New York isn’t exactly known for being a cheap place to live. If you’re looking at your paycheck and wondering why it feels a bit lighter than you expected, you aren't alone. Honestly, trying to decipher the nys tax table 2024 is enough to make anyone want to move to Florida. But before you pack your bags, you should probably know that the state actually made some decent changes recently.

Governor Kathy Hochul and the State Legislature have been accelerating middle-class tax cuts. It's not a massive windfall, but for a lot of people, the rates dropped sooner than originally planned. We’re talking about a multi-year phase-in that finally hit its stride for the 2024 tax year.

The Real Math Behind Your Bracket

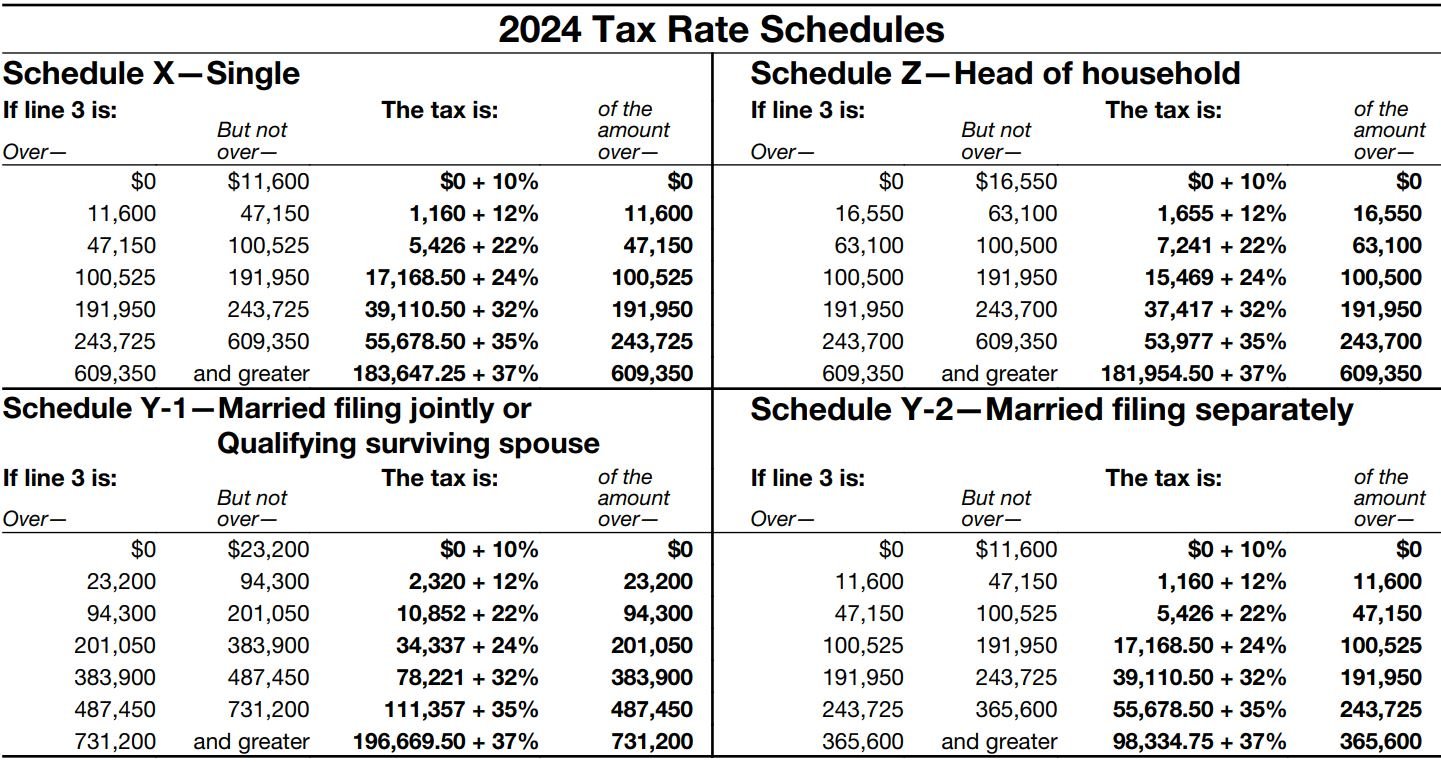

Let’s get one thing straight: New York uses a progressive tax system. Basically, this means you don't pay one flat rate on every dollar you earn. Instead, your income is chopped up into buckets. You pay a lower percentage on the first bucket, a bit more on the second, and so on. It’s a common misconception that getting a raise and "moving into a higher bracket" makes you take home less money overall. That’s just not how it works. You only pay the higher rate on the portion of your income that actually falls into that new, higher bucket.

For 2024, the brackets for single filers start at a modest 4% for the first $8,500 of taxable income. It sounds low. But it climbs fast.

If you're a single filer making between $13,900 and $21,400, your rate is 4.5%. Once you cross that $80,650 threshold, you're looking at 5.5%. And for the high earners? If you’re pulling in over $25 million—congrats, by the way—your top rate hits a staggering 10.9%. That’s actually one of the highest top-tier rates in the entire country.

Middle-Class Tax Cuts are Finally Here

The 2024 fiscal year is significant because it marks the completion of the phase-in for middle-class tax relief. A few years ago, the rate for those earning between $13,900 and $75,000 was significantly higher. Now, for 2024, that middle-income bracket has been compressed and lowered. Specifically, the rate for individuals earning up to $161,550 (or $323,200 for married couples filing jointly) has settled into that 5.5% to 6% range.

It matters.

For a family making $150,000, these adjustments can mean hundreds of dollars staying in their pocket instead of going to Albany. It’s not "buy a new car" money, but it’s certainly "pay for a few months of groceries" money, which, given inflation lately, is a win.

Don't Forget the NYC Surcharge

Here is the kicker. If you live in the five boroughs, the nys tax table 2024 is only half the story. You also have to deal with the New York City personal income tax. NYC is one of the few cities in the U.S. that levels its own hefty income tax on top of the state and federal layers.

✨ Don't miss: Hyundai Motor Company Stock: What Most People Get Wrong

The city rates are also progressive, ranging from roughly 3.078% to 3.876%. When you stack the city’s 3.876% on top of the state’s 6.85% or higher, you realize why people complain about the "tax bite" in the Big Apple. It’s a double whammy. If you’re a commuter working in the city but living in Westchester or Jersey, you generally don't pay the NYC resident tax, which is a huge relief for the suburban crowd.

Standard Deductions and the 2024 Shift

Taxable income isn't your gross salary. Thank goodness for that. Before you even look at the tax table, you subtract your deductions. For 2024, the New York State standard deduction for single individuals is $8,000. If you’re married and filing a joint return, that jumps to $16,050.

Heads of households—basically single parents or people supporting dependents—get a $11,200 deduction.

These numbers are important because they effectively create a "zero percent" bracket. If you’re a single person making $8,000 or less, you technically don't owe the state a dime in income tax.

Why the Tables Look Different This Year

If you’re looking at older forms, you’ll notice the 2024 tables have been simplified. The state eliminated some of the older, more complex "benefit recapture" calculations for the lower-income tiers. The goal was to make the filing process less of a headache.

New York also has various credits that act like "anti-taxes." The Empire State Child Credit is a big one. It’s basically a check from the government for having kids, and it’s refundable. That means even if you owe zero in taxes, the state might still send you money. In 2023 and into 2024, there were even supplemental payments added to this credit to help with the rising cost of living.

Common Pitfalls: The Resident vs. Non-Resident Trap

New York is notoriously aggressive about auditing people who claim they don't live there anymore. If you have a "permanent place of abode" in NY and spend more than 183 days in the state, they consider you a resident. Period.

It doesn't matter if your driver's license says Florida. If you kept your apartment in Manhattan and spent the summer there, the NYS Department of Taxation and Finance will likely come knocking for their cut of your total income. They use cell phone records, credit card swipes, and even veterinary records to prove where you were. It's intense.

For those who truly live out of state but work for a New York company, the "convenience of the employer" rule applies. Basically, if you work from home in another state just because it’s easier for you, New York still wants to tax that income as if you were sitting in an office in Albany. You only escape this if your employer requires you to be out of state for their own business necessity.

Credits That Change the Math

While the tax table tells you the rate, the credits tell you the final bill.

- Earned Income Credit (EIC): NY offers a credit equal to 30% of the federal EIC. It's a huge boost for low-to-moderate-income workers.

- Household Credit: This is a small, often overlooked credit for people who can't be claimed as a dependent on someone else's return.

- College Tuition Credit: If you paid for college in 2024, you can get a credit of up to $400 per student or a deduction. Usually, the credit is the better deal.

How to Use the 2024 Table Effectively

If you're doing your own taxes, don't just eyeball the table and guess. The state provides a specific "Tax Computation Worksheet."

You take your New York Adjusted Gross Income (NYAGI), subtract your deductions, and then apply the math. For example, if you are single and your taxable income is $50,000, you don't just multiply $50,000 by the 5.5% rate.

Instead, you pay 4% on the first $8,500 ($340), then 4.5% on the amount between $8,500 and $11,700 ($144), then 5.25% on the amount between $11,700 and $13,900 ($115.50), and finally 5.5% on the remaining $36,100 ($1,985.50).

📖 Related: Cost of American Express Black Card: What Most People Get Wrong

Your total state tax would be roughly $2,585.

This results in an "effective tax rate" of about 5.17%, which is lower than the top bracket you fell into. Understanding this distinction is the key to not panicking when you see your "bracket."

Looking Ahead: What to Do Right Now

Tax season is always stressful, but being proactive makes it suck a lot less. If you realize your withholdings were off in 2024, change your IT-2104 form with your employer immediately. It's the New York version of the federal W-4.

If you're a freelancer or "1099" worker, the nys tax table 2024 is your roadmap for estimated payments. New York expects you to pay as you go. If you wait until April 2025 to pay everything you owe for 2024, they will hit you with underpayment penalties and interest that add up fast.

Check if you qualify for the "Free File" program. If your income is below a certain threshold (usually around $79,000), you can use professional software for free. The state's website, tax.ny.gov, actually has a pretty decent portal for this.

Actionable Steps for New York Taxpayers

- Gather your IT-2104: Review your current withholdings. If you owed a lot last year, increase the amount taken out of each check now.

- Separate NYC and NYS: If you moved in or out of the city during 2024, you need to prorate your city taxes. Don't pay the full year of NYC tax if you spent six months in Buffalo.

- Keep receipts for credits: If you’re claiming the solar energy credit or the child care credit, have your documentation ready. New York audits these frequently.

- Contribute to a 529 plan: New York allows a deduction of up to $5,000 ($10,000 for married couples) for contributions to a New York 529 college savings account. It’s one of the best ways to lower your taxable income while saving for the future.

- Check your residency status: If you spent significant time outside the state, keep a log. Use an app or a simple calendar to track your days in vs. out of NY to defend yourself in case of an audit.

New York's tax system is a beast, but it's a predictable one. By staying on top of the 2024 rate changes and maximizing your deductions, you can keep more of your hard-earned cash. The middle-class cuts are a step in the right direction, even if it still feels like a lot. Just remember: the table is just the starting point; the credits and deductions are where the real saving happens.