You’re staring at that monthly statement. It’s huge. Honestly, it feels like you're just throwing money into a black hole where interest goes to live and your dreams of retirement go to die. Most of us just pay the minimum and move on, but then you hear about that one friend who paid off their 30-year loan in twelve. They probably used a pay mortgage early calculator to map it out, and now you’re curious. But here is the thing: most of these online tools are actually pretty deceptive because they ignore the reality of how money works over decades.

Debt is heavy. It's a weight on your shoulders every single morning.

If you plug your numbers into a basic calculator, it’ll tell you that adding an extra $200 a month will save you $50,000 in interest and shave five years off the loan. That sounds amazing. It is amazing. But a calculator is just a math machine; it doesn't know about your emergency fund, it doesn't know about the S&P 500, and it definitely doesn't know about inflation.

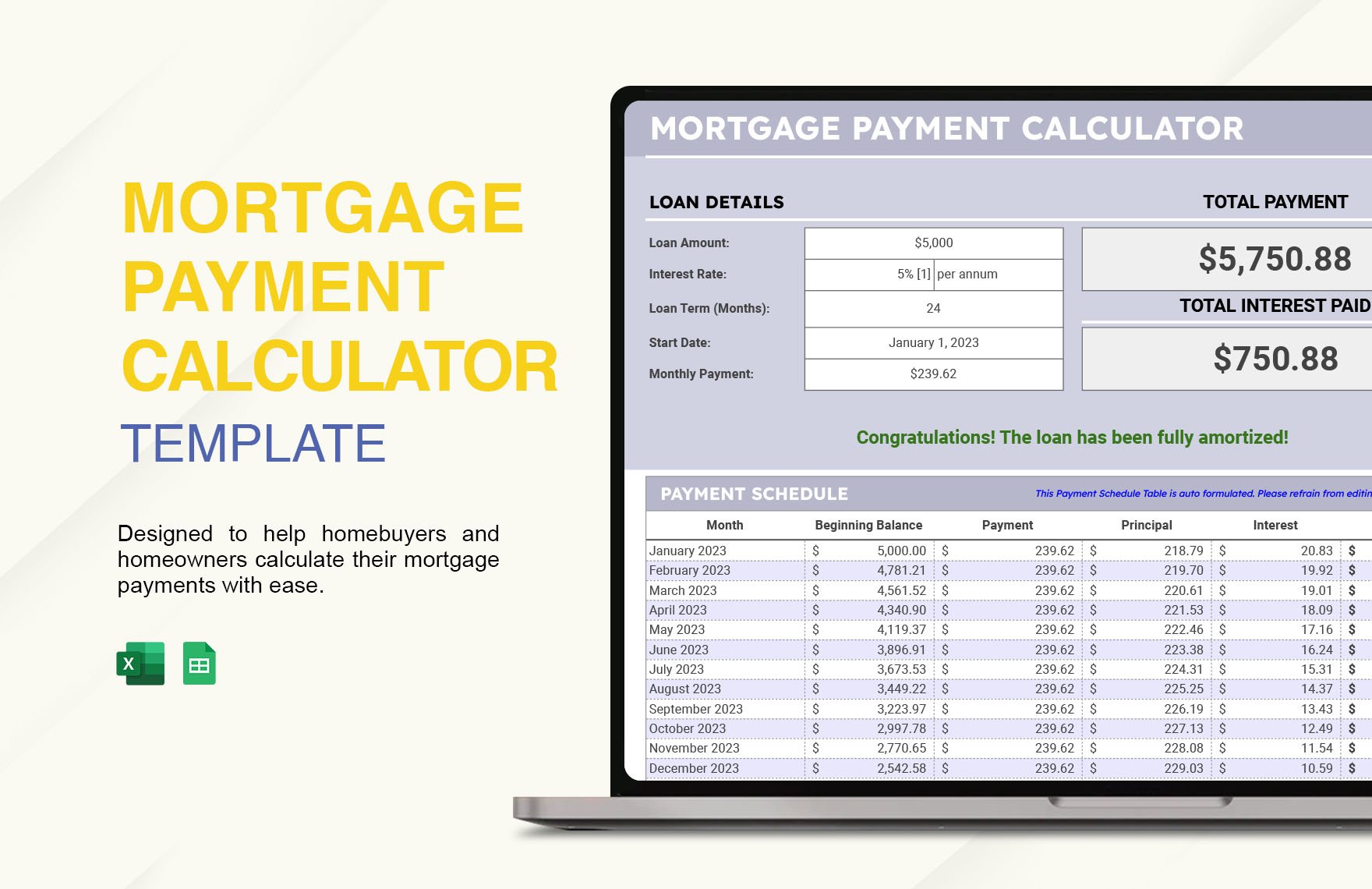

The Math Behind the Pay Mortgage Early Calculator

Most people don't realize that mortgages are front-loaded with interest. This is called amortization. In the first few years of a $400,000 loan at 6.5%, you are barely touching the principal. You’re basically just paying the bank for the privilege of standing in your own kitchen.

When you use a pay mortgage early calculator, you’re looking for the "break-even" point. The math is actually quite simple, even if the banks try to make it look like rocket science. Every extra dollar you send toward the principal today stops the compounding interest on 그 dollar for the next twenty years. It’s like a reverse investment. If your mortgage rate is 7%, every extra payment is essentially a guaranteed 7% return on your money, tax-free. You won't find that kind of "guaranteed" return in the stock market, where things swing wildly from year to year.

But there is a catch.

📖 Related: How the Money Guys Financial Order of Operations Actually Works for Your Wallet

Liquidity matters. Once you send that money to the bank, you can't get it back. If your car dies or your roof leaks, you can't tell the bank, "Hey, remember that extra $5,000 I paid last year? I need it back for a bit." They'll just laugh and tell you to apply for a Home Equity Line of Credit (HELOC), which—guess what—comes with more interest.

What the "Experts" Usually Forget to Tell You

Financial gurus like Dave Ramsey will tell you to pay off the house as fast as humanly possible. He calls it "peace of mind." On the other side, you have the math nerds and "wealth hackers" who say you're an idiot if you pay off a 3% mortgage early when you could put that money in a high-yield savings account or a brokerage account.

Both of them are kinda right. And both are kinda wrong.

The real value of a pay mortgage early calculator isn't just the final number; it's seeing how much of your life you are buying back. If the calculator says you'll be debt-free at 52 instead of 62, that’s ten years of your life where you don't have to work a job you hate just to keep a roof over your head. That’s the real metric. Not the dollars. The years.

Different Ways to Attack the Principal

You don't just have to send a random check every month. There are strategies. Some people swear by the "bi-weekly" method. Instead of one payment a month, you pay half every two weeks. Because there are 52 weeks in a year, you end up making 26 half-payments, which equals 13 full payments. It’s a psychological trick that tricks you into making one extra payment a year without feeling the sting.

Others prefer the "lump sum" approach. Maybe you get a tax refund or a bonus at work. You drop $5,000 into the pay mortgage early calculator and see the interest vanish. It’s addictive.

- The Monthly Add-On: Adding a set amount, like $100, to every payment.

- The 1/12th Rule: Take your monthly principal and interest payment, divide it by 12, and add that amount to every payment. It equals one extra payment per year.

- The "found money" strategy: Using rebates, birthday cash, or side-hustle money to chip away at the balance.

The math doesn't care which one you choose. The bank doesn't care. Only your discipline cares.

Why You Might Actually Want to Wait

Let’s get real for a second. If your mortgage rate is under 4%, you are basically borrowing money for free when you account for inflation. In 2024 and 2025, we saw inflation eat away at the value of the dollar. If your debt stays the same but the dollar is worth less, your debt is actually getting "cheaper" over time.

Also, there's the tax deduction. For many homeowners, the mortgage interest deduction is the only thing keeping them from a massive tax bill. If you pay off the mortgage, that deduction vanishes. You have to run those numbers. A pay mortgage early calculator won't show you your 1040 tax return implications.

And then there's the "Opportunity Cost." This is the big one. If you put $1,000 into your mortgage, it saves you interest at your mortgage rate. If you put that same $1,000 into a diversified index fund, it might grow at 8% or 10% over the long haul. If your mortgage is 3% and the market is 10%, you are "losing" 7% by paying off the house early.

However, you can't sleep in a brokerage account. There is a psychological safety in owning the dirt beneath your feet that a spreadsheet just can't quantify.

Surprising Facts About Mortgage Prepayment

Did you know some banks actually used to charge you a penalty for paying your mortgage off early? It's called a prepayment penalty. Most modern "qualified mortgages" don't have them, but if you have a non-conforming loan or a subprime loan, you better check the fine print before you start dumping extra cash into it. You don't want to pay a fee for the privilege of being responsible.

Another thing: Make sure you specify that the extra money goes to the principal.

If you just write a bigger check, some banks—the sneaky ones—will just apply it to your next month's "scheduled payment." That doesn't help you. It just pays your interest early. You want that money to strike the principal balance directly so the interest calculation for next month is based on a smaller number. Always check the "Apply to Principal" box on your online portal.

Real World Example: The $300,000 Scenario

Let’s look at a real-life situation. Imagine you have a $300,000 loan at 6.8%.

Your monthly payment for principal and interest is about $1,955.

Over 30 years, you will pay roughly $404,000 in interest alone. That is insane. You are buying the house more than twice.

If you use a pay mortgage early calculator and decide to add just $250 to that payment every month, you cut over 6 years off the loan. You save over $100,000 in interest. That is a hundred grand that stays in your pocket instead of the bank's executive bonus pool.

What could you do with $100,000? That's a college education. That's a fleet of reliable cars. That's a decade of world travel.

Actionable Steps to Take Right Now

Don't just read this and go back to scrolling. If you want to actually change your financial trajectory, you need a plan that isn't just "I'll pay more when I have it." Because you'll never "have it."

- Check your rate. If it’s high (above 6%), paying it down is a great "investment." If it's low (below 4%), maybe focus on your retirement accounts first.

- Read your mortgage note. Look for the words "Prepayment Penalty." If you don't see them, you're good to go.

- Automate a small amount. Don't try to pay an extra $1,000 a month immediately. Start with $50 or $100. Most people don't even notice $100 leaving their account, but the pay mortgage early calculator shows it makes a massive difference over time.

- Log into your portal. Figure out where the "Principal Only" payment button is. It's usually hidden behind a few menus because the bank isn't exactly incentivized to help you pay them less interest.

- Run your own numbers. Use a reputable calculator—Bankrate or even the basic Google one—and look at the "Amortization Schedule" before and after your extra payment. Seeing that line graph drop is the best motivation you'll ever get.

Getting out from under a mortgage is about more than just numbers. It’s about the freedom to say "no" to a boss you don't like or the ability to take a risk on a new business. It's the ultimate insurance policy. Just make sure you're doing it for the right reasons and not just because a math tool told you it was a good idea. Take a look at your total financial picture, including high-interest credit card debt or car loans, which should almost always be paid off before you even think about touching the mortgage. Once those are gone, then it's time to take aim at the big house debt.