You've probably heard the old saying that "cash is king," but in the world of dividend investing, that's often a lie. Plenty of companies pay out fat checks to shareholders while their actual bank accounts are bleeding dry. They borrow money to keep the streak alive or sell off assets just to avoid the PR nightmare of a dividend cut. This is exactly why the Pacer Global Cash Cows Dividend ETF (GCOW) exists. It doesn't just look at who is paying the most today; it looks at who actually has the cold, hard cash to keep paying tomorrow.

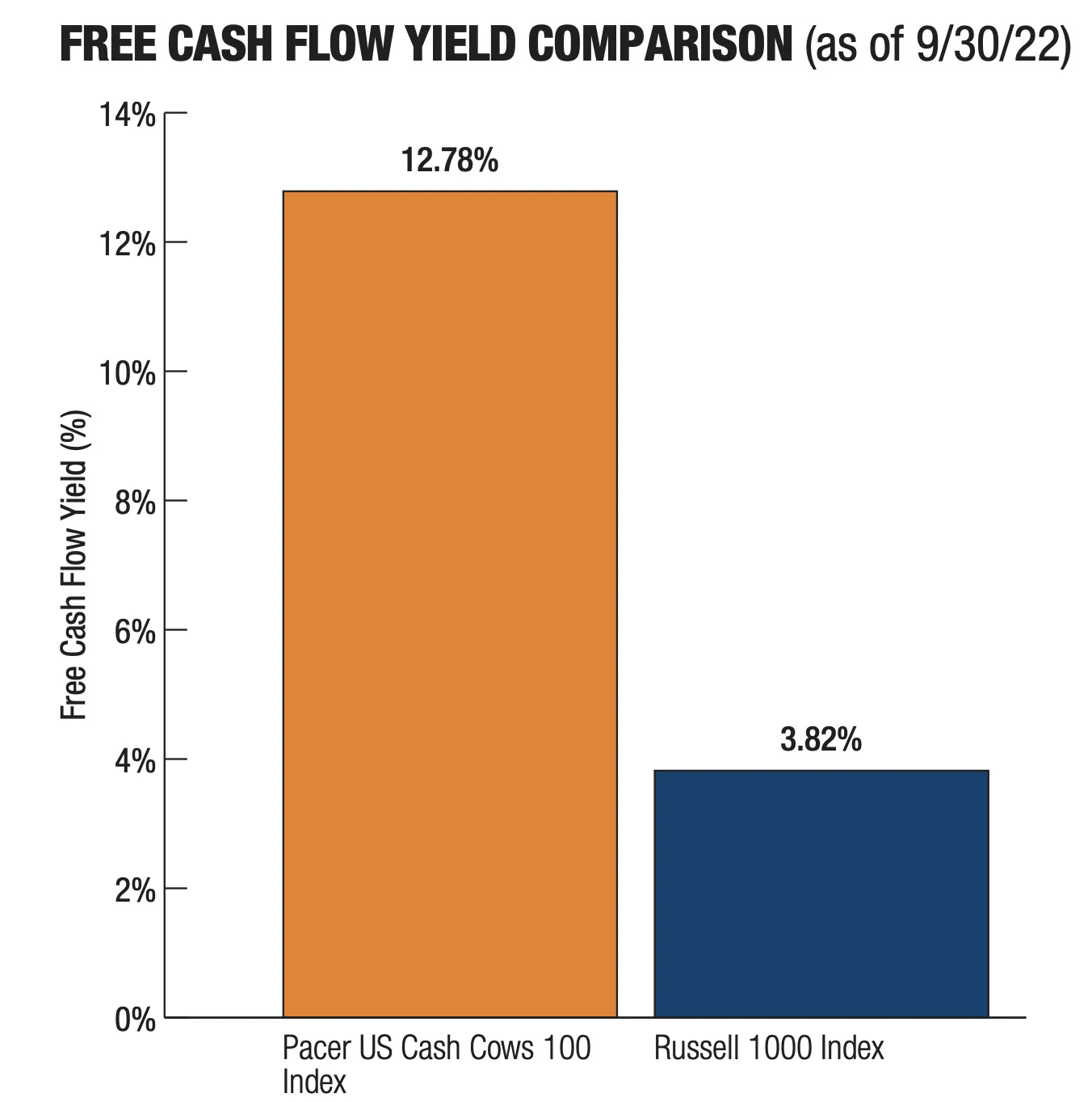

Honestly, most investors get blinded by a high starting yield. They see a 7% or 8% return and jump in, only to get walloped when the company slashes the payout and the stock price craters. GCOW tries to fix this by using a "Cash Cow" filter. It’s a strategy that focuses on free cash flow (FCF) yield. Basically, it's looking for companies that are generating more cash than they know what to do with.

How GCOW Actually Works (The Secret Sauce)

Most dividend ETFs are pretty lazy. They just grab a list of stocks that haven't cut their dividends in ten years and call it a day. GCOW is way more aggressive. It starts with a massive pool of about 1,000 global large-cap stocks from the FTSE Developed Large-Cap Index. Then, the real work begins.

First, it screens for the top 300 companies with the highest free cash flow yield. Think of free cash flow as the money left over after a business pays for everything—rent, salaries, taxes, and even new equipment. If a company has a lot of this "leftover" money relative to its price, it's usually either very healthy or very undervalued.

📖 Related: Why 8960 Woodman Av Arleta CA 91331 is a Textbook Example of the San Fernando Valley Housing Shift

Next, from those 300 cash-heavy companies, it picks the 100 with the highest dividend yields. This is a critical distinction. By looking at cash flow before dividend yield, it avoids the "dividend traps"—those struggling companies that have a high yield only because their stock price is in a free fall.

Finally, it weights these 100 companies by their total dividend payments and caps each one at 2%. This means you aren't overexposed to just one giant company. As of early 2026, the fund is sitting with around 108 holdings, keeping things diversified across the globe.

A Global Reach

One thing you’ve got to realize about the Pacer Global Cash Cows Dividend ETF is that it isn't just a US play. In fact, as of January 2026, only about 26% of the fund is in US stocks. The rest is scattered across the UK, France, Japan, and Switzerland.

If you’re someone who is already heavy on the S&P 500, GCOW provides a nice counterbalance. It gets you into names like Rio Tinto, Unilever, and Novo Nordisk—companies that are absolute cash machines but don't always get the same hype as Big Tech in California.

The Reality of the 0.60% Expense Ratio

Let’s talk about the elephant in the room: the cost. GCOW carries an expense ratio of 0.60%. For some people, that’s a dealbreaker. You can find "dumb" dividend ETFs for 0.06% or even less.

But here’s the thing. You aren't just paying for a list of stocks; you're paying for a rebalancing act that happens twice a year. This fund is constantly kicking out the "expensive" stocks that no longer have great cash flow yields and replacing them with cheaper, cash-rich alternatives.

Is it worth it? Well, if you look at the performance, GCOW has been a bit of a beast lately. For the year ending December 31, 2025, the fund's NAV return was a whopping 27.56%. That’s massive for a value-oriented dividend fund. Compare that to more traditional dividend peers, and you start to see why people are willing to pay the 60 basis points.

Pacer Global Cash Cows Dividend ETF vs. The Competition

When people talk about GCOW, they usually compare it to the Schwab US Dividend Equity ETF (SCHD). It’s a natural comparison, but sort of like comparing an apple to a mango.

- SCHD is 100% US-based. It’s cheap, reliable, and focuses on dividend growth.

- GCOW is a global beast. It’s more expensive but offers exposure to international markets and a much stricter focus on current free cash flow.

In 2025, GCOW actually outperformed many of its US-only counterparts because international value stocks finally had their day in the sun. The fund's 30-day SEC yield is currently hovering around 3.84%, which is solid, but the "implied" yield of the underlying companies is often even higher, sometimes topping 5% depending on the rebalance cycle.

Sector Breakdown: Where the Money Is

GCOW doesn't care about being "balanced" across every sector. It goes where the cash is. Right now, that means a lot of:

- Energy (approx. 19.5%): Oil and gas companies are currently printing money.

- Consumer Staples (approx. 19.1%): Think of the stuff people buy regardless of the economy.

- Healthcare (approx. 15.8%): Big pharma companies with massive patent moats.

You won't find much Tech here. As of the latest data, Information Technology makes up less than 1% of the fund. If you're looking for the next AI rocket ship, this isn't it. But if you're looking for a company that makes toothpaste and has $5 billion in the bank, you're in the right place.

The Risks: Nothing Is "Safe"

I’d be doing you a disservice if I didn’t mention the downsides. GCOW is a "value" fund. That means it buys things that are cheap. Sometimes, things are cheap for a reason.

Because the fund rebalances based on trailing twelve-month data, it can occasionally be slow to react to a sudden industry shift. If the price of oil collapses tomorrow, GCOW might still be holding those energy stocks for a few months before the next rebalance kicks them out.

👉 See also: Digital Marketing for Law Firms: Why Most Partners Are Burning Money

Also, the international exposure introduces currency risk. If the US dollar gets significantly stronger, your returns on those French and Japanese stocks will look worse when converted back to greenbacks. It’s just the nature of the beast when you're investing globally.

Why Investors Are Swapping to GCOW in 2026

We've seen a shift in the market over the last year. The "growth at any cost" mentality of the early 2020s has cooled off. Investors are getting skeptical. They want to see the receipts.

The Pacer Global Cash Cows Dividend ETF effectively acts as an auditor. It says, "I don't care what the CEO says on the earnings call. Show me the cash." In a world where accounting tricks are common, free cash flow is the hardest metric to fake.

If you look at the top holdings right now—names like Philip Morris, Merck, and Exxon Mobil—they all share a common trait: they are mature businesses that generate massive amounts of liquidity. They aren't trying to "disrupt" anything; they're just trying to be profitable. For a retiree or someone looking for a "sleep well at night" portion of their portfolio, that’s a very attractive proposition.

💡 You might also like: Car Country Harrison Ohio: What You Should Actually Expect

Actionable Strategy for Using GCOW

If you're thinking about adding this to your portfolio, don't just dump your entire savings into it on a Monday morning. Here is how experts are actually using it in 2026:

- The "Core-Satellite" Approach: Keep your low-cost S&P 500 fund as your "core." Use GCOW as a "satellite" to get international exposure and a higher yield than the broad market offers.

- Check the Rebalance: GCOW rebalances in June and December. If you want to see what the "new" cash cows are, wait until the end of those months to check the updated holdings list.

- Tax Location: Since this fund holds international stocks, you might be eligible for a foreign tax credit if you hold it in a taxable brokerage account. However, for many, holding it in an IRA is simpler to avoid the headache of dividend tax nuances.

- Watch the P/E Ratio: One of the coolest things about GCOW is its valuation. While the broader market might be trading at 20x or 25x earnings, GCOW’s portfolio often sits closer to 12x or 13x. It’s a way to buy the "unpopular" but profitable parts of the market.

Ultimately, GCOW isn't a get-rich-quick scheme. It’s a get-rich-slowly-and-stay-rich-longer scheme. By prioritizing companies that actually have the cash to support their dividends, you're building a portfolio on a foundation of reality rather than hope. In an uncertain 2026 market, reality is a pretty good place to be.