New York is a lot of things. It’s the city that never sleeps, the land of the Finger Lakes, and, unfortunately, the place where your monthly premium probably costs more than your first car did. Honestly, if you’ve looked at your renewal notice lately and felt a physical pang in your chest, you aren't alone. The ny car insurance cost has officially crossed into "how is this legal?" territory for most of us.

As of early 2026, the average driver in the Empire State is shelling out roughly $3,303 a year. That’s basically $275 every single month. And if you’re downstate? Forget it. In places like Brooklyn or the Bronx, you’re often looking at $5,000 or $6,000 annually just to keep a legal plate on your Toyota.

But here’s the thing: most people think it’s just "inflation" or "big corporate greed." While those play a part, there are some very specific, very "New York" reasons why your wallet is bleeding, and some of them just changed this month.

The 2026 Shift: Why Your Rates Just Jumped Again

If you noticed a spike in your January renewal, it might not be your driving. Effective January 1, 2026, New York hiked its minimum liability requirements. For years, the state let you skate by with a $25,000/$50,000 limit.

Those days are over.

✨ Don't miss: Will Trump's Tariffs Work: What Most People Get Wrong

The new legal floor is now $35,000 for bodily injury per person and $70,000 per accident. It’s a 40% jump in the amount of coverage you’re forced to buy. While that’s better protection if you actually get into a wreck, it means the "cheapest" possible legal insurance is now naturally more expensive than it was last year.

The "Fraud Tax" You’re Paying Every Month

Governor Kathy Hochul recently went on the record during her 2026 State of the State address about something most of us suspected: we are being fleeced by scammers. New York currently ranks second in the nation for staged crashes.

Think about that.

There were over 1,700 staged accidents reported recently. These aren’t just mistakes; they are organized rings where people purposefully slam on their brakes to get hit, then send "victims" to shady clinics for phony medical payouts. Experts at the Insurance Information Institute estimate this "fraud tax" adds about $300 a year to every single New Yorker's premium. Basically, you’re paying for a criminal’s vacation every time you pay your bill.

Where You Park Matters More Than How You Drive

In New York, your ZIP code is destiny. You can have a pristine driving record, a garage, and a sensible sedan, but if you live in Kings County, you're paying a premium.

📖 Related: Arizona Beverages Edison Warehouse: What’s Really Happening Behind the Scenes

Look at the spread:

- Brooklyn: Often exceeds $6,100/year for full coverage.

- The Bronx: Hovers around $5,900/year.

- Buffalo: Much more reasonable at roughly $3,200/year.

- Rochester: One of the few "bargains" left, frequently under $2,000/year.

Why the gap? It’s not just the traffic. It’s the "litigation environment." Downstate courts are notoriously generous with payouts, and insurers know it. They price that risk into every policy in the five boroughs.

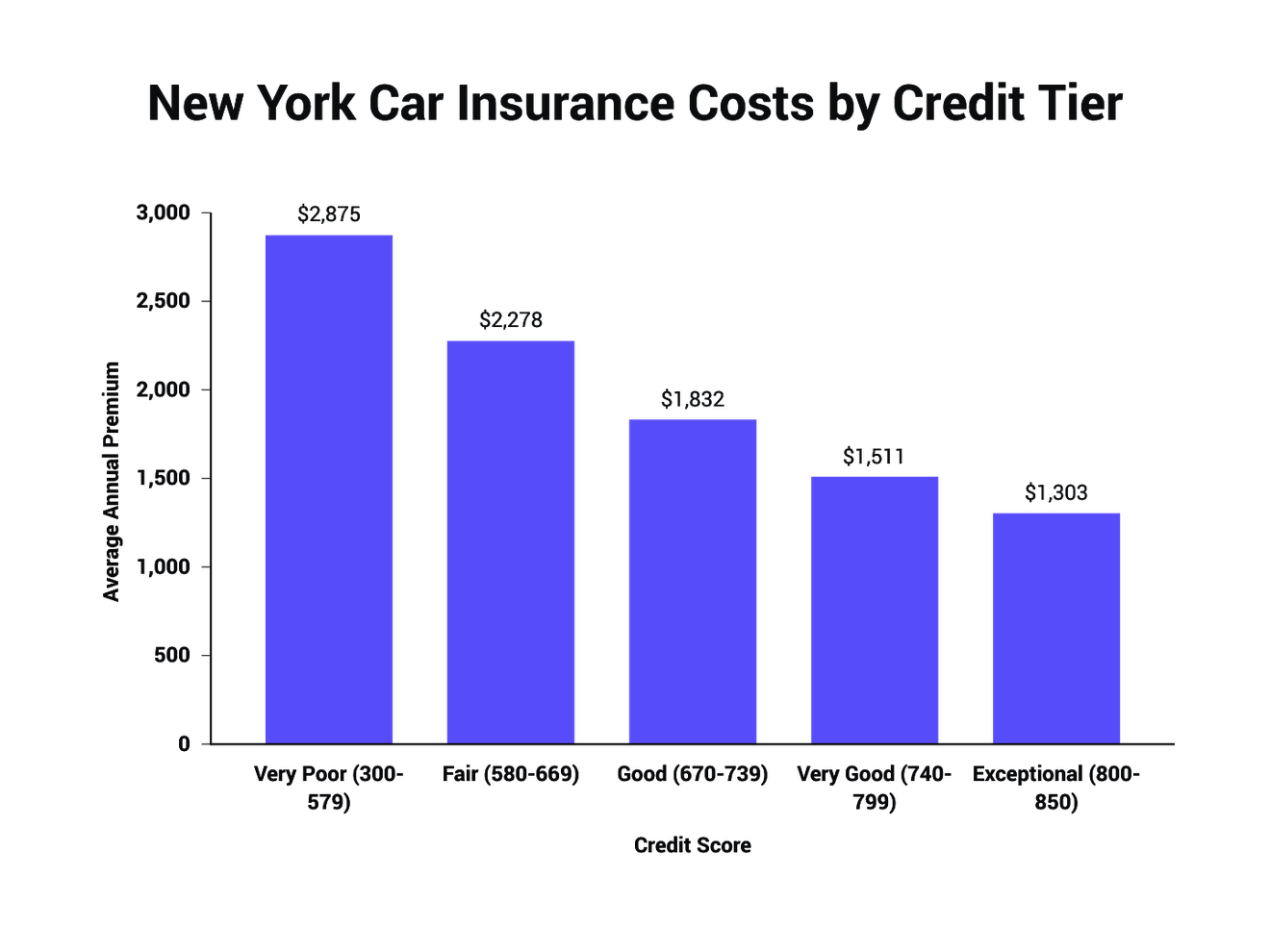

The Credit Score Trap

Kinda wild, but in New York, your financial health can matter as much as your driving. Drivers with "poor" credit scores (below 580) often see rates that are 95% higher than those with "excellent" credit. We’re talking about a jump from $3,000 to nearly $6,000 just because of a credit report. It feels unfair, especially since insurance is mandatory, but carriers argue it’s a proven metric for risk.

The Real Cost of a Single Mistake

One speeding ticket. That’s all it takes. In New York, a single moving violation typically bumps your ny car insurance cost by about 8% to 15%.

But an "at-fault" accident? That’s the killer. Your rates could surge by 40% or more, and that surcharge usually sticks around for three to five years. If you’re paying $3,000 now, an accident could push you to $4,200. Over three years, that’s $3,600 in "extra" premium.

How to Actually Fight Back (Beyond the Basics)

You’ve heard the "shop around" advice a thousand times. It works, but it’s tedious. If you want to actually move the needle on your ny car insurance cost, you have to be more aggressive.

1. The Defensive Driving Loophole

This is the lowest-hanging fruit. Taking a DMV-approved Point and Insurance Reduction Program (PIRP) course is mandatory for a 10% discount on your base liability and collision premiums for three years. You can do it online while watching Netflix. It’s a no-brainer.

2. Telematics: The "Spy" in Your Car

If you’re a boring driver, use it to your advantage. Programs like Progressive’s Snapshot or State Farm’s Drive Safe & Save track your braking and acceleration. Some New Yorkers are seeing 15-20% discounts here. Just be warned: if you have a lead foot or work the night shift (midnight to 4 AM is considered high-risk), this might actually hurt you.

3. The "Paperless" and "Paid in Full" Combo

It sounds small, but stacking these can save you $100-$200. Carriers hate sending mail and chasing monthly payments. Paying the full six months upfront usually kills the "installment fees" and triggers a "full pay" discount.

4. Re-evaluate Your Deductible

If you’re driving a car that’s worth less than $5,000, why do you have a $250 deductible? Raising it to $1,000 can drop your premium significantly. Just make sure you actually have that $1,000 in a savings account in case things go sideways.

📖 Related: Which Stocks Are Up Today: The Names Defying the January Slump

Is there hope for lower rates?

The State is finally trying to crack down on the fraud rings, and there’s a push to redefine what qualifies as a "serious injury" in lawsuits to stop the flood of minor claims. If these reforms actually pass and work, we might see the first real rate stabilization in a decade.

Until then, you basically have to be your own advocate. Check your policy every six months. Don't just let it auto-renew. Carriers like Erie and Travelers are currently some of the most competitive in the state, while the big names like Allstate and Geico have been hiking rates to keep up with repair costs.

Actionable Next Steps to Lower Your Premium

- Verify your mileage: If you're working from home now but your policy still says "15,000 miles/year commute," you're overpaying. Update it to "Pleasure" use.

- Check for the "Education" discount: If you or a driver on your policy is a student with a 3.0 GPA or higher, most NY carriers offer a "Good Student" discount that can be as high as 15%.

- Audit your ZIP: If you’ve moved recently—even just a few blocks away—and haven't updated your address, do it. Moving from one side of a county line to another can sometimes save hundreds.

- Compare at least three carriers: Use a localized broker who understands the NY market specifically, rather than just using a national website.

Stop treating your car insurance like a fixed utility bill. It’s a contract, and in New York, the terms change fast. Stay on top of it, or the state's "affordability crisis" will start right in your driveway.