Tax season usually brings to mind stacks of W-2s and the dread of income tax, but there is a quieter, more annoying cousin that creeps into your mailbox every year. I’m talking about personal property tax by state, that confusing bill you get for things you already bought and paid for. Honestly, it feels a bit like the government is double-dipping. You bought the car, paid the sales tax, and now you have to pay every year just for the privilege of letting it sit in your driveway? Sorta.

Most people use the terms "property tax" and "real estate tax" like they’re the same thing. They aren't. Real estate tax is about your house or the dirt it sits on. Personal property tax is about the "movable" stuff—your car, your boat, or if you're a business owner, your desks and laptops.

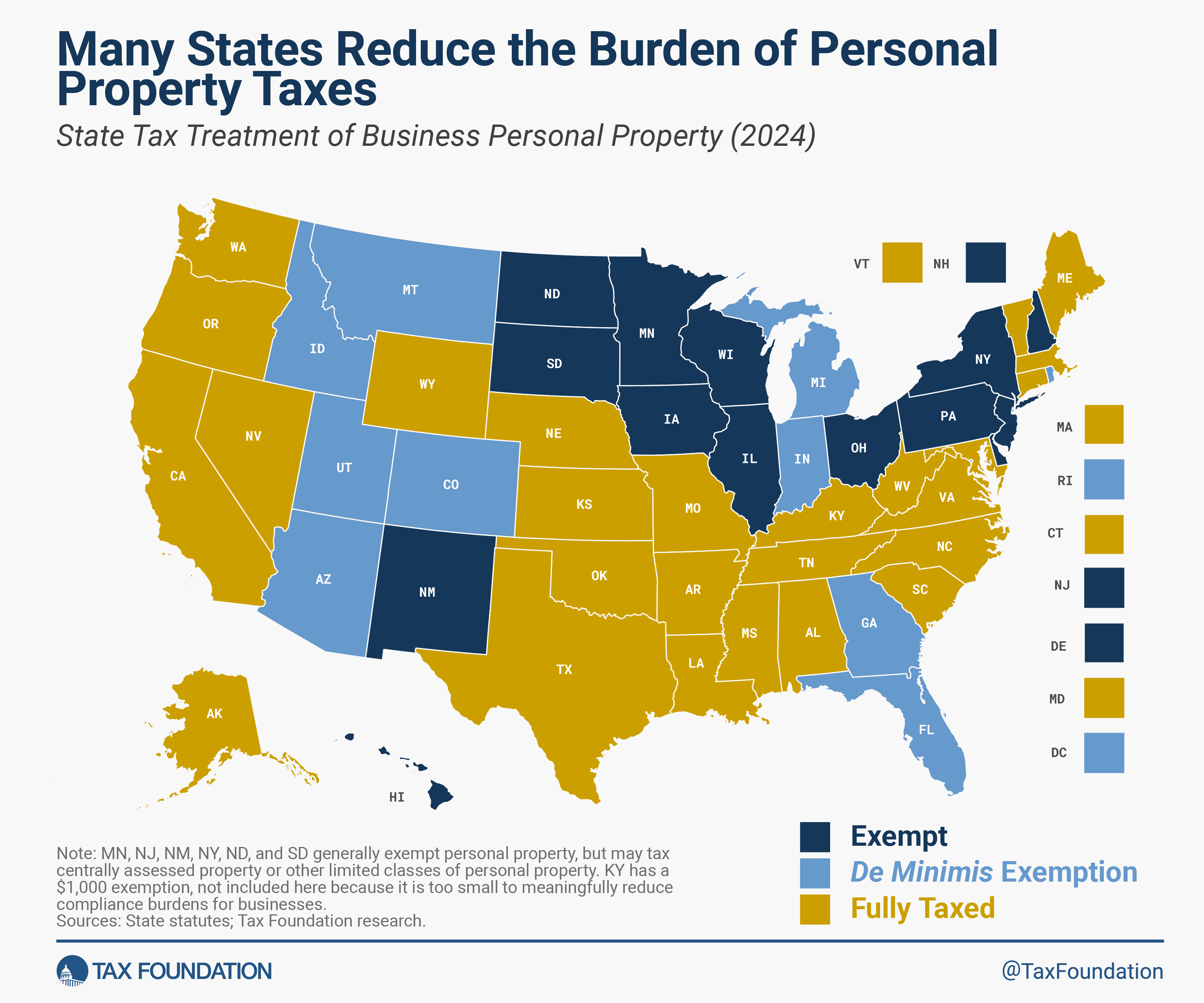

The weirdest part? Where you live changes everything. In some states, you’ll pay a fortune to own a late-model truck. In others, the tax man doesn't care if you have a fleet of yachts.

The Massive Gap in Personal Property Tax by State

It is wild how much your zip code dictates your net worth. If you live in a place like Virginia, you’re probably used to the annual "car tax" sting. Virginia consistently ranks as one of the most expensive states for vehicle owners because they tax cars as personal property at the local level.

On the flip side, states like Delaware or New Hampshire basically ignore your car. They don't have a statewide personal property tax on vehicles. You might pay a small registration fee, but you won't get a $1,000 bill every December just because you drive a nice SUV.

Why the difference is so huge

States have to get their money from somewhere. It’s a balancing act. If a state has no income tax (think Florida or Texas), they usually hammer you on real estate taxes or sales taxes. But personal property tax is often a local game. It funds the very specific things you see every day:

- Local school bus routes.

- The library down the street.

- Police and fire department salaries.

- Filling those annoying potholes on Main Street.

In 2026, we are seeing a strange shift. Some states are actually trying to back away from these taxes because they’re a nightmare to track. I mean, think about it. The government has to know exactly what you own and what it’s worth today. That’s a lot of paperwork.

Business Personal Property: The Entrepreneur's Headache

If you think personal taxes are bad, ask a small business owner. Business personal property tax is a different beast entirely. It covers "tangible" assets. Basically, if you could pick up your office, turn it upside down, and shake it, everything that falls out is probably taxable.

✨ Don't miss: tsmc stock price today per share: What Most People Get Wrong

We’re talking:

- Computers and servers.

- Furniture (even that uncomfortable lobby chair).

- Heavy machinery.

- Inventory (in some states, though many are phasing this out).

Indiana recently made a massive move here. Starting in January 2026, they’ve significantly bumped up their "de minimis" exemption. If your business equipment is worth less than $2 million in a single county, you might not owe a dime in personal property tax. That is a huge jump from the old $80,000 limit. It’s a clear signal that the state wants to attract more tech and manufacturing by lowering the "entry fee" for owning equipment.

Texas is also playing ball. They recently increased their exemption for income-producing tangible personal property to $125,000 per taxing unit. It’s a win for the little guy.

The Car Tax Trap

For most of us, "personal property tax" means one thing: the car.

There are about 27 states that charge some form of annual tax on vehicles. Some call it an "excise tax," others call it a "property tax," and some just hide it in the registration fees.

Take Mississippi. It’s often cited as one of the most expensive states to register a car because the "ad valorem" (according to value) tax is bundled right in. You go to get your tags, and suddenly you’re out $600. Meanwhile, in Oregon, you pay a flat fee every couple of years and go about your business.

How they figure out what you owe

It isn't a guess. Assessors usually use a "blue book" value or a percentage of the original MSRP. Then they apply a mill rate.

A mill rate is just a fancy way of saying "tax per $1,000 of value." If your car is worth $20,000 and the mill rate is 20, you’re looking at a $400 bill.

But wait. Your car loses value every year, right? Most states have a depreciation schedule. They assume your car is worth less every year until it hits a "floor"—a minimum value they’ll tax you on forever, even if the car is a rusted-out bucket.

States That Are Surprisingly Cheap (and Ones That Aren't)

You’d think the "tax-friendly" states would be the winners here, but it’s not always true.

Montana is a legend for having no sales tax, which makes it a haven for people buying high-end RVs and supercars. You’ll often see Montana plates on Ferraris in California. Why? Because California’s personal property and sales taxes are aggressive, while Montana is... well, not.

📖 Related: Qué precio tiene el dólar a México: Lo que nadie te explica sobre el tipo de cambio hoy

However, 2026 is bringing changes to Montana’s property tax structure. While they’re focusing more on real estate (distinguishing between primary homes and short-term rentals), the overall tax vibe in the state is shifting toward protecting permanent residents.

The "No-Tax" States

If you truly hate personal property tax, look at these spots:

- Delaware: No state or local personal property tax. Period.

- New Hampshire: They don't tax "movable" personal property.

- Hawaii: They focus on real estate, leaving your personal stuff alone.

- New York: Believe it or not, despite the high income tax, they don't have a personal property tax on individuals.

What Most People Get Wrong About Exemptions

You don't always have to pay the full sticker price on your tax bill.

Most states have "homestead" exemptions, but those usually apply to real estate. For personal property, the exemptions are more specific. Many states offer breaks for:

- Veterans and Disabled Veterans: Some states, like South Carolina, offer a total exemption on one or two vehicles for 100% disabled veterans.

- Seniors: Once you hit 65, some jurisdictions freeze your rates or give you a flat discount.

- Farm Equipment: If you're using that tractor to actually make food, many states (like Iowa or Kansas) will give you a pass.

It is honestly worth a 10-minute call to your county assessor’s office. They won't volunteer the information, but if you ask about "personal property exemptions," you might find out you've been overpaying for years.

How to Prepare for 2026

The trend for 2026 is automation and transparency. More states are moving their tax filings online and using automated data from the DMV to send you a bill before you even realize your registration is due.

If you’re moving across state lines, don't just look at the income tax. That’s a rookie mistake. A state with 0% income tax might take $2,000 a year from you in car taxes and "service fees."

Practical Next Steps:

- Check the "Situs": Tax is usually based on where the property is kept, not where you live. If you keep your boat at a marina in a different county, you might owe that county’s rate instead.

- Audit Your Business Assets: If you’re in Indiana or Texas, check those new 2026 exemption thresholds. You might not need to pay that equipment tax this year.

- Appeal Your Value: If the county thinks your 2022 Ford F-150 is worth $40,000 but it has 150,000 miles and a dented tailgate, you can appeal. You usually have a 30-day window after receiving your assessment to prove the "fair market value" is lower.

Personal property tax isn't going away, but it is changing. Staying on top of which states are raising exemptions—and which ones are getting more aggressive with local mill rates—is the only way to keep your money in your pocket.