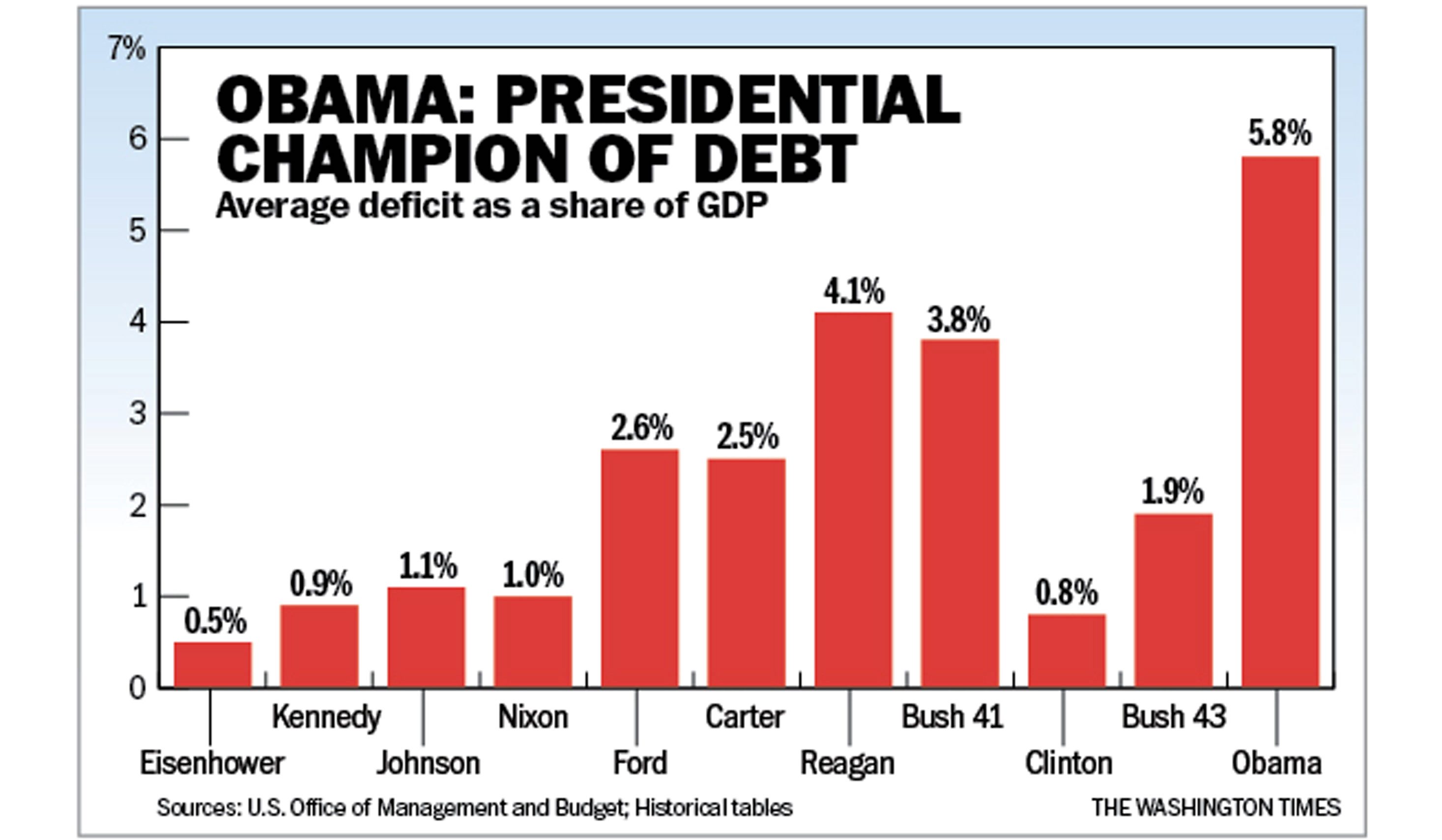

You’ve probably seen the memes. One side of the aisle posts a presidents and national debt chart showing a vertical rocket ship of red ink starting the moment their opponent took the oath. Then the other side counters with a different graph—maybe one adjusted for GDP—claiming their guy was actually a fiscal saint.

Honestly, it's exhausting.

The truth is way messier than a simple bar graph. As of January 7, 2026, the U.S. total gross national debt has hit a staggering $38.43 trillion. If you’re keeping score at home, that is an increase of about $2.25 trillion in just the last twelve months. We are currently adding debt at a rate of roughly $92,912 every single second.

But who is actually "responsible" for that number? If you look at a chart of the debt by president, you aren't just looking at a series of policy choices. You're looking at a collision between ideology, global pandemics, aging demographics, and the simple, brutal math of compound interest.

The $38 Trillion Elephant in the Room

Basically, the national debt is the accumulation of every single yearly deficit since the founding of the country. A deficit happens when the government spends more than it takes in through taxes. In Fiscal Year 2026, we’ve already run a $602 billion deficit in just the first few months.

People love to blame the person in the White House, but it's kinda like blaming a ship’s captain for the tide. Presidents don't actually hold the checkbook—Congress does. However, the President sets the agenda, signs the tax cuts, and authorizes the "emergency" spending that usually sends the charts into a tailspin.

Why the Raw Numbers Lie to You

If you look at a raw dollar chart, every president since Reagan looks "worse" than the one before. Why? Because the economy grows. A billion dollars in debt in 1980 was a massive deal; today, it’s what we add before lunch on a Tuesday.

✨ Don't miss: Skin Care Business Plan: Why Most Founders Fail Before the First Batch

To get a real sense of what’s happening, experts like those at the Congressional Budget Office (CBO) or the Committee for a Responsible Federal Budget (CRFB) look at the debt-to-GDP ratio. This measures the debt against the size of the entire economy.

At the end of World War II, this ratio was about 106%. We spent decades bringing it down to a low of 24.6% in 1974. But since then? It’s been a one-way trip up. By the end of 2024, it was back near 98%, and as of early 2026, we are staring down 124%.

Breaking Down the Modern Eras

Let’s get into the weeds of the specific administrations. It’s not a straight line, and the "winners" and "losers" might surprise you depending on which metric you use.

The Reagan and Bush I Years (1981–1993)

Ronald Reagan came in promising small government. Instead, he oversaw a massive increase in military spending and significant tax cuts. The debt roughly tripled during his eight years. By the time George H.W. Bush left office, the "Peace Dividend" hadn't really kicked in yet, and the debt continued its upward march, despite his "read my lips" tax hike that probably cost him re-election.

The Clinton "Anomaly" (1993–2001)

Bill Clinton is often cited as the last president to see a surplus. It’s true—by the end of his term, the U.S. was actually paying down the debt. A booming tech economy and the 1990 Budget Enforcement Act created a rare moment of fiscal sanity. In 2001, the CBO actually projected we would eliminate all public debt by 2006.

Yeah. That didn’t happen.

The War and Crisis Era: Bush II and Obama (2001–2017)

Two things broke the surplus: 9/11 and the 2008 Financial Crisis.

💡 You might also like: The 3 Minute Rule: Why Most Pitch Advice Fails Under Pressure

- George W. Bush: Launched two wars (Iraq and Afghanistan) and passed major tax cuts. The debt-to-GDP ratio climbed from 31.5% to nearly 40% before the Great Recession hit.

- Barack Obama: Inherited the worst economic collapse since the 1930s. The stimulus spending and lower tax revenues pushed the debt-to-GDP ratio from 52% in 2009 to 76% by the time he left.

The Pandemic and Beyond: Trump and Biden (2017–2025)

This is where the chart goes vertical.

Donald Trump’s first term saw a massive spike, largely due to the COVID-19 pandemic response. Before the virus even hit, however, the 2017 tax cuts were already widening the deficit. By the end of 2020, the debt had jumped 39% in just four years.

Joe Biden's term continued high spending levels with the American Rescue Plan and the Inflation Reduction Act. While the deficit actually fell from its pandemic peaks, the total debt continued to climb. By 2024, the interest alone on our debt started eclipsing the entire defense budget.

The 2025–2026 Reality Check

In January 2025, Donald Trump returned to office. Since his inauguration, the gross federal debt has risen from about $36.22 trillion to $38.43 trillion as of early 2026.

A big driver here has been the One Big Beautiful Bill Act (OBBBA) and the extension of various tax cuts. While the administration has seen a surge in revenue from customs duties and tariffs (up over 300% in some months), it hasn't been enough to offset the rising cost of "mandatory spending."

The Interest Trap

This is the part that actually keeps economists up at night. For years, we borrowed money for basically free because interest rates were near zero. Those days are gone.

- The average interest rate on our debt is now 3.362%.

- In 2026, interest payments are forecast to be 13.85% of all federal outlays.

- We are now paying over $1 trillion a year just in interest.

Think about that. We aren't buying roads, schools, or fighter jets with that money. We’re just paying the "rent" on the money we already spent.

What Most People Get Wrong

People love to say "we're broke." But a country that prints its own currency can't really go "bankrupt" in the traditional sense. The real danger isn't a "repo man" coming for the Statue of Liberty; it's crowding out.

👉 See also: Property Tax Relief for Seniors in NJ: What Most People Get Wrong

When the government has to spend $1 trillion on interest, that’s $1 trillion that isn't going into infrastructure, research, or lowering your taxes. It makes the economy less flexible. It makes us more vulnerable to the next crisis. If another pandemic or a major war hits tomorrow, our "fiscal space" is much smaller than it was in 2020 or 2001.

Another common myth is that we "owe it all to China." Actually, most of our debt is owed to ourselves—U.S. banks, insurance companies, and even the Social Security Trust Fund.

Actionable Insights: How to Read the Next Chart You See

The next time you see a presidents and national debt chart on social media, use these three filters to see if it's junk:

- Is it adjusted for GDP? If it’s just raw dollars, it’s a scare tactic. Look for the percentage of the economy.

- Does it show "Debt Held by the Public" or "Gross Debt"? Gross debt includes money the government owes itself (like Social Security). Debt held by the public is what actually affects markets.

- Does it account for "Inherited Deficits"? A president's first year is almost always governed by the previous president's budget. For example, the 2009 deficit spike was largely baked in before Obama took the oath.

Practical Steps for Your Own Finances

Since the national debt influences interest rates and inflation, the "macro" affects your "micro":

- Expect "Higher for Longer": With the government competing for capital to fund its debt, don't expect mortgage or car loan rates to return to the 2% range anytime soon.

- Diversify: High debt levels can put long-term downward pressure on the dollar. Consider holding a mix of assets, including international stocks or inflation-protected securities (TIPS).

- Stay Informed: Watch the CBO’s Monthly Budget Review. It’s the least biased way to see where the money is actually going without the political spin.

The debt isn't going away. It's a structural part of the modern American economy. Understanding that it's a result of decades of bipartisan choices—not just the "other guy"—is the first step toward a real conversation about fixing it.

Next Steps to Understand the Fiscal Landscape:

- Monitor the U.S. Treasury's Fiscal Data portal for real-time updates on the daily debt balance.

- Review the CBO’s 2026 Long-Term Budget Outlook to see how aging demographics will impact Social Security and Medicare spending over the next decade.

- Compare the Primary Deficit (spending minus interest) of the current administration against historical averages to see how much of the current growth is due to new policy versus old debt.