Walking into a local elevator in rural Iowa feels a lot different than staring at a blinking green terminal in a Chicago high-rise. If you're looking up the price for bushel of corn today, you're probably seeing a number somewhere between $4.20 and $4.80. But honestly? That number is a bit of a lie. It's the "board price," the paper value of a future promise traded on the Chicago Board of Trade (CBOT). For a guy hauling 1,000 bushels in a grain cart, the real price is often much lower—or occasionally higher—thanks to something called "basis."

Corn is the lifeblood of American agriculture. It's in your fuel tank, your steak, and your soda. Because it's so ubiquitous, the price fluctuates based on everything from a dry spell in Brazil to a rail strike in Canada. It’s chaotic.

The Real Drivers Behind the Price for Bushel of Corn

Most people think the price is just about how much corn is in the dirt. Supply and demand, right? Well, sort of. In 2024 and heading into 2025, we’ve seen massive yields. When the USDA World Agricultural Supply and Demand Estimates (WASDE) report comes out and says we’re hitting 180+ bushels per acre across the board, the price tanks. It’s basic math. Too much corn, not enough bins.

But then you have the ethanol factor. Roughly 40% of U.S. corn goes into fuel. If the government tweaks the Renewable Fuel Standard (RFS) or gas prices crater, the price for bushel of corn feels the heat immediately. You’ve also got to watch China. They’ve been buying less lately, opting for Brazilian corn instead because it’s cheaper and their diplomatic ties are shifting. That hurts the American farmer.

Understanding the Basis Gap

I mentioned "basis" earlier. This is the difference between the local cash price and the futures price. If the CBOT says corn is $4.50, but your local ethanol plant only offers $4.10, your basis is "40 under."

Why does this happen? Transportation. If the Mississippi River is too low for barges to move—which has happened way too often lately—the corn just sits there. When grain can't move, the local price drops because the elevator doesn't want any more of it. They have nowhere to put it. Conversely, if a local poultry farm is desperate for feed, they might pay "20 over" just to get the trucks moving.

How Global Events Mess With Your Cereal Costs

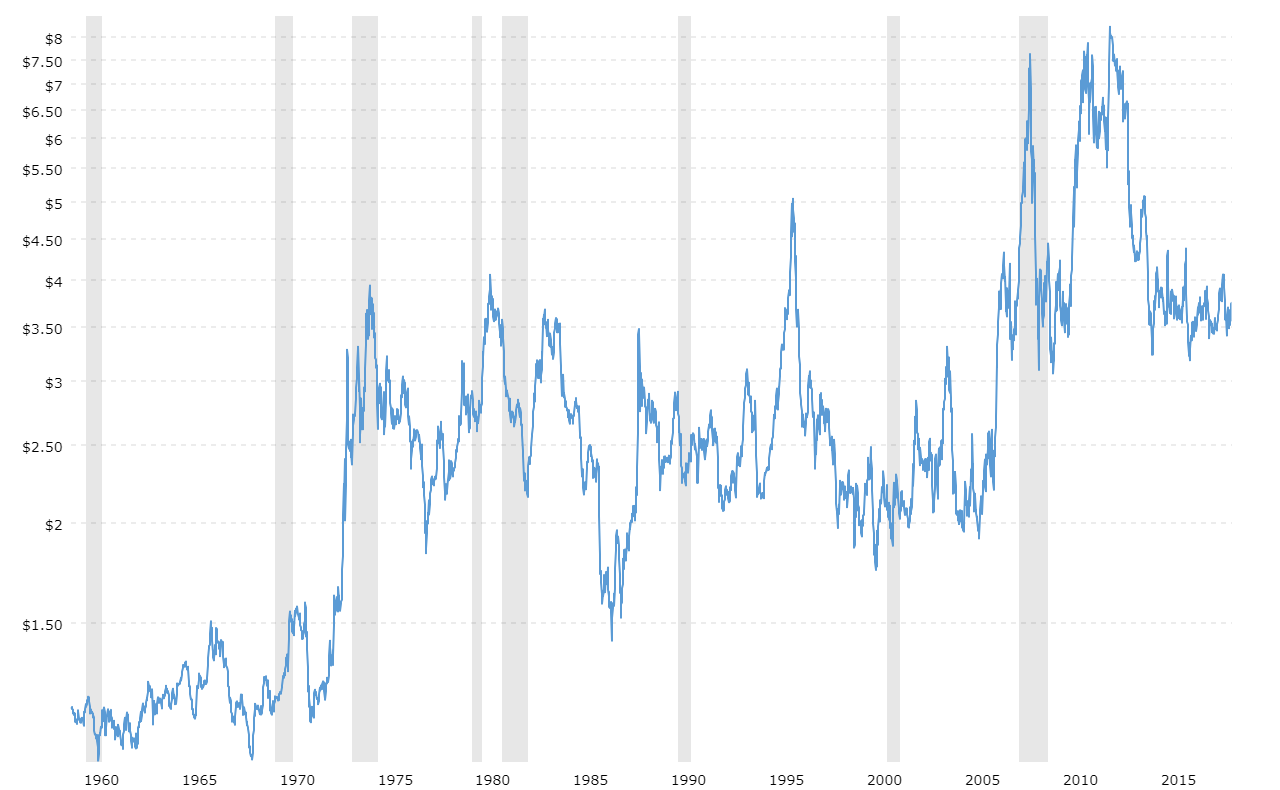

Remember when the war in Ukraine started? The market went insane. Ukraine is—or was—the "breadbasket of Europe." When their ports closed, the global price for bushel of corn shot up toward $8.00. Everyone panicked. It wasn't just about the corn itself; it was about the fertilizer.

Fertilizer is mostly made from natural gas. When energy prices spike, the cost to grow corn doubles. A farmer might get a high price for their crop, but if they spent $600 an acre on inputs, they’re still losing money. It’s a tightrope walk. You're constantly betting against the weather, the Kremlin, and the Federal Reserve all at once.

- Export Demand: If the dollar is strong, our corn is expensive for other countries. They go to Argentina instead.

- The "Stocks-to-Use" Ratio: This is a nerdy metric that basically tells us how much corn will be left in the pantry before the next harvest. Low stocks mean high prices.

- La Niña: This weather pattern usually brings drought to the Midwest. If the forecast says La Niña is coming, traders start buying, and the price jumps.

Why $4.00 Corn is a Disaster for Many

There’s this weird misconception that a $4.00 price for bushel of corn is "normal" because it was the standard for a decade. It’s not. Not anymore.

Inflation didn't just hit your groceries; it hit the tractor parts, the seed, and the diesel. Many university extension offices, like those at Iowa State or Purdue, suggest that the "break-even" point for many farmers is now well above $4.00. When the market dips to $3.90, rural economies start to bleed. Equipment dealers see cancellations. Small-town hardware stores feel the pinch. It’s a domino effect.

We also have to talk about the "carry." This is when the price for corn delivered in December is higher than the price right now. Smart farmers with enough storage will lock their corn in a bin, wait for the price to rise, and sell it in the spring. But if you're "rent-poor" and have loans to pay in October, you're forced to sell at the harvest low. It’s expensive to be poor in farming.

The Role of Speculators

Non-commercial traders—the hedge fund guys who wouldn't know a cornstalk from a sunflower—play a massive role. They trade on "technicals." If the price for bushel of corn breaks a certain moving average on a chart, they might sell thousands of contracts in minutes. This can cause a "flash crash" that has nothing to do with how much corn is actually in the silos. It’s frustrating for producers who see their livelihood swung around by a computer algorithm in Greenwich, Connecticut.

Future Outlook: What to Watch in 2026

Looking ahead, the big wildcard is Sustainable Aviation Fuel (SAF). There is a lot of buzz about using corn-based ethanol to power airplanes. If that market actually scales up, the demand for corn could explode, potentially decoupling the price for bushel of corn from traditional feed and fuel trends.

However, we’re also seeing massive competition. Brazil is now producing a second crop of corn, called the "safrinha," which is enormous. They are no longer just the coffee and sugar kings; they are a direct threat to the U.S. dominance in the grain markets.

Actionable Steps for Tracking and Managing Corn Costs

If you are a buyer, a producer, or just a curious investor, you can't just look at one number. You need a strategy.

1. Watch the Weekly Crop Progress Reports

Every Monday during the growing season, the USDA drops a report at 4:00 PM ET. It tells you how much of the crop is "Good to Excellent." If those numbers drop, the price usually goes up the next morning. It's the most reliable pulse check we have.

2. Learn to Read a Basis Map

Don't just look at the CBOT. Check sites like Brenneman-related trackers or local elevator boards. If you see the basis narrowing (getting closer to the board price), it means demand is picking up.

🔗 Read more: Why We Are Closed for Thanksgiving: The Real Cost of a Holiday Shift

3. Factor in the "Invisible" Costs

If you're calculating the price for bushel of corn for a business plan, don't forget shrink and drying. Corn has to be at about 15% moisture to store safely. If a farmer brings it in at 18%, the elevator docks the price to pay for the propane used to dry it. You never get the "top" price.

4. Follow the Fertilizer Market

The price of anhydrous ammonia is a leading indicator for next year's corn acreage. If fertilizer is too expensive, farmers switch to soybeans, which require less nitrogen. Less corn planted this year means a higher price for bushel of corn next year. It's a cyclical dance that never really ends.

Stop looking at corn as just a commodity. It's a complex intersection of global politics, local logistics, and high-stakes gambling. Whether you're buying it by the ton or the bushel, the "real" price is always local.

Key Data Points for 2026 Reference

- Average production cost: $4.25 - $4.90 per bushel (variable by region).

- Primary export competitors: Brazil, Argentina, Ukraine.

- Key price influencers: Crude oil prices, USDA WASDE reports, Chinese import quotas.

To stay ahead of the market, monitor the December futures contract (ZCZ26), as it often sets the tone for the entire marketing year. Understanding the spread between the "old crop" (last year's harvest) and the "new crop" (the one currently in the ground) will tell you everything you need to know about where the market thinks the price for bushel of corn is headed.