Timing a currency exchange is usually a nightmare. You watch the numbers flicker on a screen, hoping for a sign, but the market rarely does what you want it to. If you’ve been tracking the norwegian krone to gbp rate lately, you’ve likely noticed a weird tug-of-war.

The Krone (NOK) is a moody currency. It’s tied to oil, sure, but it’s also tethered to the whims of global risk appetite. When the world feels safe, the Krone shines. When things get shaky? It’s often the first to get dumped. Meanwhile, the British Pound (GBP) has been trying to find its feet after years of being the "sick man" of G7 currencies.

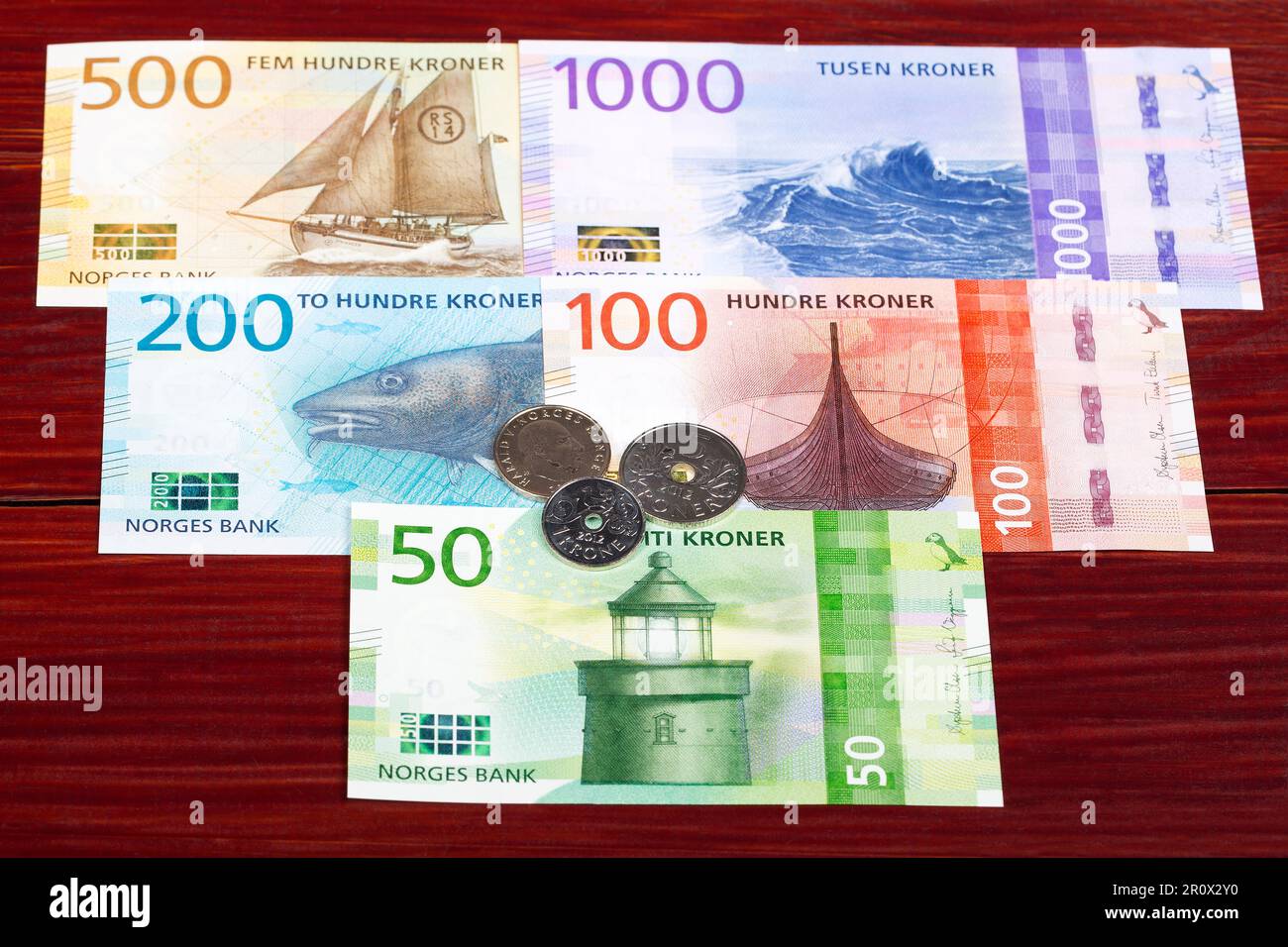

As of mid-January 2026, we’re seeing the norwegian krone to gbp exchange rate hovering around the 0.0739 mark. That means 100 Krone gets you about £7.39. It’s a slight step up from where we were a year ago, but it’s nowhere near the "cheap Norway" days travelers used to dream about.

Why the Krone is punching back

For a long time, the Krone was the underdog. Despite Norway's massive wealth, the currency just wouldn't budge. But things shifted.

Norges Bank, Norway's central bank, has been incredibly stubborn. While the rest of the world started slashing interest rates like they were on sale, Governor Ida Wolden Bache kept the Norwegian policy rate at 4% for much of late 2025. This "higher for longer" stance was a direct response to inflation that just wouldn't go away.

Think about it this way. If you’re an investor, you want to park your money where the interest is high. Norway became that place. While the Bank of England was busy cutting rates to 3.75% in December 2025, Norway held firm. That gap—the difference between what you earn in Oslo versus London—is exactly what's supporting the norwegian krone to gbp rate right now.

But it’s not just about interest rates. It’s about the black stuff. Brent Crude is currently sitting around $63 a barrel. That’s not "boom" territory, but it’s enough to keep the Norwegian economy's engine humming. Norway isn't just an oil play anymore, though. Their sovereign wealth fund—the largest in the world—is now worth over 20 trillion kroner. When that fund rebalances its portfolio, the whole world feels the ripples.

The Pound’s struggle for identity

The UK economy is in a weird spot. Honestly, it's been in a weird spot for a decade. Inflation in Britain has finally cooled down to around 3.2%, which is great for your grocery bill but tricky for the currency.

Low inflation gives the Bank of England (BoE) an excuse to cut rates. And they have. Since August 2024, the BoE has cut rates six times. Every time Andrew Bailey and the Monetary Policy Committee (MPC) vote for a cut, the Pound loses a little bit of its "yield" appeal.

If you're looking at norwegian krone to gbp, you have to realize that the Pound is currently the weaker side of the equation. Markets are already pricing in at least two more cuts from the BoE in 2026, potentially bringing the base rate down to 3.25% by the end of the year. If that happens while Norges Bank stays at 4% or only cuts once, the Krone could easily climb toward 0.075 or higher.

Real-world impact: What this means for your wallet

Stop thinking in decimals for a second. Let's look at the actual cost of living. If you’re a UK business importing Norwegian salmon or industrial equipment, a stronger Krone is a headache. You’re paying more Pounds for the same amount of goods.

On the flip side, if you're a Norwegian tourist heading to London for a weekend of shopping at Harrods, you're laughing. Your Krone goes further than it did two years ago.

Travelers going the other way—London to Oslo—are in for a shock. Norway was already expensive. Now, with the norwegian krone to gbp rate moving against the Pound, that £12 pint of beer in Aker Brygge is starting to look like £14.

The misconceptions about "Petro-currencies"

People love to say the Krone is just an oil proxy. That’s a massive oversimplification.

✨ Don't miss: Currency Dollar to Riyal: Why the 3.75 Rate Never Seems to Change

Back in the day, if oil went up 5%, the Krone went up 5%. Not anymore. In 2025, we saw several instances where oil prices spiked, but the Krone stayed flat because people were worried about global trade wars or tech stocks crashing.

The Krone is now what traders call a "High-Beta" currency. It moves with the general mood of the stock market. If the S&P 500 is soaring, the Krone usually follows. If there's a panic in the markets, investors run to the US Dollar or the Swiss Franc, leaving the Krone out in the cold—regardless of what oil is doing.

What to watch in the coming months

Nothing in the currency world is permanent. There are three big things that could flip the norwegian krone to gbp trend on its head:

- The Wage Spiral: Norway is seeing solid real wage growth (about 3.8% projected for 2026). If wages rise too fast, Norges Bank will have to keep rates even higher to fight the resulting inflation. This would boost the Krone.

- UK Election Aftermath: We're still feeling the effects of the Autumn Budget and local elections. Any sign of political instability in the UK usually sends the Pound into a tailspin.

- The Housing Gap: Norway’s housing market is actually picking up, with prices expected to rise 20% by 2028. A booming housing market often leads to a stronger currency because it signals a robust domestic economy.

Actionable insights for your exchange

If you need to move money between these two currencies, don't just guess.

For Krone buyers (GBP to NOK):

Wait for days when the stock market is "red." When global markets dip, the Krone often overreacts and drops further than it should. That’s your window to buy. The current rate of 12.96 NOK per Pound is decent, but we’ve seen it hit 13.40 in the recent past when the UK was looking stronger.

For Pound buyers (NOK to GBP):

The norwegian krone to gbp rate is currently in a sweet spot for you. At 0.0739, you're getting a better deal than the 0.070 lows of early 2025. If Norges Bank hints at a rate cut in their March 2026 meeting, that’s your signal to move your money before the Krone weakens.

Keep an eye on the interest rate spread. As long as Norway’s rates are higher than the UK’s, the Krone has the structural advantage.

To manage your risk, consider using "limit orders" through a specialist FX provider rather than just accepting whatever rate your high-street bank gives you. Banks often bake in a 3-4% margin that eats your profit. A limit order lets you set a target price, say 0.075, and automatically executes the trade if the market hits that level. This takes the emotion—and the 3 AM screen-staring—out of the process.

Stay focused on the central bank calendars. The next big Norges Bank decision is January 22, followed by the Bank of England on February 5. Those two dates will likely dictate the direction of the norwegian krone to gbp pair for the rest of the quarter.