It sounds like a dream, right? You pull a double shift, the coffee is wearing off, your feet ache, but at least the government isn't dipping into that extra "time-and-a-half" money.

Honestly, the headlines made it sound like overtime was suddenly tax-free across the board. But if you’re looking for the exact moment when no taxes on ot start, the answer is actually "it already did," but with a massive, complicated asterisk that most people are completely missing.

The "One Big Beautiful Bill" (OBBBA), signed into law on July 4, 2025, officially kicked this off. It’s retroactive. That means any qualifying overtime you worked from January 1, 2025, onward is technically eligible for a major tax break.

But wait. Don't go spending that "tax-free" money just yet.

When Does No Taxes on OT Start and Why is My Check the Same?

Here is the kicker: the law changed, but the way your boss takes money out of your paycheck probably didn't.

Most employers are still withholding federal income tax on overtime just like they always have. Why? Because the IRS didn't update the official withholding tables or the W-4 forms in time for the 2025 rollout.

Basically, 2025 was a "transition year."

👉 See also: Why the Foldable Chair for Office Spaces is Actually a Smart Move

You won't actually see the "no tax" benefit until you file your taxes in early 2026. It’s not a disappearing tax; it’s a deduction. You’ll report your overtime, claim the deduction on a new form (likely Schedule 1-A), and then—hopefully—get that money back as a fatter refund.

For those wanting to see it in their weekly take-home pay, the real change happens right now.

The 2026 Shift

Starting in January 2026, the IRS has finally integrated these changes into the W-4 and employer withholding systems. If you fill out a new W-4 this month, your employer can finally adjust your withholding to reflect the overtime deduction.

This is when the "extra" money actually starts staying in your pocket on Fridays instead of waiting for a refund check a year later.

The "Half-Pay" Trap Everyone Overlooks

You’ve probably heard you can deduct up to $12,500 in overtime (or $25,000 if you’re married filing jointly).

That sounds huge. But there is a massive detail in the fine print of the OBBBA. The deduction only applies to the "premium" portion of your overtime.

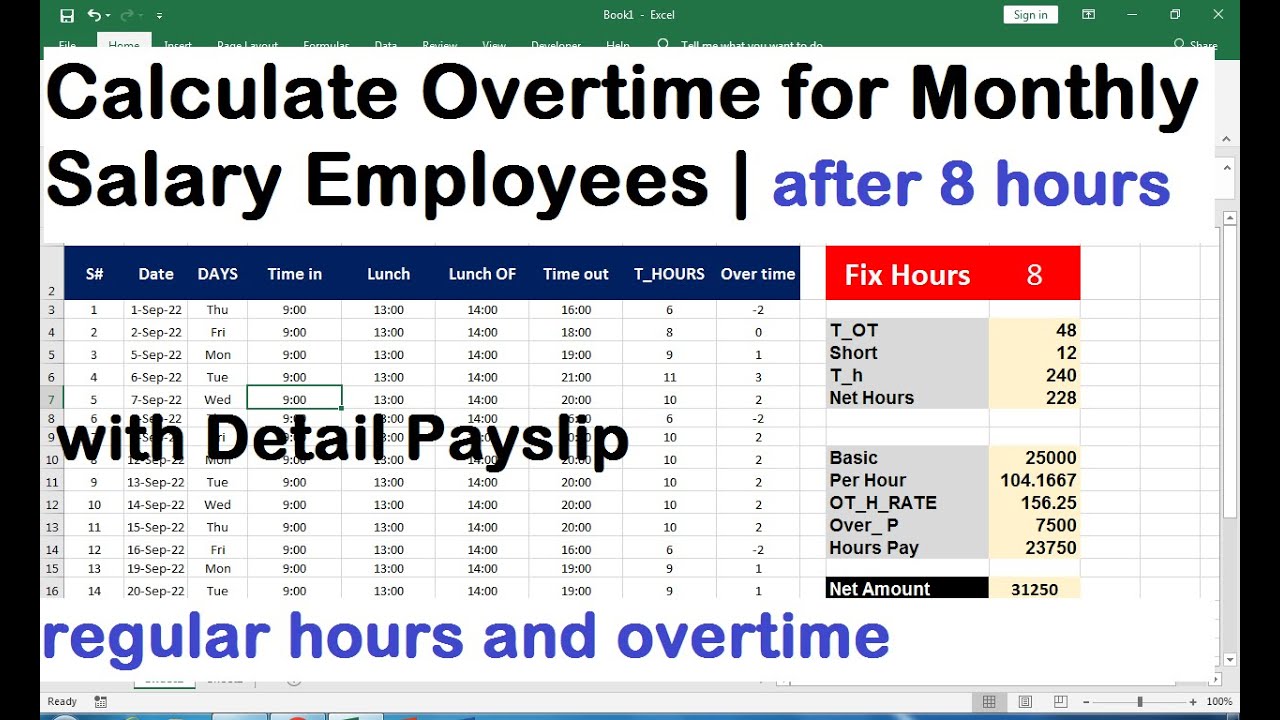

Let's break that down with real numbers because it’s confusing.

Suppose you make $30 an hour. Your overtime rate is $45 an hour (time-and-a-half).

- Your "regular" rate is $30.

- Your "premium" is the extra $15.

The law only lets you deduct the $15 premium. The base $30 you earned during those overtime hours is still taxed at your normal rate.

✨ Don't miss: New Cracker Barrel Logo Images: What Really Happened During the $100 Million Rebrand Fiasco

So, it isn't "no taxes on overtime." It’s "no federal income tax on the extra half of your time-and-a-half."

It’s still a win, but it’s not the 100% tax-free windfall some TikTok influencers made it out to be.

Who Actually Qualifies? (It’s Not Everyone)

If you're a high-salaried manager, you're likely out of luck.

To qualify for the no taxes on ot start benefits, you generally have to be a non-exempt worker under the Fair Labor Standards Act (FLSA). Basically, if you aren't legally entitled to "time-and-a-half" because of your job title or salary level, you can't claim this deduction even if you work 60 hours a week.

There are also strict income caps.

- Single Filers: The benefit starts disappearing (phasing out) once your Modified Adjusted Gross Income (MAGI) hits $150,000. By the time you hit $275,000, the deduction is gone entirely.

- Married Filing Jointly: The phase-out starts at $300,000 and vanishes at $550,000.

Also, if you're married but filing separately? You get zero. The law explicitly blocks "Married Filing Separately" status from using this deduction.

Don't Forget the "Hidden" Taxes

Another thing to keep in mind: "no tax" only refers to Federal Income Tax.

You are still going to see deductions for:

- Social Security (6.2%)

- Medicare (1.45%)

- State Income Tax (unless you live in a place like Florida or Texas)

Uncle Sam is giving you a break on the income tax, but he’s still taking his cut for your retirement and healthcare. Your state governor likely wants their piece, too, as most states haven't updated their own tax codes to match this federal deduction.

What You Need to Do Right Now

If you want to maximize this in 2026, you can't just sit back.

First, check your 2025 W-2. The IRS gave employers a "safe harbor" for 2025, allowing them to use any reasonable method to estimate your overtime. Look for a "TT" code in Box 12 or check Box 14. If your overtime isn't broken out, you might need to dig through your old paystubs to prove your "qualified overtime premium" to your tax preparer.

Second, go to your HR portal today.

Update your W-4 for 2026. There is a new worksheet section specifically for the overtime deduction. If you know you're going to grind out 500 hours of OT this year, accounting for it now on your W-4 is the only way to see that "tax-free" money in your actual 2026 paychecks.

The Sunset Clause

This isn't a permanent change to the American way of life.

As of right now, the no taxes on ot start provision is scheduled to "sunset" or expire on December 31, 2028. Unless a future Congress votes to extend it, we go back to the old rules in 2029.

It’s a four-year window.

If you’re planning on using this extra cash for a down payment or to kill off some high-interest debt, you've got a limited timeline to make it happen.

✨ Don't miss: Why Starting a Clothing Brand is Harder (and Better) Than You Think

Keep your paystubs. Talk to a CPA who actually understands the OBBBA. This is the biggest change to blue-collar tax law in decades, but it only works if you actually know which boxes to check.

Key Takeaways for 2026

- Check your W-2: Ensure your 2025 overtime is documented so you can claim the deduction this spring.

- File Schedule 1-A: This is the new form required to actually get your 2025 overtime taxes back.

- Adjust your 2026 withholding: Use the new W-4 to stop the IRS from taking the money in the first place.

- Track the "Half": Remember that only the 0.5x premium of your 1.5x pay is deductible.

This law is a massive shift in how we value extra work. Just make sure you aren't leaving money on the table because of a paperwork error.