You've probably seen the headlines. NVIDIA is basically eating the world of finance right now. If you look at the charts from late 2025, specifically October 29, the numbers are kind of hard to wrap your head around. NVIDIA stock all time high hit a closing peak of $207.03 that day. To give you some perspective, that pushed the company's market cap toward a staggering $5 trillion mark, a neighborhood usually reserved for the likes of Apple or Microsoft on their best days.

Honestly, it feels like a fever dream for anyone who held the stock five years ago.

But here is the thing. Most people looking at that all-time high are asking the wrong question. They want to know if they missed the boat. They see a stock that surged over 1,000% in a three-year window and they get nervous. It’s a reasonable reaction. Who wouldn't be? Yet, if you dig into the actual mechanics of why this is happening—specifically the transition from Blackwell to the new Rubin platform—you start to see that this isn't just some speculative bubble fueled by "AI vibes." It is a fundamental shift in how global computing infrastructure is built.

The Blackwell Peak and Why It Mattered

Last year was wild. In the third quarter of fiscal 2026 (which ended in October 2025), NVIDIA posted a record $57 billion in revenue. That is a 62% jump from the previous year. Most of that came from the Data Center division, which is basically the engine room of the AI revolution.

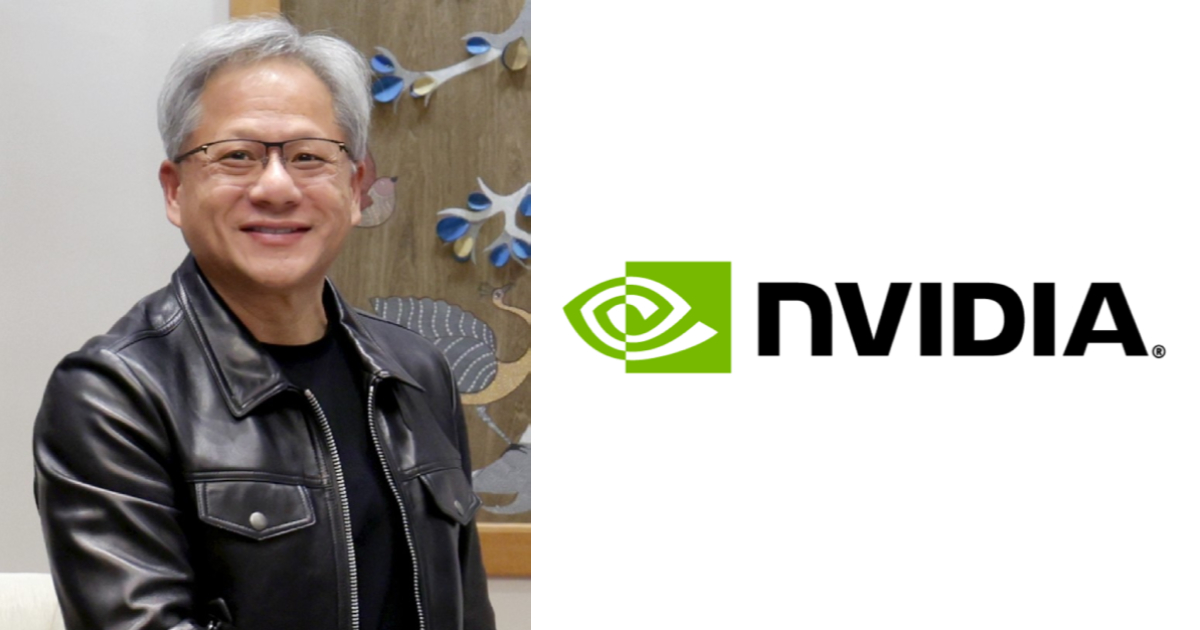

Jensen Huang, the guy in the leather jacket who somehow never seems to sleep, described the demand for the Blackwell Ultra architecture as "off the charts." It’s not just marketing speak. Major players like Microsoft and Meta aren't just buying these chips; they are building "AI factories."

The B300 and GB300 systems have become the gold standard. They offer a 10x improvement in throughput per megawatt compared to the older Hopper chips. In a world where electricity is the biggest constraint for data centers, that kind of efficiency is worth its weight in gold. That is exactly what fueled the run to the NVIDIA stock all time high of $207.03.

What’s Happening Right Now?

As of January 15, 2026, the stock has cooled off a bit from those October peaks. It's currently trading around $187.14.

Is that a bad sign? Not really. It's actually a pretty healthy consolidation.

- Profit Taking: After a vertical move to $200+, big institutional players usually trim their positions to lock in gains.

- The China Factor: There’s been a lot of back-and-forth on export controls. Recently, the US government greenlit sales of H200 chips to China in exchange for a 25% "tax" on sales. That's a huge deal because it reopens a massive market that was essentially frozen.

- Blackwell to Rubin: We are in the middle of a transition. The Blackwell cycle is mature, and investors are now looking toward the Rubin platform, which was just unveiled at CES 2026.

The Rubin architecture is named after Vera Rubin, the astronomer who found evidence of dark matter. It’s a fitting name because NVIDIA is trying to map out the "dark matter" of the digital economy—agentic AI and massive-scale reasoning.

The $4.57 Trillion Question

NVIDIA’s market cap currently sits around $4.57 trillion. That makes it the most valuable semiconductor company on the planet by a landslide. For context, Broadcom is around $1.64 trillion, and Intel—once the king of the hill—is sitting at a humble $227 billion.

The gap is widening because NVIDIA isn't just selling silicon. They are selling a vertical stack. If you want to run the most advanced AI models from OpenAI or Anthropic, you basically have to use the CUDA software platform. It’s a moat that competitors like AMD or custom silicon from Amazon and Google are finding incredibly difficult to cross.

✨ Don't miss: Biweekly Explained (Simply): Why Your Paycheck or Schedule Feels So Confusing

Risks Nobody Mentions

It isn't all sunshine and 75% gross margins, though. There are some real "tail risks" that could mess with the story.

Customer concentration is the big one. About four companies—the "hyperscalers"—account for nearly half of NVIDIA's revenue. If Microsoft decides to slow down its capital expenditure (CapEx) for one quarter, NVIDIA's stock doesn't just dip; it craters. We saw a hint of this early in 2025 when the stock fell to the $94 range during a brief panic about an "AI bubble."

Also, the hardware cycle is relentless. To keep the stock at an NVIDIA stock all time high, they have to keep launching new generations every single year. One mistake in the manufacturing process with TSMC, or a delay in the Rubin rollout, and the valuation multiple could shrink overnight.

Actionable Insights for Investors

If you are looking at the 2026 landscape, here is how to actually play this without losing your mind.

- Watch the $170-180 Support Zone: The stock has shown a lot of "memory" around these levels. If it stays above $180, the path back to $200 looks pretty clear.

- Earnings Date Alert: Mark February 25, 2026 on your calendar. That is when NVIDIA reports its Q4 and full-year fiscal 2026 results. Expect a lot of volatility leading up to that Wednesday.

- The Rubin Catalyst: Pay attention to the first shipment dates for the Vera Rubin Superchips. If they hit the market ahead of schedule in mid-2026, the previous high of $207.03 might look cheap.

- Ignore the "P/E is too high" crowd: People have been saying that since the stock was at $40. Look at the PEG ratio (Price/Earnings-to-Growth). Because the earnings are growing so fast, the valuation is actually more reasonable than it looks on the surface.

The bottom line? We are moving from an era of "experimental AI" to "industrial-scale AI." NVIDIA is the only company providing the full blueprint for that transition. Whether the stock hits a new record tomorrow or next month, the underlying business is generating more cash than almost any other entity in history.

To stay ahead of the next move, you should monitor the weekly capital expenditure reports from the "Big Four" tech companies. Their spending is the most accurate leading indicator for where NVIDIA is headed next. If they keep building data centers, NVIDIA keeps winning.