Writing a check to the IRS feels like a relic of the 1990s. Honestly, it’s a bit of a gamble too. You drop that envelope in the blue bin, hope the post office doesn’t lose it, and then wait weeks—sometimes months—to see if the government actually cashed it. If you’re self-employed, a freelancer, or a small business owner, you already have enough stress. You don't need "lost in the mail" tax penalties on your plate. That is why you should pay fed estimated tax online instead. It’s faster. It’s safer. It gives you an immediate digital receipt that acts as your "get out of jail free" card if the IRS ever claims they didn't get your money.

The Quarter-Life Crisis of Every Freelancer

Most people think tax day is April 15th. For those of us with 1099s or side hustles, tax day happens four times a year. If you wait until April to pay everything, the IRS is going to hit you with underpayment penalties. It’s not just about paying what you owe; it’s about paying it on time.

The system is built on the idea of "pay-as-you-go." The IRS expects their cut when you earn the money, not a year later.

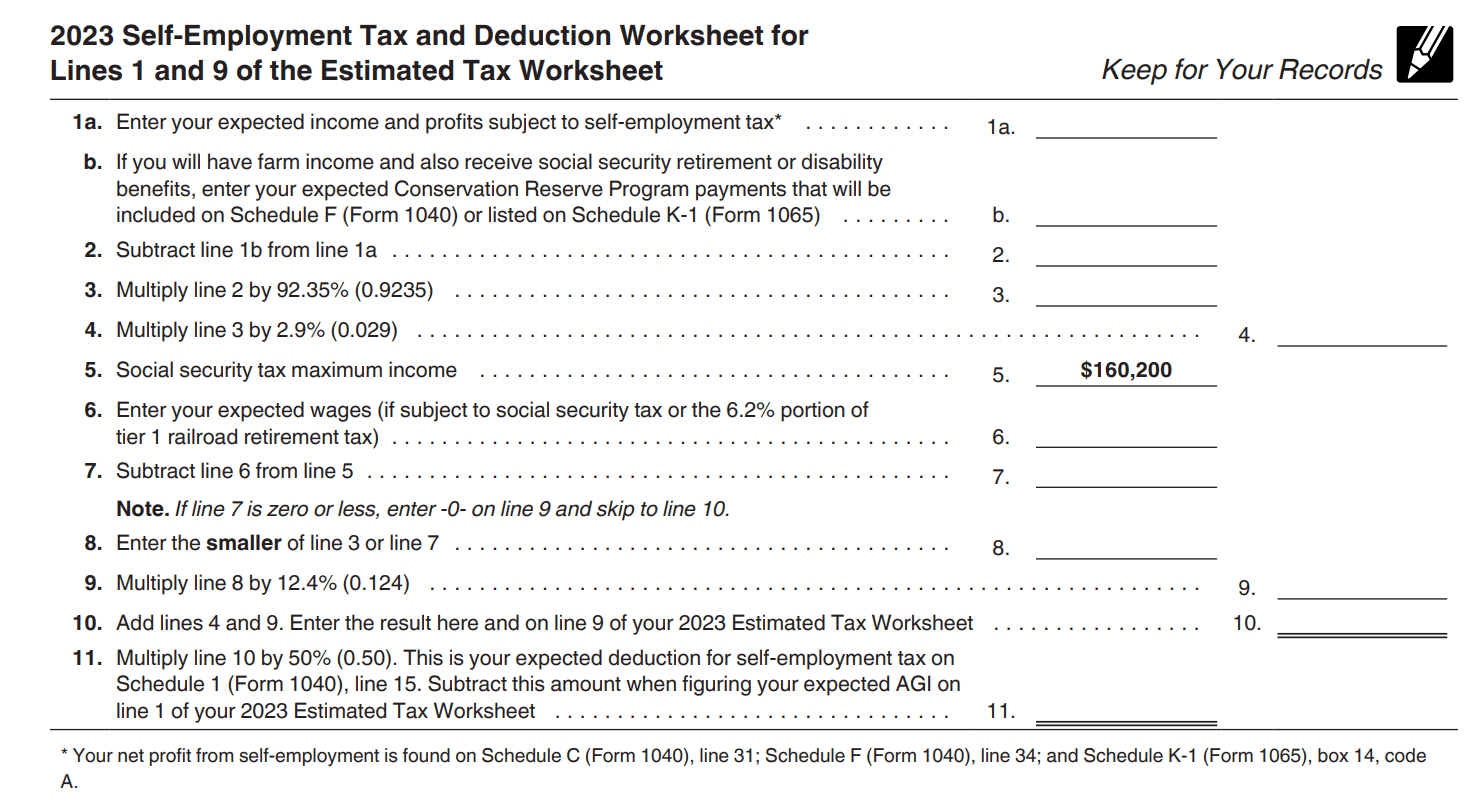

If you’re wondering how much to send, the general rule is to aim for 100% of last year's tax liability or 90% of this year's. But let's be real—calculating that to the penny is a nightmare because income fluctuates. You might have a massive Q2 and a bone-dry Q3. That’s why the online portal is a lifesaver. You can adjust your payments on the fly based on what’s actually in your bank account right now.

Direct Pay vs. EFTPS: Which One Do You Use?

There are two main ways to handle this, and people get them confused constantly.

IRS Direct Pay is the "guest checkout" version. You don’t need an account. You just go to the site, verify your identity with a previous year's tax return, and pull money directly from your checking or savings account. It’s great for one-off payments. But there’s a catch. You can’t schedule payments very far in advance, and you have to re-verify your identity every single time you use it.

Then there’s EFTPS (Electronic Federal Tax Payment System). This is the "pro" version.

EFTPS is technically for businesses, but individuals can use it too. It allows you to schedule payments up to 365 days in advance. If you know you're going to owe $2,000 every quarter, you can set it and forget it on January 1st. However, the signup process for EFTPS is notoriously slow. They actually mail you a physical PIN via the USPS. It takes five to seven business days. If it's the 14th of the month and you need to pay by the 15th, EFTPS won't help you today. You’d need Direct Pay for that.

How to Pay Fed Estimated Tax Online Without Losing Your Mind

First, grab your 1040 from last year. You’ll need it for verification.

When you land on the IRS website, select "Make a Payment." You’ll see a dropdown menu for the "Reason for Payment." This is where most people mess up. If you are paying for the current year, select Estimated Tax. Do not select "Balance Due" unless you are paying off a bill from a previous year.

Next, select the tax year. If it’s 2025, pick 2025.

The system will then ask you to verify who you are. This is the "Primary Taxpayer" check. You have to enter your name, SSN, and filing status exactly as they appeared on a specific prior-year return. If you moved recently and haven't updated your address with the IRS, use your old address—the one they have on file. If the data doesn't match perfectly, the system will lock you out. It’s frustrating. It’s clunky. But it’s better than a $500 penalty.

Why Credit Cards Are Usually a Bad Idea

You can pay with a credit card. The IRS uses third-party processors like PayUSAtax or ACI Payments.

But you’re going to pay for it.

These processors charge a convenience fee, usually around 1.8% to 2%. On a $5,000 tax bill, that’s an extra $100 just for the privilege of using your card. Unless you are "churning" a new credit card for a massive sign-up bonus that outweighs the 2% fee, it’s almost never worth it. Stick to the bank transfer (ACH). It’s free.

The Mystery of the 1040-ES Voucher

Some people still print out the 1040-ES paper vouchers. Honestly, just stop.

If you pay online, you don't need the voucher. The digital record is linked to your SSN. When you go to file your taxes at the end of the year, your tax software (or your CPA) will ask how much you paid in estimated taxes. You just give them the total. The IRS already has the record in their system, so it reconciles almost instantly.

One thing to watch out for: state taxes.

Pay fed estimated tax online only covers your federal bill. Most states have their own separate portals. If you live in a place like California or New York, you have to go to their specific Department of Revenue sites to do the same thing. Don't assume the IRS shares this money with your state. They don't.

The Deadlines You Can’t Ignore

The IRS follows a weird schedule. It’s not a perfect three-month split.

- Q1 (Jan 1 – March 31): Due April 15.

- Q2 (April 1 – May 31): Due June 15. (Yes, only two months).

- Q3 (June 1 – Aug 31): Due September 15.

- Q4 (Sept 1 – Dec 31): Due January 15 of the following year.

If the 15th falls on a weekend or a holiday, you get until the next business day.

What happens if you miss a deadline? Don't panic. Just pay as soon as you can. The penalty is calculated based on how late the payment is. If you’re three days late, the interest is negligible. If you’re three months late, it starts to sting.

Managing the Cash Flow Nightmare

The hardest part about estimated taxes isn't the website—it's having the money.

Expert accountants like those at Bench or Pilot often suggest the "percentage method." Every time a client pays you, move 25-30% of that check into a separate "Tax" savings account. Don't touch it. Don't look at it. It’s not your money; it’s the government’s money, and you’re just holding onto it for a few months.

If you find yourself short at the deadline, pay whatever you can. The IRS is much friendlier to people who pay something rather than people who pay nothing and go silent.

🔗 Read more: Whitman Associates Washington DC: What Most People Get Wrong

Technical Glitches and How to Handle Them

Sometimes the IRS website just... breaks.

It happens during peak times, like April 14th or June 15th. If the site is down, take a screenshot of the error message. This can be used as evidence to get a penalty waived if you end up being a day late.

Also, keep your confirmation number.

The moment you hit "Submit," the site will give you a confirmation number and an email receipt. Save this as a PDF. Every year, I hear stories of people who thought they paid, but the transaction was reversed by their bank, or there was a typo in the account number. Without that confirmation number, you have zero leverage to argue with an IRS agent.

Actionable Steps to Take Right Now

- Audit your income from the last three months. If you made more than you expected, increase your next estimated payment.

- Sign up for an IRS Online Account. This is different from EFTPS. It lets you see your entire payment history and any outstanding balances. It’s the best way to verify that your "pay fed estimated tax online" transactions actually cleared.

- Set calendar alerts. Don't rely on your memory. Set an alert for the 10th of April, June, September, and January so you have five days to move money around.

- Check your bank's daily transfer limits. Some small credit unions have low limits on ACH transfers. If you owe $15,000 and your bank limits you to $5,000 a day, you need to start paying a few days early.

- Download the IRS2Go app. If you’re on the move, you can actually make a Direct Pay payment through the official IRS mobile app. It’s surprisingly stable.

The goal here is to make taxes a non-event. By using the online tools, you're removing the human error of the mail system and the manual processing of the IRS. It puts you in control of your data and your cash.