You're standing in your kitchen, check in hand, wondering if you actually need to put on shoes and drive to a branch. Honestly, you don't. Most people using pnc bank mobile deposit just want to know two things: how fast can I spend this money, and why does the app sometimes act like my handwriting is ancient hieroglyphics?

Banking has changed. It's less about marble pillars and more about how steady your hands are while holding a smartphone over a dinner table. PNC’s mobile deposit feature, tucked inside their Virtual Wallet app, is a workhorse, but it has its quirks. If you've ever dealt with a "check image unclear" error three times in a row, you know the frustration. It's not just you.

The Reality of PNC Bank Mobile Deposit Limits and Timing

Let's talk about the "pending" purgatory.

When you snap that photo, the money doesn't just teleport into your spent account. PNC generally operates on a "4:00 PM ET" cutoff. If you get that photo uploaded at 3:59 PM on a Tuesday, it’s usually processed as that day's business. Hit "submit" at 4:05 PM? You're looking at Wednesday’s business. This matters because of federal regulations like the Expedited Funds Availability Act, which dictates how long banks can sit on your cash.

For most established PNC customers, the first $100 to $200 of a mobile deposit is often available immediately or within one business day. The rest? That usually hangs out in limbo for a second business day. If you’re a new customer—meaning your account has been open for less than 30 days—PNC is going to be way more cautious. They might hold the entire amount for up to five or even seven business days. It’s annoying, but it’s their way of making sure the check doesn't bounce like a rubber ball.

Limits are another story. Your personal limit isn't a fixed number written in stone for everyone. It’s dynamic. PNC looks at your average balance, how long you’ve been a customer, and your history of overdrafts. Some people have a $2,500 monthly limit; others have $10,000. You can check yours by tapping the "Deposit" tab in the app and looking for the tiny "info" icon or text that lists your specific daily and monthly remaining amounts.

Why Your Deposits Get Rejected (And How to Prevent It)

Most failures happen because of the "Endorsement" trap.

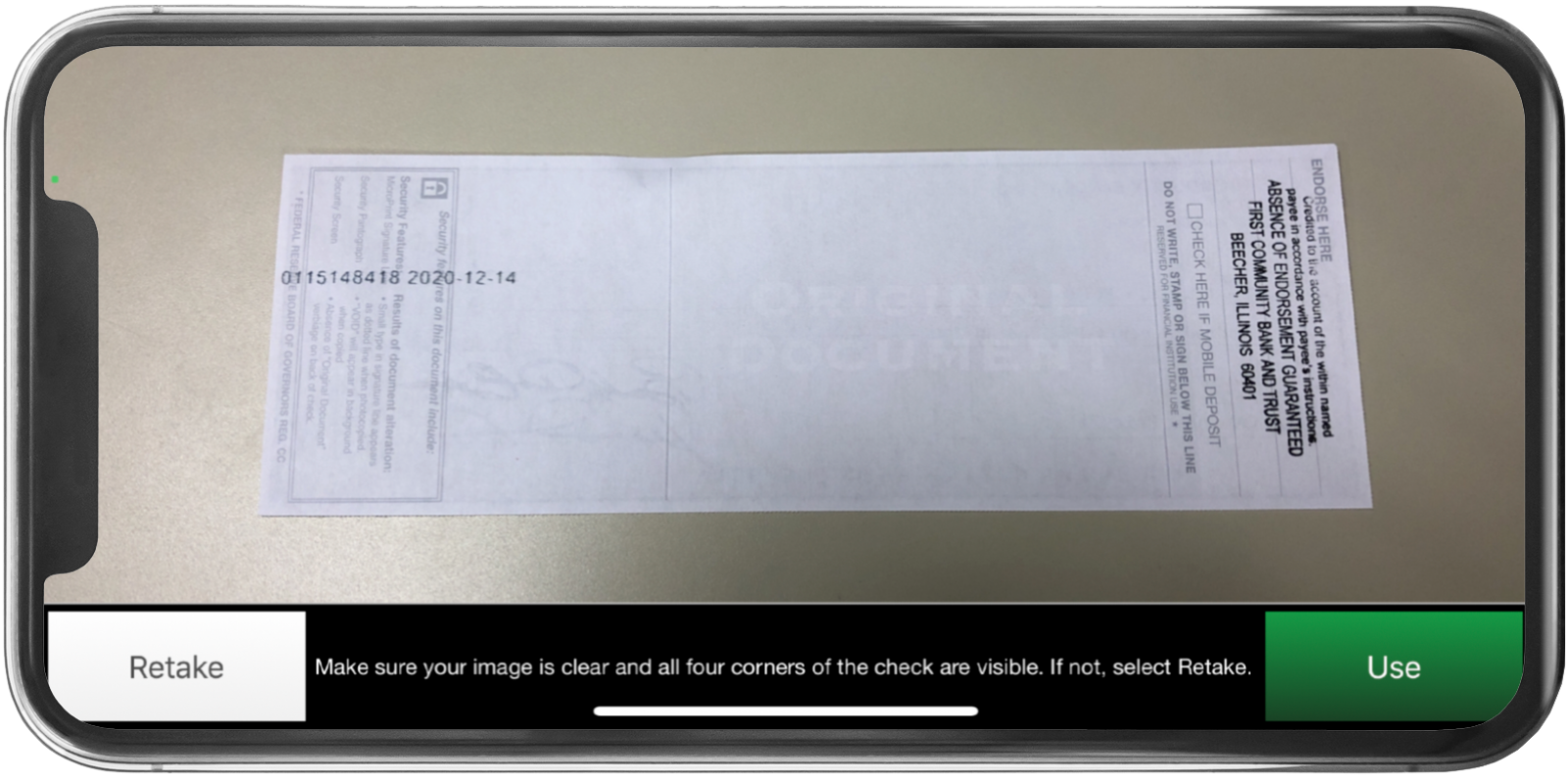

PNC is strict. You can't just scribble your name. You need to write "For Mobile Deposit Only to PNC Bank" right under your signature. If you forget that specific phrase, the automated clearing house (ACH) system might flag it, or a manual reviewer will kick it back. It feels like busy work, but it's a security measure to prevent you (or someone else) from trying to cash the physical check at a grocery store after it's already been digitally deposited.

- Lighting is everything. Avoid shadows. If your head is blocking the kitchen light while you take the photo, the sensor won't pick up the MICR line (those weird numbers at the bottom).

- Contrast matters. Don't take a picture of a white check on a white countertop. Use a dark wood table or a black mousepad.

- Flatten the creases. Checks that have been folded in a wallet are the enemy. Smooth them out.

Sometimes the app just crashes. It happens. If you're seeing a "Service Unavailable" message, it’s rarely your phone. PNC often does server maintenance late at night or on Sunday mornings. If it's a weekday and it's failing, try toggling your Wi-Fi off and using cellular data. Occasionally, bank apps have "handshake" issues with certain home router firewalls.

Understanding the "Virtual Wallet" Integration

PNC doesn't just have a "checking account." They have the Virtual Wallet. This splits your money into "Spend," "Reserve," and "Growth."

When you use pnc bank mobile deposit, you get to choose which "bucket" the money goes into. Most people default to "Spend." However, if you're trying to hide money from yourself to pay a bill later, depositing directly into "Reserve" is a pro move. It skips the step of transferring it later and keeps your "Spend" balance honest.

The Security Side: Is It Actually Safe?

People worry about their check photos sitting in their phone's gallery. They don't. The PNC app is designed so that the images are encrypted and sent directly to the bank. Once you hit submit, those photos aren't stored in your "Recent Photos" or your iCloud/Google Photos backup.

There's a specific "danger zone" though. What do you do with the paper check afterward?

PNC recommends keeping the physical check for at least 14 days. Don't shred it immediately! If there’s a dispute or the image was somehow corrupted during transmission, you’ll need that paper. Write "VOID" across it in big letters after the app confirms the deposit, then stick it in a drawer. After two weeks, once the money is fully cleared and reconciled in your monthly statement, then you can feed it to the shredder.

Comparing PNC to the Competition

How does PNC stack up against Chase or Wells Fargo?

In terms of interface, PNC’s app is a bit busier. It tries to do a lot with the "Money Bar" and various calendars. Chase is a bit more "minimalist." However, PNC’s mobile deposit tends to be slightly more forgiving of "shaky cam" than some older banking apps. They use a proprietary auto-capture feature that waits until the check is in focus before snapping the shot. It saves you the trouble of pressing a button and blurring the image simultaneously.

The downside? PNC’s "standard" holds can sometimes feel longer than online-only banks like Ally or SoFi, which often provide faster access to funds to stay competitive. If you’re a high-net-worth client with PNC (think PNC Private Bank), those holds basically disappear. For the rest of us, we wait.

✨ Don't miss: Why the Company Pizza Party Meme Still Hits So Hard in 2026

Common Myths About Mobile Deposits

You might have heard that you can't deposit a third-party check (a check made out to someone else that they signed over to you) via the app. That's mostly true. While some banks allow it with a lot of extra paperwork, PNC’s mobile system will almost always reject these. If your grandma wrote a check to your spouse and they signed it over to you, take that one to the teller. Don't risk a "restricted account" flag by trying it on your phone.

Another myth: Mobile deposits don't count toward your "minimum balance" to avoid fees until they are fully cleared. Actually, the "pending" amount usually counts toward your ledger balance, which can help you dodge those $7 to $25 monthly maintenance fees, even if the "available" balance is still zero.

Actionable Steps for a Flawless Deposit

To make sure your money hits your account without a headache, follow this exact workflow next time you have a check.

First, check the date. If the check is more than six months old, it’s "stale-dated." The app might catch it, but even if it doesn't, the issuing bank will likely reject it later, triggering a "returned item fee" on your account. That’s usually about $30 you don't want to lose.

Second, sign and endorse. Write "For Mobile Deposit Only to PNC Bank" clearly. Don't let your signature cross into the MICR encoding (the numbers at the bottom).

Third, find a dark, flat surface. Turn on as many lights as possible.

Fourth, open the app and select "Deposit." Choose your "Spend" account.

Fifth, use the auto-capture. Hold the phone steady, parallel to the check. Don't tilt it.

Finally, look for the confirmation email. PNC sends a "Deposit Received" email almost instantly. This is NOT the same as "Deposit Approved." You'll get a second email later—usually within a few hours or the next morning—telling you the funds are actually being processed. Save both until the money is in your "Available Balance."

If you hit a snag where the app says "Amount Mismatch," it means the OCR (Optical Character Recognition) software misread your handwriting. You can manually overrule this by typing in the correct amount, but this usually triggers a human review, which adds 24 hours to your wait time. Make sure your numbers are clear. A "7" that looks like a "1" is the most common culprit for these delays.

By understanding these backend rules, you can stop treating the app like a slot machine and start using it like the tool it's meant to be. Keep that paper check for 14 days, watch your email for the "Approved" notification, and keep your balances in check.