If you’ve been watching the tickers today, Wednesday, January 14, 2026, you’ve probably noticed some red ink splashed across the big tech names. Nvidia is currently trading at $182.80, which is down about 1.62% from yesterday’s close of $185.81. It’s a bit of a bumpy ride this morning. The stock opened at $184.32 and has spent most of the session bouncing between a low of $180.80 and a high of $184.46.

Honestly, it’s not just Nvidia feeling the heat. The whole sector is a bit jittery. We're seeing Meta, Microsoft, and Tesla all trading lower today as investors chew on some new geopolitical headaches involving China and the usual mid-January profit-taking. Despite the slight dip, Nvidia’s market cap is still sitting at a staggering $4.45 trillion. To put that in perspective, that’s bigger than the entire GDP of many developed nations.

The China Factor and H200 Roadblocks

What’s actually driving the price movement today? It basically comes down to a fresh wave of "China risk." New reports suggest that shipments of the H200 chips—Nvidia’s high-performance AI workhorses—are hitting some regulatory roadblocks. Washington and Beijing are doing their usual dance of trade restrictions, and investors are worried this might put a dent in the massive revenue Nvidia gets from the East.

Nvidia already took a $4.5 billion hit earlier in the fiscal year due to inventory issues with its H20 products after previous export rules changed. Now, people are looking at the H200 and wondering if we’re about to see a repeat. Even with these hurdles, the company’s profit margins are kind of ridiculous. We’re talking over 50% net profit margins. Most hardware companies would sell their soul for half of that.

💡 You might also like: How to invest in an IRA without making the mistakes everyone else makes

Blackwell and the Rubin Revolution

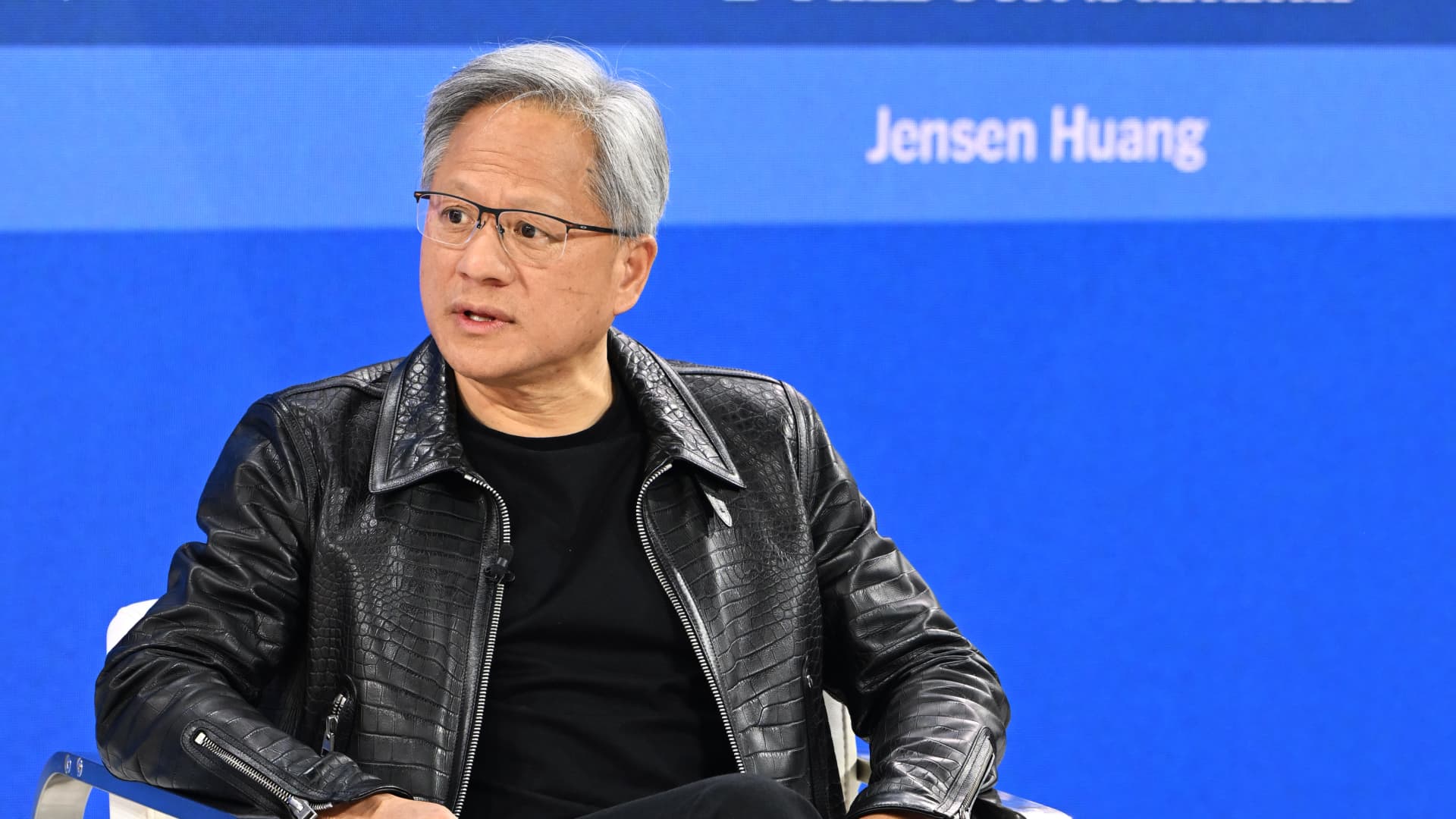

While the daily price is what everyone stares at, the real story is under the hood. CEO Jensen Huang recently noted that "Blackwell sales are off the charts." These chips are literally sold out. If you’re a cloud provider like AWS or Google Cloud, you’re basically begging Nvidia to take your money so you can get these units into your data centers.

And then there’s Rubin. This is the next-gen architecture set to ramp up in the second half of 2026. Analysts like Hans Caso from Wolfe Research are already calling it a game-changer because the AI inference performance is supposedly five times better than Blackwell. It uses an 800-volt power system, which sounds like technical jargon, but it basically means these chips are more efficient at a time when data centers are literally breaking the power grid.

A Quick Look at the Numbers

If you’re a fan of the data, the trailing P/E ratio for Nvidia currently sits around 45.36. Some people say that’s expensive, but when you consider they just reported third-quarter revenue of $57.01 billion—up 62% year-over-year—the "overvalued" argument starts to look a bit shaky.

Nvidia is a different beast compared to its rivals.

AMD is trading at a P/E of nearly 60, and Broadcom is around 52.

By comparison, Nvidia actually looks... well, not cheap, but reasonably priced for a company that effectively owns the infrastructure of the future.

They’ve returned $37 billion to shareholders through buybacks and dividends so far this fiscal year.

They still have over $62 billion left in their buyback "war chest," which acts as a nice safety net for the stock price.

What Analysts are Saying Right Now

The "Strong Buy" consensus isn't going anywhere. The average price target is still hovering around $252.81. If that hits, we’re looking at a 42% upside from where the stock is sitting today.

Morningstar recently pointed out that if you took Nvidia out of the US market index, the market would look significantly less "overvalued." It’s basically carrying the S&P 500 on its back. However, there’s a growing "alpha list" of stocks that might outperform Nvidia in the short term because Nvidia has become such a crowded trade. Some analysts are looking at Micron or even custom chip solutions as the "next big thing," though Nvidia’s moat still looks pretty wide for now.

Is This Dip a Buying Opportunity?

Most people asking about the current price are trying to figure out if they should jump in. Stock market volatility is just part of the deal with Nvidia. We’ve seen it drop 10% in a week only to gain 20% the next.

If you believe the AI boom is a bubble, then $182 is way too high. But if you think we’re in the early innings of "Physical AI"—the stuff that powers robots and autonomous factories—then this might just be a blip on a much longer chart. The company is already working with General Motors on autonomous vehicle tech and has a massive partnership with OpenAI to build out infrastructure that could require ten gigawatts of power.

Actionable Insights for Investors

If you're tracking the stock today, keep an eye on these specific levels and events:

- The $180 Support Level: Watch if the stock holds above $180. It’s been a psychological floor for the last few weeks. If it breaks, we might see a slide toward $170.

- China Export Updates: Any official word from the Department of Commerce regarding the H200 will move this stock 5% in either direction instantly.

- Earnings Calendar: We are approaching the end of the fiscal year. Expect the next major volatility spike when the Q4 and full-year fiscal 2026 results drop, where revenue is projected to hit $65 billion.

- Dollar-Cost Averaging: Given the volatility, many pros suggest not "all-inning" at one price. If you like the long-term story, nibbling on these 1-2% red days is usually the play.

Nvidia isn't just a chip company anymore. It’s basically the utility company for the AI age. Whether it’s trading at $182 or $190, the fundamental question remains the same: Do you believe the world needs more compute? Based on the backorders for Blackwell, the answer from the world’s biggest companies is a resounding yes.