Waiting for a paper check feels like living in the 1990s. It sucks. Honestly, if you're still walking into a branch to hand over a physical piece of paper just to get your own money, you're burning time you'll never get back. Setting up a PNC Bank direct deposit form is supposed to be the "easy" button for your finances, but banks have a weird way of making simple things feel like a chore. You've got routing numbers that don't match what’s on your app, different account types, and that nagging fear that your paycheck might just vanish into the digital ether if you typo a single digit.

It happens. People mess this up all the time.

✨ Don't miss: Average Pay in Houston Texas: What Most People Get Wrong

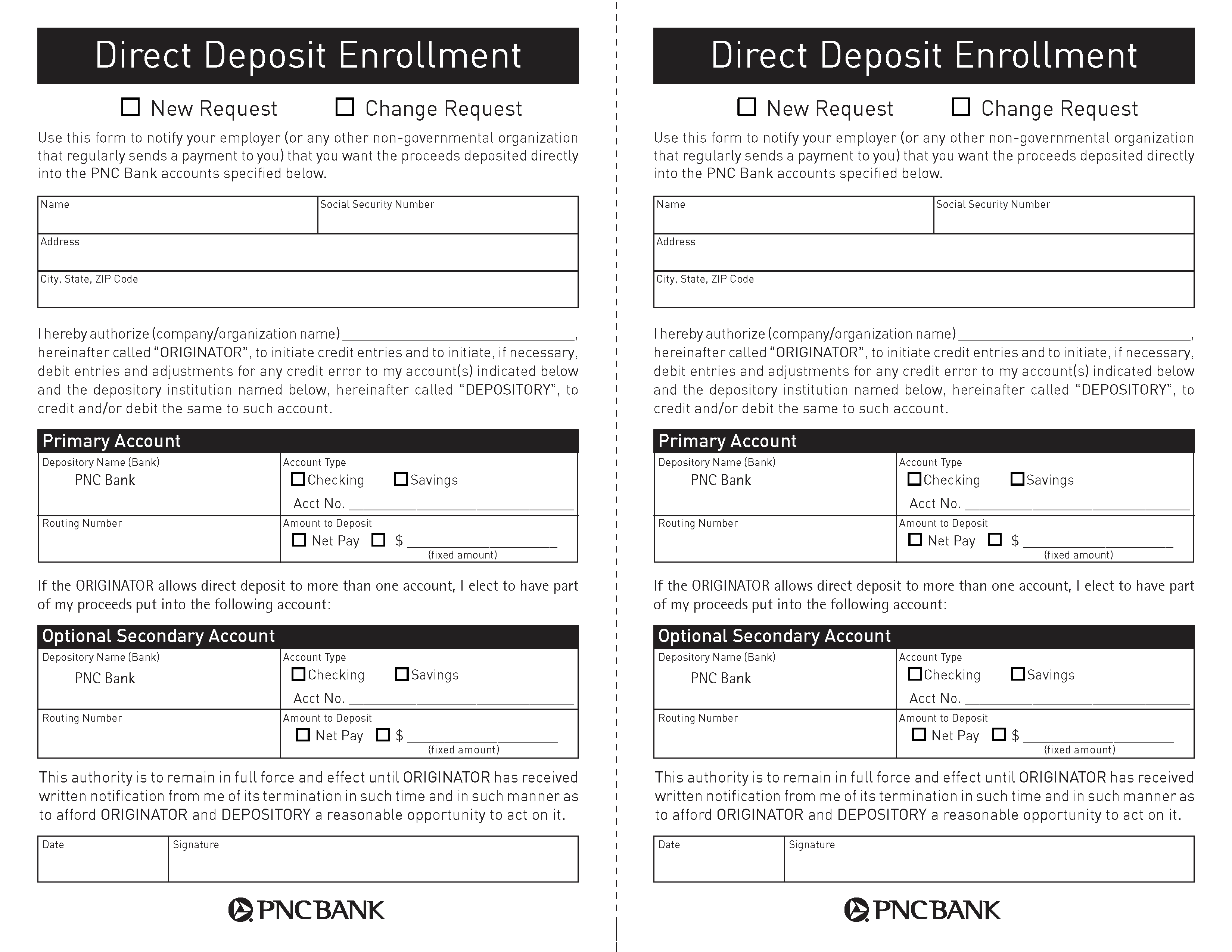

Most folks think they need a specific, official-looking document with a fancy seal to get paid. They don't. While PNC provides a standard PDF for this, the reality of modern payroll is a bit more flexible—and sometimes more frustrating. Whether you're starting a new gig at a massive corporation or just trying to get your tax refund faster, understanding how PNC handles these electronic transfers is the difference between getting paid on Friday morning and stressing out until Monday.

Why the PNC Bank Direct Deposit Form Is Just the Start

Here is the thing about direct deposit: it’s basically just a handshake between two computers. Your employer’s bank (the ODFI) talks to PNC (the RDFI), and they agree to move numbers around. To make that happen, you need three specific ingredients. You need the PNC routing number, your personal account number, and your account type.

If you log into the PNC Mobile app, you can usually find a pre-filled direct deposit form. This is a lifesaver. It’s a simple PDF that already has your name and account details typed out. You just print it, sign it, and toss it at your HR department. But wait. There’s a catch that trips people up constantly. PNC uses different routing numbers depending on what state you opened your account in and what kind of transaction is happening.

Sometimes, the routing number on the bottom of your checks isn't the one your employer's payroll system wants.

If you’re using a service like ADP or Workday, they often don’t even want the form. They just want the raw numbers. This is where the PNC Bank direct deposit form acts more like a cheat sheet than a required document. You're basically just copying data from the form into a web portal.

Finding Your Real Numbers Without Losing Your Mind

Don't guess. Seriously. If you guess your routing number because you saw a list on some random website, your money will bounce. PNC is a massive regional bank, and they’ve swallowed up a lot of smaller banks over the years. This means their routing infrastructure is a bit of a patchwork quilt.

✨ Don't miss: How Much Home Would I Qualify For? The Numbers Your Bank Isn't Telling You

The easiest way to get the "bulletproof" info is to click on your account in the PNC online banking portal. Look for "Account Assets" or "Account Details." It should explicitly list the "Direct Deposit Routing Number." This is often different from the "Wire Transfer Routing Number." If you use the wire number for a standard paycheck, it might work, or it might get rejected and sent back to your boss. That is a conversation nobody wants to have on payday.

The Mystery of the "Early Pay" Feature

PNC has been pushing their "PNC Express Funds" and early direct deposit features lately. It's a huge selling point. They claim you can get your money up to two days early.

How?

It’s not magic. When your employer sends the payroll file, they usually do it a few days before the actual "payday." Most banks see that file and just sit on it until Friday. PNC, like many modern banks, sees that the money is "guaranteed" and just credits your account immediately.

But—and this is a big but—this only works if you've set up your PNC Bank direct deposit form correctly and your employer uses a standard ACH (Automated Clearing House) transfer. If your boss is still manually sending transfers or using a smaller, wonky payroll provider, you might not see that money early. Don't plan your rent payment around a Wednesday arrival if your official payday is Friday. It's a "nice to have," not a "bank on it" guarantee.

What if You Don't Have Checks?

A lot of younger accounts, like the PNC Virtual Wallet "Student" or "Foundation" accounts, don't even come with a checkbook. In the old days, HR would demand a "voided check" to verify your account. If you don't have one, don't panic.

The PNC Bank direct deposit form is the legal equivalent of a voided check. It has the ABA routing number and your account number clearly displayed. Most HR managers in 2026 are totally fine with this. If they're being difficult and insisting on a voided check, you can actually print a "specimen check" from some banking portals, or just stand your ground and tell them the direct deposit authorization form is the official bank-provided alternative.

Step-by-Step: Getting It Done Right

- Grab the Form: Log into PNC Online Banking. Go to the "Accounts" tab and look for "Direct Deposit." Download the PDF.

- Verify the Routing Number: Double-check that the routing number on the PDF matches your specific region. PNC has different numbers for places like Indiana vs. New Jersey.

- Choose Your Split: You don't have to put 100% of your check into one place. You can tell your employer to put $50 into a "Growth" (savings) account and the rest into "Spend" (checking). You'll just need to provide the account numbers for both.

- Submit and Wait: It usually takes one to two pay cycles for the change to kick in. You’ll probably get one last paper check before the digital flow starts.

Common Mistakes That Delay Your Cash

The biggest headache? Transposing numbers. It sounds stupidly simple, but flipping an "8" and a "3" happens more than you'd think. When the ACH system tries to drop money into a non-existent account, it triggers a "Return."

That money goes back to the sender.

Then your employer has to wait for the return to clear, which can take 3-5 business days, and then they have to cut you a manual check. You're looking at a week of being broke because of a typo. This is why using the digital PNC Bank direct deposit form—where you can copy and paste the numbers—is way safer than handwriting them on a scrap of paper for your boss.

Another weird quirk: account titles. If your PNC account is a joint account with your spouse, but your payroll is only in your name, it's usually fine. However, some government benefits (like Social Security) can be finicky if the names don't match perfectly. Make sure the name on your PNC account is the same as the name on your payroll file.

Dealing With Multiple Accounts (Virtual Wallet)

PNC’s "Virtual Wallet" is a bit unique. It’s basically three accounts in one: Spend, Reserve, and Growth. When you're filling out your PNC Bank direct deposit form, you almost always want to use the "Spend" account number for your primary deposit. This is your "checking" account. If you send it to "Growth," you might find yourself at a grocery store with a declined card because your money is sitting in a savings bucket that isn't linked to your debit card for immediate spending.

Actionable Next Steps

Stop procrastinating on this. If you're still doing manual deposits, you're losing money in the form of lost time and missed interest.

First, log into your PNC mobile app right now. Navigate to the account services section and find the "Direct Deposit" link. Download that PDF to your phone. It’s the most accurate version of your data.

Second, check your payroll portal at work. Most companies use self-service portals now. Instead of handing a paper form to a human, you’ll just copy the routing and account numbers from your PNC form into the portal.

👉 See also: 645 Fifth Avenue: Why Olympic Tower Still Matters in the Midtown Game

Finally, keep an eye on your "Spend" account the day before your next payday. If you've set everything up correctly, you should see the pending transaction. If you don't see it by the time you wake up on payday, call your HR department immediately to ensure they didn't have a "bounce back" error. Once it's set, you're golden—no more Friday trips to the bank.