Passing the CPA exam isn't about being the smartest person in the room. Honestly, it’s about endurance and how well you can mimic the actual torture of the testing center. Most candidates spend way too much time highlighting textbooks and watching video lectures at 2x speed. That feels like progress. It isn't. The real heavy lifting happens when you sit down with a practice test for CPA exam and realize you've forgotten everything about pension accounting or the finer points of Treasury Regulations.

The AICPA doesn't care if you read the book. They care if you can handle the pressure of the 2024 CPA Evolution blueprints. Since the Core-Discipline model took over, the game changed. You’re now dealing with three core sections—AUD, FAR, and REG—plus one discipline you choose yourself (ISC, TCP, or BAR). This shift means your old study habits might be totally obsolete. If you aren't using your practice sessions to bridge the gap between "knowing the material" and "applying it under a ticking clock," you're basically just donating your registration fees to the NASBA.

The psychological trap of high MCQ scores

We’ve all been there. You run through a set of 20 Multiple Choice Questions (MCQs), score an 85%, and feel like a god of accounting. You’re not. You might just be memorizing the questions.

Top-tier review providers like Becker, UWorld Roger, and Gleim have massive test banks, but even those have limits. If you see the same question three times, you aren’t learning the GAAP principle; you’re learning that "Option C is the one with the $40,000 salvage value." This is why a practice test for CPA exam needs to be more than just a random click-through. You have to explain why the three wrong answers are wrong. If you can’t do that, you don’t know the material. You’re just guessing with confidence.

Expert candidates—the ones who pass all four sections on the first try—treat practice exams like a post-mortem. They spend twice as much time reviewing the results as they did taking the test. Did you miss the question because of a calculation error? Or was it a "distractor" word like except or not? The AICPA loves those. They’re basically professional trolls.

✨ Don't miss: 49 Canadian to US: What You Actually Get After Fees

Simulating the simulation (The TBS nightmare)

Task-Based Simulations (TBS) are where CPA dreams go to die. It’s one thing to answer a four-sentence MCQ; it’s another to open a simulation and find seven tabs of "supporting documents" including emails, invoices, and partial balance sheets.

Most people skip these during study because they’re "too hard" or "take too long." That is a massive mistake. When you’re taking a practice test for CPA exam, the simulations are where you learn to manage your document fatigue. In the actual Prometric center, your brain starts to fog around hour three. If you haven't practiced navigating the split-screen interface of a TBS under time pressure, you will panic.

Look at the 2024 FAR exam. They’ve moved some of the more complex technical content to the BAR discipline, but FAR still hits you with heavy reporting requirements. You need to be able to scan an exhibit, find the one relevant number, and plug it into the cell without getting distracted by the "noise" the examiners intentionally put there.

Why the "Mock Exam" is your only real yardstick

There is a huge difference between doing practice questions in your pajamas and taking a full-length, four-hour mock exam. Basically, if you haven’t felt the physical back pain of sitting in a chair for 240 minutes, you aren't ready.

The "Becker Bump" and other myths

There’s a legendary concept in the CPA community called the "Becker Bump." The idea is that students typically score 10-15 points higher on the real exam than they do on their final Becker practice tests. While there is some truth to this—mostly because review providers make their questions intentionally harder to ensure you’re over-prepared—you can’t rely on it.

- Real-world check: If you're scoring a 55% on your mock exams, a "bump" isn't going to save you.

- The Discipline factor: We don’t have enough historical data on the new Discipline exams (ISC, TCP, BAR) to know if a "bump" even exists for them yet.

- The 75 rule: A 75 on the CPA exam is not a 75%. It’s a scaled score. This makes the practice test for CPA exam even more vital because it helps you understand the weight of certain topics.

Managing the clock or let the clock manage you

Time management is the silent killer. In the REG (Regulation) exam, for example, you have to balance tax research with complex basis calculations. If you spend 2 minutes per MCQ, you’ve used up 72 minutes before you even touch a simulation. That leaves you with roughly 18 minutes per TBS.

Is 18 minutes enough to read five exhibits and fill out a tax form? Barely.

When you're running a practice test for CPA exam, you need to use the "stopwatch method." If an MCQ takes more than 90 seconds, mark it, guess, and move on. You cannot afford to lose 10 minutes on a single question about S-Corp distributions at the expense of an entire simulation later.

Breakdown of the 2024 Exam Structure

The current landscape requires a specific tactical approach for each section. You can't study for AUD the same way you study for REG.

✨ Don't miss: HSBC Financial Technology and Innovation in Global Banking: What Most People Get Wrong

- AUD (Auditing and Attestation): This is all about logic and fine print. Practice tests here are about reading comprehension. One word—like "reasonable" vs. "absolute"—changes the entire answer.

- REG (Regulation): This is about rules and exceptions to rules. Your practice tests should focus on "basis"—individual, partnership, and corporate. Basis is the sun that the REG solar system revolves around.

- FAR (Financial Accounting and Reporting): The sheer volume of material is the enemy. Practice tests help you identify which areas (like Leases or Bonds) are your weak points so you don't waste time on things you already know.

- Disciplines: These are deeper dives. If you chose ISC (Information Systems and Controls), your practice exams will be heavy on IT governance and SOC reporting.

The "Final Review" phase: Don't overdo it

Burning out two days before the exam is a classic rookie move. Your last practice test for CPA exam should be taken about 5 to 7 days before the actual test date. This gives you enough time to fix the holes in your knowledge without completely draining your mental battery.

In those final days, stop doing full exams. Focus on "Flash MCQs"—sets of 5 or 10 questions in a "random" mode. This keeps your brain sharp and forces you to switch mental gears quickly between different accounting topics. It’s like interval training for your intellect.

Acknowledging the stress

Let’s be real: this process sucks. You’re likely working a 40-60 hour week in public accounting or corporate finance while trying to master the nuances of state and local tax or governmental fund accounting. The CPA exam is a test of grit as much as it is a test of knowledge.

If you’re failing your practice tests, good. Better to fail in your living room than at Prometric. Every wrong answer in a practice test for CPA exam is a gift. It’s a specific map of exactly what you need to go back and read for 20 minutes.

Actionable steps for your next study session

Stop "passive" studying. If you’ve been reading the same page of your textbook for 30 minutes, close it. You're done for now. Instead, try this:

- Select a "Weak" Topic: Choose one area where you consistently score below 60%.

- Targeted MCQ Set: Run 30 questions on only that topic. Do not look at your notes.

- The "Why" Journal: For every question you get wrong, write down one sentence explaining the correct logic. Don't copy-paste. Write it in your own words.

- Cumulative Review: Once a week, take a 50-question cumulative practice test for CPA exam covering everything you’ve studied so far. This prevents "leakage" where you learn new stuff but forget the old stuff.

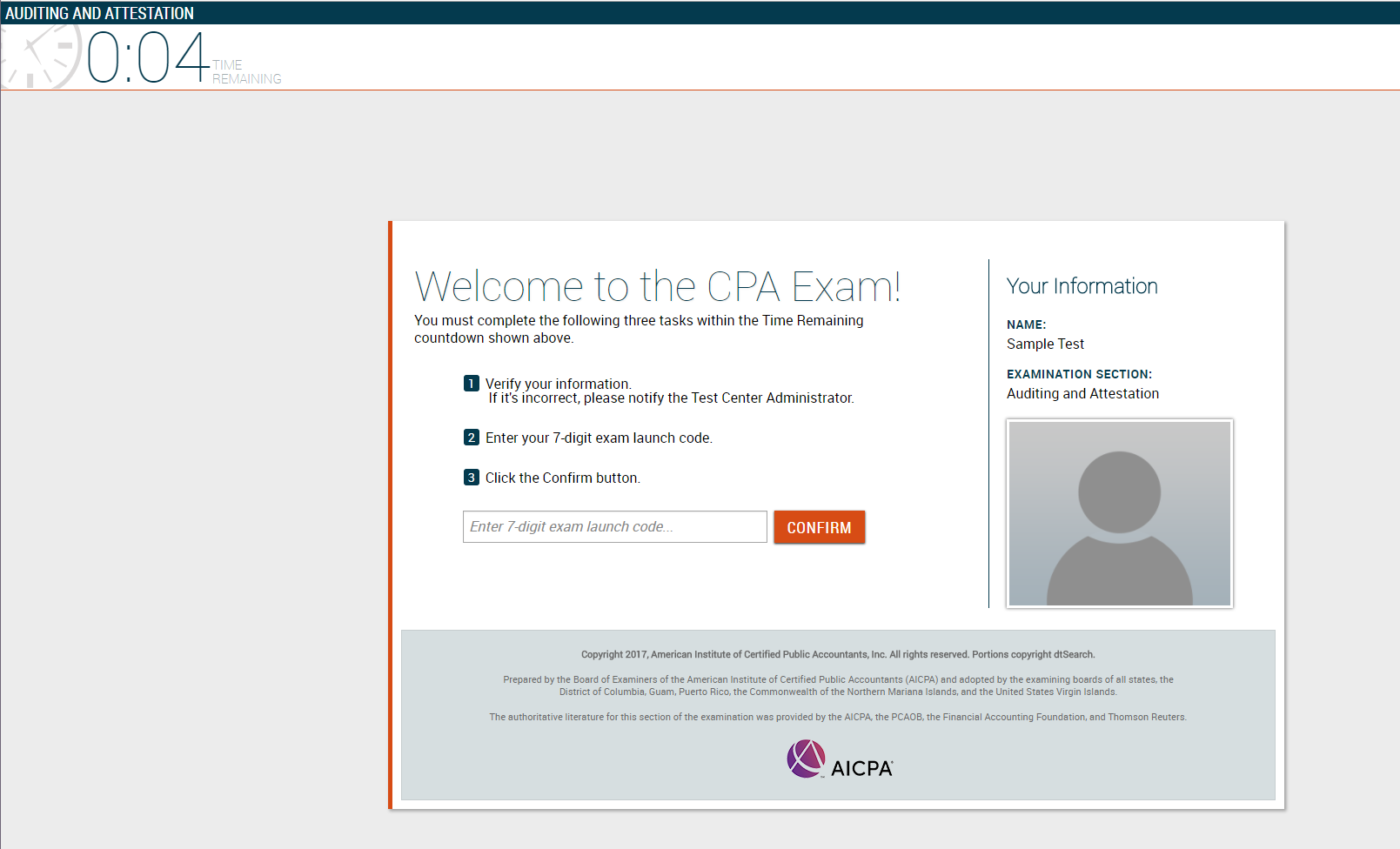

- Simulate the Tech: Use the official AICPA sample test on their website. It’s the only place where you can see the exact software interface you’ll use on exam day. The calculator is clunky. The spreadsheet tool isn't quite Excel. You need to know that now, not during the exam.

The CPA designation is a marathon. The practice tests are your training runs. If you put in the miles now, the actual 26.2 miles of the exam will still hurt, but you’ll know you can finish. Stop worrying about "perfect" scores and start worrying about "consistent" effort. You've got this, but only if you stop hitting the "show answer" button the second you get confused.

Build the mental muscle. Finish the test. Get those three letters after your name.

👉 See also: Eric Trump Net Worth: What Most People Get Wrong

Next Steps for Success:

- Visit the AICPA website immediately to download the most recent Uniform CPA Examination Blueprints. These are the "answer keys" to what will be on the test.

- Schedule your mock exam for a Saturday morning. Start at 8:00 AM sharp to mimic real-world testing conditions.

- Audit your test bank. If you have seen more than 50% of the questions before, it’s time to supplement with a different provider's "cram" course or test bank to get fresh perspectives on the material.

- Focus on the "why," not the "what." If you can explain a concept to a non-accountant, you actually understand it. Try explaining the difference between a finance lease and an operating lease to a friend; if you stumble, go back to the practice questions.