You’re standing at the counter of a local New Jersey wholesaler, ready to buy five hundred dollars worth of inventory for your boutique. The clerk looks at you and asks for your "ST-3." If you don’t have that piece of paper, you’re basically handing over an extra 6.625% to the state for no reason. It’s annoying. It's paperwork. But honestly, the NJ ST-3 form is one of the most powerful tools in your small business arsenal if you actually want to keep your margins healthy.

Most people confuse it with a tax return. It isn't. The ST-3 is a Resale Certificate. It’s a formal declaration to a seller that you are buying goods for the sole purpose of selling them again. In the eyes of the New Jersey Division of Taxation, the "final consumer" pays the sales tax. Since you aren't the final consumer, you shouldn't be paying that tax when you stock up.

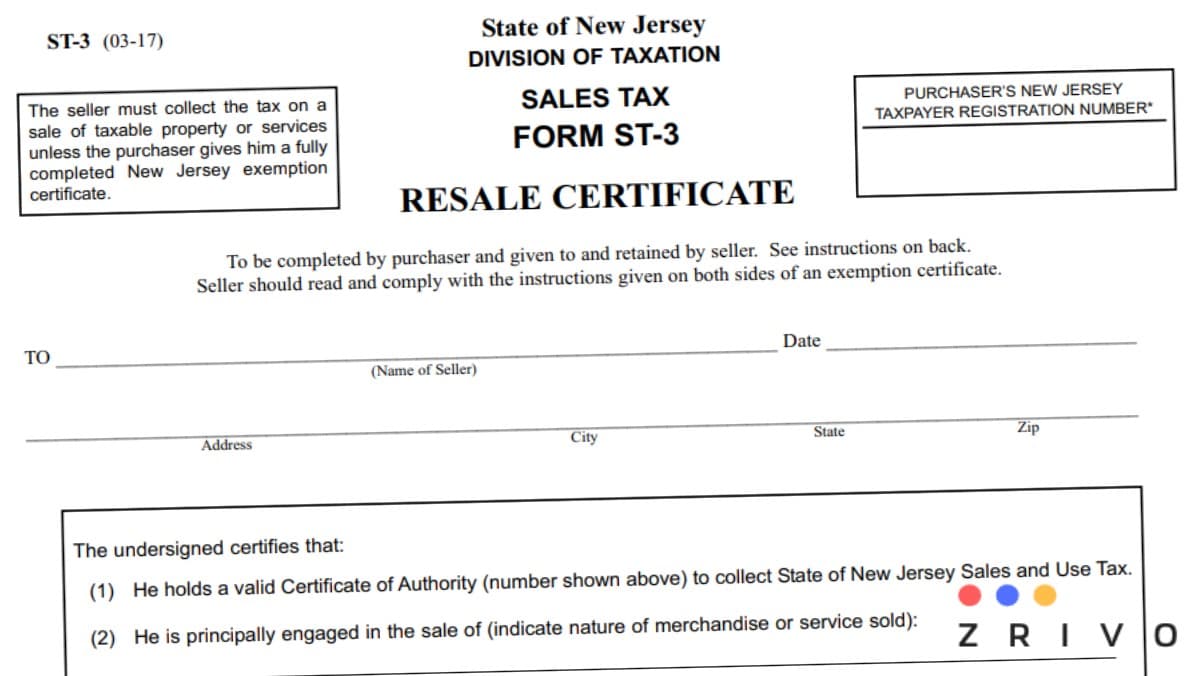

The Anatomy of the ST-3 Form in New Jersey

It’s a single page. Simple, right? Not exactly.

The form requires your New Jersey Tax Registration Number. This isn't just your federal EIN, though they look similar. You get this 12-digit number when you register your business with the state via the NJ Division of Revenue and Enterprise Services. If you try to use a fake number or a placeholder, the seller’s audit will eventually catch it, and that’s a headache you don't want.

Look at the "Description of Property" section. You have to be specific. If you’re a florist buying ribbons, don't just write "stuff." Write "decorative floral supplies." The state wants to see a direct link between what you're buying tax-free and what you’re eventually charging customers tax on later.

Why You Can't Just Use Your Business Registration

A common mistake is handed a copy of the Business Registration Certificate (BRC) to a vendor. That won't fly. The BRC proves you exist as a legal entity in Trenton’s eyes, but the NJ ST-3 form is the specific legal "hall pass" for sales tax. Vendors are required by law to keep a physical or electronic copy of your ST-3 on file for at least four years. If they don't have it and the state audits them, they are on the hook for the tax they didn't collect from you. That’s why they’re so pushy about it.

When to Use It (And When You Definitely Shouldn't)

Resale is the keyword.

If you own a restaurant and you’re buying take-out containers, those are for resale because they go to the customer. Use the ST-3. But if you’re buying a new desk for your office? Pay the tax. The desk isn't being resold; you're the end user.

I’ve seen business owners get into hot water by trying to buy "office supplies" or "cleaning chemicals" on an ST-3 when those items are clearly for internal use. The Division of Taxation calls this "tax evasion," and they aren't particularly fond of it.

Out-of-State Complications

Here is where it gets kinda weird. If you are a New York business and you come over to a Jersey warehouse to pick up goods, can you use your NY resale certificate? Generally, no. New Jersey is pretty strict. You usually need to be registered in NJ to use the NJ ST-3 form. However, there is a "Drop Shipment" rule that gets complicated fast. If you're an out-of-state seller and you're having a NJ supplier ship directly to your NJ customer, you might actually need the ST-3NR (Non-Resident) form instead.

Digital Signatures and Modern Compliance

We aren't in 1995 anymore. You don't necessarily need to hand over a wet-ink paper copy every single time. Most major retailers like Home Depot or Staples have online portals where you can upload a PDF of your NJ ST-3 form.

Once it’s in their system, it’s usually tied to your pro account or phone number. But keep a copy on your phone anyway. You never know when a system will glitch or a new manager will demand to see the "papers."

The Registered Agent Factor

If you're running a flip-business or a side hustle and you haven't officially registered with the state, you can't technically issue an ST-3. This puts many "solopreneurs" in a bind. They pay retail prices + tax, which eats their profit. The fix is simple: register for a Certificate of Authority. It costs nothing to register for sales tax collection in NJ, though you will then have to file quarterly sales tax returns (Form ST-50), even if you had zero sales.

Common Blunders That Trigger Audits

Don't leave fields blank. It sounds obvious, but "blank form syndrome" is real. If the "Seller's Name" is missing, the form is technically invalid.

Another big one: using the ST-3 for services. This form is for "tangible personal property." If you're trying to avoid tax on a repair service or a membership fee, the ST-3 isn't the right tool.

The 60-Day Rule

Technically, you should give the seller the NJ ST-3 form at the time of purchase or within 90 days. If you wait longer, the seller might refuse to refund the tax, and you'll have to file a direct claim with the state for a refund (Form A-3730). That process takes months. It’s a nightmare. Just give them the form upfront.

Specific Examples for Different Industries

- E-commerce Sellers: You buy 100 widgets from a wholesaler. You give the wholesaler an ST-3. When you sell those widgets on Shopify or Amazon, you collect tax from the buyer (unless you're shipping to a tax-free state).

- Contractors: This is the most confusing group. If you're a kitchen remodeler buying cabinets to install, you are often considered the "end user" in NJ's eyes unless you have a specific setup. Usually, contractors use an ST-8 (Exempt Use Certificate) or pay tax at the source. Using an ST-3 for construction materials that get "annexed" to real estate is a quick way to get a red flag on your account.

- Graphic Designers: If you buy paper for a client's brochure, that’s a resale. If you buy a $3,000 MacBook to design the brochure, you pay the tax.

Actionable Steps to Get Compliant

First, verify your status. Go to the NJ Treasury website and make sure your business is "Active" and authorized to collect sales tax. If you aren't, don't even touch the ST-3 yet.

Second, download the official, most recent version of the form. Don't use a blurry photocopy from a 2012 blog post. The state updates these occasionally, and using an obsolete version is just asking for a clerk to reject it.

Third, create a "Tax Folder" in your cloud storage. Keep your Certificate of Authority, your EIN confirmation, and a pre-filled, signed PDF of your NJ ST-3 form. When a vendor asks for it, you can email it in two seconds.

Fourth, audit your own purchases. Look back at your last three months of bank statements. If you see sales tax charged on items you bought to resell, you're losing money. Contact those vendors, give them your ST-3, and ask if they can credit your account. Some will, some won't, but it sets the stage for future savings.

💡 You might also like: PLN to USD Exchange Rate Today: Why the Zloty is Showing Surprising Teeth

Finally, remember that the ST-3 is a legal document. Signing it means you're certifying under penalty of perjury that the items are for resale. Use it correctly, and it's a massive benefit. Use it wrongly, and it's a liability. Keep your records clean, keep your registration current, and stop paying taxes you don't actually owe.