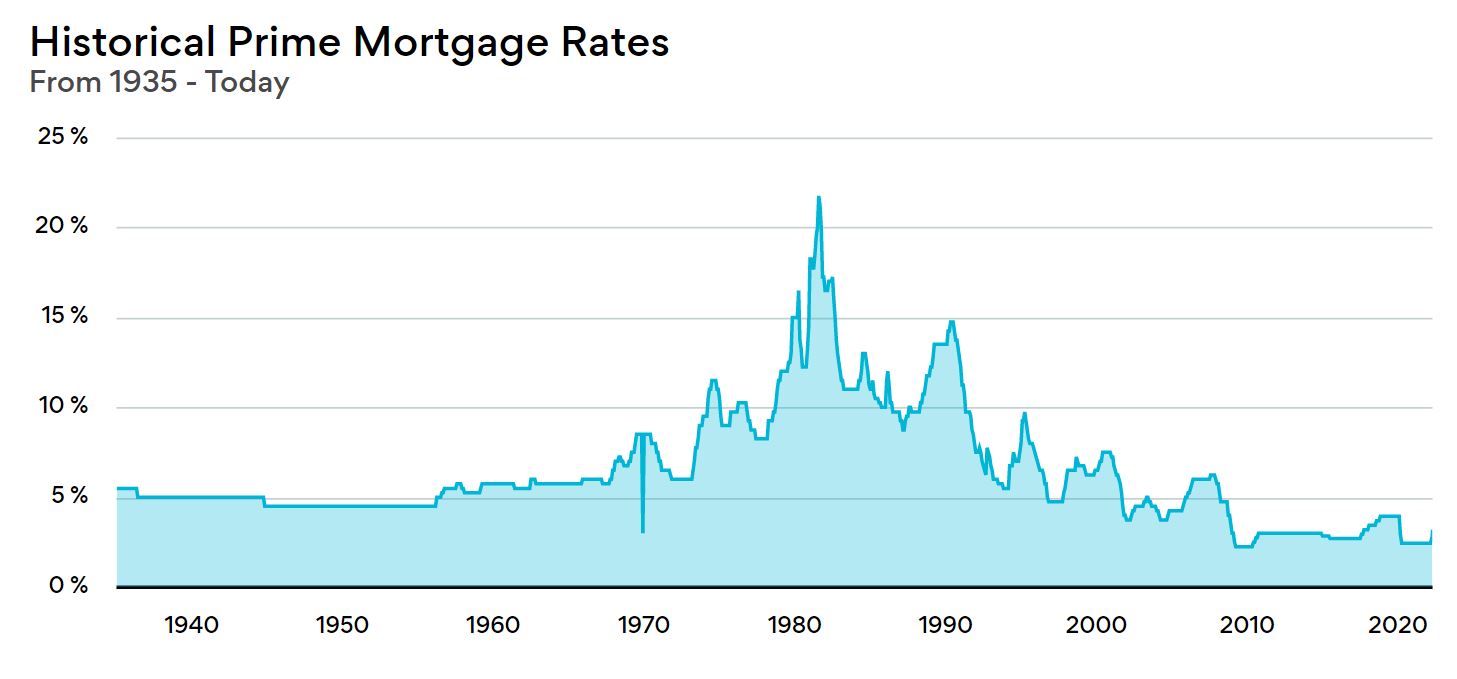

It is early 2026, and if you’re looking at your mortgage statement or a line of credit balance, you’ve probably noticed things feel... well, different. Not necessarily "cheap," but certainly less chaotic than the rollercoaster of the last three years.

The prime interest rate canada currently sits at 4.45%.

For most of us, that number is the "base" of our financial lives. It’s what banks like RBC, TD, and Scotiabank use to price everything from your HELOC to that variable-rate car loan. But honestly, just knowing the number isn't enough. There is a weird gap between what the headlines say and what actually happens to your wallet.

Most people assume that if the Bank of Canada (BoC) hits "pause," the story is over. It isn't. We are currently in a "structural adjustment" phase. That's a fancy economist term for: "We're trying to figure out how to keep the economy from breaking while everything costs more than it used to."

The Real Deal With the Prime Interest Rate Canada

Right now, the Bank of Canada’s overnight rate is parked at 2.25%.

You might wonder why your bank is charging you 4.45% (the prime rate) if the central bank is only at 2.25%. Basically, the "spread" is 2.2%. That's the standard gap. Banks take the BoC rate, tack on their 2.2% margin, and boom—you have the prime rate.

It’s been at this 4.45% mark since the end of October 2025.

Why did we stop cutting?

Inflation is a stubborn beast. While the headline Consumer Price Index (CPI) is hovering near the 2% target, "core" inflation—the stuff that actually matters like rent and services—is still sitting closer to 2.8%.

Tiff Macklem and the Governing Council are in a tough spot. If they cut more, they risk reigniting a housing market that is already showing "green shoots" according to recent CREA data. If they hike? Well, nobody wants to be the person who pushed the economy into a recession during a trade negotiation year.

🔗 Read more: 4 Percent of 100000: Why This Number Pops Up Everywhere in Finance

2026 is the year of the CUSMA review. That’s the trade deal between Canada, the US, and Mexico. The uncertainty around tariffs is acting like a wet blanket on business investment. It’s why the BoC is playing it safe. They've signaled that the current rate is "about right" for now.

What This Means for Your Mortgage

If you’re one of the 33% of Canadian mortgage holders facing a renewal in 2026, take a deep breath.

It’s not going to be as pretty as 2020, but it’s a lot better than 2023. Most people renewing 5-year fixed rates this year are coming off rates near 2%. Jumping to a 4% or 4.5% fixed rate is a shock. We're talking an average payment increase of about 20%.

- Variable Rate Holders: You’re finally catching a break. Many who stuck it out through the hikes are now seeing their payments actually cover some principal again.

- The "TD Exception": Watch out for TD’s "Mortgage Prime." While most banks have a prime rate of 4.45%, TD often uses a separate rate (currently around 4.60%) for their variable products. Always read the fine print.

- Insured vs. Uninsured: If you have less than 20% down (insured), you can actually snag a 5-year fixed rate closer to 4.04% right now. If you're uninsured, expect to pay a bit more.

Is a Hike Lurking in the Shadows?

Most experts at TD and RBC think we stay at 4.45% all through 2026.

But Scotiabank is the outlier. Their team, led by Derek Holt, has suggested we might actually see 50 basis points of tightening later this year. Why? Because the job market is "ripping." Canada added over 180,000 jobs in the last quarter of 2025.

If people keep spending and the loonie keeps sliding against the US dollar (currently around 72 cents), the BoC might have to nudge rates up to protect the currency. A weak loonie makes everything we import from the US—which is almost everything—more expensive. That causes inflation. It’s a vicious circle.

💡 You might also like: Sheridan Corporation Fairfield Maine: Why Local Businesses Keep Coming Back

Actionable Steps for 2026

Stop waiting for "2% interest rates" to come back. They aren't coming. The "neutral rate"—the sweet spot where the economy neither speeds up nor slows down—is likely higher than it was a decade ago.

- Check your "Trigger Rate": If you have a variable-rate mortgage with fixed payments (VRM), make sure your recent cuts have moved you out of the danger zone where you're only paying interest.

- Shop the "Spread": Don't just accept "Prime - 0.5%." Lenders are hungry for business right now because the condo market is slow. You can find "Prime - 0.9%" or even lower if your credit is stellar.

- HELOC Management: Since the prime interest rate canada is the anchor for HELOCs, your borrowing cost is 4.45% plus whatever premium your bank added (usually +0.5%). If you're carrying a balance, consider rolling it into a fixed-term portion of your mortgage to lock in a lower rate.

- Watch January 28: The next BoC announcement is coming up fast. While a "hold" is the betting favorite, the language they use about "structural damage" from trade tensions will tell us if they’re leaning toward a cut or a hike later this summer.

The bottom line? We've traded volatility for stagnation. The 4.45% prime rate is the new normal. It’s high enough to hurt, but low enough to keep the gears turning. Plan your budget around this number staying put for at least the next twelve months.