You’ve probably seen the name Nicholas Biddle in a dusty history textbook, likely buried in a chapter about the "Bank War." Most people gloss over him as some boring 19th-century suit. Honestly? That is a huge mistake.

Biddle wasn't just a banker. He was a child prodigy, a literary nerd, and basically the closest thing America had to a financial king in the 1830s. He was also the man who stared down Andrew Jackson—a guy who literally carried bullets in his body from duels—and thought, Yeah, I can take him. Spoiler: It didn't go well for Biddle. But the fallout of their fight literally changed how you spend and save money today.

Who Was Nicholas Biddle? The Kid Genius

Before he was public enemy number one for the Jacksonian Democrats, Biddle was the ultimate "gifted kid." Born in Philadelphia in 1786 to a super-prominent family, he was basically speed-running life.

He entered the University of Pennsylvania at age ten. Ten! When the school realized he was too young to actually graduate, his parents just sent him to Princeton. He finished there at 15 as valedictorian.

💡 You might also like: US Inflation Rate Explained (Simply): Why Your Bills Still Feel So High

While most of us were figuring out high school, Biddle was in Paris. He served as secretary to the U.S. Minister to France and even got to watch Napoleon’s coronation. Imagine being 18 and having "Saw Napoleon get crowned" on your resume.

A Writer at Heart

Interestingly, Biddle didn't start in banking. He was a man of letters. He edited the Port Folio, a top-tier literary magazine of the time. He was also the guy who took the raw, messy journals of the Lewis and Clark expedition and turned them into a readable narrative. If you’ve ever read about the Corps of Discovery, you’re likely reading Biddle’s polished prose.

He loved the "Greek Revival" style—everything from architecture to philosophy. You can still see this at his estate, Andalusia, which looks like a Greek temple dropped into the Pennsylvania countryside. This obsession with order and classical beauty eventually bled into how he thought a bank should run: perfectly, rationally, and without the mess of "common" politics.

Taking Over the Second Bank of the United States

In 1823, at the age of 37, Biddle became the president of the Second Bank of the United States (BUS). To understand why this was a big deal, you have to realize that the BUS wasn't like a modern Chase or Wells Fargo. It was a weird hybrid. It was a private corporation, but it held all the government’s money.

Basically, Biddle was the unofficial Chairman of the Federal Reserve before the Fed existed.

What Biddle Actually Did

When Biddle took over, the U.S. economy was a mess. Every tiny state bank was printing its own paper money, and half the time, that money was worthless. Biddle used the massive power of the BUS to force these smaller banks to stay honest.

- He regulated the money supply: If a state bank printed too much paper, Biddle would collect those notes and demand "specie" (actual gold or silver) in return.

- He stabilized the currency: For the first time, a dollar in New Orleans was worth the same as a dollar in Boston.

- He acted as the government's fiscal agent: He handled the national debt and moved money around to where the country needed it most.

For about a decade, it worked. The economy boomed. Biddle was hailed as a financial wizard. But he had a blind spot: he was an elitist. He truly believed that "men of intelligence" should run the economy and that the "uneducated masses" shouldn't have a say in it.

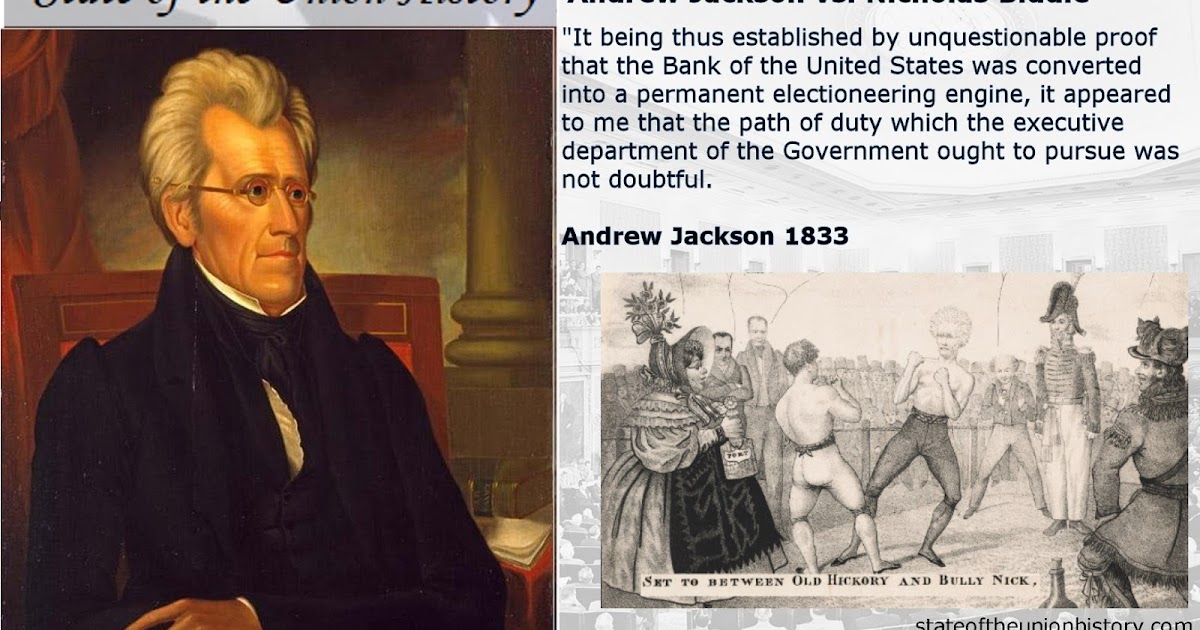

The Bank War: Biddle vs. "Old Hickory"

Enter Andrew Jackson.

👉 See also: Kristi Jackson and QualityMetric Explained: What Most People Get Wrong

Jackson hated banks. Like, really hated them. He’d lost a bunch of money in land speculation early in his life and blamed the "paper system." To Jackson, the Bank of the United States was a "Monster"—a corrupt institution that made the rich richer and the poor poorer.

In 1832, the bank’s charter was coming up for renewal. Biddle had a choice: wait until after the election to renew it, or force the issue now.

The Fatal Miscalculation

Biddle’s friend, Henry Clay, convinced him to push for the recharter early. They thought that if Jackson vetoed it, he’d lose the election because the bank was so popular with business owners.

They were wrong.

Jackson didn't just veto the bill; he wrote a blistering message that framed the bank as an enemy of the common man. He famously told his Vice President, Martin Van Buren: "The bank is trying to kill me, but I will kill it!"

Jackson won the 1832 election in a landslide. Biddle, instead of backing down, went scorched earth. He started calling in loans and restricting credit across the country, trying to trigger a mini-depression. He thought he could "show" the public that they needed the bank.

It backfired spectacularly. People didn't blame Jackson; they blamed Biddle for being a vindictive aristocrat.

The Fall and the Aftermath

By 1836, the bank's federal charter expired. Biddle tried to keep it going as a state-chartered bank in Pennsylvania, but the magic was gone. He got caught up in some risky cotton speculations that failed miserably.

In 1841, the bank finally went under. Biddle was even arrested and charged with fraud (though he was later acquitted). He spent his final years in "elegant retirement" at Andalusia, watching his reputation crumble. He died in 1844, relatively young at 58, broken by the stress and the loss of his social standing.

Why You Should Care Today

Historians are still divided on who was the "villain" here.

- The Pro-Biddle View: Without him, the U.S. entered a period of "Wildcat Banking" where the economy was unstable for decades. We didn't get a real central bank again until 1913.

- The Pro-Jackson View: Biddle proved Jackson right by using the nation's economy as a weapon for his own political survival. No single, unelected person should have that much power.

Practical Takeaways from the Life of Nicholas Biddle

If we look past the 19th-century drama, Biddle’s life offers some pretty sharp lessons for anyone in business or leadership today.

📖 Related: Why the Red Lobster Commercial 2025 Strategy is Actually Saving the Brand

- Intelligence isn't everything: Biddle was the smartest guy in the room, but he lacked emotional intelligence. He didn't understand how his actions looked to regular people.

- Don't weaponize your product: When Biddle choked the money supply to win a political fight, he destroyed the very thing he was trying to save: public trust.

- Read the room: Biddle assumed the "elites" ran the country. He failed to see the rising tide of populism that Jackson represented.

If you want to understand why the Federal Reserve is so carefully insulated from politics today (and why people still argue about it), you have to understand the fight between Biddle and Jackson. It was the first time America had to decide who really controls the "purse strings" of the nation.

To get a better sense of how this shaped modern finance, you might look into the Panic of 1837, which was the direct economic fallout of the Bank War. Seeing how the markets reacted when the "Monster" finally died gives a lot of perspective on why we have the banking regulations we do now.