Location is everything. You’ve heard that a thousand times from real estate agents, but they usually mean the view or the schools. They rarely lead with the fact that your neighbor three miles away across a state line might be paying for a used Toyota every single year in taxes while you’re paying for a Starbucks latte. It’s wild. The map of property tax by states looks less like a logical financial plan and more like a Jackson Pollock painting—splattered, inconsistent, and often confusing as hell.

Most people think property tax is just a flat percentage of what they paid for their house. If only. In reality, it’s a chaotic cocktail of millage rates, assessment ratios, and local exemptions that vary so wildly it can make your head spin.

The Jersey Problem and the Coastal Gap

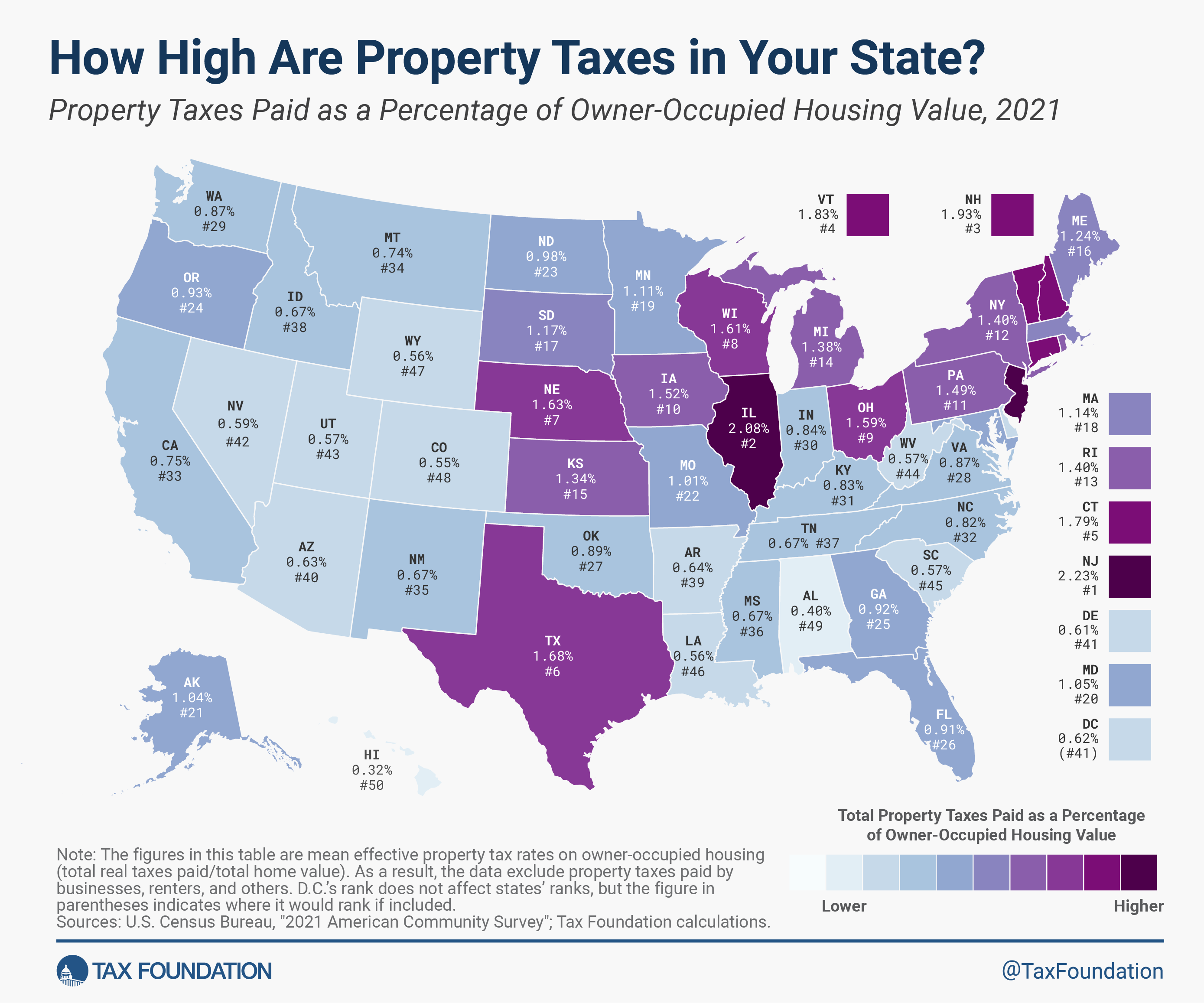

New Jersey is the heavyweight champion here, and not in a way anyone actually wants to win. According to data from the Tax Foundation and the U.S. Census Bureau, the Garden State consistently sits at the top with an effective property tax rate hovering around 2.47%. To put that in perspective, if you own a $500,000 home in Jersey, you’re potentially cutting a check for over $12,000 every year. That is a brutal monthly carry.

Why? It’s basically because New Jersey has a ton of local jurisdictions. Every little town has its own school board, its own police department, and its own municipal government. Local control is great until you have to pay for fourteen different fire chiefs in a ten-mile radius.

Contrast that with Hawaii. People think Hawaii is expensive—and it is, for literally everything else—but their property tax rate is famously low, often under 0.30%. You could own a multi-million dollar beachfront estate in Maui and pay less in annual property tax than a guy with a split-level ranch in Paramus. But there's a catch. Hawaii makes that money back through high sales taxes (GET) and a cost of living that makes a gallon of milk feel like a luxury purchase.

How Assessments Actually Work (The Part They Hide)

Here is where it gets weird. Your tax bill isn't just (Home Value x Rate). It's (Assessed Value x Millage Rate).

👉 See also: Heritage Tractor Galesburg IL: Why This Shop Still Matters to Local Farmers

Some states, like California, have Proposition 13. This is the "holy grail" for long-term homeowners. Basically, your property tax is capped at 1% of the purchase price, and the assessed value can only go up by 2% a year. You could be living in a house worth $3 million that you bought in 1975, and you’re paying taxes like it’s worth $200,000. It creates this bizarre "lock-in" effect where people can't afford to move because their tax bill would quintuple the moment they bought a new place next door.

Then you have states like Texas. Texas has no state income tax. None. Zip.

The money has to come from somewhere, right? So, Texas hammers property owners. In places like Austin or Dallas, you might see effective rates north of 1.8%. When people move from California to Texas thinking they’re saving money, they often get a "tax shock" when they realize their property tax bill just doubled, even if their mortgage stayed the same. It's a trade-off. You keep more of your paycheck, but you pay more to stay in your house.

The Southern Sweet Spot?

Generally, the Southeast is where you go if you want to stop the bleeding. Alabama, Louisiana, and West Virginia consistently rank among the lowest for property tax by states. Alabama’s effective rate is often around 0.40%.

But look closer.

Low property taxes often correlate with lower spending on public infrastructure or schools. Or, it means the state is getting its pound of flesh elsewhere. Tennessee has no income tax (on wages) and low property taxes, but they have some of the highest sales taxes in the country—sometimes nearly 10% when you add local surcharges. You’re paying one way or the other.

Misconceptions About the "Fair" Share

One thing people get wrong is thinking that high taxes mean "better" services. Not always. Illinois is a prime example of a state with high property taxes (often over 2%) where the money is frequently tied up in legacy pension debt rather than new parks or better roads. Residents in the Chicago suburbs often feel like they’re paying "luxury prices for budget services."

On the flip side, some New England states like New Hampshire have massive property tax bills because they have no sales tax and no income tax. It is the purest "user fee" model. If you want to live there, you pay for the land. Period.

Homestead Exemptions and the Secret Discounts

You have to check the fine print. Almost every state has some version of a "Homestead Exemption."

In Florida, if your home is your primary residence, you can knock $50,000 off the assessed value for certain tax calculations. More importantly, they have the "Save Our Homes" cap, which limits how much your assessment can increase each year. If you’re a senior citizen, a veteran, or have a disability, there are often massive layers of "stealth" discounts that aren't reflected in the headline rates you see on Google.

What You Should Actually Do Before Buying

If you are looking at the map of property tax by states and trying to decide where to move, don't just look at the percentage.

👉 See also: Digital Ally Inc Stock: Is This Penny Stock Rollercoaster Finally Over?

First, call the local county assessor’s office. Ask them when the last "reassessment" happened. If a town hasn't reassessed property in ten years and they are scheduled to do it next year, your tax bill could explode 40% the moment you close.

Second, look at the "Assessment Ratio." Some states only tax you on 10% of your home's value, while others tax you on 100%. A "low" rate on a 100% assessment can be way more expensive than a "high" rate on a 10% assessment.

Third, check the "Mill Rate." A mill is one-tenth of a cent. So a tax rate of 20 mills means you pay $20 for every $1,000 of assessed value. It sounds small. It isn't.

Actionable Steps for Homeowners

Appeal your assessment. This is the most underutilized tool in the shed. According to the National Taxpayers Union, between 30% and 60% of taxable property in the U.S. is over-assessed. If your neighbor’s identical house is valued lower than yours, or if your basement is unfinished but the city thinks it’s a cinema, file an appeal. Most people win at least a small reduction just by showing up with photos and data.

Audit your exemptions. Are you a veteran? Do you work in certain public service sectors? Did you just turn 65? Many states don't "gift" you these discounts automatically. You have to file paperwork, often by a specific deadline in the spring, to get the credit for the following year.

Calculate the "Total Tax Burden." If you're moving for taxes, use a total-load calculator. A state with high property tax but zero income tax might actually save a high-earner money, while a retiree on a fixed income would get crushed by that same structure.

👉 See also: Whole Foods Market Opening: Why the New Small-Format Stores Change Everything

The bottom line is that property tax is the only tax you pay on something you already "own" with money you’ve already been taxed on. It’s a recurring subscription to your own zip code. Understanding how your state stacks up isn't just about trivia; it's about whether you can actually afford to stay in your home ten years from now when the neighborhood gets popular and the tax man comes knocking.