You’ve probably got a bottle of Tide under your sink. Or maybe some Crest toothpaste on the bathroom counter. Most people look at Procter & Gamble and see a boring consumer goods giant that sells soap and diapers. But if you're an investor, you see something else entirely. You see a "Dividend King." Honestly, in a world where tech stocks swing 10% in a single afternoon, there is something deeply comforting about a company that has been paying shareholders every single year since 1890. That's not a typo. P&G has paid dividends for over 130 years straight.

It’s almost a ritual. Every April, the board of directors sits down and usually announces an increase. They’ve done this for 68 consecutive years. Think about that for a second. Through the Great Depression, two World Wars, the 2008 financial crisis, and a global pandemic, the Procter and Gamble dividend didn't just stay steady—it grew. It’s the kind of reliability that makes financial advisors drool, but it also raises a fair question: Can they actually keep this up forever, or is the tank starting to run dry?

The Mechanics of the P&G Payout

Let's get into the weeds. Right now, P&G generally pays out billions—with a "B"—to its shareholders every year. If you look at the most recent fiscal data, they're returning about $9 billion in dividends annually. That is a staggering amount of cash. The yield usually hovers somewhere between 2.2% and 2.5%, depending on how much the market is freaking out on any given day. It isn't going to make you rich overnight. It won't give you Nvidia-style gains in a week. But that's not the point.

The payout ratio is the number you really need to watch. It tells you what percentage of their earnings is going out the door as dividends. For P&G, this usually sits in the 60% to 70% range. Some analysts think that's a bit high. "It doesn't leave much room for error," they say. But when your business model is selling Gillette razors and Pampers, your cash flow is remarkably predictable. People don't stop shaving or changing diapers just because the S&P 500 is in the red. This "defensive" nature is the secret sauce.

I remember talking to a retired guy who bought P&G back in the 80s. He doesn't even look at the stock price anymore. He just waits for the mail. To him, the Procter and Gamble dividend isn't just a number on a spreadsheet; it’s his grocery money and his travel fund. That’s the power of compounding over decades.

Why the Dividend Increases Actually Matter

It’s easy to dismiss a 3% or 5% annual raise as "inflation hedging." But over time, those raises transform your yield on cost. If you bought shares ten years ago, you aren't earning 2.4% on your initial investment; you're likely earning double digits.

The company manages this by being ruthless about productivity. They’ve cut billions in waste over the last decade. They sold off a bunch of "dead weight" brands—remember when they owned Pringles or those perfume lines? They ditched them to focus on the 10 categories where they actually win. It worked. By narrowing their focus to things like fabric care and grooming, they boosted margins. Higher margins mean more cash. More cash means the dividend stays safe. It’s a simple cycle, but incredibly hard to execute at this scale.

Understanding the "Dividend King" Status

To be a Dividend Aristocrat, you need 25 years of increases. To be a Dividend King, you need 50. P&G is at 68. They are in an elite club with companies like American Water Works and Genuine Parts Co. But P&G is bigger. It’s more global.

The sheer momentum of this streak acts as a psychological floor for the stock price. The management knows that if they ever cut the dividend, or even just failed to raise it one year, the stock would be absolutely slaughtered. Institutional investors—the big pension funds and insurance companies—hold P&G specifically for that streak. This creates a massive incentive for the CEO, Jon Moeller, to keep the cash flowing.

Is There a Downside?

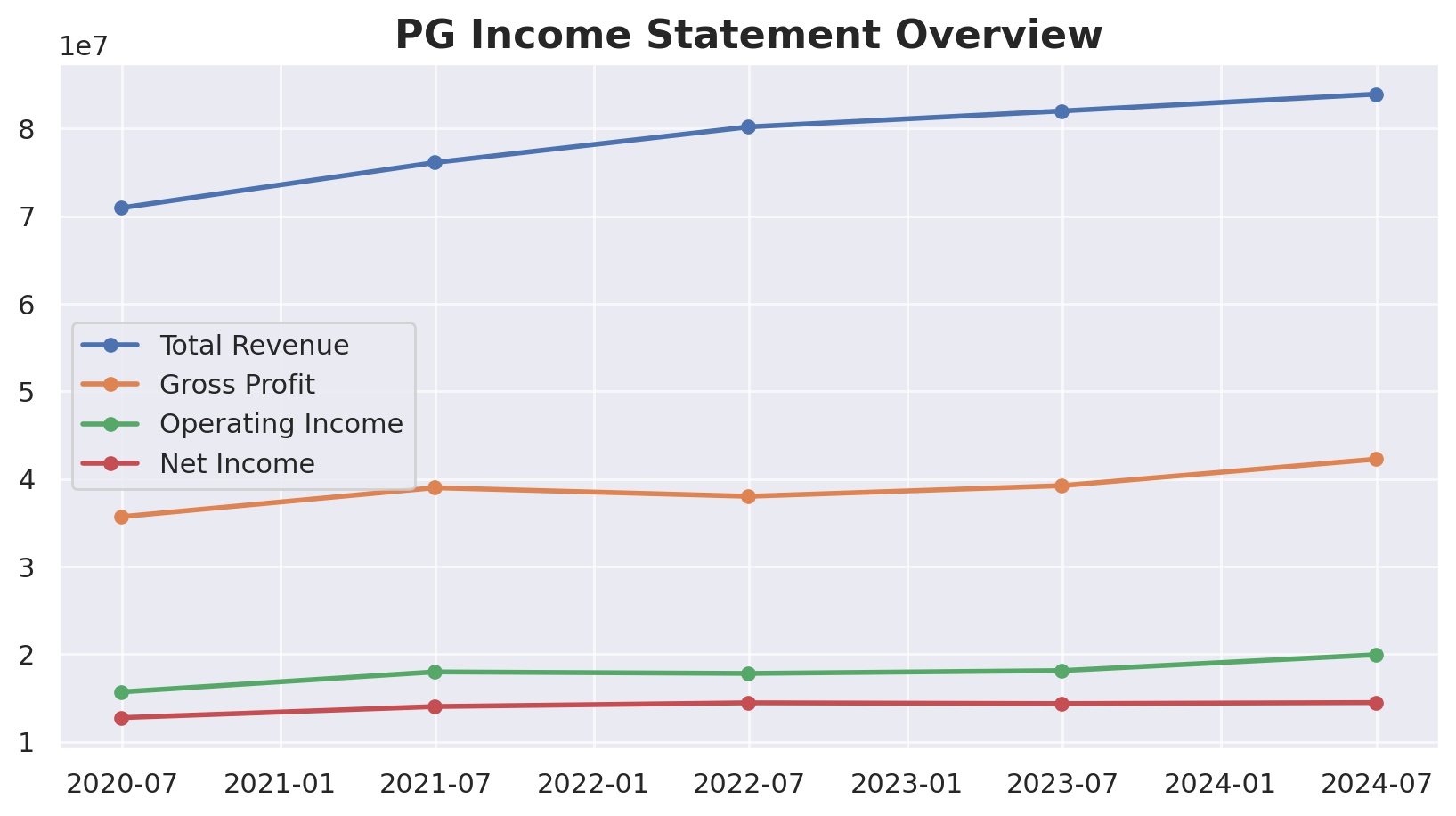

Nothing is perfect. The biggest threat to the Procter and Gamble dividend isn't a competitor; it's the "Law of Large Numbers." When you're already doing $80+ billion in sales, it is incredibly hard to grow at a fast clip. You have to find new ways to squeeze blood from a stone.

Also, watch the dollar. Since P&G sells stuff in nearly every country on Earth, a strong U.S. dollar can actually hurt them. They sell a bottle of Pantene in Tokyo for Yen, but they report their earnings in Dollars. If the exchange rate is wonky, their reported profits look smaller, even if they sold more shampoo.

Then there’s the "private label" threat. During high inflation, some shoppers switch from Tide to the Costco or Walmart brand. It happens. P&G counters this by constantly "innovating"—which is often just a fancy way of saying they added a new scent or a better cap so they can charge 5% more. It sounds cynical, but it’s the reality of the consumer staples business.

How to Value the Dividend Right Now

If you're looking to jump in, don't just look at the share price. Look at the Free Cash Flow (FCF). That is the real money left over after they pay for their factories and advertising. P&G is a cash-generating monster. They usually convert nearly 100% of their earnings into free cash flow.

When the yield hits 2.7% or higher, the stock is usually considered a "steal" by historical standards. When it dips below 2%, it might be getting a bit pricey. Right now, it’s sitting in that "fair value" sweet spot where you aren't overpaying, but you aren't getting a bargain-basement deal either.

The Role of Share Buybacks

It’s not just about the dividend. P&G is also obsessed with buying back its own shares. This reduces the total number of shares in existence, which makes each remaining share—and the dividend attached to it—more valuable.

- In a typical year, they spend billions on buybacks.

- This helps boost Earnings Per Share (EPS) even when total sales growth is modest.

- It acts as a secondary way to return value to you without the tax implications of a cash dividend.

Strategies for Income Investors

If you're serious about the Procter and Gamble dividend, don't just take the cash and spend it. Set up a DRIP (Dividend Reinvestment Plan). Most brokerages do this for free. Instead of getting $50 in your account, you get a fraction of a share. Over twenty years, the number of shares you own grows exponentially, and since the dividend per share is also growing, the effect is like a snowball rolling down a mountain.

Some people worry about the "death of the brand" in the age of TikTok and direct-to-consumer startups. But look at the data. P&G’s market share in most categories is actually holding steady or growing. They have the marketing budget to outspend anyone. They own the shelf space. That "moat" is what protects your quarterly check.

🔗 Read more: Cuánto son 300 dólares en pesos colombianos: Lo que realmente recibes tras comisiones y TRM

Real Talk: The Risks Nobody Mentions

Inflation is the silent killer. If the cost of the chemicals to make soap or the plastic for the bottles goes up faster than P&G can raise prices, the dividend coverage gets tighter. So far, they’ve been able to pass costs to consumers. But there is a limit. If a jug of Tide hits $30, people will find an alternative. We haven't hit that breaking point yet, but it's something to keep an eye on in your quarterly reading.

Another thing? Regulation. Governments are getting weird about plastic waste. P&G uses a lot of plastic. If new laws force them to change their entire packaging supply chain, that’s going to cost a fortune. It won't kill the company, but it might mean a 3% dividend raise instead of a 5% one.

Moving Forward With Your Portfolio

Investing in P&G is basically a bet on the persistence of human hygiene and the stability of the global middle class. It’s not exciting. It won't give you bragging rights at a cocktail party. But it will likely be there, paying out, long after the latest "disruptive" tech startup has gone bankrupt.

To get the most out of this, you need to think in decades, not quarters. Check the payout ratio every few months to ensure it stays below 75%. If it spikes higher without a good reason, that’s your red flag. Otherwise, it’s a "set it and forget it" type of situation.

Action Steps for the Prudent Investor

- Check your current exposure: Look at your mutual funds or ETFs. Since P&G is a massive part of the S&P 500 and the Dow, you might already own more than you think.

- Evaluate the "Yield on Cost": If you already own it, calculate what you’re making based on your original purchase price. It’s a great way to stay motivated during market downturns.

- Monitor the April Announcement: Keep an eye out every April. The size of the dividend increase is a direct signal from management about how they see the next 12 months playing out.

- Consider the Tax Implications: Dividends are taxed. If you hold these in a Roth IRA, that growth is tax-free. If it’s in a standard brokerage account, Uncle Sam is taking a cut of every check. Plan accordingly.

- Don't ignore the valuation: Even a great company is a bad investment if you pay too much. Aim to buy on the dips when the "boring" sectors are out of favor.

The Procter and Gamble dividend remains a gold standard for a reason. It is the result of a century of brand building and logistical dominance. It’s a boring way to get rich, but as many seasoned investors will tell you, boring is usually where the real money is made.

Watch the cash flow, ignore the daily noise of the stock market, and let the compounding do the heavy lifting for you. You aren't just buying a stock; you're buying a tiny piece of a global machine that turns soap into cash. That’s a pretty good deal in any economy.