Honestly, if you looked at the headlines back in late 2024, you probably saw a lot of "mission accomplished" vibes regarding the economy. But when the Bureau of Economic Analysis dropped the data for PCE inflation October 2024, the mood in the room shifted. It wasn’t a disaster. It wasn’t a 1970s-style blowout. It was just... stubborn.

The numbers came in exactly where the pros expected, but that’s actually the problem. Prices rose 2.3% over the previous year. That’s a jump from the 2.1% we saw in September. When the "Fed’s favorite inflation gauge" starts ticking up instead of down, people get twitchy.

It’s easy to get lost in the weeds with this stuff. You’ve got "headline" inflation and then you’ve got "core" inflation. They’re like two different siblings. One is volatile and reacts to every gas station price change, while the other—the core—is the steady, grumpy one that reflects the actual cost of living. In October 2024, that core PCE, which ignores the roller coaster of food and energy, held steady at 2.8% annually.

Think about that for a second.

We are trying to get to 2%. We’ve been trying to get to 2% for what feels like an eternity. Seeing that number refuse to budge from 2.8% is like trying to lose those last five pounds; the first twenty were easy, but this last bit is a nightmare.

What Actually Drove the PCE Inflation October 2024 Numbers?

Prices didn't just go up because of some vague "economic ghost." It was specific stuff. If you paid rent or a mortgage in October, you felt it. Services are the real culprit here. While the price of "stuff"—like TVs or clothes—has actually been falling (we call that deflation, and it's a rare win for your wallet), the price of doing things and living places is still climbing.

Health care got more expensive. Portfolio management fees went up because the stock market was ripping. Even taxes and various "other services" saw bumps. It’s this weird tug-of-war. You’re paying less for a toaster but way more to insure your car.

Housing is the elephant in the room. It’s a lagging indicator, meaning it takes forever for the real-world reality of leases to show up in the government’s spreadsheets. The BEA data showed housing and utilities were major contributors to that 0.2% monthly increase. Jerome Powell, the Fed Chair, has been talking about this for months. He basically told us that the "disinflationary path" would be bumpy. He wasn't lying.

The Personal Income Paradox

Here is the part that gets weird. Americans were actually making more money in October 2024. Personal income increased by $51.6 billion, or 0.2%. You’d think that’s great news, right? Well, it is, until you realize that if everyone has more money to spend, businesses keep their prices high because they know we’ll pay them.

Consumer spending—the engine of the entire US economy—rose 0.4% in October. We aren't stopping. We are buying cars, we are going to dinner, and we are paying for streaming services. This spending is exactly what keeps the PCE inflation October 2024 numbers from falling as fast as the Fed wants. If we don't stop spending, the heat stays in the system.

Why the Fed is Stuck Between a Rock and a Hard Place

The Federal Reserve has a dual mandate: keep people employed and keep prices stable. Usually, these two things fight each other. In October 2024, the labor market was still looking pretty solid, which gives the Fed permission to keep interest rates higher for longer.

Before this data came out, everyone was betting on a series of aggressive rate cuts. After the 2.3% headline figure hit the wires, those bets started to look a bit shaky. If the Fed cuts rates too fast, they risk reigniting the inflation fire. If they wait too long, they might break the job market.

It’s a high-stakes game of chicken.

The "sticky" nature of the 2.8% core PCE is the biggest red flag. It suggests that inflation isn't just a leftover side effect of the pandemic supply chain mess anymore. It’s baked into the service economy. When your barber raises his prices because his rent went up, and his landlord raised the rent because property taxes went up... that’s a cycle that is hard to break with just interest rate tweaks.

What the Experts Are Saying (And Where They Disagree)

Not everyone is panicking. Some economists, like those at Goldman Sachs, have pointed out that the "base effects" were always going to make October look a bit higher. Basically, we were comparing October 2024 to a particularly low month in 2023, which makes the year-over-year jump look worse than it really is.

✨ Don't miss: Trump Banning Tesla Production: What Most People Get Wrong

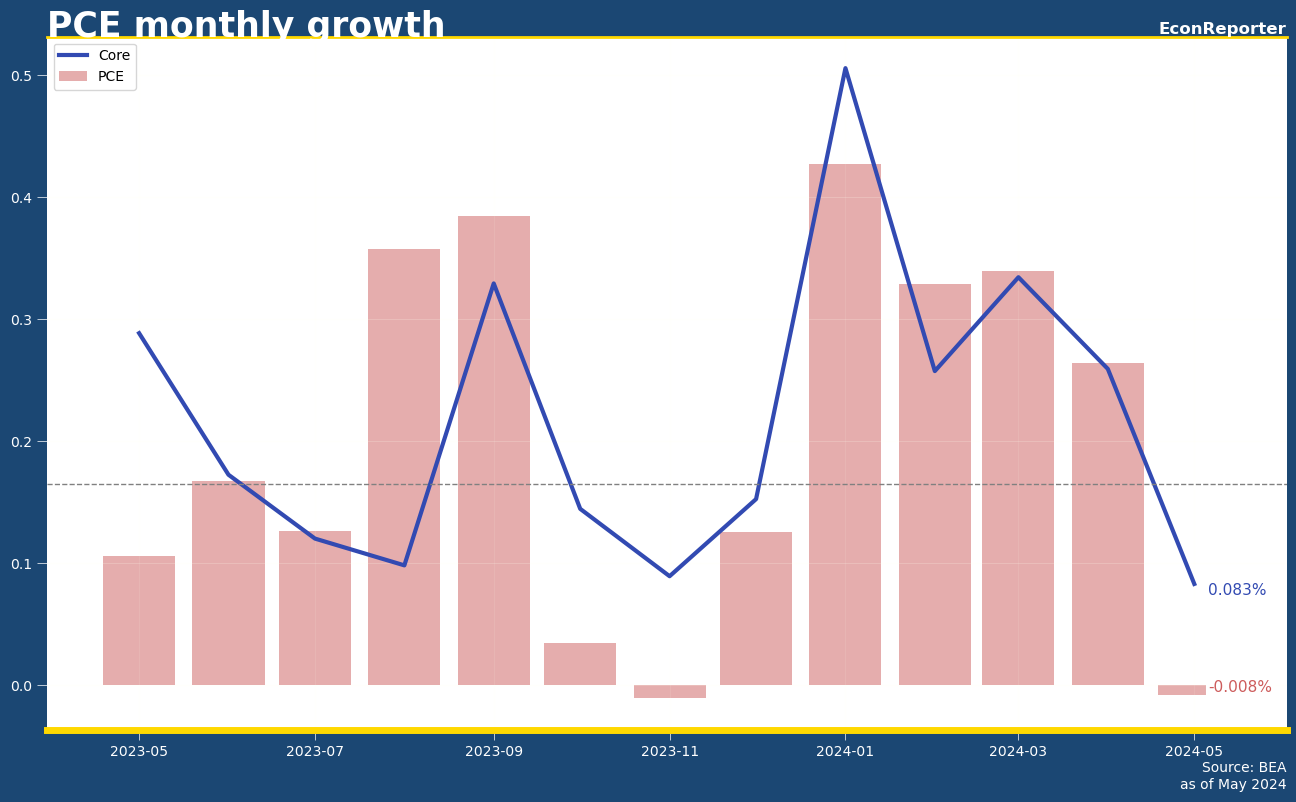

On the other side, you’ve got the hawks. They look at the 0.3% monthly increase in core PCE and see a trend that isn't moving toward the 2% goal. They argue that the Fed should pause rate cuts entirely until we see a "2" at the start of that core inflation number.

There is also the "supercore" inflation metric—which is services minus energy and housing. This is what the Fed watches to see if wages are pushing up prices. In October, this remained uncomfortably firm. It’s the kind of data that makes a central banker want to reach for a bottle of Tums.

Real World Impact: Your Wallet vs. The Data

Numbers are fine, but what does this actually look like for you?

If you were car shopping in October 2024, you might have seen some slight relief in used car prices, which had been cooling off. But if you were renewing your home insurance or taking your cat to the vet, you likely felt the 3.9% year-over-year increase in services.

- Energy was a bright spot. Gas prices were down compared to the previous year, which acted as a massive weight pulling down the headline number. Without that drop in energy, the PCE inflation October 2024 report would have looked much grimmer.

- Food prices are stabilizing. They aren't going down—don't get your hopes up—but they are rising at a much slower pace than they were in 2022 and 2023. A 0.1% monthly increase in food is almost "normal."

- The Savings Rate. This is a sneaky-important stat from the report. The personal saving rate was 2.3%. That is historically very low. It means Americans are dipping into their reserves or leaning on credit cards to keep up their spending habits. That can’t last forever.

How to Navigate This Sticky Economy

We are in a "sideways" period. The easy wins against inflation are over. Now we’re in the grind. Understanding that the PCE inflation October 2024 data signals a plateau is key for your own financial planning.

Don't count on massive interest rate drops. If you were waiting for mortgage rates to hit 4% again before buying a home, you might be waiting a long time. The Fed is in no rush to slash rates while core inflation is sitting at 2.8%.

Audit your service subscriptions. Since service inflation is the stickiest part of the economy, this is where you're getting "nickeled and dimed." From Netflix to your gym membership to that cloud storage you forgot about, these are the categories where prices are quietly creeping up.

Watch the labor market. As long as the PCE stays above 2%, the Fed will be okay with the "higher for longer" strategy—as long as people have jobs. If unemployment starts to spike, the Fed will pivot, regardless of what the inflation data says. Keep an eye on the monthly jobs reports; they are the other half of this puzzle.

Lock in high-yield rates while you can. While the Fed might slow down its cuts, they are still generally on a downward path over the next 18 months. If you have cash in a high-yield savings account or a CD, those 4.5% or 5% rates won't stay forever.

The big takeaway from the October data is that the "last mile" of the inflation fight is going to be the hardest. It’s not a straight line down to 2%. It’s a zig-zag. And right now, we’re on a "zig."

Actionable Next Steps

- Re-evaluate your debt strategy. With inflation staying sticky, the Fed won't be dropping rates as fast as people hoped. If you have variable-interest debt, consider options to lock in a fixed rate now.

- Focus on "service" costs in your budget. Since service inflation is the primary driver right now, negotiate your internet bills, insurance premiums, and other recurring service costs. These are the areas most likely to see price hikes.

- Adjust your investment expectations. The market often reacts poorly to "sticky" inflation because it means the Fed stays aggressive. Ensure your portfolio isn't overly leveraged on the assumption of rapid rate cuts.