Honestly, the whole idea of "saving for retirement" feels like a distant dream when you’re staring at a mountain of bills or a sudden medical emergency. You know that money is sitting there in your EPF account. It’s yours. But the thought of navigating the government's digital maze to actually get it? That's enough to give anyone a headache.

Wait. It’s actually gotten a lot better lately.

The EPFO (Employees' Provident Fund Organisation) has spent the last couple of years, especially leading into 2026, overhauling their systems. They finally realized that if you can order a pizza in ten minutes, you shouldn't have to wait three months to access your own salary deductions. But here’s the kicker: even with the new "auto-settlement" features, thousands of claims still get rejected every single day. Why? Usually, it's a tiny typo or a missed checkbox that a human would ignore but a computer hates.

📖 Related: California Take Home Pay Calculator: What Most People Get Wrong

If you’re trying to figure out the pf amount withdraw online process without losing your mind, you need to know exactly what the system is looking for before you hit that submit button.

The 2026 Reality: Can You Actually Get 100% of Your Money?

There’s a massive misconception that once you quit a job, you can just "cash out" everything immediately. That’s not quite how it works. The EPFO is like that one protective aunt who doesn't want you spending your inheritance on a whim.

If you’ve been unemployed for one month, you can generally pull out 75% of your total balance. That’s the "safety net" rule. To get the remaining 25%, you have to wait until you’ve been out of work for at least two full months. This is to ensure you don't accidentally drain your retirement fund if you find a new job quickly.

However, the rules shifted slightly in late 2025. Now, in 2026, if you’ve completed at least 12 months of continuous service, the eligibility for full settlement has been liberalized for certain "Special Circumstances." But for the average person switching jobs, that two-month gap remains the golden rule for a 100% withdrawal.

What about those "Advances"?

You don't always have to quit to get your money. Partial withdrawals—now often called "Advances"—are basically interest-free loans from yourself.

💡 You might also like: Procter and Gamble Kansas City: Why This Massive Factory Is Still the Lifeblood of the Midwest

- Medical Emergencies: No minimum service required. If you or a family member is sick, you can pull out up to 6 months of basic wages plus DA.

- Marriage: You need 7 years of service. You can take 50% of your contribution (not the employer's part) for your wedding or a sibling's.

- Home Purchase: This is the big one. After 5 years, you can withdraw up to 90% of the total corpus.

- Education: 7 years of service gets you 50% for your kids' post-matric studies.

The Checklist Nobody Tells You About

Before you even log into the Unified Portal, you have to be "system-ready." If these three things aren't green, don't bother applying. You'll just get a rejection notification in ten days.

- UAN Activation: Your Universal Account Number must be active. If you just have the number but never set a password, do that first.

- The Aadhaar Link: This is the bridge. Your name on your Aadhaar MUST match the name in the EPF records exactly. If your Aadhaar says "Rajesh Kumar" and the PF portal says "Rajesh K," the system will reject your claim automatically.

- Bank Verification: You need your bank account seeded and verified by your employer. Also, the IFSC code needs to be current. Banks merge all the time, and old IFSC codes are a common reason for failed transfers.

Step-by-Step: How to Pull the Trigger Online

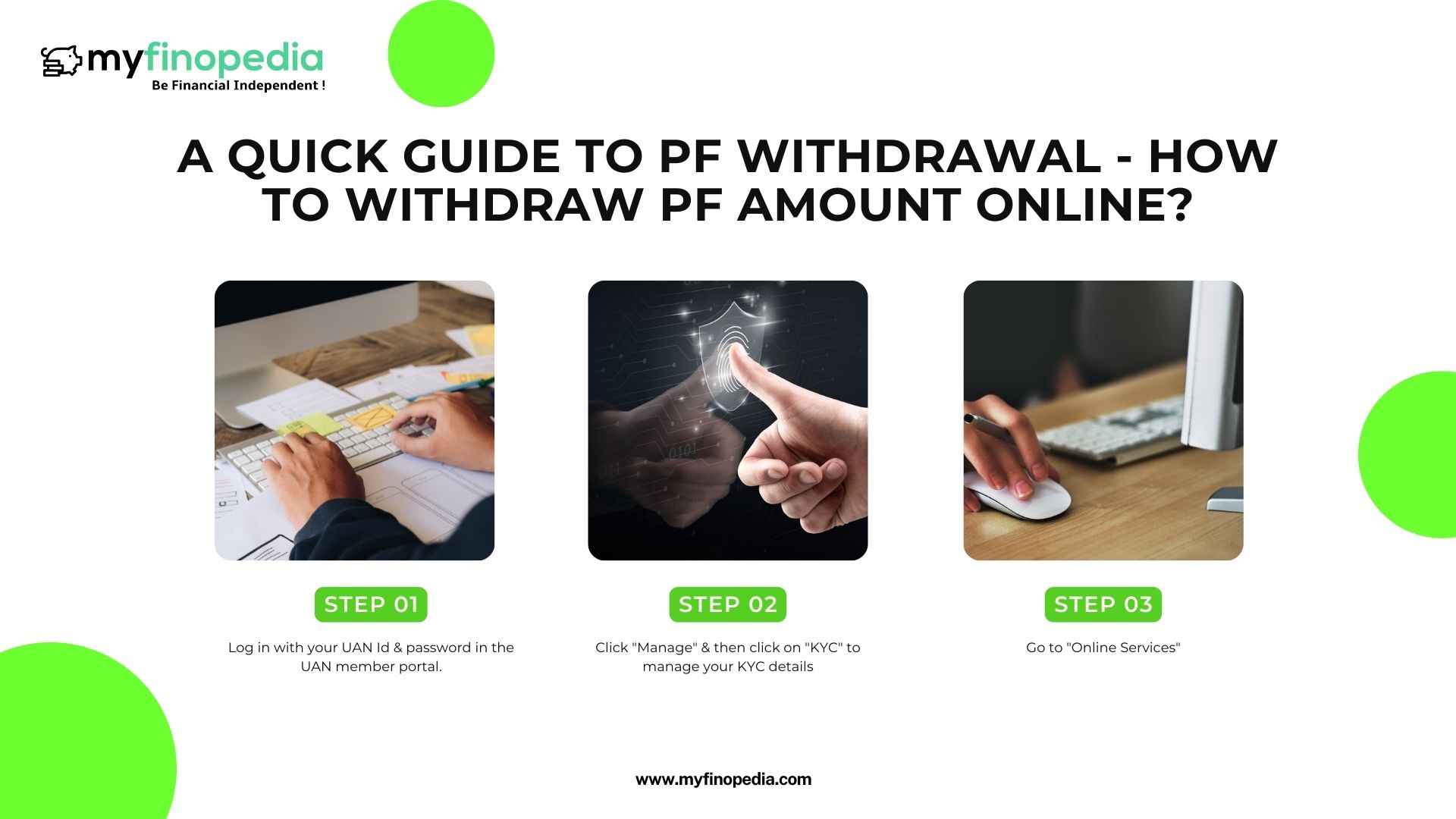

Okay, let's say your KYC is perfect. Everything is linked. Here is how the pf amount withdraw online process actually flows on the portal.

First, head over to the EPFO Member Portal. You’ll need your UAN, password, and you’ll have to solve a captcha that always seems to be slightly harder than it needs to be. Once you're in, look at the top menu and find 'Online Services.'

Select 'Claim (Form-31, 19, 10C & 10D).' The screen will show your details. It’ll ask you to verify your bank account by entering the last four digits of your account number. Click 'Verify' and then 'Yes' to the certificate of undertaking.

Now, look for the section: "I want to apply for." This is where people trip up.

- Form 31 is for an Advance (while you're still working).

- Form 19 is for the Full Settlement (after you've left and the 2-month period has passed).

- Form 10C is for the Pension withdrawal.

If you are doing a full withdrawal, you usually have to submit Form 19 AND Form 10C separately. Do not forget the pension part!

The "Scanned Cheque" Trap

The portal will ask you to upload a scanned copy of a cancelled cheque or your bank passbook. Make sure the image is clear. The bank account number and the IFSC code must be visible. If it's blurry, a human at the regional office will reject it just to be safe.

Once you’ve filled in your address and uploaded the docs, click 'Get Aadhaar OTP.' Enter the code sent to your phone, and you’re done. You’ll get a Claim Reference Number (CRN). Keep that. You’ll need it to track the status later.

Taxes: The Sting in the Tail

Nobody likes the taxman, but he’s definitely watching your EPF.

💡 You might also like: Who is the Secretary of Commerce? Why the Head of the Commerce Department Actually Matters to Your Wallet

If you withdraw your money before completing 5 years of continuous service, it is taxable. There are a few exceptions, like medical emergencies or the company shutting down, but generally, 5 years is the magic number for tax-free money.

If your withdrawal is over ₹50,000 and you haven't hit that 5-year mark, you must submit Form 15G or 15H along with your PAN. If you don't, they will slice off 34.608% in TDS (Tax Deducted at Source). That's a massive chunk of your savings gone just because you forgot one form.

If you have your PAN linked but don't submit 15G, they still take 10%. Just be smart and complete the 5-year cycle if you can.

Why Your Claim is Taking Forever

Usually, a claim is settled in 7 to 10 working days. If you’re lucky and the "Auto-claim" bot picks it up, it could be 3 days. But if it’s been 20 days and the status still says 'Under Process,' something is wrong.

Often, it’s because your employer hasn't updated your 'Date of Exit.' You can actually do this yourself now under the 'Manage' tab, provided you haven't worked for that company for at least two months.

Another reason? The signature on your uploaded cheque doesn't match the system, or your bank hasn't "approved" the KYC on their end.

If it's stuck for more than 25 days, don't just sit there. Use the EPFiGMS (Grievance Management System). It’s surprisingly effective. You file a complaint with your CRN, and a real human usually has to respond within a few days.

Moving Forward: Actionable Steps

Stop guessing and start clicking. Here is what you should do right now:

- Audit your KYC tonight: Log in and check if your Aadhaar and Bank status say "Verified." If they don't, trigger the update immediately.

- Check the 'Mark of Exit': If you’ve left your job and it’s been 60 days, ensure that date is recorded. Without it, Form 19 won't even appear in your dropdown menu.

- Verify your IFSC: If your bank was part of a merger (like many Indian banks recently), ensure your UAN has the new IFSC.

- Prepare Form 15G: If you're withdrawing more than ₹50k and haven't finished 5 years, download that form and have it ready to upload.

PF money isn't just a number on a screen; it's your safety net. Getting it out shouldn't feel like a second job. Double-check your details, stay patient with the portal, and you'll see that "Claim Settled" status sooner than you think.