning.

Actionable Insights for Your Portfolio

If you’re holding NHPC or thinking about jumping in, don't just stare at the 1-minute candle charts.

Watch the February 3rd earnings date. This will be the next major "tell" for the company's trajectory. If they show progress on the Parbati II tariff clarity, it could trigger a move back toward the ₹90 level.

Check the technicals. The stock is currently trading right around its 100-day Simple Moving Average (SMA). Historically, if it holds this level, it tends to consolidate before a leg up. If it breaks significantly below ₹78, the next support isn't until the ₹71-₹72 range.

Consider the "Utility" hedge. In a volatile market, PSU (Public Sector Undertaking) stocks like NHPC often act as a cushion. With the Government of India holding over 67%, the "too big to fail" sentiment is strong here.

Keep an eye on the bond yields and the upcoming February earnings report. If you are a long-term player, the "boring" periods of consolidation like we are seeing now are often the most important times to stay disciplined.

Next Steps for You:

- Monitor the ₹79-₹81 support zone over the next week to see if the price stabilizes.

- Verify your dividend eligibility if you held shares prior to the last record date to ensure your bank mandate is active.

- Review the Q3 FY26 earnings results on February 3, 2026, specifically looking for updates on the Subansiri commissioning timeline.