You just ripped open that blue-and-white envelope. There it is—the plastic ticket to your PayPal balance. But it's just a piece of plastic until you actually handle the paypal debit card activate process. It should be a thirty-second task. Sometimes it is. Other times, you’re staring at an error message on your phone at 11:00 PM wondering why a multi-billion dollar fintech company is making your life difficult.

I’ve been there. Honestly, most people expect the card to just "work" because their digital account is already active. It doesn’t. You have to bridge that gap between the digital wallet and the physical world.

The Reality of Getting Your Card Online

Let’s get the basics out of the way. You can't just walk into a CVS and buy a pack of gum the second you get the mail. You have to tell PayPal you actually received the card. This is a security thing. If someone swiped your mail, you wouldn't want them buying a PS5 on your dime.

There are two main ways to do this. Most people grab their phone.

💡 You might also like: Rounding Calculator Nearest Cent: How to Stop Getting Your Change Wrong

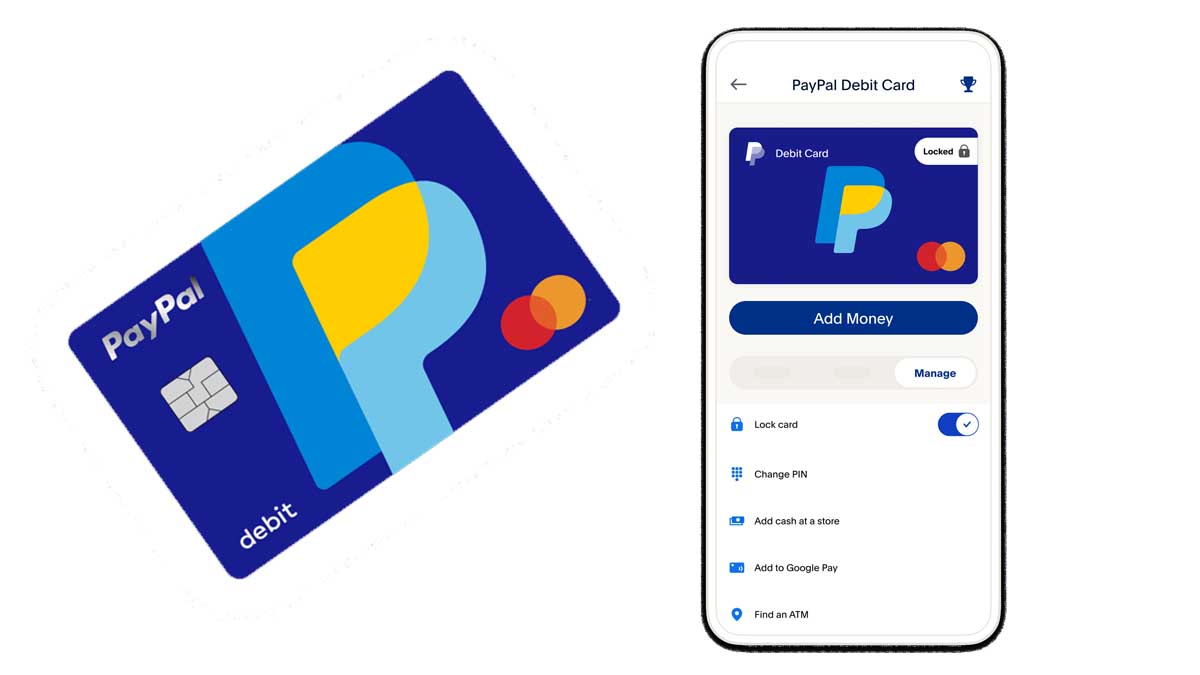

Open the app. You'll usually see a prompt right on the home screen that says "Ready to use your card?" If you don't see that, don't panic. Tap on the "Wallet" icon. It’s usually tucked away at the bottom right. Find the card image that looks like the one in your hand. There should be an "Activate" button. Tap it. They might ask for the expiration date or the CVV—that three-digit code on the back that everyone forgets exists until they need it.

What if the app is glitching?

It happens. Apps crash. Cache gets bloated. If the app is being stubborn, just go to the website. Use a laptop. It’s often more stable. Go to paypal.com/activate. You’ll have to log in, obviously. Once you’re in, it’s a straightforward form.

Sometimes, PayPal asks you to set a PIN during this stage. Do not use 1234. Don't use your birthday. Pick something you'll remember but that isn't printed on your driver's license.

Why Your PayPal Debit Card Activate Attempt Might Fail

You’ve tried the app. You’ve tried the site. It’s still not working. Why?

Usually, it’s a verification issue. PayPal is notorious for being "extra" about identity. If you haven't fully confirmed your SSN or your home address in your main account settings, the card activation will hang in limbo. It’s annoying. They won't always tell you why it's failing; they’ll just give you a generic "Something went wrong" message.

Check your notifications. Are there any "Action Required" banners?

Another sneaky reason: your account is limited. Maybe you received a weirdly large transfer recently, or you logged in from a VPN in a different country. PayPal’s fraud bots are twitchy. If your account has a "limitation," you can’t activate new products until you resolve the "Center of Excellence" tickets (that's just fancy talk for their compliance department).

The "Old School" Phone Method

If you're tired of clicking buttons, there is a phone number. It’s usually printed on a sticker right on the front of the card. Use it.

Calling 1-800-313-5100 is the direct line for PayPal Business Debit cards. If you have the personal "PayPal Cash" card, look at the paperwork in the envelope. The automated system is actually pretty fast. You’ll punch in your card number, verify your identity, and a robot voice will tell you you're good to go. Done.

Business vs. Personal: Does it Matter?

Yes. It matters a lot.

The paypal debit card activate steps for a Business Mastercard are slightly more rigorous. PayPal wants to make sure you’re actually a business. If you signed up as a "Sole Proprietorship" but haven't provided a tax ID, they might put a temporary hold on the card activation.

Personal cards (the PayPal Cashback or the standard Debit) are usually smoother. But here’s a tip: if you have the Business card, you get 1% cash back on "non-PIN" purchases. That means when you’re at the store, don't put in your PIN. Choose "Credit." It still comes out of your PayPal balance, but you get a little kickback. Personal cards don't always offer this.

Common Mistakes People Make

- Waiting too long: If you don't activate the card within a few months, PayPal might void it. Then you have to order a new one. Total waste of time.

- Forgetting the "Backup" Source: Even after you activate, the card needs money. If your PayPal balance is zero, it’ll decline unless you have a backup bank account linked.

- Ignoring the App Update: If your PayPal app is three versions old, the activation toggle might literally be missing. Update your apps, people.

Deep Nuance: The "Shadow" Verification

There is something experts call "shadow verification." Essentially, PayPal tracks the device you use to activate the card. If you try to activate your card on a friend's phone or a public library computer, the system might flag it as "High Risk."

Always activate on your own device, on your own home Wi-Fi. It sounds paranoid, but PayPal’s risk algorithms are some of the most aggressive in the world. They see everything.

Beyond the Activation

Once the card is live, you aren't quite finished. You should immediately hop into the settings and toggle your "Automatic Top-Up" preferences.

Basically, if you’re at a restaurant and the bill is $50 but you only have $40 in PayPal, do you want the card to decline? Or do you want PayPal to instantly pull that extra $10 from your linked Wells Fargo or Chase account? Most people prefer the top-up. It saves you from the embarrassment of a declined card while you're trying to impress a date.

Is it actually a Debit Card?

Technically, yes. It’s a debit card. But in the eyes of many merchants, it processes as a Mastercard. This is great because it means it’s accepted almost everywhere. However, some car rental companies are still weird about "prepaid" or "fintech" cards. They might see the PayPal logo and ask for a "real" credit card for the deposit. Just a heads-up.

Actionable Steps to Take Right Now

- Check the Envelope: Look for the specific activation URL or phone number provided. Don't just Google "PayPal activation" and click the first ad—scammers love making fake login pages.

- Log in to the Web Portal: If the mobile app fails twice, stop. Don't keep trying and lock yourself out. Move to a desktop browser.

- Confirm Your Identity: Go to your PayPal "Settings" and then "Account Settings." Ensure your "Confirmed" status is green across the board for your email and phone number.

- Set Your Backup: In the "Wallet" section, link a secondary bank account. This ensures your newly activated card doesn't fail the first time you use it just because your balance is low.

- Test with a Small Purchase: Go to a gas station or a grocery store. Buy a soda. If it works, you're golden. If it doesn't, you know you need to call the number on the back of the card immediately while you're still in "setup mode."

Activation is the boring part. Once it's done, you actually have real-time access to your digital money, which is the whole point. Just get through the digital red tape first.